In the world of cryptocurrencies, choosing the right exchange can be as crucial as picking the right coin. Our KuCoin crypto exchange review objectively examines one of the most popular options amongst blockchain enthusiasts.

KuCoin is known for offering a huge variety of altcoins, on top of industry staples like Bitcoin (BTC) and Ethereum (ETH). But what if I told you that’s just the tip of the iceberg?

With a comprehensive trading platform, unique NFT products, and its very own blockchain network, KuCoin ticks all the boxes required of a crypto exchange today. But what makes it stand out in the crowded crypto space? Is it the right platform for your trading and investment needs?

Sponsored

In this KuCoin review, we’ll explore the ins and outs of KuCoin and see how the crypto exchange platform stacks up against other industry giants. We have a lot of ground to cover, so let’s get stuck in!

Table of Contents

What Is KuCoin?

KuCoin is a global cryptocurrency exchange popular amongst experience crypto users. Based in the Seychelles, KuCoin has rapidly ascended the ranks to become one of CoinMarketCap’s top five best crypto exchanges.

It offers a convenient platform for buying, selling, and trading a massive spread of cryptocurrencies, boasting over 700 different digital assets. KuCoin calls itself ‘The People’s Exchange’, boasting over 20 million users in more than 200 countries. But KuCoin isn’t just about quantity; it’s about quality too.

Sponsored

The crypto exchange offers a user-friendly interface, competitive fees, and a swathe of features, KuCoin aims to provide a seamless and enriching trading experience for both first-timers and experienced traders alike.

Beyond that, KuCoin users also benefit from all the standard security measures you’d expect from a top exchange, like two-factor authentication and cold storage.

KuCoin History

KuCoin’s journey began in 2017 when the Kucoin token (KCS) opened its doors with an initial coin offering (ICO). Initially based in Singapore, the co-founders envisioned creating a platform for the people, a vision that has largely shaped KuCoin’s trajectory.

Despite its relatively recent entry into the market, KuCoin has managed to carve a significant niche in the global crypto landscape. Crypto enthusiasts put this rapid growth down to KuCoin’s wide range of cryptocurrencies and value-added features.

However, KuCoin’s journey hasn’t been without its share of challenges. The exchange faced regulatory issues in countries like The Netherlands and Canada and was even rumored to have significant exposure to FTX when it fell in November 2022.

Despite these hurdles, KuCoin has continued to evolve and adapt, solidifying user trust by releasing a Proof of Reserves in light of the FTX events.

KuCoin Review: Products and Features

KuCoin is more than just a website to trade crypto; it’s a fully-fledged platform that offers a suite of products and features designed to cater to the diverse needs of its users.

Whether you’re a casual investor looking to dip your toes into the crypto waters or a seasoned trader seeking advanced trading options, KuCoin has something for everyone.

KuCoin Trading Platform

KuCoin’s trading platform looks much like all the others. The key difference between KuCoin and other crypto exchanges is the sheer diversity of digital assets available. With over 700 listed cryptocurrencies, including top altcoins like Litecoin (LTC), PolkaDot (DOT) and Ripple (XRP), this extensive selection caters to both mainstream and niche crypto market enthusiasts.

As is standard in crypto, the platform supports various order types, including limit orders, market orders, and all your favorite stop-loss and take-profit triggers. It also offers advanced trading options such as margin trading , derivatives, and peer-to-peer (P2P) trading.

For those looking to automate their trading, KuCoin has introduced a Trading Bot feature. Think of it like a robo-advisor for your cryptocurrency portfolio, simplifying the trading process and letting your trades run hands-free.

If KuCoin’s trading platform had one fault, it offers limited payment methods for people looking to on-ramp fiat currency. KuCoin users can buy basic crypto assets using their credit or debit cards, but will need to dive into specific Tether (USDT) trading pairs for niche projects.

Let’s briefly recap the KuCoin trading platform’s main features:

- Spot Trading Market.

- Margin Trading Market.

