- Cardano has maintained stability despite unwarranted market turbulence.

- While Cardano’s recent developments suggest a positive trajectory, investor sentiment has remained mixed.

- Still, despite how Cardano’s ADA performs, its DeFi ecosystem continues to thrive.

Cardano’s ADA has been showing a lot of strength lately as it successfully navigates market turbulence, even as news of impending chaos continues to surface. Concurrently, its DeFi ecosystem has also displayed exceptional growth, breaking record after record.

To provide insights into these exciting developments, we are delighted to present our Bi-Weekly DailyCoin Regular on Cardano from our expert, Insha Zia.

Current Outlook

While Cardano is still recovering from the SEC’s security classification, trading 35% below its June high of $0.38, it has displayed exceptional stability in the face of rising regulatory pressure. This resilience is evident even with the SEC pressuring US exchanges to delist Cardano.

Sponsored

While major exchanges like Coinbase have taken a stand against the regulator’s scrutiny, platforms like Robinhood, eToro, Bakkt, and Revolut have yielded to the SEC’s demands and are planning on dumping their ADA bags, adding copious amounts of sell pressure on the token.

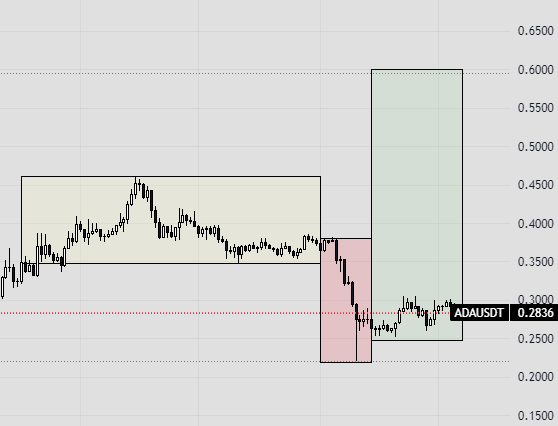

Nevertheless, despite the FUD surrounding the token, Cardano has shown great strength as it effortlessly absorbed the pressure to reclaim the $0.3 level this week before pulling back. At press time, ADA exchanged hands at $0.28, up 27% from its lowest point of the year. Although the token is down 6% since the last DailyCoin regular, it has been showing positive signs.

Bears and Bulls Clash

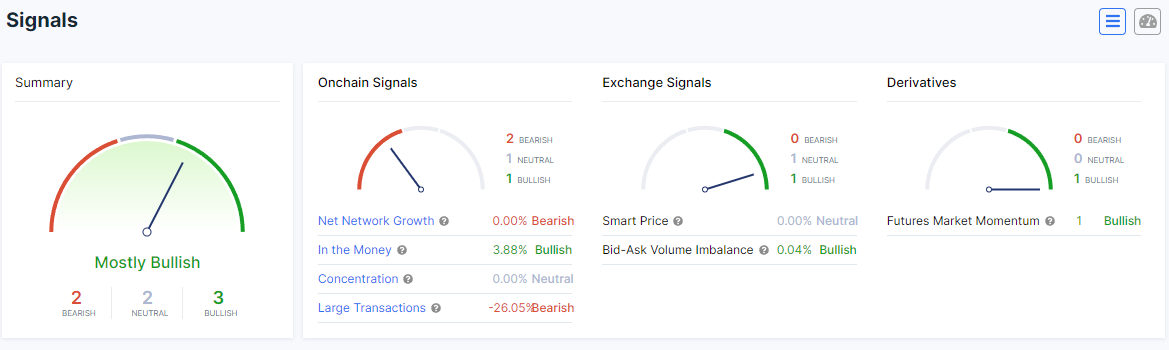

Cardano’s recent performance has given rise to both bullish and bearish patterns, with bulls and bears competing for dominance. While investor sentiment, as indicated by derivatives and exchanges data from IntotheBlock, remains bullish, on-chain data presented a more bearish outlook at press time.

It’s worth noting that investor sentiment has remained primarily bearish this week, mainly because of Robinhood and Celsius selling their ADA holdings, leading to volatility in the derivatives market.

Sponsored

Following the sell-off, traders lost over $1.6 million on long positions compared to $700,000 on short positions, according to Coinglass data. At press time, Cardano’s open interest stood at $111 million with a long-to-short ratio of 0.95, suggesting investors were selling rather than buying.

However, amidst these dynamics, an interesting bullish pattern has been forming, which, if all factors align, could potentially lead to a 300% surge. The Power of Three trading analysis tool suggests ADA is currently in the manipulation phase, where smart money strategically influences the price towards its desired direction, as exemplified by the crash following the SEC’s accusations.

Considering Cardano’s solid recovery, the token could be teetering on the edge of the expansion phase, gaining the much-needed momentum to break through crucial resistances. However, it’s important to note that the journey may not be as smooth as many hope because the crypto industry is unpredictable.

