- Cardano’s DeFi ecosystem remains unfazed by the chaos that regulators ensued in the crypto industry.

- Cardano’s DeFi TVL made a remarkable surge, outperforming major chains.

- With Cardano’s ADA eyeing a breakout, Cardano’s DeFi TVL could achieve new heights.

On June 6, the SEC rocked the crypto markets by suing two of the world’s leading crypto exchanges, Binance and Coinbase, classifying several crypto assets as unregistered securities, including Cardano’s ADA. Following the regulator’s accusations, Cardano’s DeFi ecosystem tanked, shedding over $50 million, and has been struggling to find solid footing since.

Sponsored

However, weeks later, Cardano finally shows signs of recovery as it outperforms major chains and achieves new milestones.

Slow and Steady Wins the Race

Despite the initial setback caused by the SEC, the Cardano DeFi ecosystem has demonstrated remarkable resilience and steadily gained momentum. Active users on the network remained steadfast, even spiking to levels last seen in February in the wake of the unprecedented regulatory pressure.

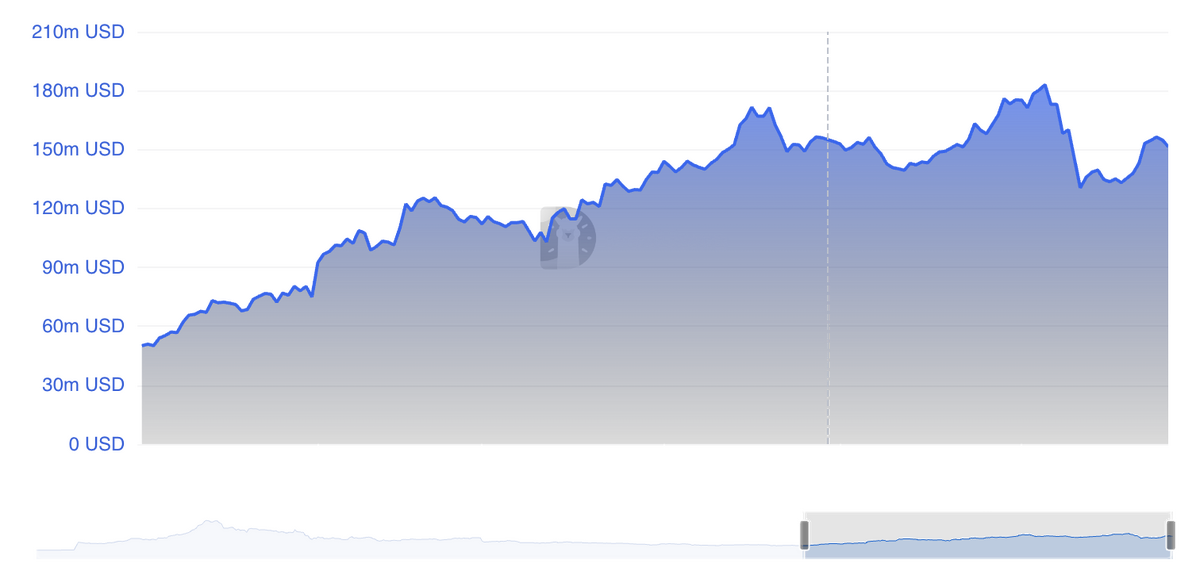

In contrast, other major chains like Ethereum, Solana, and Avalanche have been experiencing an extended decline in this metric. Cardano’s unwavering strength has resulted in a remarkable surge in its DeFi TVL, which recently soared by 17% to reach $157 million. This was accompanied by an impressive daily trading volume of $6.5 million at press time, according to DeFiLlama.

Notably, Cardano’s DeFi TVL, in terms of ADA, also achieved a new all-time high, surpassing 534.8 million ADA on June 25. This milestone cements Cardano as one of the fastest-growing networks in terms of its native currency, outclassing even significant chains like Ethereum, Solana, and Polygon.

Cardano’s recent recovery can be attributed to ADA’s remarkable surge in the past week, fueled by rising interest from TradFi in the crypto industry. This surge sparked an exciting rally and fostered a wave of optimism among investors, helping Cardano briefly reclaim the crucial $0.3 level and flip market sentiment from mostly bearish to primarily bullish.

Sponsored

Although Cardano exchanged hands for $0.287 at press time, 30% below its June peak of $0.381, the token appears to be on a positive trajectory. Investors expect ADA to break out into the $0.4 and $0.5 range, potentially resulting in a TVL of $267 million. This would help Cardano DeFi surpass Solana’s current TVL of $252 million.

On the Flipside

- Cardano’s DeFi ecosystem comprises 20 DeFi protocols.

- If ADA reached its all-time high of $3.1, Cardano’s DeFi TVL would amount to an impressive $1.6 billion.

Why This Matters

Cardano’s DeFi has been showing remarkable strength despite the fear and uncertainty in crypto markets following the SEC’s crypto crackdown. Recent developments suggest the network’s DeFi ecosystem will persevere despite major capitulation events and negative news.

Another TradFi giant shows interest in Crypto ETFs:

ETF Influx Inspires HSBC Crypto ETF Offering in Hong Kong

Follow up on Cardano developments:

DailyCoin Cardano Regular: Bullish Trends, Optimistic Investors, New Protocols, and Price Bump