Cardano dApps are blessed with an ideal growth environment. The Cardano network gives developers a powerful and diverse platform to build innovative new projects, while the Cardano community is undoubtedly one of the crypto industry’s most supportive fanbases.

As you can imagine, this hotbed of blockchain functionality and support has paved the way for a litany of creative applications in the Cardano (ADA) ecosystem that would make co-founder Charles Hoskinson proud.

In this guide, we’ll review some of the essential Cardano dApps that every ADA holder and fan should know about.

Table of Contents

What Are Cardano dApps?

Cardano dApps, or decentralized applications, are products and services that run on the Cardano blockchain. The Cardano blockchain is an open-source, decentralized public network designed to be a more balanced and sustainable ecosystem. It’s the first blockchain platform to evolve from a scientific philosophy and a research-first-driven approach.

Sponsored

The beauty of blockchain, self-custody, and smart contract technology is that using these apps is completely trustless and permissionless. For example, Cardano DeFi apps can be accessed by anyone with a Cardano crypto wallet, giving financial tools to thousands of people who might be otherwise excluded.

Sponsored

Cardano dApps leverage the network’s unique features, including its scalability, security, and sustainability. They cover a vast range of services, from DeFi (Decentralized Finance) platforms and decentralized exchanges to NFT marketplaces and more.

Why Are Cardano dApps Special?

Cardano dApps are not just your run-of-the-mill decentralized applications. They bring something unique to the table thanks to the distinctive features of the Cardano blockchain.

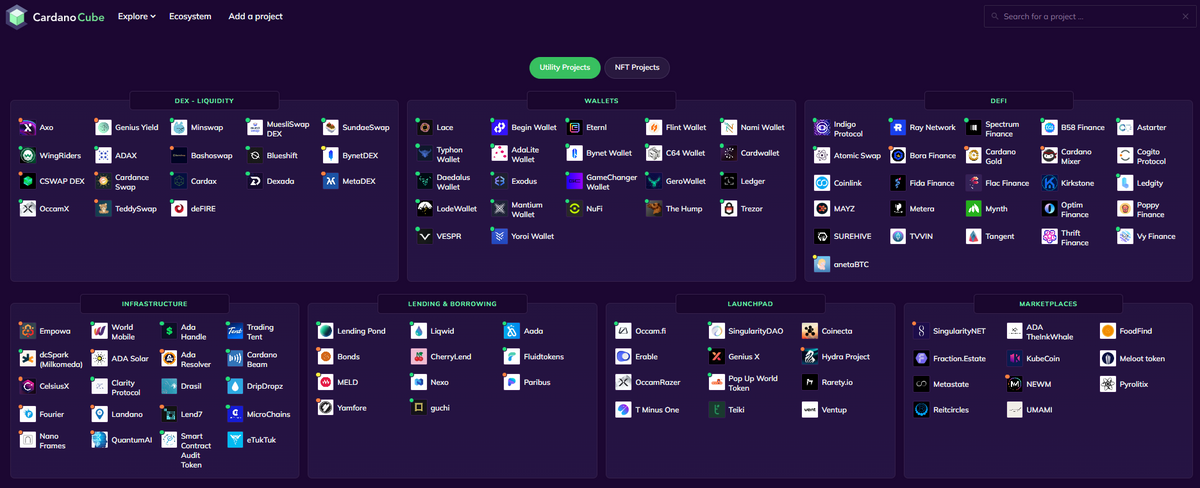

One look at the ecosystem map is enough to understand Cardano’s scope. Cardano’s blockchain is built on a scientific philosophy and a research-driven approach. Every aspect of the blockchain, from its architecture to its consensus algorithm, has been meticulously researched and peer-reviewed. This rigorous process ensures that the blockchain is robust, secure, and capable of handling various applications.

On top of that, Cardano uses a unique consensus algorithm called Ouroboros. This Proof-of-Stake algorithm is more energy-efficient than the Proof-of-Work algorithm used by legacy blockchains like Bitcoin (BTC). As a result, Cardano dApps are more sustainable and environmentally friendly.

