Paypal, perhaps the world’s best-known payments giant, has finally announced its full crypto market immersion with the launch of PYUSD. A new stablecoin pegged 1:1 with the US dollar, PYUSD blurs the line between traditional finance and Web3’s digital frontier.

For some, the Paypal stablecoin marks a key turning point in cryptocurrency mass adoption. For others, the digital payments Goliath represents yet another dangerous, centralized force vying for control in what should be a decentralized economy.

Is the launch of Paypal’s stablecoin a noble stride that bridges the old with the new, or a dastardly move that threatens the very ethos of the crypto world?

Sponsored

Let’s explore PYUSD and unravel its implications, potential, and ethical grey areas.

Table of Contents

What Is PYUSD?

At its core, PYUSD is a stablecoin, a digital currency designed to minimize price volatility by being pegged to a stable asset, in this case, the U.S. dollar. Cryptocurrencies like Bitcoin (BTC), Litecoin (LTC), and Bitcoin Cash (BCH) are widely considered to be poor methods of transacting funds online due to their volatile price movements.

Fully backed by U.S. dollar deposits, short-term U.S. Treasuries, and similar cash equivalents, PYUSD promises a 1:1 redemption with the U.S. dollar. In a perfect world, no matter what happens in the crypto market, PYUSD will retain its value and provide a stable platform for crypto payments in the PayPal ecosystem.

Sponsored

PYUSD will be issued by the Paxos Trust Company, a fully licensed unit operating within the regulatory oversight of the New York State Department of Financial Services. While this sounds promising and reliable, it’s worth remembering that this isn’t Paxos’ first rodeo. Paxos was also the issuer behind Binance’s stablecoin, BUSD, and were ordered to stop minting new BUSD after Binance’s regulatory woes.

How Does PayPal USD Work?

If you know how other centralized stablecoins like Tether (USDT) and USD Coin (USDC) work, PayPal USD’s mechanics will be no surprise. Just good old American dollars, PYUSD can be used as a currency of exchange within PayPal applications, including PayPal checkouts in online stores.

Built on the Ethereum (ETH) blockchain, users can transfer their PYUSD holdings between their PayPal balance and compatible private wallets, such as MetaMask or Coinbase Wallet, potentially unlocking the world of Web3 dApps and services. On top of that, PayPal plans to integrate PYUSD into Venmo, expanding PYUSD’s reach even further.

Of course, this interoperability comes at a cost, literally. While transfers of PYUSD to other US-based accounts within the Paypal app are feeless, crypto payments and transfers to external private wallets will naturally come with blockchain gas fees.

But hang on. Didn’t PayPal already support fiat currency transactions between PayPal accounts and checkout services with millions of retailers worldwide? How do Paypal and CEO Dan Schulman benefit from creating an ERC-20 stablecoin now?

What Are the Benefits of a PayPal Stablecoin?

Paypal is undeniably one of the world’s financial titans. As with the approval of crypto ETFs, we’re seeing more and more traditional financial players and services entering the cryptocurrency world. How does the birth of PYUSD benefit both PayPal and the legions of crypto enthusiasts worldwide?

- Trust and Credibility – With PayPal’s longstanding reputation in the fintech sector, PYUSD will likely be trusted by cryptocurrency beginners. This faith is also reinforced by PYUSD’s transparent backing of U.S. dollar deposits and short-term U.S. bonds.

- Seamless Integration – Unlike other centralized stablecoin rivals like Tether, PYUSD is not a standalone entity. Right off the bat, PYUSD is already deeply woven into existing PayPal services, meaning users can effortlessly use the stablecoin for transactions within PayPal’s network.

- Web3 Compatibility – As an ERC-20 token, PYUSD isn’t confined to PayPal’s domain. It can be transferred to supporting crypto wallets, opening the doors to DeFi integration. Who knows, maybe PYUSD will even be used to buy PayPal NFTs in the future.

- Stability – Being a stablecoin, PYUSD offers newcomers a refuge from the notorious volatility of the crypto market while still enjoying exposure to the emerging use cases of blockchain technology.

While it all looks good on paper, it’s important to remember that this is nothing new. Aside from piggybacking off PayPal’s reputation, PYUSD doesn’t bring anything to the table that didn’t already exist. Millions of merchants worldwide already accept crypto payments in one way or another, while storing your digital assets in self-custody has always been a cornerstone of the crypto movement.

With this in mind, why is PayPal doing this? Does the international payments giant want to contribute to the Web3 economy? Or is Dan Schulman simply trying to boost PYPL share prices and pave the way for a myriad of future CBDCs (Central Bank Digital Currencies)? Let’s examine what PYUSD could mean for the crypto market.

What Does the PYUSD Stablecoin Mean for the Crypto Market?

The entry of large centralized bodies into the crypto space is always met with mixed feelings. While it could be viewed as a triumph and a sign that institutional funds are entering the market, blockchain purists argue that it means Big Tech is coming to monopolize and control our decentralized economy.

