Rivalries exist everywhere. Soccer has Lionel Messi and Cristiano Ronaldo in Soccer, Basketball has Stephen Curry and LeBron James in Basketball, and Tennis has Serena Williams and Maria Sharapova. It’s the same for crypto as well. The only difference is that the rivalries between personalities in crypto can lead to extraordinary market outcomes.

While the crypto ecosystem might be led by a couple of chill eccentric math nerds (like Vitalik Buterin and CZ of Binance), its rivalries are anything but chill. Great rivals in crypto don’t usually clash, but when they do they can ignite a chain of reactions that eventually wipe off 8 billion dollars from the market.

Sponsored

Here are five of the greatest rivalries that the world of crypto has ever seen.

1. CZ Binance Vs. Sam Bankman-Fried (SBF)

In the early days of November 2022, Twitter users @CZ_Binance and @SBF_FTX waded into an online back and forth that would eventually lead to 8 billion dollars or more of value getting wiped off the crypto market.

While no one knows about the background of this rivalry, we do know that it reached a boiling point sometime in the fourth quarter of 2022.

Sponsored

Before their rivalry turned toxic, Sam Bankman-Fried, the owner and founder of FTX, and CZ, the owner and founder of Binance, had a somewhat cordial relationship. Binance had invested about $2.1 billion in FTX, so it was a huge shareholder in the exchange’s stakes. This kind of investment is usually not done on a whim, and CZ presumably believed in SBF and the FTX vision at the time.

In the time since that investment, FTX grew to become the second-largest crypto exchange in the world. The only exchange bigger than it was Binance, and there were, in institutional terms, the biggest rivals in crypto. Despite this, FTX and Binance never really had a public spat, and things went swimmingly between both companies.

However, all of that changed in 2021. According to CZ, Binance exited its position in FTX in July 2021 after being “increasingly uncomfortable” with FTX and the relationship it had with a sister firm, Alameda Research. CZ tweeted that Binance’s decision to pull out of FTX and exit their position made SBF very angry and that he became rather unhinged.

But that was just the beginning. In a bombshell thread, CZ claimed Binance would be selling all the FTT tokens it had on its books. Almost immediately, the CEO of Alameda Research, Caroline Ellison, made a tweet saying Binance should sell all its FTT to Alameda at $22.

In the early days of November 2022, Twitter users @CZ_Binance and @SBF_FTX waded into an online back and forth that would eventually lead to 8 billion dollars or more of value getting wiped off the crypto market.

While no one knows about the background of this rivalry, we do know that it reached a boiling point sometime in the fourth quarter of 2022.

Before their rivalry turned toxic, Sam Bankman-Fried, the owner and founder of FTX, and CZ, the owner and founder of Binance, had a somewhat cordial relationship. Binance had invested about $2.1 billion in FTX, so it was a huge shareholder in the exchange’s stakes. This kind of investment is usually not done on a whim, and CZ presumably believed in SBF and the FTX vision at the time.

In the time since that investment, FTX grew to become the second-largest crypto exchange in the world. The only exchange bigger than it was Binance, and there were, in institutional terms, the biggest rivals in crypto. Despite this, FTX and Binance never really had a public spat, and things went swimmingly between both companies.

However, all of that changed in 2021. According to CZ, Binance exited its position in FTX in July 2021 after being “increasingly uncomfortable” with FTX and the relationship it had with a sister firm, Alameda Research. CZ tweeted that Binance’s decision to pull out of FTX and exit their position made SBF very angry and that he became rather unhinged.

But that was just the beginning. In a bombshell thread, CZ claimed Binance would be selling all the FTT tokens it had on its books. Almost immediately, the CEO of Alameda Research, Caroline Ellison, made a tweet saying Binance should sell all its FTT to Alameda at $22.

@cz_binance if you're looking to minimize the market impact on your FTT sales, Alameda will happily buy it all from you today at $22!

— Caroline (@carolinecapital) November 6, 2022

However, industry players noted that this was far from logical behavior from Ellison. If she truly believed that FTX and Alameda were stable, she wouldn’t be desperately asking Binance to sell FTT to Alameda Research.

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

In any case, the thread immediately created a bank run on FTX that eventually led the market to understand that the exchange was insolvent already.

In later threads, CZ said that he would never support people who lobby against other industry players behind their backs. This tweet was about reports that SBF supported the DCCPA draft bill that could have given FTX a market advantage.

Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won't pretend to make love after divorce. We are not against anyone. But we won't support people who lobby against other industry players behind their backs. Onwards.

— CZ 🔶 Binance (@cz_binance) November 6, 2022

This tweet revealed a personal dynamic to the entire drama that people weren’t aware of before. CZ wasn’t just selling FTT because of business, he was also selling it because he viewed SBF, and consequently FTX, as bad actors.

