Like a phoenix bursting from the ashes, the Aptos blockchain proves that some things only improve after burning to the ground. When Meta pulled the plug on Diem, their dedicated blockchain network, it was not the end of Web3 masterpiece, but the birth of a new one.

The Aptos network is a Layer-1 blockchain that ticks all the right boxes. Smart contracts, DeFi, NFTs; you name it, Aptos delivers. Add in the network’s blistering scalability and minuscule fees, and you have a recipe for one of the most performant blockchains in the cryptocurrency industry.

Sponsored

What is Aptos? How does it accomplish such impressive specs? If its architecture is truly so spectacular, why did Meta abandon it?

Introducing Aptos, the ‘Solana-killer’ aiming to unseat Ethereum (ETH) at the top of the Layer-1 pyramid.

What Is Aptos?

Aptos is a fast and affordable blockchain capable of supporting smart contracts. The Aptos mainnet launched in October 2022 amidst plenty of hype and anticipation, thanks to its fascinating origin story and overwhelming interest from venture capitalists and crypto investment firms.

The Aptos blockchain introduces a variety of new technological features to the cryptocurrency industry. Namely, it uses its own dedicated programming language and leverages a new method of executing transactions that gives it an edge over legacy networks.

How Does Aptos Work?

The Aptos ecosystem aims to disrupt the Layer-1 race by providing the most scalable and secure network in the crypto market. This commitment to high transaction finally and throughput means that dApps and tools on the network operate smoothly with minimal gas fees.

Aptos Labs’ ultimate vision is to build a blockchain capable of supporting millions of users and driving Web3 adoption worldwide.

Consensus Mechanism

Aptos uses a Proof-of-Stake consensus mechanism to secure the network and produce new blocks. This algorithm is proven to be exceptionally energy-efficient, especially when compared with Proof-of-Work chains like Bitcoin (BTC).

In this mechanism, holders can stake their Aptos tokens to validator node operators in return for block rewards.

Move Programming Language

The Aptos blockchain is coded using Move, a programming language created behind closed doors at Meta. Considering it was originally intended to support Meta platforms like Facebook, it was designed with security in mind.

Move includes built-in support for checking the validity of smart contracts at compile-time, which helps to prevent bugs and vulnerabilities from being introduced into the code. The language is also deterministic, meaning that the outcome of a smart contract can be predicted with certainty. This is important for financial transactions and other critical applications.

Being a derivative of Rust, the dominant programming language of Solana, Move is also relatively familiar and easy to learn for experienced developers.

Parallel Execution Engine

Aptos’ impressive transaction speeds and throughput is made possible thanks to its unique parallel execution engine. The network is able to separate transactions into multiple threads and execute them concurrently, instead of processing them one by one.

This helps the network bypass dense bottlenecks and ease congestion. An easy way to think of it is to imagine two different highways. A highway with multiple lanes will have much faster-flowing traffic than a highway with only one lane for every single vehicle.

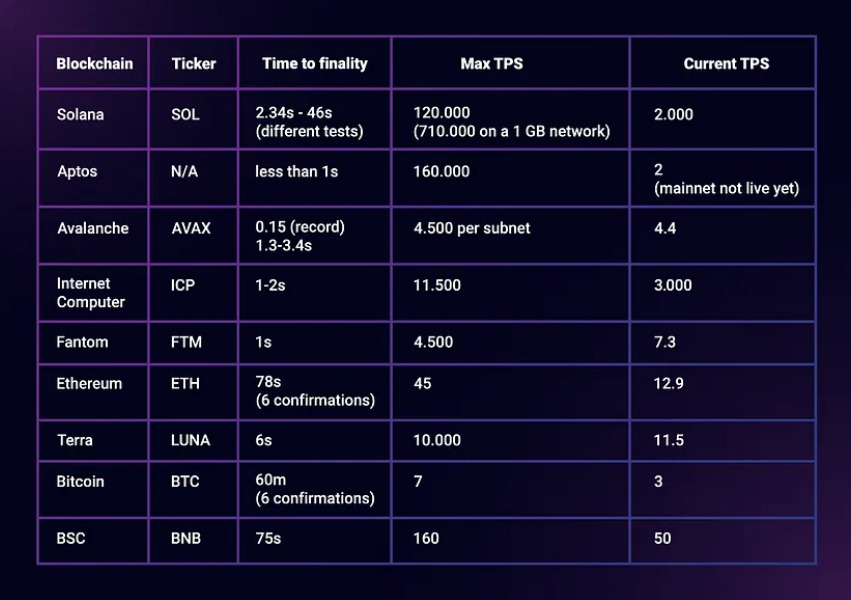

Courtesy of Aptos’ unique infrastructure, the network theoretically achieves 160,000 transactions per second. Aptos’ scalability outperforms its competitors in this regard, executing 1,000x more TPS than the BNB chain.

Why Is the Aptos Blockchain so Special?

The Aptos network’s scalability and security make it an excellent base for building an ecosystem of DeFi applications and NFT collections. What’s more, transaction fees on Aptos only cost a few cents at most, making it one of the more affordable blockchains available.

Aptos Labs is also committed to making node operation simple to make the network as decentralized as possible. They’ve gone so far as to form a strategic partnership with Google Cloud, making it possible for anyone to launch an Aptos validator node within just 15 minutes.

The Team: From Meta to Aptos Labs

The Aptos blockchain began its life within Meta headquarters. The Facebook and Instagram parent company spent years working on its own blockchain. With Meta’s immense resources, they were able to attract some of the brightest minds in the crypto industry and dedicate years of research and development to the protocol.