The Cardano network is designed for scalability. Thanks to novel tech features like Cardano’s Hydra protocol, the blockchain theoretically handles thousands of transactions per second, making it ideal for building dApps that need to serve a large number of users. Cardano also boasts low transaction fees, giving it an advantage over older networks like Ethereum (ETH).

Of course, no blockchain is perfect. One of the biggest issues Cardano faces is its reliance on Plutus, a niche programming language. While EVM-compatible networks like Ethereum, Avalanche (AVAX), and Polygon (MATIC) support dozens of programming languages like Solidity, Cardano applications must be written in Plutus, a Turing-complete Haskell-based language.

It boils down to this: Native Cardano developers are in short supply. To rub salt in the wound, onboarding new developers is difficult because it requires them to learn a new language. Fortunately, these onboarding woes haven’t stopped the Cardano community from building creative dApps on the network.

Top 7 Cardano dApps

As the Cardano ecosystem continues to grow, various innovative dApps are emerging, each with unique offerings. Here, we’ve curated an essential list of the top seven Cardano dApps making waves in 2023.

1. MinSwap

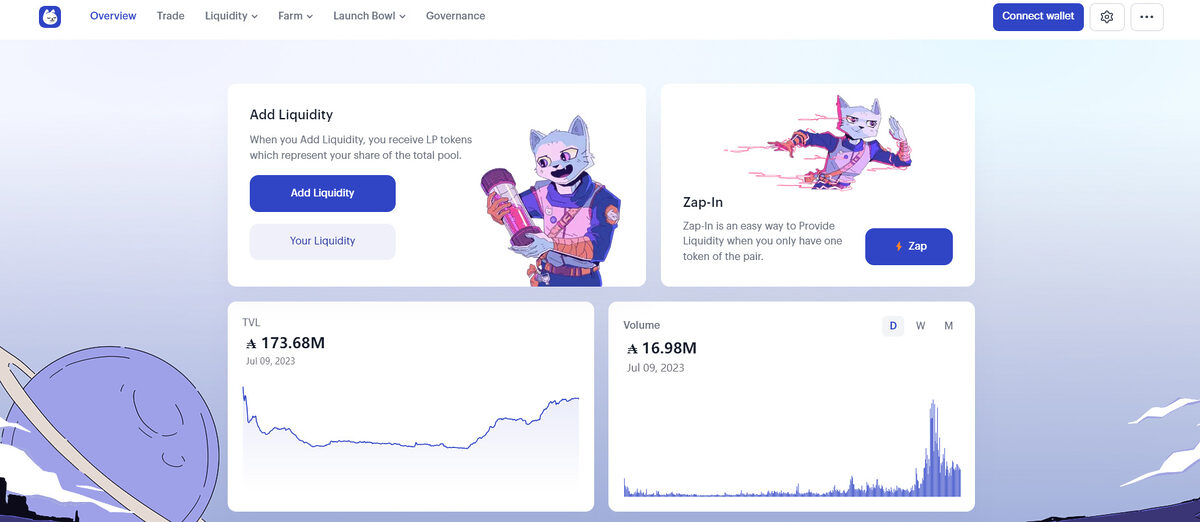

MinSwap is a decentralized exchange (DEX) built on the Cardano blockchain. It’s one of the first functioning DEXs on Cardano, making it an ecosystem pioneer. MinSwap allows users to swap different tokens directly on the blockchain, eliminating the need for intermediaries.

Like what UniSwap is to Ethereum, MinSwap uses an automated market maker (AMM) model, meaning traders can instantly swap Cardano ecosystem tokens like SNEK through liquidity pools.

What I like about MinSwap is its user-friendly interface, making it easy for beginners and experienced traders to navigate the platform. MinSwap boasts the highest key metrics, like TVL (Total Value Locked) and trading volume, of all DEXes on Cardano, beating out competitors like SundaeSwap and MuesliSwap.

2. Liqwid Finance

Before you say anything; No, it’s not a typo. That’s just how it’s spelled.

