- Cardano’s ADA is steadily recovering from the SEC’s accusations.

- Recent developments suggest a positive trajectory for the token.

- Given Cardano’s recent performance, investors are filled with excitement.

Cardano’s ADA is showing signs of recovery after enduring significant sell pressure triggered by the SEC’s allegations. As one of the weakest performers among the top ten tokens in response to regulatory scrutiny, Cardano has experienced a remarkable surge in the past week, sparking enthusiasm among investors for a potential summer bull run.

Sponsored

To provide insights into these exciting developments, we are pleased to present our Bi-Weekly DailyCoin Regular on Cardano, crafted by our expert, Insha Zia.

Current Outlook

Given TradFi’s growing interest in the crypto industry, Cardano has been steadily gaining momentum, registering daily gains. At press time, ADA exchanged hands at $0.3021, boasting a daily trading volume of $234 million and a market cap of $10 billion. Notably, the token has surged by a modest 2% on June 23 and an impressive 15% increase over the past week.

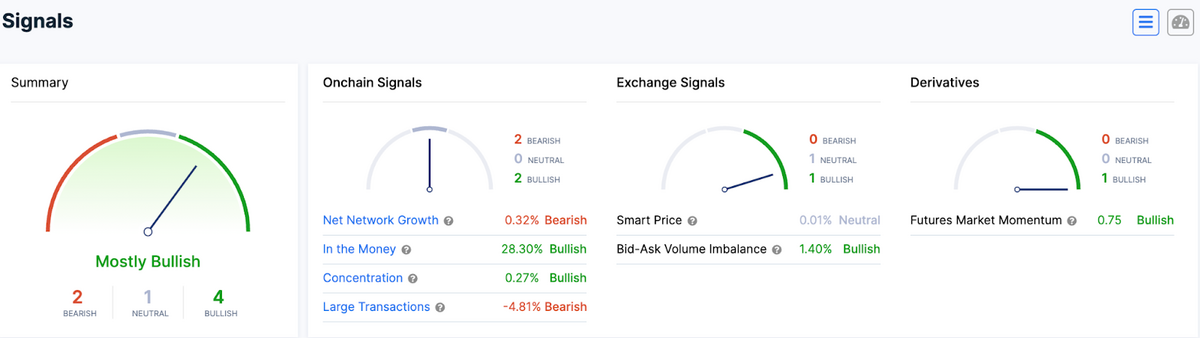

This week, according to Coinglass data, over $3 million worth of ADA shorts and $1.5 million worth of long positions were liquidated in ADA futures. As a result, market sentiment has flipped from mostly bearish at the beginning of the week to mostly bullish at press time. According to data from IntoTheBlock, both exchanges and derivatives markets are signaling bullish trends while on-chain sentiment remains neutral.

Cardano’s sentiment flip coincides with its recovery of the $0.3 level. Following the SEC’s classification of ADA as an unregistered security on June 6, the token plummeted to its lowest point of the year at $0.22. Since then, ADA has struggled to find footing, ranging between $0.23 and $0.26.

Although Cardano is still 21% down from its June peak of $0.381 and has yet to recover from the SEC’s accusations, its reclaim of $0.3 suggests the token could break out and surpass this month’s high to trade between $0.4 and $0.5 if it maintains momentum and there’s no major capitulation event.

Sponsored

Having rallied 15% this week, ADA’s continuous gains have ignited excitement among investors as they eagerly anticipate a bullish summer.

Investors and Whales are Bullish

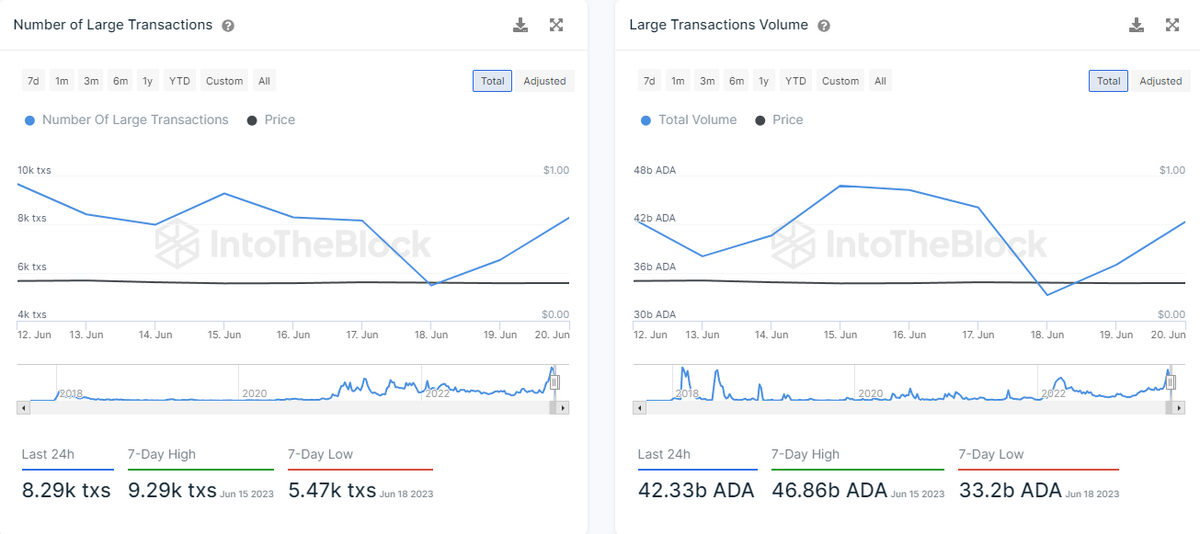

According to IntoTheBlock data, Whale interest in Cardano has been burgeoning lately. While large transactions worth over $100,000 have dwindled since the SEC’s accusations, Cardano’s recent price performance and sentiment flip has woken up whales from their deep slumber.