- Futures and Derivatives contracts.

- OTC Trading Desk.

- KuCoin Trading Bots.

- Simplified Crypto converter.

- Compatible with API-based trading tools.

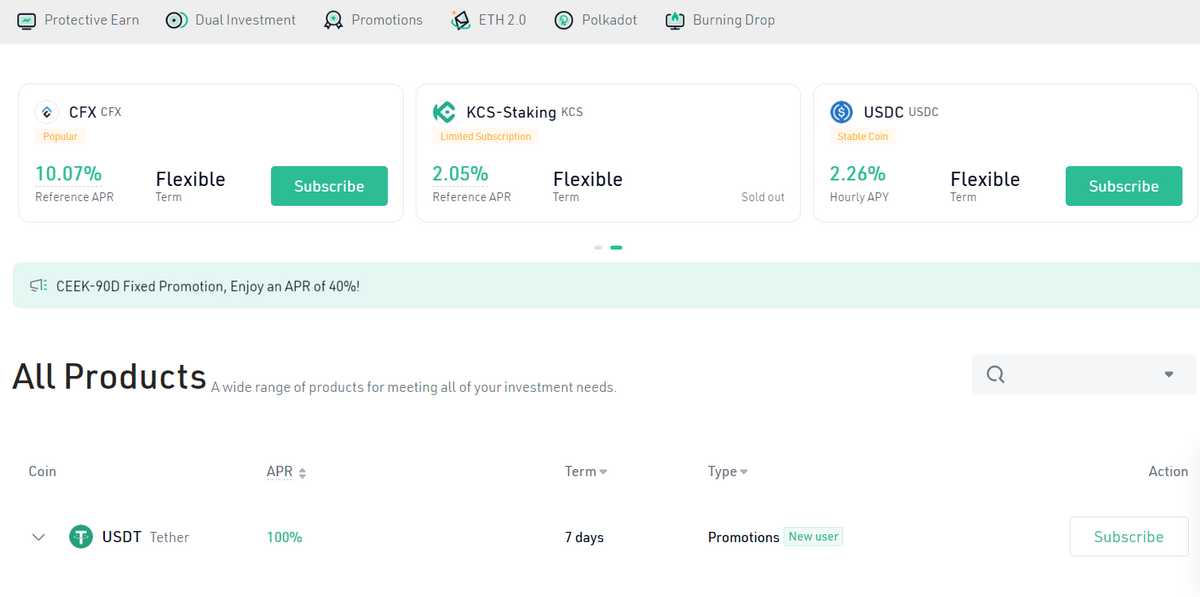

KuCoin Earn

KuCoin Earn is a feature that allows users to earn passive income from their cryptocurrency holdings. Account holders can participate in a variety of typical programs, including staking, yield farming, and a personal favorite, crypto lending.

The crypto lending process is straightforward: KuCoin users select the cryptocurrency they wish to loan to traders, set the duration and interest rate, and wait for a borrower to accept the offer. Once the loan is repaid, the lender receives their cryptocurrency back along with the agreed interest.

If you think these passive income strategies sound too good to be true, that’s because they are. It’s important to note that while KuCoin Earn can provide an additional income stream, it also comes with risks. Returns are never guaranteed and your staked assets are still liable to drop in USD value.

KuCoin Exchange Launchpad

KuCoin’s Exchange Launchpad, also known as Spotlight, is a platform that introduces and lists high-potential digital assets before they hit the public market. Crypto launchpads are a common exchange feature that allows users to participate in the early-stage investment rounds of promising crypto projects.

Spotlight works by holding token sales for new projects. Users can participate in these sales using KuCoin Shares (KCS), the native token of the KuCoin platform. In fact, KuCoin Spotlight is one of the best crypto launchpads in the industry, with high rates of successful token launches.

It’s worth noting that, unlike all other KuCoin features, KuCoin Spotlight requires that your account has completed KYC verification.