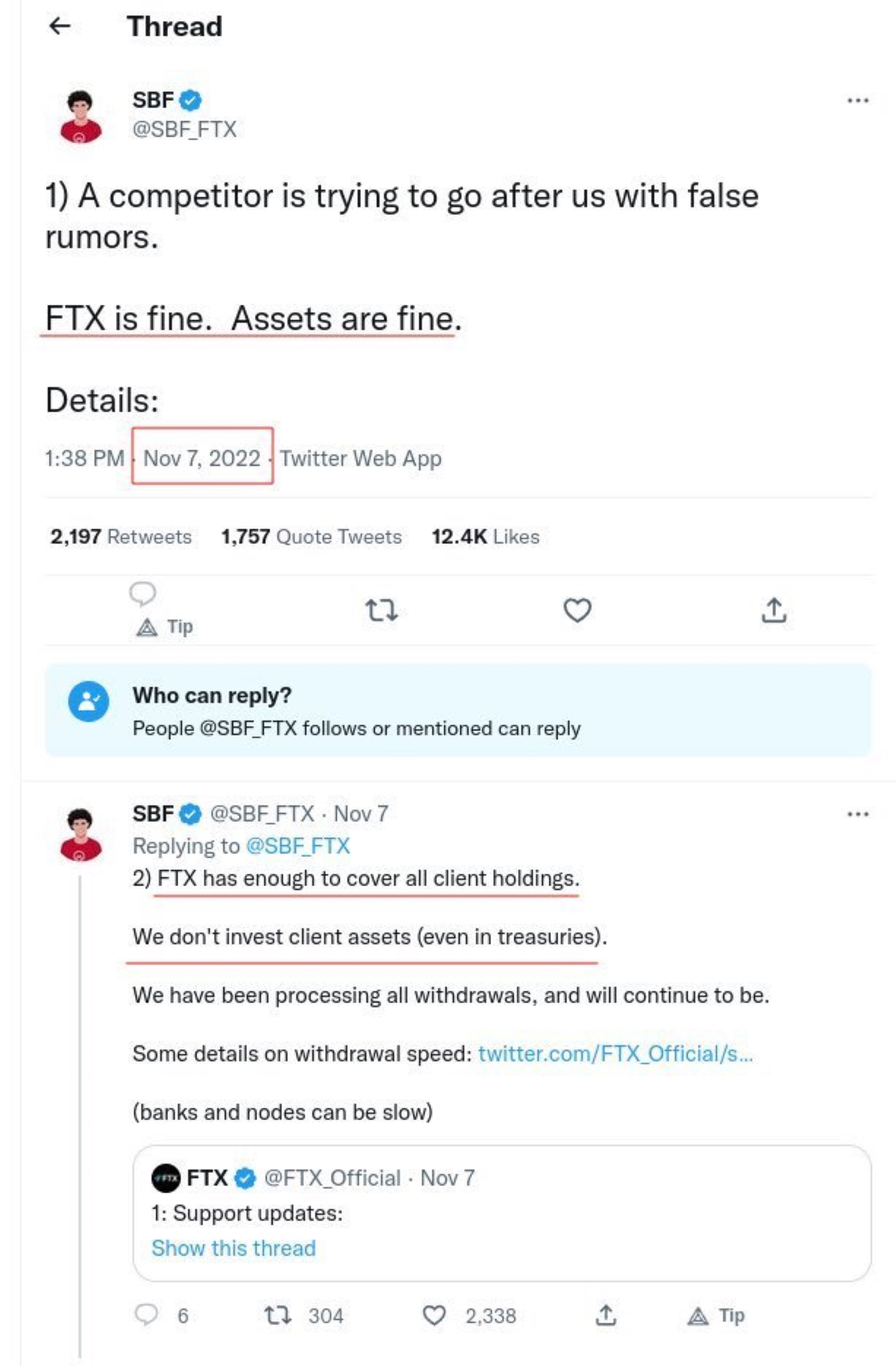

SBF kept calm through all this, and only replied to CZ days later. In his now-deleted reply, he said that assets were fine and nothing was wrong with FTT. However, that turned out to be a lie as the exchange soon restricted withdrawals.

Eventually, SBF tweeted that FTX had reached an arrangement to be bought out by Binance. Unfortunately, that arrangement fell through. But the worst of the spats between SBF and CZ were yet to come.

As the situation with FTX unraveled and people realized just how badly run FTX was, public sentiment against SBF grew. CZ went on to call SBF a fraud in a tweet thread. He also said that SBF threatened the entire Binance team when FTX was forced to buy Binance’s stake out. Lastly, he insisted that SBF used customer funds to purchase goodwill in the media.

It seems $15m not only changed @kevinolearytv’s mind about crypto, it also made him align with a fraudster. Is he seriously defending SBF?https://t.co/JoKapOcMXr (baseless attacks start around 4:20).

— CZ 🔶 Binance (@cz_binance) December 9, 2022

A thread. 1/11

To this, a resigned SBF tweeted that CZ should stop lying, and should take the “win.”

You won, @cz_binance.

