- Effects from the SEC’s crypto crackdown continue to linger.

- The regulator is forcing exchanges to delist tokens.

- Despite negative news piling up, Cardano continues to display strength.

- However, investor sentiment suggests something different.

The SEC’s unwarranted crypto crackdown placed immense pressure on the crypto industry in the United States, specifically targeting tokens like Cardano, Solana, and Polygon. This led to Crypto assets and exchanges facing an existential threat in the country as the regulator compelled them to make tough decisions to ensure their survival.

As a result, the crypto market experienced mounting sell pressure, leading to significant drops across the board, with tokens like Cardano plummeting as much as 50%. However, with the market showing signs of recovery and TradFi’s newfound interest in crypto, the worst may be behind us as Cardano successfully navigates through regulatory turbulence, even as news of impending chaos continues to surface.

Cardano Stands Tall

Following the SEC’s classification of Cardano as an unregistered security, several US exchanges were forced to delist the token to operate in the country. While major exchanges like Coinbase, which the SEC also sued, decided to take a stand against the regulator and continue offering ADA, platforms like Robinhood succumbed to the regulator’s demands in the hopes of mitigating further scrutiny.

Sponsored

Robinhood’s decision to delist ADA prompted other platforms like eToro, Bakkt, and now Revolut to follow suit, citing regulatory uncertainties. While Robinhood’s delisting led to Cardano’s ADA plunging to its lowest point this year at $0.22 in June, recent negative news has had minimal effect on the asset.

Cardano has since displayed remarkable strength and has repeatedly rebounded despite its delisting spree. The token recently reclaimed the $0.3 level before returning to $0.295 at press time, with a daily trading volume of $228 million. Given its recent performance, it appears the asset has already priced in future capitulation and delisting events, including now-defunct lender Celsius’ $26 million ADA sell-off plan.

Sponsored

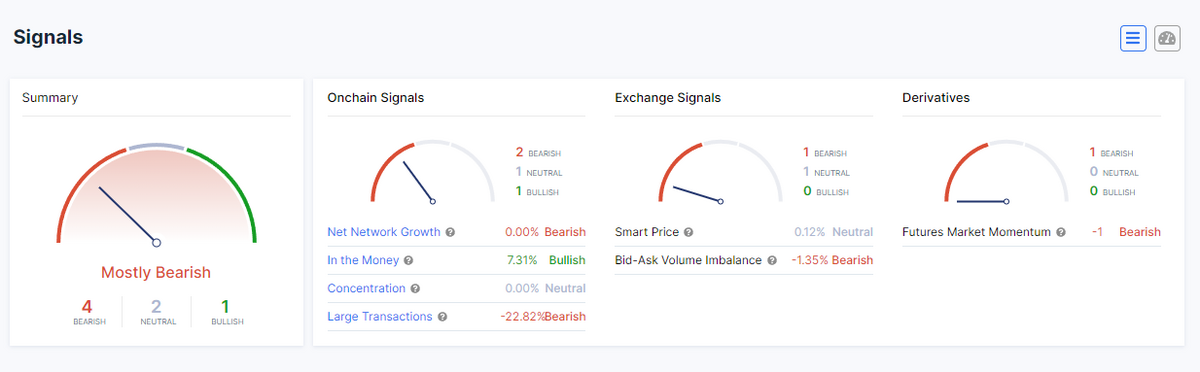

However, it’s worth noting that ADA has been exhibiting bearish patterns despite its resilience. IntotheBlock shows investor sentiment remains mostly bearish, as indicated by on-chain, exchange, and derivatives data.

Additionally, as per CoinGlass data, at press time, Cardano’s open interest stood at $115 million with a long-to-short ratio of 0.9, suggesting that investors are selling rather than buying.

On the Flipside

- Amidst its challenges in the US, Cardano is finding opportunities in other regions like Indonesia and Hong Kong.

- Robinhood recently reduced its workforce by 7% after delisting Cardano.

- Cardano is one of the fastest-growing networks in terms of its native currency, outclassing even significant chains like Ethereum, Solana, and Polygon. Its DeFi ecosystem recently achieved a new all-time high of 554 million ADA.

- The SEC’s case against Binance and Coinbase sparked a wave of liquidations throughout the market, amounting to $104 million.

Why This Matters

Cardano’s ADA has been showing remarkable strength despite the fear and uncertainty in crypto markets following the SEC’s crackdown. Recent developments suggest Cardano’s ADA will persevere despite negative news surfacing.

Catch up on Cardano’s DeFi developments:

Cardano DeFi TVL Resurges, New ATH, Volume Spike, and More

Read how the NFT market is doing:

NFT Market Sees Worst Liquidation Event in History, BAYC, Azuki Holders Hit