Solana crypto set the blockchain industry alight in 2021 as SOL scorched from $3 USD to over $250 over the year. Despite burning out under the collapse of FTX and the strain of repeated network outages, Solana is firmly back on its feet and ready to blaze new trails in the cryptocurrency world.

As the industry’s most performant Layer One blockchain, Solana is often touted as the leading ‘Ethereum (ETH) Killer’ in the crypto market. Solana has garnered a substantial following and a staunch community of supporters by boasting lightning-fast speeds and watertight network security.

What about Solana has got everyone from Wall Street moguls to your next-door neighbor humming with excitement? How does Solana’s novel Proof-of-History consensus mechanism work, and what can we expect from Anatoly Yakovenko’s blockchain in the future?

Table of Contents

What Is Solana Coin?

Solana is a revolutionary Layer-1 protocol designed to facilitate decentralized apps and crypto transactions at speeds previously thought impossible. Founded by Anatoly Yakovenko, this blockchain network credits its scalability to a unique consensus mechanism known as Proof-of-History (PoH).

Sponsored

But wait, there’s more. Solana offers more than just instant transactions and secure contracts; it’s also affordable. Yakovenko and the Solana Foundation envision a world where you can execute thousands of transactions per second for just a fraction of a cent.

Wait a second. Haven’t we heard all this before? Isn’t that the same goal that everyone from Dogecoin (DOGE) and Ripple (XRP) to Cardano (ADA) and Binance Coin (BNB) has already promised us?

Sponsored

What makes Solana any different? Let’s take a look under the hood.

How Does Solana Work?

At the heart of Solana’s groundbreaking speed and efficiency is its unique consensus mechanism, Proof-of-History (PoH). But what is PoH, and why is it causing such a stir in the crypto community?

Proof-of-History is not just a tweak to existing blockchain models; it’s a complete overhaul. Traditional blockchains like Bitcoin (BTC) and Ethereum rely on validators and miners individually reaching a consensus to add a new block, which can be time-consuming and energy-intensive.

Solana co-founder Anatoly Yakovenko found a clever way around this, helping Solana reach its trademark speeds.

Solana’s Proof-of-History introduces a historical record proving that an event has occurred at a specific time. These timestamps allow validator nodes to communicate with each other and process data simultaneously instead of sequentially.

An easy way to understand this is to imagine a relay race. Normally, a runner can’t start their section of the track until their teammate brings them the baton.

Using Proof-of-History, every runner carries their own baton and starts simultaneously, meaning their team can run the same distance as other teams in the time it takes one normal runner to reach their first teammate.

But that’s just scratching the surface. Solana also employs a Proof-of-Stake (PoS) mechanism, where validators are chosen based on the number of tokens they hold and are willing to “stake” as collateral. This adds an extra layer of security and makes the network more energy-efficient.

This combination has provided a popular environment for developers to build a thriving ecosystem of smart contracts and Solana dApps (decentralized applications).

What Can I Do on Solana?

Solana is a veritable playground for anyone looking to push the boundaries of what’s possible in the crypto space. From decentralized finance (DeFi) to non-fungible tokens (NFTs) and even Web3 mobile devices, Solana provides a dynamic range of use cases within blockchain technology.

DeFi

Welcome to the future of decentralized finance, where Solana’s blazing speed and minuscule transaction costs set the stage for a financial revolution.

Imagine swapping tokens, lending or borrowing assets, and even earning yield through liquidity pools—all at a fraction of the cost and time you’re accustomed to on other blockchains. Solana’s DeFi ecosystem is not just about doing the same things faster; it’s about enabling entirely new financial products and services previously untenable due to limitations in speed and cost.

Decentralized exchanges like Orca leverage Solana’s capabilities to offer lightning-fast trades and high liquidity, while money markets like MarginFi help DeFi users tap into decentralized lending and borrowing pools.

With the unveiling of SPL Token-2022, a more composable new token standard, Solana DeFi is ready for its next big wave of innovation. Moreover, Solana supports top stablecoins like Tether (USDT) and USDC, giving on-chain traders a refuge from market volatility.

NFTs

While Ethereum has always been the go-to blockchain for NFTs, its high gas fees and lethargic transaction speeds have left many yearning for alternatives. With its jaw-dropping speed and low-cost transactions, Solana is home to a cultivated NFT scene.

While other networks have struggled to retain users, NFT culture and trading volume are alive and well on Solana. This is supported by popular dApps like the Tensor Marketplace and a wealth of NFT Lending platforms on the network.

Unlike Ethereum, NFT creator royalties can be enforced at a contractual level. This means that Solana has effectively resolved the marketplace royalty wars that plague other networks.

Whether you’re an artist looking to monetize your creations or a collector searching for the next big thing, Solana’s NFT ecosystem offers a tantalizing array of possibilities.

Solana Saga: Web3 Phone

In a bid to catch the vast wave of mobile-first blockchain users, Solana Labs unveiled one of their most ambitious projects yet. The Solana Saga is a Web3 smartphone with a built-in hardware wallet vault designed to integrate seamlessly with decentralized applications.