— SBF (@SBF_FTX) December 9, 2022

There's no need to lie, now, about the buyout.

We initiated conversations around buying you out, and we decided to do it because it was important for our business.

And while I was frustrated with your 'negotiation' tactics, I chose to still do it.

To many spectators, this just outlined how nonchalant SBF was, as he still assumed that the crypto market was some kind of game one could win or lose with minimal material consequences.

In the end, the FTX crash will always be linked to CZ taking a stand and deciding to publicly make a move to protect his business from his biggest rival.

2. Vitalik Buterin Vs. Justin Sun

Ever since Ethereum came online, many cryptos have been created with the explicit mission of being Ethereum’s killer. Vitalik Buterin, the main person behind Ethereum, has hardly ever given these projects any thought.

Tron is one of these projects, and it’s led by Justin Sun. Strictly speaking, Tron and Ethereum can hardly be compared as projects. Ethereum has a way bigger market cap, better use cases, and hosts bigger projects than Tron.

However, this hasn’t stopped Sun and Buterin from clashing on several issues. One time, Sun made a tweet listing seven reasons why Tron was better than Ethereum. Buterin replied with an eighth reason, which was that Tron had a better whitepaper since it was made through copying and pasting from other projects.

8. Better white paper writing capability (Ctrl+C + Ctrl+V much higher efficiency than keyboard typing new content)

— vitalik.eth (@VitalikButerin) April 6, 2018

Sun has also clashed with Buterin on what path Ethereum should take after its merger. According to Sun, the Proof-of-Work (PoW) mechanism should exist post-merge. Buterin, on the other hand, had harsh words for Sun and other people who wanted the continued existence of the Proof-of-Work (PoW) mechanism. He stated that they were mostly exchange owners trying to make more money.

3. Elon Musk Vs. Sam Bankman-Fried (SBF)

While SBF was dealing with the tragic crash of FTX, he was also suffering verbal attacks from the richest man in the world.

When news of the FTX crash broke and people realized just how much SBF donated to Democrat campaigns, lots of conspiracy theories began to fly around. And some of these theories were fanned by Mr. Musk himself.

Musk argued that SBF was a lot better at paying the media for favorable stories than at running his company. At the time, a rumor that SBF had significant investment in Twitter also began spreading. Musk immediately debunked them by saying SBF had no shares in Twitter as a private company.

Musk also scoffed at the idea that SBF had enough liquidity to invest in the purchase of Twitter. In leaked messages with Micheal Grimes, his banker, he seemingly found it incredulous that SBF had up to $3 billion in cash. Musk then went on to claim that when he met SBF he felt his “bullshit meter redlining.” Of course, SBF was in no position to give Musk a rebuttal. He had bigger fish to fry.

4. Vitalik Buterin Vs. Michael Saylor

Michael Saylor may not be building an Ethereum killer, but that didn’t stop Buterin from clashing with him. Saylor and Buterin are two of the most important people in crypto, and one could say they are rivals in the crypto-influencing space.

However, this doesn’t mean they have any love for one another. In July 2022, Saylor granted an interview where he called Ethereum unethical because it violated fundamental securities laws.

Noted cypherpunk Michael Saylor on why Ethereum is inherently unethical because its existence violates securities laws which have their basis in the 10 commandments:

— Daniel "e1c04d9987a20652018" Goldman (parody) (@DZack23) July 30, 2022

(h/t @adjtewck)https://t.co/GzhTGnPfK8

Vitalik Buterin wasn’t willing to take that comment lying down, so he quoted Saylor and gave a scathing reply. He tweeted that Saylor was a Bitcoin maximalist who also turned out to be a total clown.

5. CZ Binance Vs. OKCoin

Today, CZ is known for building the behemoth called Binance. However, what people don’t know is that CZ used to be the CTO for OKCoin in 2014. That was one of CZ’s first jobs in cryptocurrency.

Interestingly, CZ didn’t leave his job at OKCoin amicably. At first, he tendered his resignation and said he was leaving to pursue other interests. However, things got dicey during a legal tussle that OKCoin had with Roger Ver, the CEO of Bitcoin.com.

Roger Ver and OKCoin had negotiated a payment agreement over service, and CZ had been a signatory to that agreement. However, things turned on their head when another agreement that CZ hadn’t signed emerged. CZ argued that by generating another agreement, OKCoin was seriously violating its contractual obligations.

In the end, CZ made very serious allegations against OKCoin. He claimed that the company used his physical signature to conduct multiple bank transfers from bank accounts. He also confirmed that OKCoin used bots to trade on their platform and that some of these bits were assigned to pump trading volume up.

On the Flipside

- For what it’s worth, these rivalries in crypto are often driven by opposition based on ideas, not on malice. As such, these rivalries hardly ever leave Twitter.

Why You Should Care

Sometimes, rivals can reveal deep problems with business models that crypto investors should pay attention to. The plagiarism claim that Vitalik Buterin made against Justin Sun, for example, may inform traders to be wary of Tron.