In the stablecoin market, no battle rages harder than the colossal conflict of USDT vs. USDC. Stablecoins are widely considered the most useful application of DeFi and blockchain technology. While many value-pegged cryptocurrencies exist, Tether (USDT) and USD Coin (USDC) are light years ahead of the crowd.

Before directly comparing the crypto market’s most popular stablecoins, we first need to ask the burning questions.

What are stablecoins? Are these fiat-pegged digital currencies work, and are they truly safe to use?

What Are Stablecoins?

Stablecoins are a kind of cryptocurrency pegged to the value of other assets, like fiat currencies or gold. The most common stablecoins in the crypto market are pegged to US Dollars, although new coins pegged to other fiat currencies like EUR and RMB are slowly emerging.

Sponsored

These crypto assets live on the blockchain, providing a somewhat safe refuge from the market’s iconic volatility. In a perfect world, these digital assets are designed to maintain a stable value, regardless of fluctuations in the crypto market.

Sponsored

What are the different kinds of stablecoins, and how do they work?

How Do Stablecoins Work?

Depending on how they’re created and issued, stablecoins can be both centralized or decentralized. Most blockchain-based stablecoins fall into one of three distinct categories.

Fiat-Backed Stablecoins

Widely considered the safest variety, fiat-backed stablecoins are supported by their corresponding fiat currency reserves. Coins are backed 1:1 with an equal amount of fiat, which the issuer holds in reserve. USDT, USDC, and Binance USD (BUSD) are all excellent examples of fiat-backed cryptocurrencies.

Let’s use an issuer like Tether as an example. If I want one USDT token, I simply provide one USD to their reserves and receive one USDT in return. When I want fiat currency, I can redeem any USDT token in exchange for one USD.

Fiat-backed coins are the most resilient stablecoins. They typically recover strongly when de-pegging, or divergence from their intended value, occurs. These coins are centralized by nature, because they’re controlled by a central authority who governs stablecoin issuance and redemption.

Collateralized Stablecoins

Collateralized stablecoins are backed by other assets that are not fiat currency, like Bitcoin (BTC) or traditional assets like gold. Instead of providing fiat in exchange for stablecoins, users lock external assets into issuer protocols to mint the corresponding value in stablecoins.

For example, I could lock up 1 BTC within a protocol and receive 1 BTC worth of DAI, a popular collateralized stablecoin. These cryptocurrencies are popular in DeFi communities because these coins enjoy decentralized governance.

Unfortunately, collateralized stablecoins are generally less secure than fiat-backed coins because their value is derived from other assets. If the value of the provided collateral slips beneath the redeemable value of the number of coins in circulation, collateralized stablecoins are liable to depeg and don’t have the funds to recover.

Algorithmic Stablecoins

The wildest of the bunch, algorithmic stablecoins are cryptocurrencies that maintain a stable value through smart contracts. These blockchain-based contracts automatically buy and sell reserve currencies to ensure that coins stay at their intended value. Cardano’s native stablecoin, DJED, is an excellent example of algorithmic coins in action.

These coins are the most decentralized of all their peers, but also the most vulnerable. An algorithmic stablecoin, UST, was responsible for one of crypto history’s most devastating crashes when it lost its peg in May 2022.

Why Are Stablecoins so Important?

In the early days of the crypto market, all cryptocurrency prices were paired off against Bitcoin and Ethereum. The only way to realize profits was to sell digital assets back to fiat currencies and withdraw them back to a bank account via a cryptocurrency exchange.

If the cryptocurrency industry was ever going to mature, it needed stability and refuge from its inherent volatility. BTC and ETH were unreliable currencies of exchange because their value was constantly in flux.

Traders needed to be able to trade into a secure asset that would maintain a stable value on-chain. Since then, stablecoins have grown exponentially and fulfill a multitude of use cases in the industry.

- Fast transactions – While fiat transfers between bank accounts are limited to business hours and lengthy processing times, stablecoins can be sent and received within seconds.

- DeFi assets – Stablecoins can be lent out to DeFi enthusiasts at generous interest rates, used as collateral for crypto-backed instant loans, and deposited in staking contracts.

- Cross-border payments typically take days to process and charge extortionate fees. Stablecoin transfers have low transaction fees and are executed in seconds.

- Stable wealth in self-custody – Storing digital assets in self-custody and being your own bank is one of the fundamental pillars of cryptocurrency. Stablecoins allow you to store funds on-chain, without being exposed to fluctuations in crypto prices.

What Is Tether? (USDT)

Tether is the largest and most popular stablecoin in the cryptocurrency market. The USDT token was originally launched in 2014 by Tether Limited and is owned by iFinix, a financial institution based in Hong Kong. iFinex is also the company behind the Bitfinex crypto exchange.

The first stablecoin ever created, USDT tokens are backed 1:1 by US dollars held in Tethers reserves. Tether is one of the largest cryptocurrencies in the industry by market capitalization, third only to big kahunas Bitcoin and Ethereum.

USDT was originally deployed on the Bitcoin blockchain via the Omni Layer protocol but has since found a home on almost every network under the sun.

Despite being the biggest stablecoin in the crypto market, Tether has a shady reputation.

Tether Concerns

The Tether ecosystem is no stranger to controversy. Since USDT hit the blockchain, Tether has consistently failed to prove that its fiat reserves sufficiently back the circulating supply of USDT tokens in the market.

The red flags waved even harder after financial regulators and law enforcement investigated Tether. It was discovered that Tether’s reserves were insufficient, and corporate loans and bad debt also shored them up.

Bitfinex, Tether’s sister company, had misplaced $850M worth of client and corporate funds and used Tether’s reserves to bolster their balance sheet. Naturally, Tether Limited kept news of this loan under wraps, never informing their investors. In 2021, Tether saw the error of its ways and paid an $18M fine.