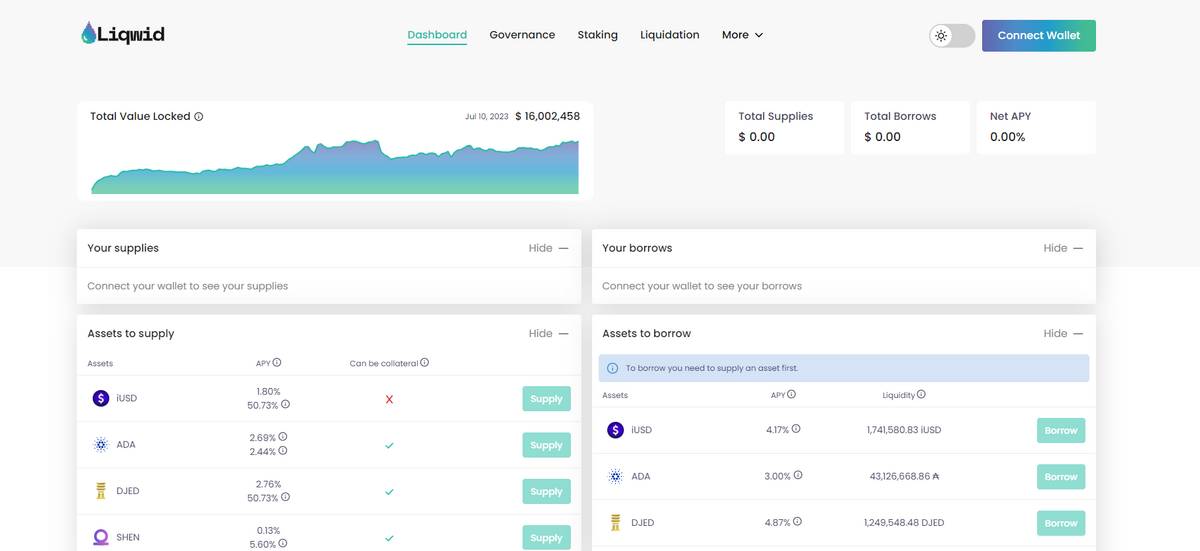

Liqwid Finance is a cornerstone DeFi application within the Cardano ecosystem. An open-source, algorithmic, and non-custodial interest rate protocol, Liqwid Finance helps users lend and borrow cryptocurrencies securely and transparently.

If you’re already familiar with AAVE on Ethereum, Liqwid Finance should be easy to get the hang of. The platform enables Cardano users to earn interest on their cryptocurrency holdings by lending them to other users.

On the other side of the coin, users can also borrow cryptocurrencies against their existing holdings. Interest is algorithmically adjusted based on supply and demand to ensure fair and competitive rates.

3. DJED Protocol

A staple of the ecosystem, DJED Protocol is perhaps the most important member of the Cardano dApp family. DJED is the native decentralized stablecoin on the Cardano blockchain, which uses an algorithm to ensure its value, regardless of fluctuations in the crypto markets.

In case you didn’t know, stablecoins are cryptocurrencies pegged to a stable asset, like USD. They’re designed to minimize the volatility typically associated with cryptocurrencies, making them ideal for transactions and storing value. The DJED stablecoin is algorithmically stabilized, meaning it uses smart contracts to adjust the supply of the stablecoin in response to changes in demand.

Unlike other stablecoins like Tether (USDT) and USD Coin (USDC), DJED is fully decentralized. It’s not controlled by any single entity, but instead, it’s governed by the users of the protocol and wider Cardano blockchain.