With PayPal’s vast user base and global reach, PYUSD can potentially introduce a significant portion of the global population to the world of stablecoins and, by extension, cryptocurrencies. This could accelerate the mainstream adoption of digital assets.

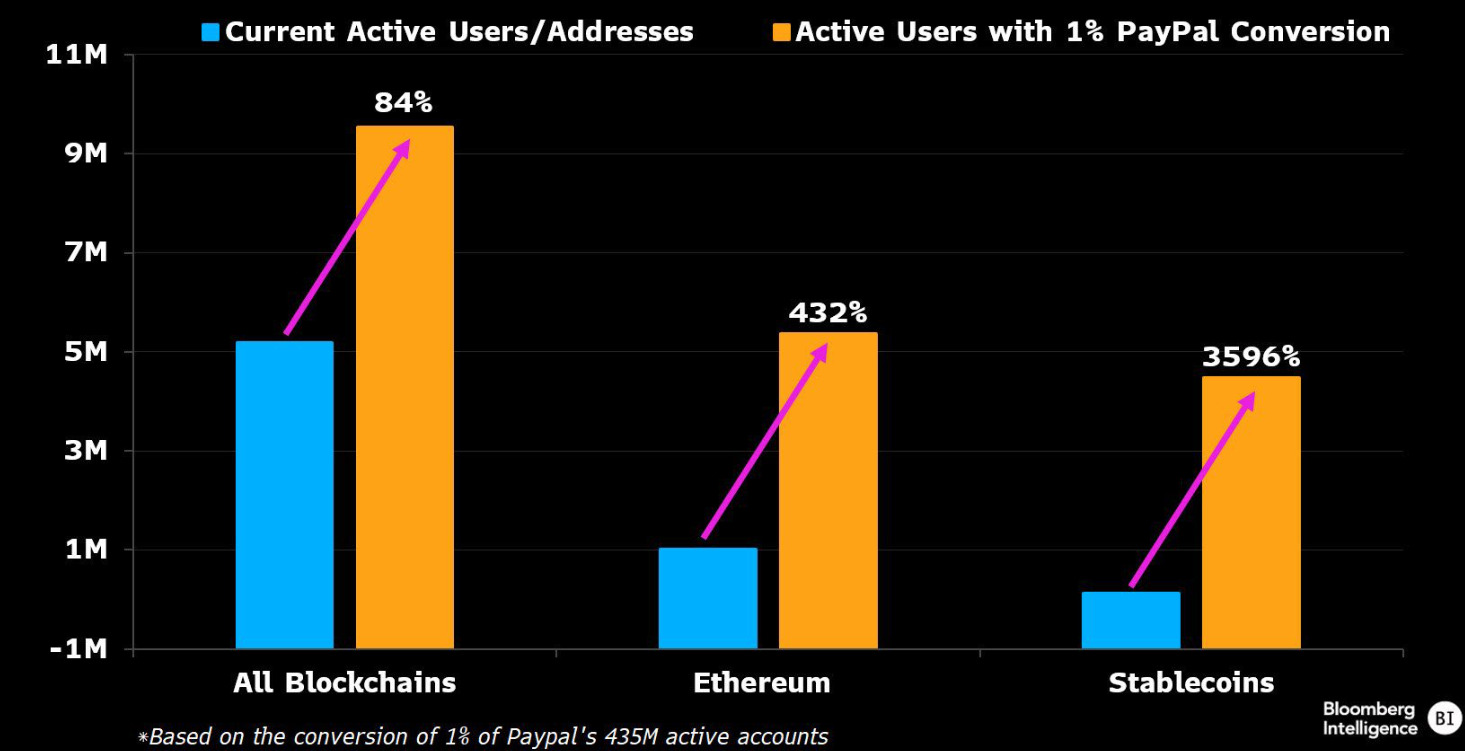

If even 1% of PayPal’s ~435 million existing users make the jump, Ethereum’s active user count will multiply threefold. While this would be a great step for blockchain adoption, I’m not convinced that the Ethereum network would handle the congestion. Gas fees and network congestion would explode, rendering the network largely unusable.

Moreover, introducing a stablecoin by a major player like PayPal could influence the dynamics of the stablecoin market. It will likely challenge the dominance of existing stablecoins and reshape the market hierarchy. PYUSD could well be the snowdrift that causes the avalanche, with dozens of financial entities launching their own stablecoins.

This leads to my next point. Centralized stablecoins have always been controversial, and PYUSD is no different. What did smart contract auditors find in PYUSD’s code that rang alarm bells across the crypto space?

PYUSD Controversy: One Code to Rule Them All?

PYUSD’s entry hasn’t been without its share of whispers and raised eyebrows in the shadowy alleys of the crypto realm where code is the law. While the stablecoin promises stability and trust, certain aspects of its contract code have drawn ire and criticism from crypto users.

