- Cardano’s recent price recovery could lead to a summer break out, with ADA showing more strength.

- Additionally, Cardano’s DeFi ecosystem is thriving and has become a major driving force behind the project’s growth.

- Given Cardano’s recent performance, the token could be on track for a major trend reversal.

Cardano has yet to recover from the SEC’s attack as it still trades 35% below its June high of $0.38, struggling to break through crucial resistances.

However, with ADA showing more strength than ever, investor sentiment flipping, and patterns churning, the token could be on track for a summer breakout given its recent performance, as its founder Charles Hoskinson envisioned.

Trend Reversal

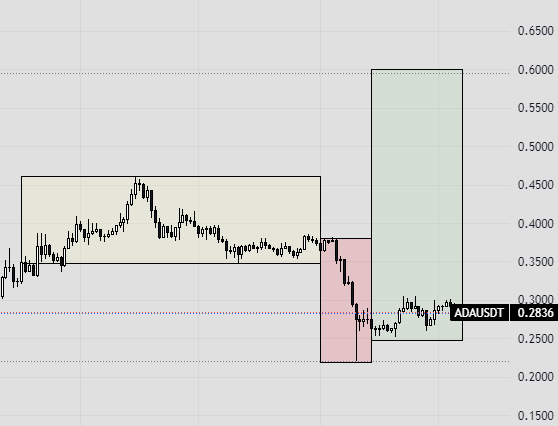

After the SEC classified ADA as an unregistered security earlier in June, Cardano plunged by more than 50% to its lowest point of the year at $0.22. However, the token has since steadily regained its lost valor, climbing from one trading range to another to now exchanging hands at $0.29 at press time, according to CoinMarketCap data.

Sponsored

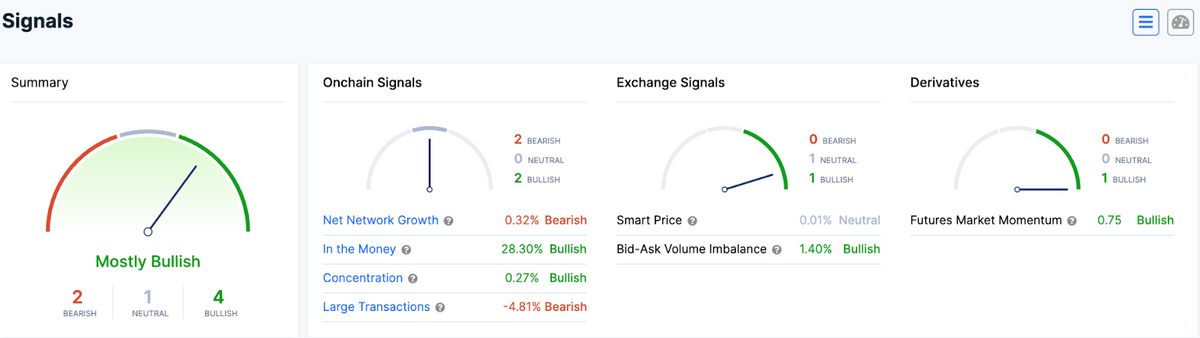

This upward price movement has sparked a primarily bullish sentiment among investors, as indicated by on-chain, derivatives, and exchanges data collected by IntotheBlock. This performance has also woken whales from their deep slumber, leading to frequent large transactions on the network, hinting at a possible trend reversal.