While ADA struggles to break through crucial levels, Cardano’s DeFi ecosystem, on the other hand, has been flourishing.

DeFi Ecosystem Outshines Other Major Chains

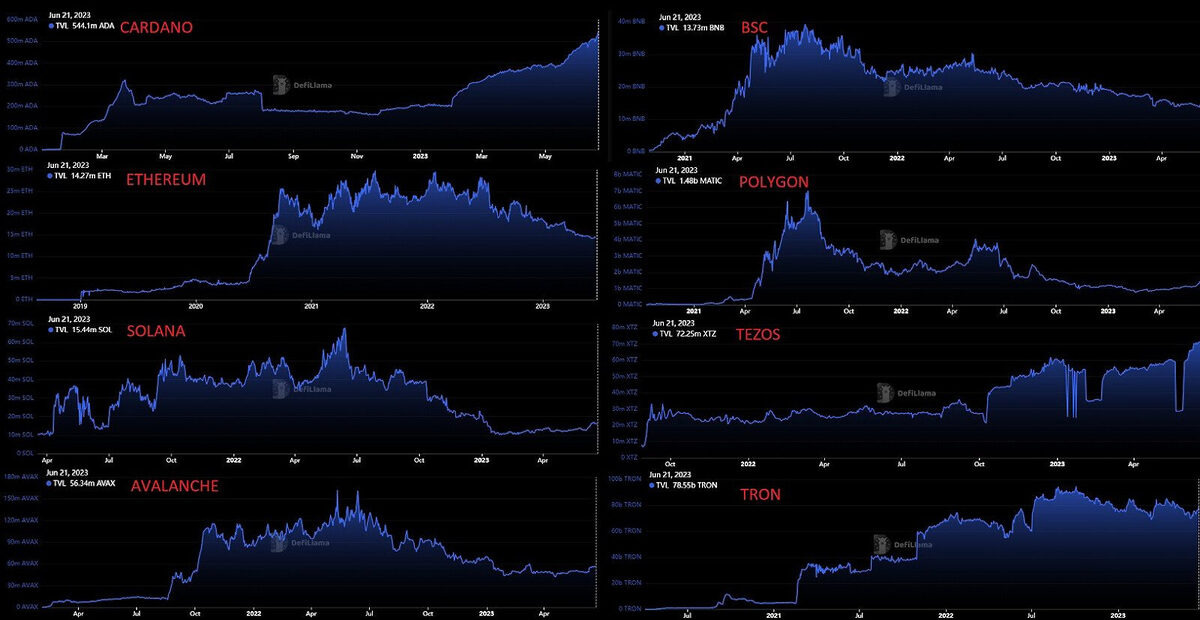

Cardano’s DeFi ecosystem has been on a roll recently, consistently registering new all-time highs. Its Total Value Locked (TVL) in ADA recently exceeded 583 million ADA, worth approximately $163 million, marking a 180% increase since the start of the year.

This milestone cements Cardano as one of the fastest-growing networks in terms of its native currency, outclassing even significant chains like Ethereum, Solana, and Polygon.

Cardano’s success in the DeFi sector can be attributed to the exciting developments the network has made over the past two weeks.

Cardano Developments

The Cardano ecosystem has witnessed many exciting developments since the last DailyCoin report. One notable milestone was Vodafone, one of the world’s largest telecommunications companies, choosing Cardano to launch its NFT collection over other popular venues like Ethereum, Polygon, and Solana.

The announcement stirred excitement within the Cardano community, with the multinational company praising the network for its community, sustainability, and cross-chain capabilities.

Alongside this news, Cardano launched Marlowe to the public. Marlowe is a set of tools that makes creating DeFi apps and smart contracts significantly easier and more accessible on Cardano. Marlowe opens up many opportunities for the Cardano ecosystem and marks a significant step forward for its adoption.

As the Proof-of-Stake (PoS) chain approaches its final stages, it has also proposed new changes to its CIP-1694 proposal, introducing an optional tax for submitting governance actions. These changes aim to foster an incentivized and decentralized ecosystem free from bad actors.

On the Flipside

- At press time, ADA is 90% down from its all-time high of $3.1.

- Charles Hoskinson believes that by the summer of 2023, once CIP-1694 is complete, Cardano could surpass Bitcoin, Ethereum, and every other cryptocurrency in decentralization.

- It’s important to consider alternative perspectives and opinions when evaluating the future performance of Cardano, as market dynamics can be unpredictable.

Why This Matters

Cardano’s progress and performance amid ongoing controversies demonstrate its strength as a notable player in the industry. With a thriving DeFi ecosystem and exciting developments in the pipeline, the PoS chain continues to make its mark in the crypto sphere.

Read the previous DailyCoin regular:

DailyCoin Cardano Regular: Bullish Trends, Optimistic Investors, New Protocols, and Price Bump

Cardano addresses on Binance are expiring; should you be worried?:

Binance Is Retiring More Deposit Addresses: Are Your Wallets in Danger?