KuCoin NFT Ecosystem

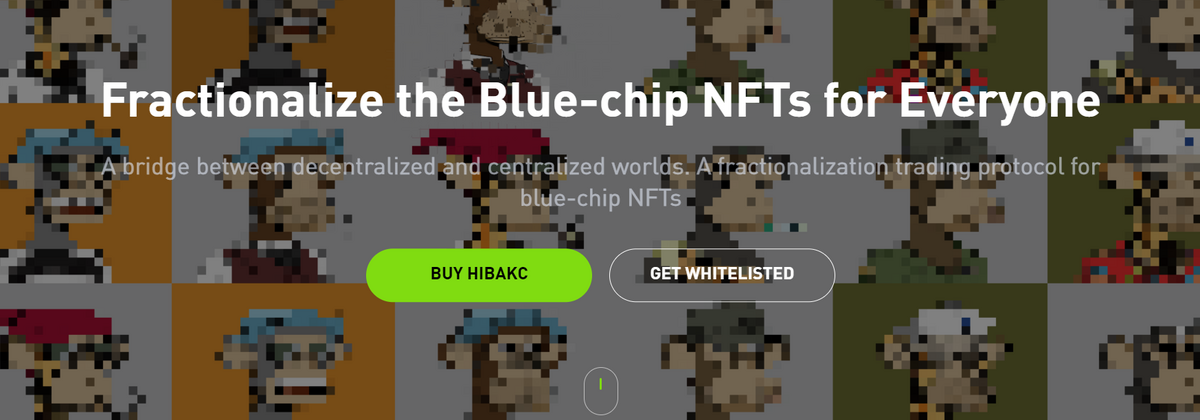

If everything has sounded pretty run-of-the-mill, that’s about to change. The KuCoin exchange has launched two key initiatives to cater to the burgeoning NFT market: Windvane and its unique Fractionalized NFT platform.

Windvane, KuCoin’s NFT aggregator, provides a comprehensive overview of the NFT market, pulling listings from all NFT marketplaces in the space. Certainly a helpful tool, but not exactly revolutionary.

On the other hand, KuCoin’s Fractionalized NFT platform is a game-changer in the NFT space. If you’ve ever wanted to buy Yuga Labs NFTs, but can’t afford the price tag, this one’s for you!

KuCoin’s Fractionalized NFT platform allows users to buy and sell fractions of high-value NFTs, making it possible for more people to participate in the NFT market. This tool makes expensive NFTs more accessible, allowing a broader range of investors to benefit from the potential upside of these unique digital assets.