Since June 19, whales have engaged in over 30,000 large transactions on Cardano, with a daily average of 7,700 transactions. This surge in activity increased large transaction volume, rising from 33.2 billion ADA to 43 billion ADA, equivalent to $12.8 billion.

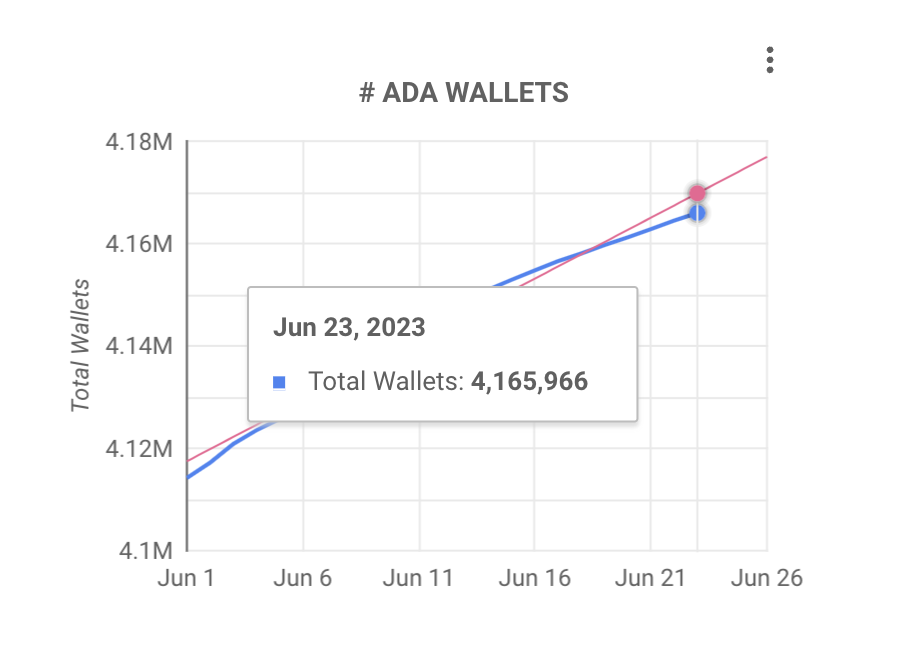

In addition to whales, retail investor adoption has also been proliferating. According to Cardano Blockchain Insights, Cardano has been adding an average of over 2,400 new crypto wallets daily in June, bringing the total number of Cardano holding addresses to 4.1 million. At press time, Cardano has grown by over 48,000 new addresses in June, bringing the total number of new crypto wallets added this year to 315,643.

The recent rise in investor adoption can also be attributed to the flurry of developments the network has made this week.

Developments This Week

The Cardano ecosystem has witnessed exciting developments this week. One notable release is the latest version of Cardano’s first light wallet platform Lace, which now supports Web3’s most successful browser, Brave. In this update, the wallet has also introduced new NFTs features and made necessary performance and security tweaks.

Alongside its wallet updates, the POS chain has also rolled out its highly anticipated node update, Node 8.1.1. This update plans to optimize network performance, especially for stake pool operators (SPO). Node 8.1.1 significantly improves epoch boundary performance and addresses concerns with peer-to-peer network communications and its domain name system (DNS).

With the new update, Cardano will benefit from faster network processes during epoch transitions, faster transactions, improved smart contracts, and significantly lower latency.

What to Look Out for?

Recent developments suggest Cardano could break through resistance at $0.30 once it gathers enough momentum. However, news of an upcoming liquidation event by now-bankrupt crypto lender Celsius could threaten Cardano’s hard-earned recovery.

The defunct crypto lender has announced that it plans to sell $26 million worth of users’ ADA starting July 1st as part of its bankruptcy recovery strategy. Although experts suggest minimal impact, the additional pressure could introduce volatility and instill fear in the market.

On the Flipside

- Founder Charles Hoskinson has hinted at a Cardano Summer this year.

- Hoskinson claimed SEC’s action against ADA was motivated by a hidden agenda of implementing CBDCs.

- It’s important to consider alternative perspectives and opinions when evaluating the future performance of Cardano, as market dynamics can be unpredictable.

Why This Matters

Cardano’s current outlook, sentiment, and development provide crucial insights into the ongoing market dynamics. These insights could guide traders and investors in making informed decisions.

Follow Cardano’s bull run:

Cardano (ADA) Flashes Bullish Trend with $0.3 Reclaim and Daily Wallet Surge

Read more about Celsius’ altcoin sell-off plan:

How Does Celsius Selling Cardano (ADA) in Bankruptcy Impact Users?