What is Binance Coin (BNB)? The native token of the world’s largest crypto exchange has certainly seen its fair share of FUD and euphoria, yet BNB coin has solidified itself as a staple of the blockchain industry.

BNB stands out as more than just another digital asset in the bustling world of cryptocurrencies. It’s the lifeblood of the Binance ecosystem, a powerhouse exchange that has carved out a significant niche in the crypto market.

The BNB Chain witnesses more daily traffic than its greatest rival, Ethereum (ETH). On top of that, the BNB chain is also faster and cheaper to use than the top Layer-1 blockchain. By the numbers, it looks better in every way.

Sponsored

Is Binance Coin merely a glorified exchange token, or does it pose a legitimate threat to Ethereum’s dominance? With regulatory vultures circling Changpeng Zhao and the Binance trading platform, is BNB Coin a crypto asset that needs to be taken with a grain of salt?

Table of Contents

What Is Binance Coin?

Binance Coin, or BNB, is the native cryptocurrency of the Binance exchange, easily the largest and most influential trading platform in the crypto industry. Launched in 2017, BNB coin began its dramatic life on the Ethereum network as an ERC-20 token. As the Binance ecosystem exploded in scale, BNB transitioned and became the native currency of its own blockchain, the Binance Chain.

BNB was introduced to the world through an initial coin offering (ICO), with a strict cap of 200 million tokens. The BNB whitepaper declared that token distribution would be allocated as follows:

- 10% – Angel Investors.

- 40% – Founding Team.

- 50% – ICO Participants.

But BNB isn’t just a token for trading on Binance. It has evolved into a multi-faceted altcoin with many uses within and beyond the Binance ecosystem. In a thriving and dynamic blockchain network, what is Binance Coin actually used for?

What Can I Do with Binance Coin?

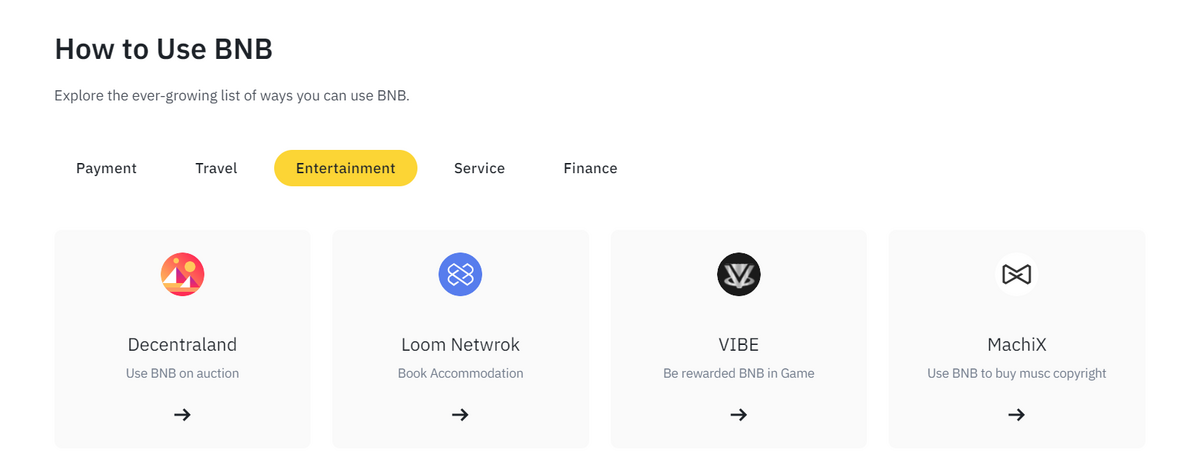

Binance Coin is a versatile digital asset that reaches far beyond the confines of Binance.com. While BNB was introduced as a utility token for discounted trading fees, its functionality has significantly expanded over the years, making it a multi-purpose token with a wide array of applications.

For starters, BNB can be used to pay transaction fees on the Binance platform, including trading, withdrawal, and listing fees. The advantage is that users who pay with BNB often receive a discount, making transactions more cost-effective. Holding a qualifying amount of BNB also reduces traders’ rates on their maker-and-taker trading fees.

But the use cases of BNB don’t stop there. For instance, you can use BNB to book travel accommodations and flights, buy products online using the Binance credit card, and even hire freelancers for your business.