From decentralized social media to secure, peer-to-peer messaging on the blockchain, the Web3 Solana phone aims to redefine our understanding of what a mobile device can do.

Despite the noble intent and excitement from pockets of the Solana community, the Solana Saga has struggled to see its hoped-for adoption. The retail price of the Solana Saga has been cut almost in half since launch, indicating that demand is low.

Solana: The Eco-Friendly Cryptocurrency

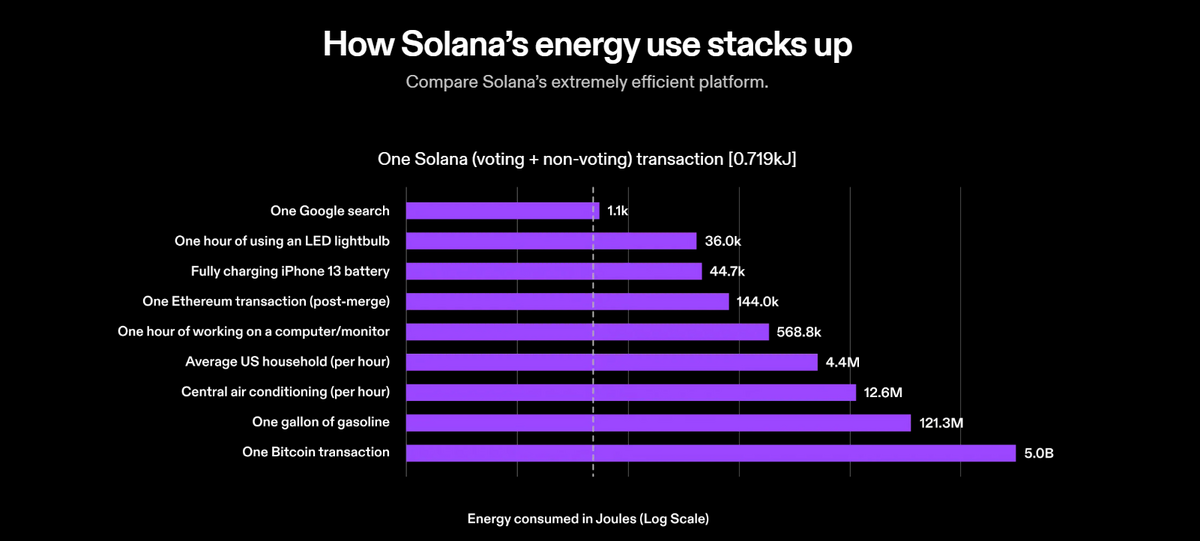

Not only does Solana’s unique network architecture keep financial costs low, but it also ensures that your environmental consciousness has a lower price to pay. Unlike the energy-intensive Proof-of-Work systems employed by Bitcoin and others, Solana is designed to be as light on the planet as it is on your wallet.

Solana has shocked the crypto world by achieving carbon neutrality thanks to low emissions and a dedicated carbon offsetting program. In fact, Solana Labs claims that sending a transaction on the Solana network uses less energy than a humble Google search.

As we hurtle towards a future where blockchain technology could underpin everything from international finance to governance, sustainability cannot be ignored. Solana offers a glimpse into a future where you don’t have to choose between groundbreaking technology and the health of our planet.

Even better, you have a snappy retort whenever someone tells you crypto is bad for the environment.

Solana Concerns and Controversy

While Solana has been basking in the limelight for its technological prowess and eco-friendly credentials, it’s not without its share of controversies and concerns. From centralized venture capital control to repeated network outages and the shocking collapse of FTX, Solana’s journey has been anything but smooth sailing.

Let’s start with the elephant in the room: centralized venture capital control. Solana has been backed by some of the biggest names in the VC world, including Multicoin Capital and Andreessen Horowitz.

While this has undoubtedly fueled its rapid growth, it also raises questions about the true extent of its decentralization. After all, what happens when a handful of wealthy investors wield disproportionate influence over a supposedly decentralized network?

In its early days, the Solana network faced several outages due to overwhelming demand. While this was always resolved in hours, it discouraged blockchain purists who felt that Solana wasn’t a safe place to store their cryptocurrency funds.

And who could forget the collapse of FTX, one of the largest crypto exchanges and a significant player in the Solana ecosystem? The downfall sent shockwaves through the community and raised serious concerns about the robustness and reliability of projects built on the Solana blockchain.

Even today, FTX and Alameda Research hold upwards of 10M SOL tokens, which will likely be unloaded on the market to pay forced liquidations as legal proceedings around FTX’s Bankruptcy unravel. This casts a foreboding shadow over the Solana ecosystem as a lingering threat.

While these issues are significant, the network and its users remain confident and committed. Despite what its detractors say, Solana is one of the industry’s most decentralized networks.

According to the Nakamoto Coeffeciency Score, a metric measuring how many validators it would take to seize a blockchain, Solana is more secure than rivals like Ethereum and Polygon.