4. JPG Store

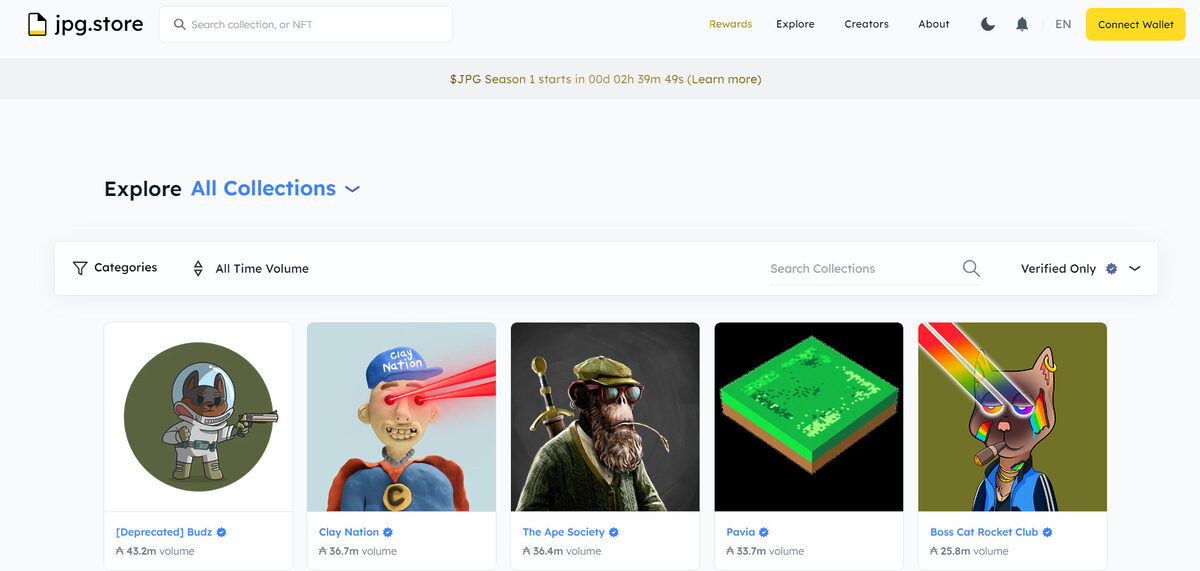

Now for something a bit more fun. Like Ethereum and Solana (SOL), the Cardano blockchain hosts its own thriving NFT community. JPG Store is the beating heart of Cardano’s NFT culture.

JPG Store is a vibrant and exciting dApp that brings the world of Non-Fungible Tokens (NFTs) to the Cardano blockchain. NFTs are unique digital assets representing ownership of a specific item or piece of content, both in real life and in the Metaverse.

At its core, JPG Store is an NFT marketplace where users can mint, collect, and trade NFTs. It’s a hub of creativity and innovation, with a wide range of digital art and collectibles available for purchase. The platform dominates other NFT marketplaces on Cardano, with competitors like cNFT no longer having enough trading volume to continue operations.

One of the unique features of JPG Store is its commitment to supporting artists. The platform offers a fair and transparent fee structure, ensuring that artists receive a significant portion of the sales proceeds.