BNB is the backbone of the ecosystem and is used to pay gas fees and secure the blockchain network. DeFi apps use BNB as a financial asset and store of value, giving users the power to earn through liquidity pools on sites like PancakeSwap, the top Binance DEX.

It can also be used to participate in token sales on the Binance Launchpad, allowing retail investors to buy new cryptocurrencies before they get listed on public markets. Moreover, BNB is also used in non-fungible tokens (NFTs). It can be used to purchase virtual gifts, process payments, and even donate to charity.

At this stage, the question isn’t ‘What is Binance Coin used for?’ The question is what can’t it be used for?

The BNB Chain

The BNB Chain, also known as Binance Smart Chain (BSC), is a significant innovation and arguably the biggest growth sector in the Binance ecosystem. It’s a standalone blockchain that aims to make crypto onboarding as seamless as possible.

The BSC emerged in early 2021 as a threatening alternative to the Ethereum blockchain. While Layer 1 blockchains are a dime a dozen these days, that wasn’t always the case. In the early days of DeFi, Ethereum was the only network that supported enough users to create an on-chain economy.

Anyone who wanted to trade on a DEX, or loan crypto assets on decentralized lending platforms had to do so on Ethereum. In periods of network congestion, gas fees on Ethereum make the chain almost unusable. No one wants to spend a $50 gas fee on a $100 USD trade, so Binance unveiled a cheaper, faster, and more accessible blockchain network for the masses.

One of the standout features of BSC is its compatibility with the Ethereum Virtual Machine (EVM). This means it supports all existing Ethereum tooling, making it easier for developers to build products and services on BNB Chain. It also allows for creating smart contracts and decentralized applications (dApps), opening up a world of possibilities for developers and users alike.

How Does BNB Chain Work?

The BNB Chain, or Binance Smart Chain (BSC), operates using a unique consensus mechanism known as Proof of Staked Authority (PoSA). This model combines elements of Proof of Authority (PoA) and Delegated Proof of Stake (DPoS) to achieve a balance of speed, security, and decentralization.

In the PoSA model, blocks are produced by a limited set of validators. While other Layer-1 networks like Cardano (ADA) create new tokens to reward validators, BNB Chain collects network transaction fees from users and distributors them to node operators who secure the network.

Unlike legacy networks like Bitcoin (BTC) and Ethereum, the BNB Chain enjoys a much shorter block time. With a block time of around three seconds, BNB Chain can process transactions quickly, providing a smooth and efficient user experience. This is crucial for high-performance dApps that require fast and seamless transactions.

Decentralized Finance (DeFi) on BNB Chain

DeFi on BSC encompasses a wide range of financial applications available to anyone with a crypto wallet. The key advantage of DeFi is that it expands the scope of financial services beyond traditional institutions, offering a more inclusive and open financial system.