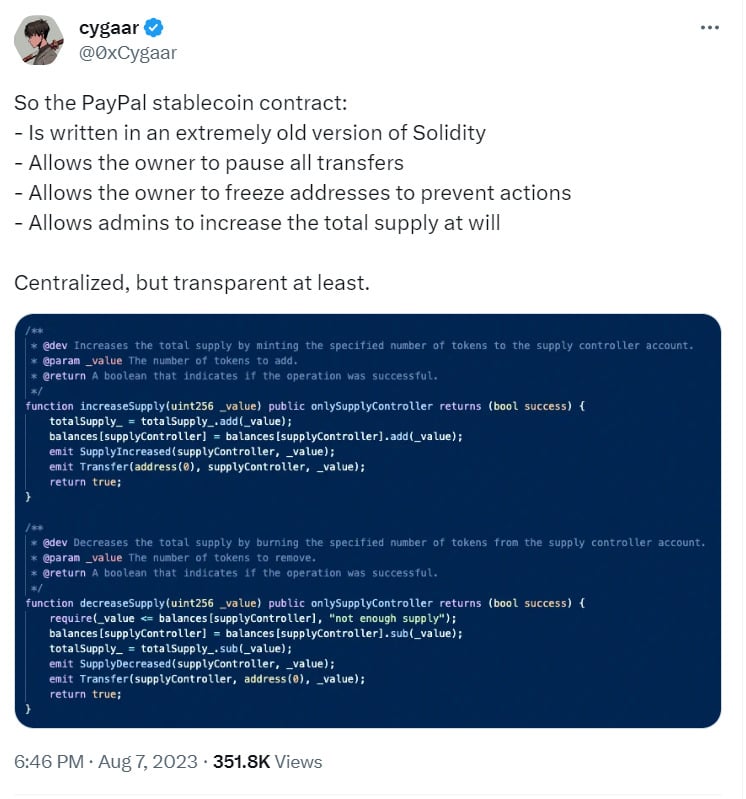

- Outdated Solidity – One of the first concerns raised was using an old version of Solidity, an Ethereum-based programming language, for the PYUSD contract. An older version could expose the contract to known exploits in a world where security vulnerabilities can lead to significant losses.

- Centralized Control – The PYUSD contract allows the owner to pause all transactions and freeze addresses. While this might be seen as a protective measure against fraudulent activities, it also means that a single entity has significant control over the assets, a notion that goes against the decentralized ethos of the crypto world.

- Supply Manipulation – The contract code grants the owners the ability to increase or decrease the total supply. Such a level of control over the supply could lead to concerns about manipulation and trust in the stablecoin’s peg to the U.S. dollar.

- Trust in Centralized Entities – While PayPal’s reputation might lend credibility to PYUSD, the centralized control mechanisms in the contract code could lead to debates about the level of trust users should place in such entities.

- Regulatory Implications – The centralized control features in the contract could also attract regulatory scrutiny. Regulators might view such controls as a way for PayPal to exert undue influence over the stablecoin market.

Ultimately, PYUSD is not a stablecoin that gives users a whole lot of control or security over their funds. If PayPal has the power to freeze your assets within your wallet and pause your transactions, your PYUSD is not truly yours.

PYUSD Pros and Cons

As much as we love criticizing centralized bodies trying to join the crypto industry, PayPal’s stablecoin brings many positives. Let’s take an objective look at the benefits and drawbacks of PYUSD.

Pros

- Trustworthiness – PayPal is one of the world’s most trusted financial companies. Newcomers to the crypto space will likely trust PayPal over companies like Tether and Circle, which they may not be familiar with, streamlining adoption.

- Stability – Pegged 1:1 with the US Dollar, PYUSD offers traditional financial players to enter the crypto market without risking a dramatic price crash.

- Integration – PYUSD will integrate existing PayPal services, including checkouts and the Venmo payments app.

- Web3 Readiness -As an ERC-20 token, PYUSD is primed for the future, allowing users to explore the world of Web3 and decentralized finance.

Cons

- Centralization Concerns – The PYUSD contract’s features, such as the ability to pause transactions and control supply, raise concerns about centralized control, going against the decentralized ethos of the crypto world.

- Older Codebase – Using an outdated version of Solidity for the contract could raise security concerns and potential vulnerabilities.

- Fees – While PYUSD promises seamless transactions, they come with associated fees, which could vary based on transaction types and methods.

- Market Impact – PYUSD’s introduction could disrupt the dynamics of the existing stablecoin market, potentially affecting other stablecoins and their valuation.

On the Flipside

- With PYUSD joining the ranks of stablecoin titans like Tether (USDT), Circle’s USD Coin (USDC), and decentralized alternatives like DAI and DJED, the question needs to be asked: Do we need more stablecoins?

Why This Matters

PYUSD might give people confidence and assurance to enter the cryptocurrency world, but the stablecoin doesn’t offer any exciting new utility and is plagued by centralized code issues.

FAQs

If your account is verified for crypto services, you can buy PYUSD through the PayPal application. PYUSD is redeemable for US Dollars at a 1:1 ratio.

PayPal Stablecoin (PYUSD) is a cryptocurrency built on the Ethereum blockchain that is pegged to the value of the US dollar.

No, PayPal is not a cryptocurrency exchange. However, in certain regions, you can hold a select range of cryptocurrencies like Bitcoin in your PayPal account.