This only scrapes the surface of Tether’s murky history. Fortunately, the stablecoin giant appears to have turned a new leaf. Tether is more committed to transparency than ever and provides daily updates on the state of its reserves.

What Is USD Coin? (USDC)

Like its older brother, USD Coin is a crypto asset backed by fiat currency and pegged to the value of 1 USD. The USDC stablecoin was created by the Centre Consortium and was initially deployed as an ERC-20 token on the Ethereum blockchain in 2018.

Unlike Tether, USDC has always enjoyed a sterling reputation and demonstrated transparent proof of cash reserves. The Centre Consortium is a trusted financial institution with other respected companies like Circle and Coinbase. USDC tokens are exchanged 1:1 through regulated financial institutions rather than through one company like Tether.

USDC releases monthly attestations and audits proving that its fiat reserves are sufficiently stocked to service its expanding crypto ecosystem. USD COIN has surged recently, climbing the ranks to become the second-largest stablecoin in the industry and a top 10 cryptocurrency by market cap.

USD Coin Concerns

Even though USD Coin has a glowing reputation, it’s not immune to risk. Silicon Valley Bank had held over $3B in USD Coin, so during the bank’s collapse, USDC suffered a significant de-peg and dropped as low as $0.86.

The same slew of bank collapses also saw Signature Bank go belly up. This forced the closure of Signature Bank’s product Signet, which facilitated the redemption of USDC for US dollars. This brought more negative sentiment to Circle and USD Coin, questioning the stablecoin’s resilience in a crisis.

Fortunately, USD Coin weathered the storm and recovered its peg shortly after the initial divergence.

USDT vs. USDC

Ultimately, USDT and USDC are very similar and serve the same fundamental purposes. Both have shown strength in the face of adversity and quickly recovered their intended value after de-pegging. Despite their apparent similarities, it’s worth objectively examining what separates the stablecoin giants.

By the Numbers

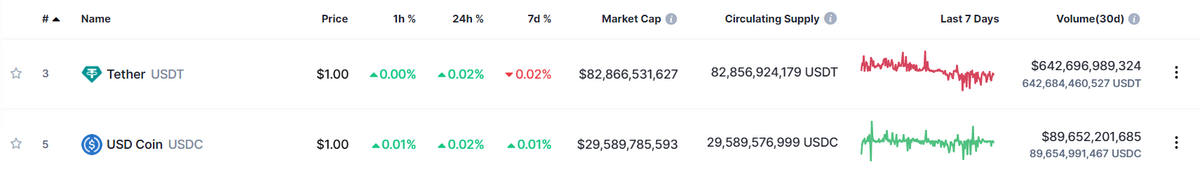

In terms of market share, Tether is the clear leader. At the time of writing, USDT’s market cap sits at $82B. This is more than double the size of USDC, which hits the scale at $29B.

Tether also enjoys deeper liquidity. Over the last 30 days, USDT has attracted over $620B worth of trading volume. This figure vastly outstrips USDC, which recorded just over $92B worth of trading volume in the same period.

Adoption & Availability

Both USDT and USDC are integrated and available on almost any blockchain you can think of, including Ethereum, BNB Chain, Tron (TRX), Solana (SOL), Avalanche (AVAX), Polygon (MATIC), Algorand (ALGO) and Hedera (HBAR).

USD Coin has a slight edge in the adoption stakes. Thanks to a partnership with Visa, the Circle Visa Corporate card allows customers to use USDC as payment at over 60 million merchants worldwide.

Another factor playing into USD Coin’s favor is its relationship with Coinbase. Because both companies are a part of the Centre Consortium, Coinbase doesn’t list USDT on its crypto exchange platform. Coinbase is often considered the most accessible exchange in the industry and is a popular choice for beginners entering the crypto space.

Safety

While Tether has a complicated history, USDT has stood the test of time. Besides small, market-wide depegs, USDT has maintained a stable value for almost a decade. There are still lingering questions about Tether’s honesty and accountability, but in a practical sense, USDT has always been a safe haven for value in the crypto market.

On the other hand, USD Coin has tried to do everything right and stayed transparent and accountable from the outset. Despite a brief divergence from its peg in early 2023, USDC has shown stability throughout its lifespan and recovered well when put under pressure.

The Bottom Line

Ultimately, which stablecoin you prefer to use is a personal choice. USDT is clearly the larger and more established of the two. However, USDC has proven its transparency and resilience and is quickly gaining ground on the leader.

Of course, do we even need stablecoin maximalism? Why put all your eggs in one basket when you can hold as many stablecoins as you like?

On the Flipside

In the USDT vs. USDC battle, there is still one glaring fault. Both stablecoins are heavily centralized, which goes against the ethos of cryptocurrency and blockchain technology. In fact, both Tether and USD Coin have questionable clauses that mean holders don’t have a legal right to redeem stablecoins for fiat currency.

Why This Matters

Stablecoins are an integral part of the cryptocurrency market. Their utility and role is crucial to the stability and reputation of the crypto space. Learning about stablecoins and how they function can help you to understand the associated risks and protect yourself from black swan events like the UST collapse.

FAQs

USDC is a popular stablecoin because its issuers show transparent proof that they have sufficient assets to back USDC tokens at a 1:1 value with the US dollar.

Historically, USDT has been the most stable coin in the crypto market. However, this is no guarantee of future stability.

You can swap and trade USDT to USDC on crypto exchanges and DEXes that list both stablecoins.

USDC’s reserves are audited and regulated to a higher standard than USDT’s reserves. However, this does not guarantee that it is the safer stablecoin.

If USDT collapses, it will be a disaster for the crypto industry. Over $80B in value would evaporate, and the crypto’s reputation might never recover.