Unfortunately for Meta, the project was hindered almost from day one. Regulators and investors scrutinized Mark Zuckerberg’s blockchain network. They struggled to settle on a name, rebranding from Libra to Diem.

After years of work, Meta eventually abandoned the project. While this was the death of Diem, it was a new beginning for the powerful technology being built. Mo Shaikh and Avery Ching, two of the executive developers on the project, had dedicated years to the project and decided to rebrand the protocol and push on with development.

Aptos Labs Funding & Investors

The Aptos blockchain’s unique origin story and powerful technology have proven a tempting investment for some of the largest Venture Capital funds in the crypto market. Over the course of 2022, Aptos Labs was able to raise over $350M USD from top funds like Andreessen Horowitz (a16z crypto) and Multicoin Capital.

These funds were a boon for Aptos Labs, who were able to offer generous ecosystem grants and initiatives to attract developers to the network. This included the Aptos Incentivized Testnet, where network participants could test the network in exchange for APT tokens.

By the time the Aptos network launched in October 2022, it had a valuation of $4B, one of the largest pre-launch valuations the industry had ever seen.

Aptos Red Flags & Issues

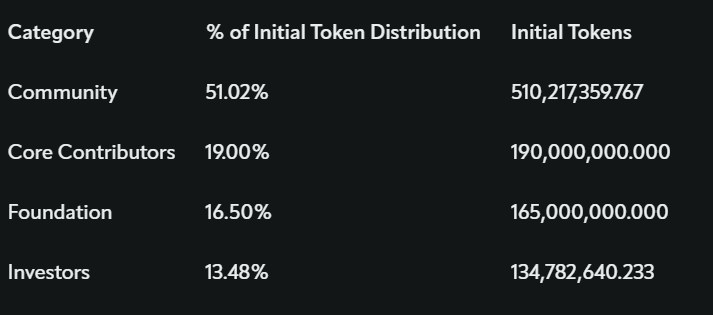

Naturally, these private sales and enormous valuations raised concerns amongst the crypto community. After the release of the Aptos whitepaper and token distribution, the protocol was criticized for having ‘predatory’ tokenomics.

Early private investors were given a large portion of the token supply at a significantly discounted price, while the Aptos Foundation could immediately stake their allocation and sell unlocked staking rewards every 30 days.

These controversial tokenomics meant that trending crypto news outlets crafted a narrative that Aptos was another Venture Capital pump-and-dump scheme, where private investors are able to exploit retail investors as exit liquidity. Aptos is not the first crypto project to receive this treatment, with Solana receiving similar criticism.

Aptos Pros & Cons

With a budding ecosystem and powerful technology, the Aptos blockchain brings new fire to the competitive Layer-1 race. Is it enough to offset the questionable tokenomics and threat of centralized VC allocations?

Pros

- Scalable – On paper, the Aptos network is one of the most powerful blockchains in the industry. Capable of over 160,000 TPS and micro gas fees, Aptos is a prime candidate to support mass adoption.

- Secure – Thanks to its dedicated programming language and Proof-of-Stake consensus mechanism, Aptos is designed from the ground up to give users peace of mind and optimism when using the network.

- Massive War Chest – Aptos Labs attracted huge interest from investors and raised large amounts of funding to execute their vision. These resources give Aptos plenty of runway and resources to hire the best talent in the market and provide generous incentives for developers.

- Strong Narrative – Don’t forget that Meta initially designed this technology. The original network was created by a company with experience in providing infrastructure for billions of people.

Cons

- Tokenomics – Looking at the distribution of Aptos tokens, it’s clear that there is certainly an element of risk. There is a high concentration of tokens sitting in wallets controlled by VC funds who bought APT at significantly lower prices than retail was able to.

- Untested Performance – While Aptos can theoretically process over 160,000 transactions per second, network usage has never even come close to testing this figure. Until the limits of Aptos’ scalability are truly tested, we won’t know for sure whether these impressive metrics are possible.

- Low User Count – Despite all Aptos’ resources, the network isn’t home to many regular users and has a low TVL (Total Value Locked) when compared to competing networks like Solana and Cardano.

On The Flipside

- While the Aptos network has some hurdles to overcome, including low users and controversial tokenomics, the blockchain’s architecture and narrative make it a fascinating crypto project to watch.

- It’s also worth mentioning that FTX Ventures was one of the lead investors in Aptos Labs. Since the collapse of the crypto exchange, it still isn’t clear what will become of their allocation.

Why You Should Care

Keeping up to date with emerging networks in the crypto market is a great way to learn more blockchain technology and its possibilities. Aptos is a powerful network, pushing the boundaries of the industry.

FAQs

Many crypto enthusiasts like to call Aptos Solana 2.0 or the next Solana. This is because it’s blockchain specialized for speed and scalability, popular with venture capital investment firms.

Aptos Labs received investment and funding from some of the biggest names in the crypto market, including a16z crypto, Multicoin Capital, and Jump Crypto.

No one knows what will happen in the crypto market, however it seems unlikely that Aptos will reach $1,000. If the APT price hit $1,000, the market cap of Aptos would be over $1 trillion, making it larger than Bitcoin.

The maximum supply of Aptos is uncapped, given the inflationary token emissions that reward node operators. The total supply of APT tokens at launch was 1 billion, and the current circulating supply is roughly 187 million at the time of writing.

You can buy Aptos on leading crypto exchanges like Coinbase and Binance. These exchanges provide high liquidity markets and even track APT price in real-time fiat currencies like EUR and GBP.

According to CoinMarketCap, the APT’s all-time high price is $19.90, recorded on January 30th, 2023.