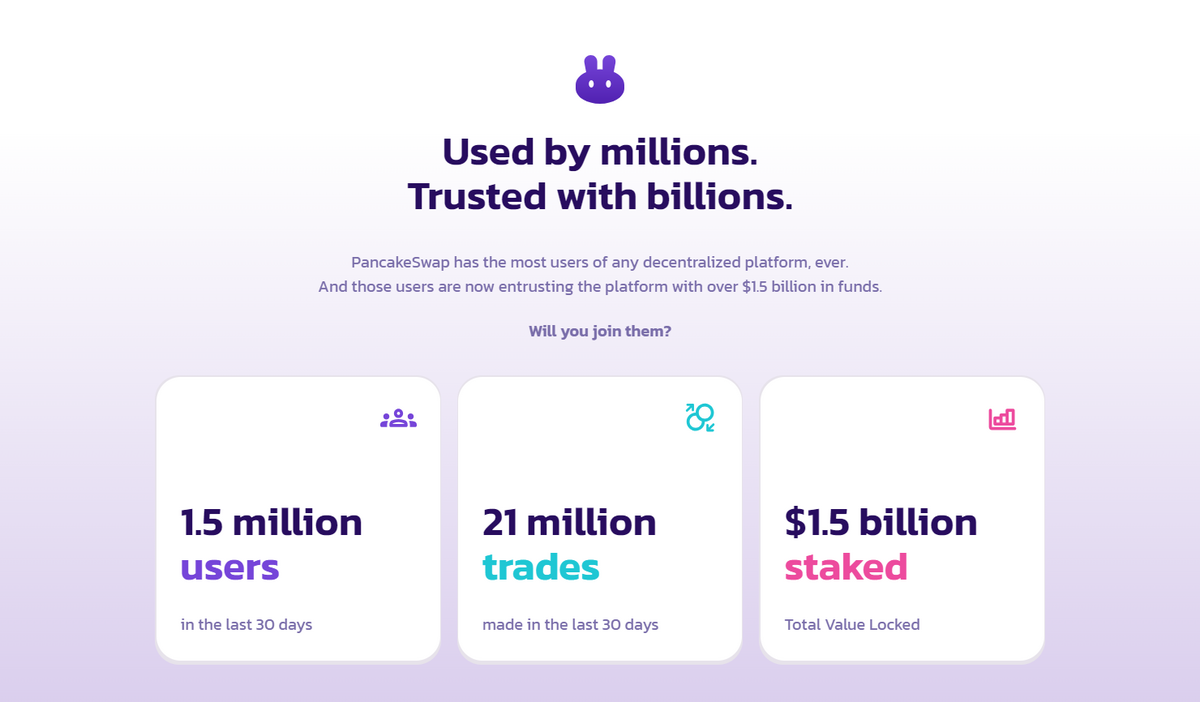

The most popular DeFi application on BNB Chain is PancakeSwap, a decentralized exchange (DEX) that allows users to swap BNB and other BEP-20 tokens directly from their wallets. PancakeSwap also offers yield farming and staking services, where users can earn rewards by providing liquidity to the platform.

Another notable DeFi platform on BSC is Venus Protocol, an algorithmic money market and synthetic stablecoin protocol. Venus allows users to earn interest on their cryptocurrencies, borrow against their crypto, and mint synthetic stablecoins like USDT.

BNB Chain NFTs

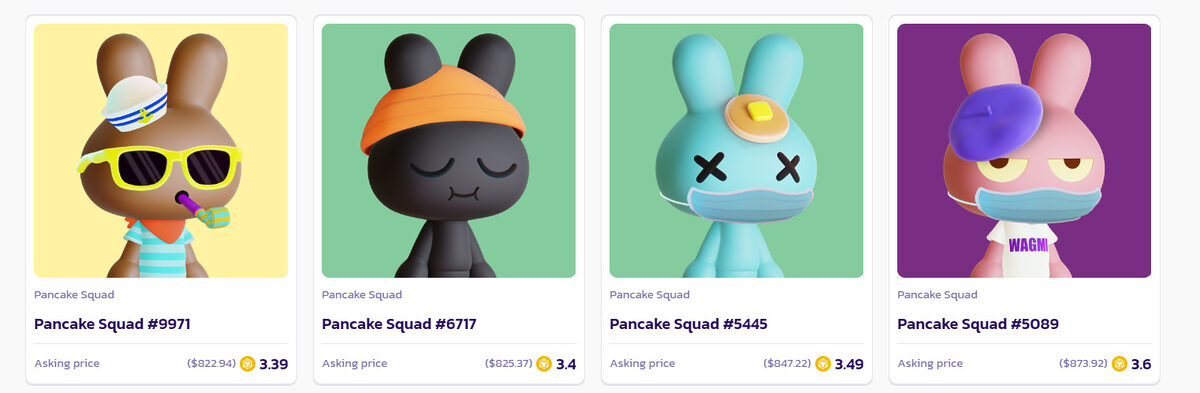

While DeFi on the BNB chain is alive and kicking, the network’s NFT scene leaves much to be desired. Compared with other networks like Ethereum or Solana, BNB Chain struggles to attract significant NFT trading volume.

That being said, the blockchain network has fostered solid NFT collections and communities. The most iconic BNB Chain-based NFT collection is the Pancake Squad, a fun art-based NFT project of 10,000 3D bunnies.