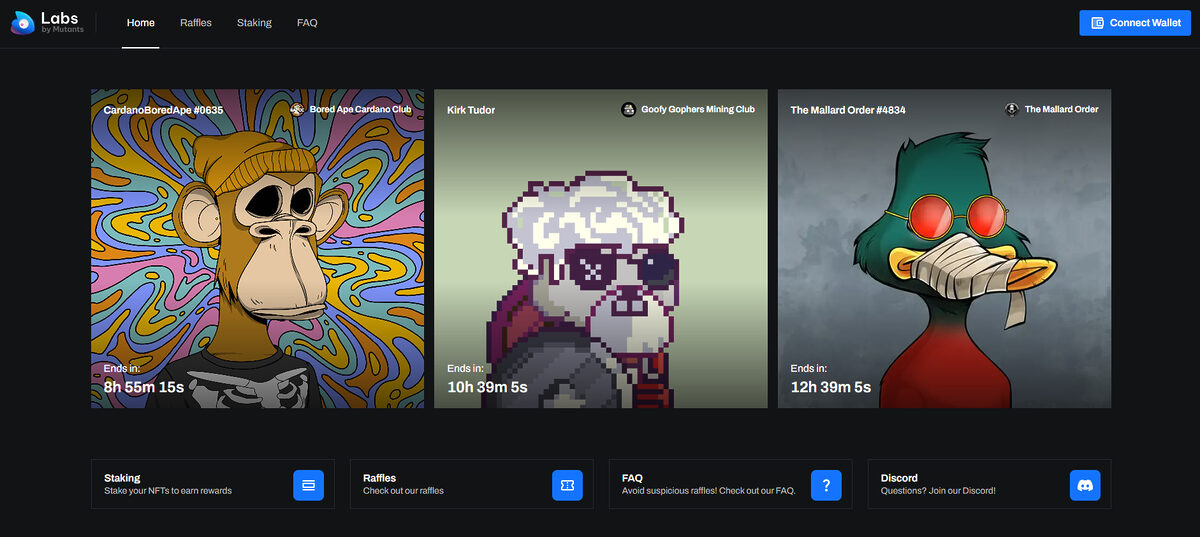

5. Labs by Mutants

Sticking with the NFT theme, Labs by Mutants is a simple NFT raffle and staking platform that adds a utility layer to Cardano’s emerging NFT scene.

With Labs by Mutants, NFT project founders can set up staking pools that reward their holders with Cardano ecosystem tokens. What’s more, individual users can buy raffle tickets for blue chip Cardano NFTs that might typically be outside their price range.

Labs by Mutants proves that you don’t need to be a rocket scientist to build useful Cardano dApps. A simple, well-executed product that is useful is all needed to help bring value to the network.

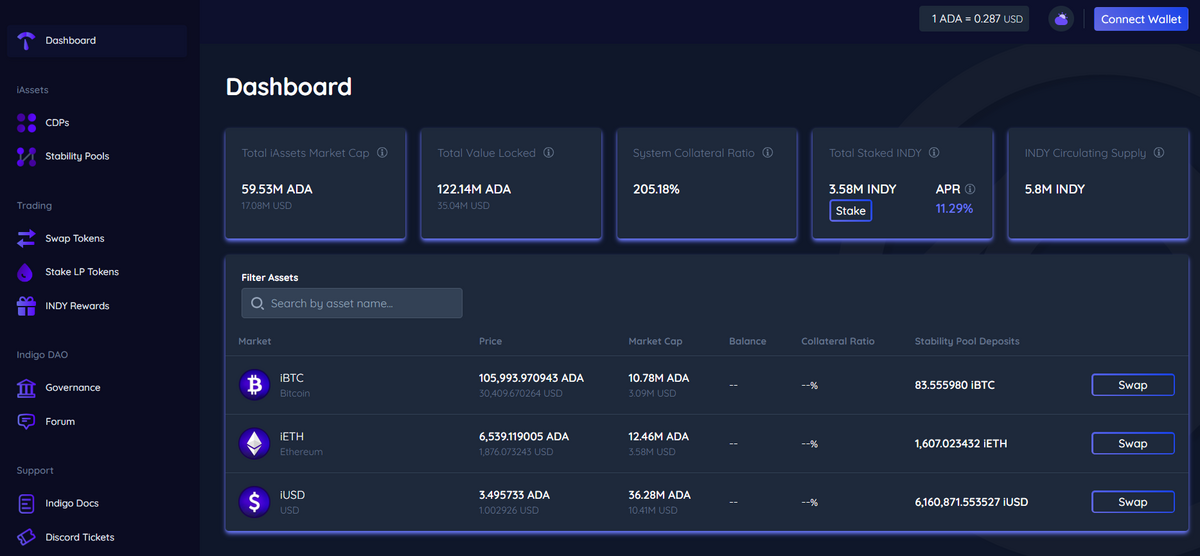

6. Indigo Protocol

Indigo Protocol is a powerful Cardano dApp aiming to bring real-world assets on-chain. It’s a platform that provides decentralized synthetics trading within the Cardano network. Using Indigo Protocol, anyone can create synthetic assets called iAssets.

In theory, Synthetic assets give users exposure to a variety of assets, like gold and traditional stocks, without the need to own the underlying asset. Indigo Protocol leverages Cardano’s scalability and accessibility to deliver all these assets to anyone with access to the Internet.

While Indigo Protocol’s potential is massive, the platform is yet to offer iAssets outside of top cryptocurrency assets like Bitcoin and Ethereum.

7. Revuto

Rounding out our list of the best Cardano dApps is Revuto. With a focus on mass adoption and a real-world use case, Revuto is a subscription management and tracking platform that makes it easy to start, snooze, or cancel any subscription, like Netflix or Spotify, as you please.