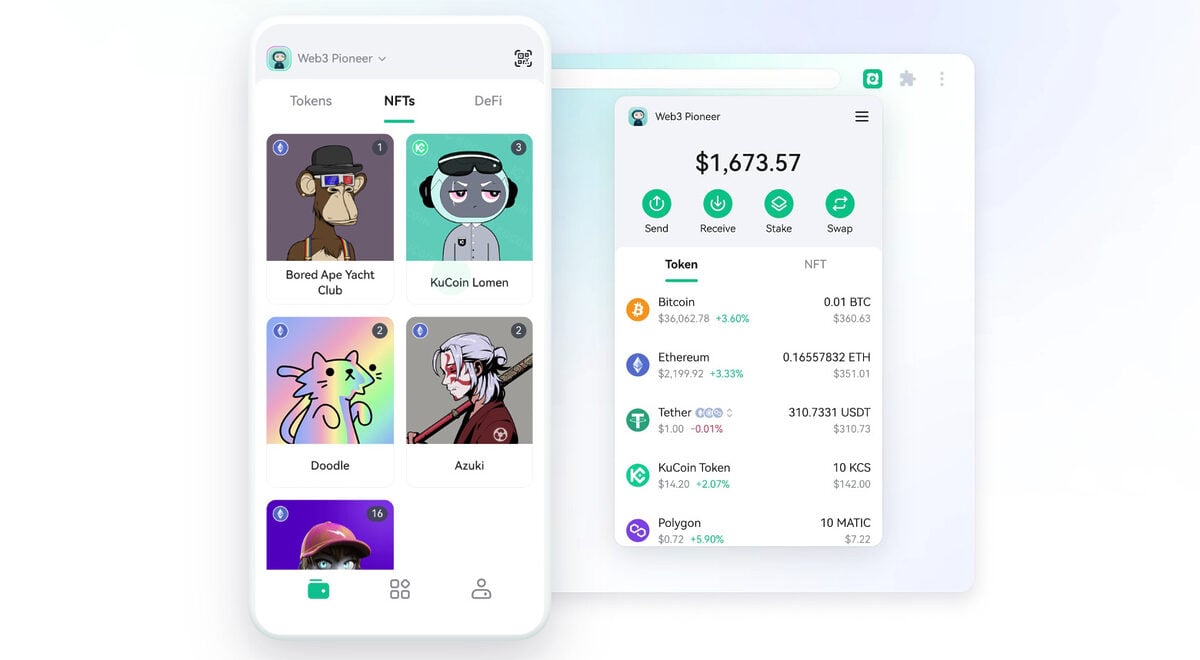

Halo Wallet

In the same way that Binance has Trust Wallet, KuCoin has developed its own multi-chain crypto wallet. The Halo Wallet is a convenient self-custody solution, designed to simplify the process of managing, transferring, and securing cryptocurrencies.

Halo Wallet is a slick platform that blends social networking and digital asset management. Users can connect with other crypto enthusiasts, share their market insights, and stay updated on the latest trends and news in the crypto world.

The wallet boasts all the standard security features you’d expect. Your seed phrase and private keys are well-protected and your wallet address is compatible with top EVM-compatible networks like Polygon (MATIC) and Arbitrum (ARB).

KuCoin Community Chain (KCC)

KuCoin Community Chain (KCC) is a public blockchain developed by fans of the KCS token and Kucoin. It aims to provide users with a more efficient and low-cost experience for using blockchain services.

The KCC operates an Ethereum Virtual Machine, meaning the network is compatible with Ethereum-based smart contracts. This makes it easy for developers to migrate their projects from Ethereum to KCC, potentially leading to a more diverse ecosystem of decentralized applications (dApps) on KCC.

One of the main benefits of the KCC is its low fees. By optimizing the block generation time and increasing the block capacity, KCC aims to offer faster transaction speeds and lower fees compared to the Ethereum mainnet.

KuCoin Account Registration

Signing up for KuCoin begins with a straightforward account registration process. Designed to be user-friendly, KuCoin ensures that even those new to the crypto world can easily navigate the sign-up process.

To create an account, you only need an email address or a phone number. It only takes a couple of minutes to sign up and start trading.

This highlights one of my favorite Kucoin features. You don’t need to go through any KYC verification processes to access most of the crypto exchange’s tools and markets.

KuCoin Fees

It wouldn’t be an objective KuCoin crypto exchange review if we didn’t look at fees. Fortunately, KuCoin’s fees are among the most competitive in the industry. The fees vary based on the trading level and the “class” of the coin traded on KuCoin.

For most popular cryptocurrencies like Bitcoin and Ethereum, which fall under Class A, the maker/taker fee range is 0.1%/0.1% respectively. More obscure coins fall under Class B and C, with slightly higher fees. KuCoin also charges withdrawal fees when pulling crypto out to a private wallet.

However, KuCoin offers ways to reduce these fees. Users can receive discounts on their trading fees based on their average monthly holdings of KuCoin Shares (KCS), the platform’s native token, or their previous month’s trading volume. Additionally, fees can be further slashed if they are paid with KCS.

KuCoin Shares (KCS)

KuCoin Shares (KCS) is the native token of the Kucoin platform. Like Binance’s BNB and Huobi’s HT, holding KCS unlocks a host of benefits that enhance the user experience on Kucoin.