BNB Burn

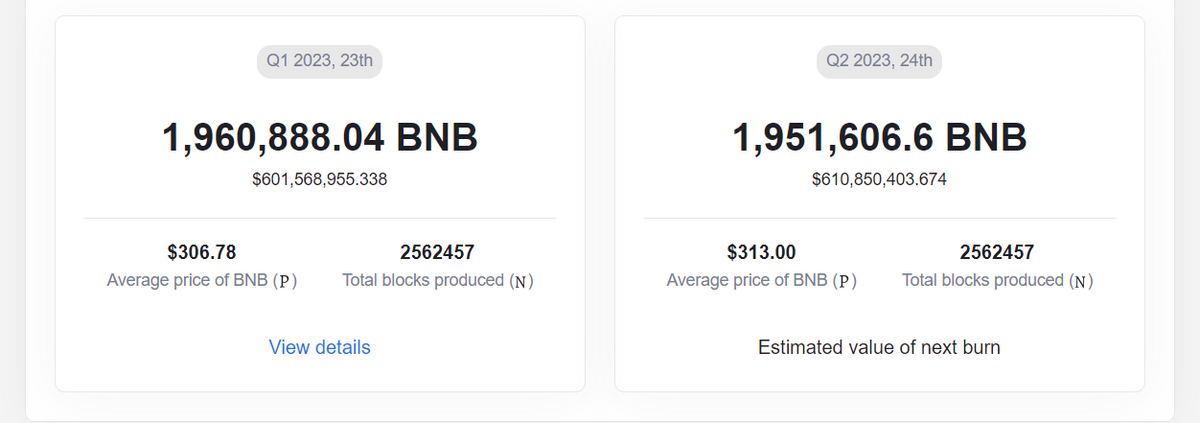

To drive token scarcity and maintain the long-term value of BNB, Binance implemented a unique burn mechanism. Binance periodically burns BNB coins from circulation, reducing the total supply of BNB.

Binance conducts these burns every quarter, using a portion of its profits to buy back BNB from the open market and then permanently destroying or “burning” them. The amount of BNB that gets burned is based on the trading volume on the Binance exchange during the previous financial quarter.

Since the inception of Binance Coin, several burns have already taken place, each time reducing the total supply of BNB. The last recorded burn removed over 2M BNB tokens from circulation, valued at over $600M USD.

BNB Coin History

Binance Coin’s journey began in 2017 when it was introduced through an Initial Coin Offering (ICO), a popular fundraising mechanism in the crypto industry. During the ICO, 100 million BNB tokens were sold to the public, raising approximately $15 million for Binance.

Initially, BNB was an ERC-20 token on the Ethereum blockchain. However, in 2019, Binance launched its blockchain, the Binance Chain, and BNB was migrated to this new chain to become its native asset. This was a significant milestone in BNB’s history, as it marked the coin’s evolution from a utility token for the Binance exchange to a standalone cryptocurrency with its own blockchain.

Since then, BNB has grown exponentially, both in terms of value and utility. This is mostly due to the adoption of the BNB Chain. DeFi exploded on the network in early 2021, which drove BNB’s price from $40 to its all-time high of $690 in months.

However, like all cryptocurrencies, Binance Coin is not without its concerns.

Binance Coin Concerns

While BNB has seen significant growth and success, it’s not without its potential concerns. These primarily revolve around regulatory issues with the Binance exchange and questions about the centralization of the BNB Chain.

Binance Exchange Regulatory Woes

Binance has faced significant regulatory scrutiny in various jurisdictions around the globe. In most cases, these issues stem from concerns about compliance with financial regulations, consumer protection, and anti-money laundering (AML) measures.

Regulators in several countries, including the United States, the United Kingdom, Germany, and Japan, have issued warnings or taken actions against Binance. The concerns these regulators raise often revolve around Binance operating without the necessary licenses or failing to implement adequate measures to protect consumers and prevent illicit activities.

For instance, in the United Kingdom, the Financial Conduct Authority (FCA) issued a warning in June 2021 stating that Binance Markets Limited was prohibited from undertaking any regulated activity in the country. In the United States, Binance has been investigated by the Department of Justice (DOJ) and the Internal Revenue Service (IRS) for potential violations of AML and tax regulations.

More recently, Gary Gensler and the SEC launched another attack on the Binance exchange, claiming that they are operating as an unlicensed securities exchange. These regulatory challenges pose a significant risk to Binance and, by extension, BNB. If Binance were to face severe penalties or restrictions, it could impact the utility and value of BNB.