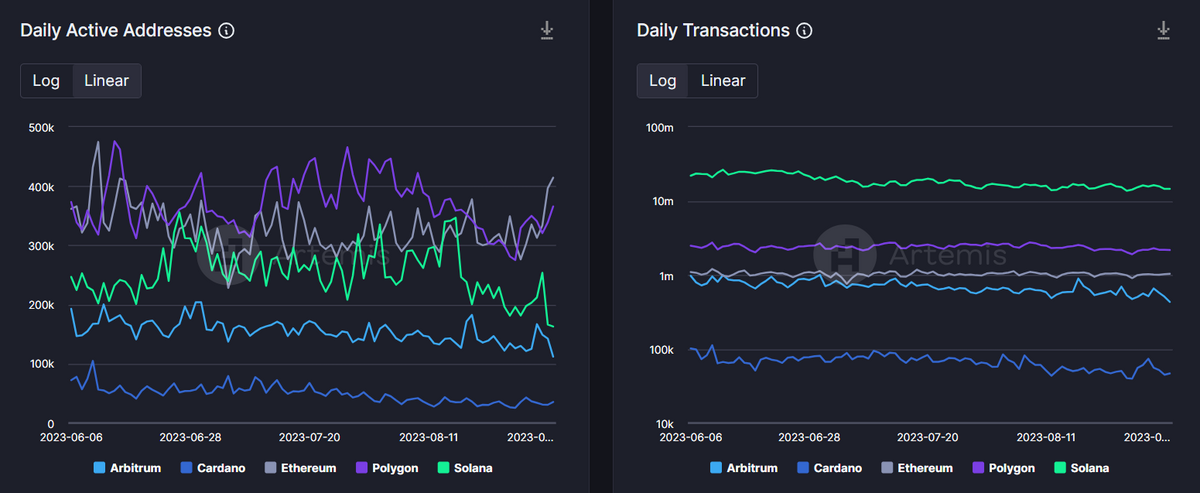

On top of that, Solana has just recorded six consecutive months of network uptime despite hosting similar levels of Daily Active Addresses and a vastly greater number of transactions. While it’s worth noting that these include validator voting transactions, Solana still averages around 300 ‘true’ transactions per second. This is over 20x what Ethereum and its other competitors handle during regular usage.

What’s Next for Solana?

The biggest network update on Solana’s is the rollout of the Firedancer Validator Client. Developed by Jump Crypto, this initiative aims to introduce significant performance, scalability, and efficiency improvements.

Firedancer promises to enhance transaction throughput, allowing for even faster and more efficient operations. This is a game-changer for developers and users alike, who can now look forward to even more robust and responsive decentralized applications (dApps). In a live demo, a single Firedancer validator client could execute over 1M transactions per second, breaking all previous blockchain records.

But that’s not all. Firedancer also aims to improve the network’s security features, making it more resistant to attacks and vulnerabilities. This added layer of protection is crucial as Solana continues to grow in size and complexity, attracting more users and larger transactions.

Solana Crypto: Pros and Cons

For all its groundbreaking innovations and jaw-dropping speed, Solana is not without its share of strengths and weaknesses. Let’s cut through the noise and get down to the nitty-gritty, shall we?

Pros

- Speed – Solana’s blockchain transactions are processed in split seconds, making it one of the fastest networks in the industry.

- Low Transaction Fees – Forget about shelling out exorbitant fees for simple transactions. At a fraction of a cent, Solana’s minimal costs make it a haven for users and developers alike.

- Scalability – With the ability to handle thousands of transactions per second, Solana is built for mass adoption.

- Eco-Friendly – Solana’s energy-efficient architecture is a breath of fresh air in a world grappling with climate change.

- Expanding ecosystem – Solana has a thriving developer community and a proliferating range of dApps.

Cons

- Centralized VC Control – The involvement of venture capital firms raises questions about Solana’s decentralization credentials.

- Price Volatility – Let’s be honest: Solana’s price chart looks like a coordinated pump-and-dump on a massive scale. This discourages new investors from exploring the Solana network.

- Growing Pains – Solana has experienced its share of technical glitches and outages as a relatively new entrant to the crypto space.

- FTX/Alameda Holdings – Alameda Research, Sam Bankman-Fried’s sister company to FTX, still owns a significant portion of SOL tokens and will be forced to liquidate them during bankruptcy proceedings.

On the Flipside

- Solana was the shining star of the 2021 bull run. However, when the next crypto bull cycle rolls around, who knows if its technology will still be relevant in a competitive field of emerging alternative Layer Ones, like Aptos (APT).

Why This Matters

Solana is one of the top ten cryptocurrencies by market cap and is seen as a serious threat to Ethereum’s dominance. It has even been included in some crypto ETFs. Understanding what Solana is and how it works will help you make informed decisions in the crypto market.

FAQs

You can buy Solana (SOL) on top crypto exchanges like Binance, Coinbase and Kraken.

According to realtime data provided by CoinMarketCap, the circulating supply of SOL tokens is approximately 408.7 million.

If SOL reached $1,000 USD, it would have a market capitalization of around $400B. This would make Solana larger than Ethereum and almost as large as Bitcoin.

The all-time high price of Solana was recorded on November 6, 2021. The SOL price at the time was $260 USD.