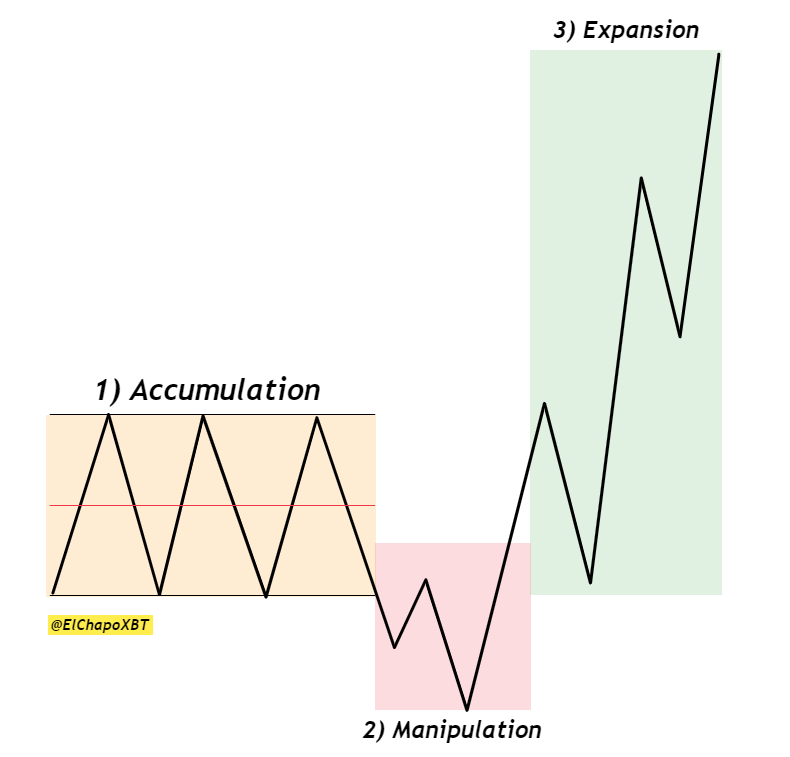

Given Cardano’s recent recovery, the asset’s price chart is exhibiting both bearish and bullish patterns. However, the Power of Three stands out the most among those patterns, a strategy designed to identify trend reversals.

Expansion

The Power of Three pattern comprises three distinct phases: Accumulation, Manipulation, and Expansion. During the Accumulation phase, smart money accumulates positions, causing prices to trade within tight ranges, as seen earlier this year when Cardano traded between $0.31 and $0.45.

Sponsored

This is followed by Manipulation, where smart money employs strategies to push the price in its desired direction, as exemplified by the crash following the SEC’s allegations. And then comes the final stage, expansion, where the trend gains momentum and breaks through resistance.

With the SEC’s manipulation priced in, as evidenced by Cardano’s resilience against negative news like Celsius’ $26 million ADA sell-off and the delisting rampage, Cardano could be in the final stage of the cycle.

If all factors align, Cardano could surpass the $1 milestone this year, accounting for a remarkable 300% surge from current levels. However, it’s important to note that the journey may not be as smooth as Cardano enthusiasts hope, as things can be unpredictable in the crypto industry.

Nevertheless, despite ADA’s price performance, Cardano’s DeFi ecosystem has been thriving and is a major driving force of its growth.

Cardano DeFi Perseveres

Cardano’s DeFi ecosystem has been on a roll recently, consistently registering new all-time highs. Cardano’s TVL in ADA recently toppled over 564 million ADA, worth approximately $161 million, noting a 180% increase since the start of the year.

This milestone cements Cardano as one of the fastest-growing networks in terms of its native currency, outclassing even significant chains like Ethereum, Solana, and Polygon.

At press time, Cardano ranked 18th overall in terms of DeFi TVL.

On the Flipside

- At press time, ADA is 90% down from its all-time high of $3.1.

- If ADA reached $1, Cardano’s DeFi TVL would amount to an impressive $564 million, helping it surpass Mixin to bag the 8th rank.

Why This Matters

The $1 price level is of great significance for Cardano investors. With the token currently down 90% from its all-time high, surpassing the $1 resistance would indicate a highly bullish scenario and the possibility of Cardano reclaiming its previous all-time high.

Cardano memecoin SNEK is gearing up for an eventful summer:

Cardano Memecoin SNEK Manifests Summer CEX Listing Ambitions

More on Cardano:

Cardano’s ADA Barely Reacts Despite Robinhood Dump Fears

FAQs

A DeFi ecosystem is a collection of Decentralized Applications (dApps), protocols, and financial instruments built on blockchain networks such as Cardano, Ethereum, and Solana.

Cardano is a Proof-of-Stake chain with a very vibrant developer community. It’s unclear if it has weaknesses; however, its relatively slower development progress and meticulous research-driven approach are often targets of criticism from the community.

An ecosystem in crypto refers to the interoperable and interconnected system of projects, platforms, protocols, and participants that collectively contribute to the growth of the underlying blockchain network.

Cardano (ADA) is a decentralized cryptocurrency, which means it doesn’t have a single owner or central authority. Its decentralized community of stakeholders governs Cardano. It’s worth noting the development and maintenance of Cardano are overseen by Input Output Hong Kong (IOHK) and the Cardano Foundation.