One of the primary advantages of holding KCS is the potential for discounted trading fees. Kucoin offers a tiered discount system based on the amount of KCS held in a user’s account. The more KCS you hold, the lower your trading fees can be, making it an attractive proposition for frequent traders.

What separates KCS from other crypto exchange tokens is the opportunity to earn passive income through KuCoin Bonus. This bonus rewards holders of 6+ KCS tokens to earn rewards taken from KuCoin’s daily trading fee revenue. The more KCS you hold, the larger your share of the bonus.

On top of that, KuCoin has implemented a KCS buyback and burn program to drive value and scarcity to the native token. A portion of KuCoin’s net profit is used to buy back KCS from the market and burn them, reducing the total supply.

KuCoin vs. Binance

When it comes to choosing a cryptocurrency exchange, the decision often boils down to comparing the leading platforms. In the battle of KuCoin vs. Binance, both exchanges offer a wide range of cryptocurrencies, advanced trading features, and competitive fees. But how do they stack up against each other?

In terms of trading volume, Binance is the clear leader. As one of the largest exchanges globally, it offers high liquidity, which can be a significant advantage for traders. Binance also has a broader range of features, including NFT lending and tax reporting.

Not to be counted out, KuCoin shines in its own ways. It offers a more extensive selection of cryptocurrencies, making it an excellent platform for those looking to explore less mainstream coins. KuCoin also doesn’t require KYC-verification, making it a popular choice for traders who want to remain anonymous.

KuCoin vs. Coinbase

Coinbase, based in the U.S., is known for its user-friendly interface and is often recommended for beginners venturing into the world of cryptocurrencies. It offers a limited but carefully curated selection of cryptocurrencies, focusing on the most established and reliable coins.

On the other hand, KuCoin is more of an ‘anything-goes’ kinf of crypto exchange, supporting over 700 digital asset. KuCoin also offers more advanced features, including futures trading, margin trading, and lending, making it a preferred choice for more experienced traders. What’s more, KuCoin generally offers lower trading fees than Coinbase.

KuCoin Crypto Exchange Review: Pros and Cons

Every cryptocurrency exchange has its strengths and weaknesses, and KuCoin is no exception. To provide a balanced view, let’s delve into the pros and cons of using KuCoin as your go-to platform for trading and investing in cryptocurrencies.

Pros

- Wide range of crypto assets – In case you hadn’t realized, KuCoin’s biggest strength is the huge variety of available digital currencies.

- Advanced Trading Options – KuCoin offers advanced trading features that cater to experienced traders looking for more sophisticated trading options.

- Kucoin Shares (KCS) Benefits – Holding KCS unlocks benefits, including trading fee discounts and the opportunity to earn passive income through the KuCoin Bonus feature.

- Competitive Fees – KuCoin’s trading fees are among the most competitive in the industry, and users can receive further discounts by holding KCS or increasing their trading volume.

- KYC-Free – A big one for privacy buffs, you don’t need to give Kucoin any personal details to start trading.

Cons

- Complex for Beginners – While KuCoin’s interface is user-friendly, the sheer number of features and options can overwhelm beginners.

- Customer Support – While KuCoin offers 24/7 customer support, some users have reported slow response times and issues with resolving complex problems.

- Regulatory Risks – Like many cryptocurrency exchanges, KuCoin faces regulatory risks. Changes in regulations in the countries where it operates could impact its services.

On the Flipside

- KuCoin deposits and withdrawals are known to suspend with no warning temporarily. I once tried to deposit some MATIC tokens to the exchange from a personal wallet and the transaction was left pending for days.

Why This Matters

KuCoin has quickly risen through the crypto exchange ranks to become one of the most popular platforms in the blockchain industry. Understanding KuCoin’s unique features and flaws will help you decide if you want to use KuCoin as your preferred exchange.

FAQs

Yes, KuCoin’s mobile app is available on iOS and Android devices.

KuCoin is available in over 200 countries around the world.

KuCoin is a popular crypto exchange thanks to its wide range of available assets, extra features, and KYC-Free registration process.