Revuto allows users to control their subscriptions and leverage recurring payments with their debit/credit card, crypto, or DeFi services. The platform actively rewards users through cashback and referral rewards paid in REVU, the native token of the dApp.

With its innovative approach to subscription management and user-friendly interface, Revuto is a must-know dApp for anyone looking to take control of their subscription payments using blockchain technology.

8. Atala Prism

Developed by the Input-Output Global team, Atala Prism is a decentralized identity system (DID). Both individuals and businesses can use Atala to verify their identity and share their credentials, like educational achievements, without compromising their privacy or security.

Relatively speaking, Atala is flying under the radar within a booming ecosystem. While DeFi apps and NFT platforms enjoy most of the glory, platforms like Atala are already making significant changes in people’s lives.

The Ethiopian government has already leveraged Atala to provide over 5M students and 750,000 teachers with tamper-proof credentials that are verifiable on-chain.

Atala proves that blockchain technology is much more than meme coins and DeFi experiments. It shows that decentralized networks can be integrated into our society for meaningful change.

8. Astarter

Rounding out our list of the best Cardano dApps in 2024, we have Astarter. Astarter aims to be the next hub of Cardano DeFi, featuring a user interface that most blockchain enthusiasts will be familiar with.

Backed by EMURGO, the commercial arm of the Cardano ecosystem, Astarter encompasses everything you’d expect from a top DeFi platform. Users enjoy a wealth of great features, including token swapping, staking, and even on-chain money markets for lending and borrowing cryptocurrency.

Adding another utility layer, Astarter doubles as a launchpad for emerging Cardano-based projects. By staking $ADA, or the platform’s native token $AA, users can earn early-stage allocations to upcoming token launches on the Cardano blockchain.

Where Can I Learn About Other Cardano dApps and Projects?

If you want to explore even further and find everything the Cardano ecosystem offers, Cardano Cube is an excellent resource worth knowing about. The site provides detailed coverage across the growing range of Cardano dApps and official links that’ll help you avoid scams.

Another good place to find emerging Cardano projects is social media. Almost any Cardano crypto project worth its ADA will do its best to make itself known on social media, so following reliable Cardano influencers is a great place to start searching for new crypto startups.

Pros and Cons of Cardano dApps

As with any technology, Cardano dApps come with their own set of advantages and potential drawbacks. Let’s look at the benefits and potential challenges of using Cardano dApps.

Pros

- Decentralization – Cardano dApps are decentralized, providing increased transparency and security, as there’s no central point of failure.

- Scalability – With low transaction fees and high throughput, Cardano’s blockchain is designed for scalability.

- Sustainability – Cardano uses a proof-of-stake consensus algorithm making it energy-efficient and far more sustainable than older blockchains.

Cons

- Low User Count – Despite Cardano’s position as one of the top Layer 1 networks in the industry, the Cardano ecosystem attracts far fewer users than rival networks like Ethereum or Solana.

- Technical Understanding – To truly take advantage of dApps on Cardano, a certain level of Web3 know-how is required.

- Smart Contract Safety – While Cardano’s approach to smart contracts is designed to be secure, the risk of smart contract bugs or exploits is always present.

On the Flipside

- While Cardano is still an emerging network that hasn’t shown its maximum capabilities, none of the dApps on Cardano are truly revolutionary. On top of that, Cardano’s programming language restricts the number of developers who can build on the network.

Why This Matters

Cardano is one of the most popular blockchain networks in the industry with a passionate community of devout supporters. If you’re a Cardano fan, it’s important to clearly understand the dApps available on the Cardano network and how they function.

FAQs

Based on TVL and trading volume, MinSwap is the biggest DEX on the Cardano blockchain.

Since the Alonzo hard fork went live in September 2021, Cardano has supported smart contracts.

Thanks to its scalable design, secure infrastructure, and decentralized network, Cardano has the potential to be as big as Ethereum. However, Ethereum is well-established as the largest Layer-1 network in the crypto industry and will be difficult to displace.