BNB Chain Centralization

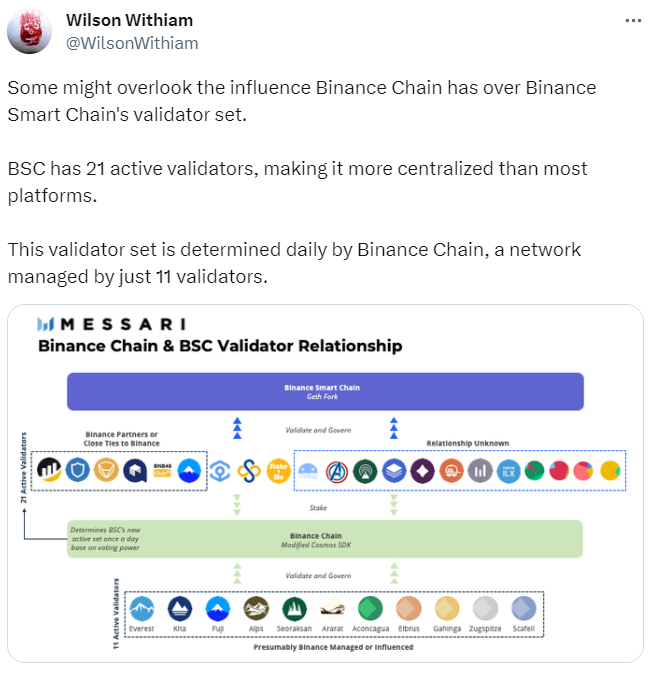

While the Binance Smart Chain (BSC) has brought many benefits to BNB and its users, it has also raised concerns about centralization. This is because Binance, the entity behind BSC, is a centralized organization with significant control over the network.

In a truly decentralized network, no single entity controls the entire system. This is one of the fundamental principles of blockchain technology and the very ethos of cryptocurrency. However, in the case of BSC, Binance has significant influence over the network’s operation and development.

For instance, Binance selects the validators for the BSC network. While this process is based on a staking model, the fact that Binance has the final say in validator selection has led to concerns about centralization. This is in contrast to networks like Ethereum, where anyone can become a validator or miner.

Binance Coin Pros and Cons

Binance Coin (BNB) comes with its own set of advantages and disadvantages, shaped by its unique features, the Binance ecosystem, and the broader crypto market dynamics. Let’s delve into the pros and cons to gain a balanced perspective on this prominent cryptocurrency.

Pros

- Versatility – BNB is a multi-purpose token with many uses within and beyond the Binance ecosystem. It can be used for trading, participating in token sales, paying discounted transaction fees, and even making purchases in the real world.

- Performance – The BNB Chain offers fast transaction times and low fees, making BNB Chain an excellent host for DeFi applications.

- Market Position – BNB is backed by Binance, one of the world’s largest and most influential cryptocurrency exchanges.

Cons

- Regulatory Risks – Binance, the entity behind BNB Coin, faces smoking guns from regulators on all sides.

- Centralization Concerns – The BNB Chain is controlled by Binance, a centralized entity. This level of centralization could potentially impact the network’s security, transparency, and trustworthiness.

- Dependence on Binance – The value and utility of BNB are closely tied to the Binance ecosystem. If Binance were to lose its market position or face significant issues, it could negatively affect BNB.

On the Flipside

- The BNB blockchain network has onboarded thousands of users to the world of cryptocurrency; it’s starting to fall behind compared to newer, more performant networks like Solana and Aptos (APT).

Why This Matters

BNB Coin has established itself as one of the industry’s largest and most significant crypto assets. Like Bitcoin and Ethereum, it’s important to understand what BNB coin is and how it works to navigate the crypto market effectively.

FAQs

If BNB reached $10,000 USD, its market cap would be around $1.6T USD. That would make BNB larger than the entire crypto market.

Binance Coin is so popular because it has plenty of use cases within the Binance ecosystem and is tied to the largest crypto company in the world.

You can buy BNB on the Binance exchange or on decentralized exchanges that support the BNB chain.

Cryptocurrencies are considered high-risk assets due to the volatility and uncertainty of the crypto market.