- CBDC is a digital form of any national currency. It is the opposite of decentralized cryptocurrencies.

- CBDC is intended to modernize the monetary system and make it more competitive in times of the cryptocurrency revolution.

- Governments are massively exploring CBDCs, but the fast pace of adoption is risky.

Digital currencies have stormed into headlines and millions of digital wallets in the past few years. Cryptos saw triple-digit growth during the global pandemic, brought higher returns than traditional stores of value, and continue to attract billions of dollars from institutions worldwide.

Decentralized money alternatives eventually became a threat for the established financial system and for its guardians, the central banks. Some of them decided to ban the competitors, others chose a more sophisticated way to combat them: central bank digital currencies (CBDCs).

According to the International Monetary Fund (IMF), more than a half of the world’s central banks are exploring digital versions of their own national currency. Some of them, like China, are already at the finish line.

Sponsored

Although CBDCs are still in their very early development stage, they might affect all our lives if implemented.

What Is Central Bank Digital Currency?

CBDC is a digital form of any national currency, and it is always issued by a central bank. In other words, it is issued by a national bank that implements the monetary policy of the government and controls the country’s money supply.

Regardless of the fact that CBDC is issued on a blockchain, it remains a centralized currency.

Why Are CBDCs in the Spotlight?

Societies worldwide are increasingly moving away from cash, and interest in digital assets is growing. Billions of institutional and corporate funds were allocated to cryptos in the past few years. Cryptocurrencies became a recognized asset class, and their influence strengthened.

At the same time, the saturated global landscape of payment service providers started to show signs of power concentration in several hands.

Central banks, which are responsible for national monetary policies, found this a threat to the status quo and financial stability. They also saw decentralized and unregulated cryptos as a means for tax avoidance and money laundering.

One of the world’s biggest economies, China, is leading the race to create a CBDC. The country plans to change its financial system and launch its digital yuan in 2022. This could even strengthen China’s global economic power and also threaten the status of the US dollar, the world’s main reserve currency.

As no one wants to be left behind in the race, countries worldwide are jumping into researching their own digital currencies.

The Role of Central Bank Digital Currency (CBDC)

Central Bank Digital Currencies are an advanced form of money. But they are still meant to coexist with physical cash and serve the same purposes of money: to be a store of value, the unit of account, and the means of payment.

In general, the key task for CBDCs is to bring innovations to the monetary systems and financial infrastructure that play an important role in a country’s economic development. CBDCs are expected to make payment services faster, effective, accessible, secure, and thus more competitive.

1. More efficient payment system

Current financial systems rely on multiple intermediaries and third-party service providers. This makes international cross-border transactions slow and expensive, and sometimes even hard to access.

Blockchain functionality allows CBDCs to facilitate direct peer-to-peer (P2P) payments and bypass long chains of payment transfers. Governments do not need to print paper money and manage it. So digital currency transactions significantly lower the cost and time needed for funds to flow through economies. Unlike multiple intermediaries that operate within strict working hours, CBDC transactions can be completed 24/7.

In addition to that, CBDCs could offer an alternative to a highly concentrated financial payment market. The current tendency shows that even in payments systems, the concentration is narrowing in the hands of a few major companies. And traditionally, higher competition means lower prices and better services for the end-users.

2. Financial Inclusion

Further, CBDCs may play an important role in enhancing the monetary system with new players. This not only includes new payment service providers but also people who were previously unable to use financial services. Currently, nearly 2 billion people live under such conditions, almost a quarter of the world’s total 7.7 billion population.

CBDCs could help to solve this problem. The blockchain functionality allows central banks to bypass intermediaries and transfer money directly to users’ digital wallets.

3. Security and Resilience

As of now, the majority of CBDCs would be built on the blockchain infrastructure, which is immutable, trackable, and transparent. Every transaction recorded into the distributed digital ledger is encrypted and impossible to delete or change.

And as any single transaction is recorded and traceable, the usage of CBDCs could help institutions to better control tax evasion and identify illicit payments. Eventually, the higher level of transparency in public finance should contribute to governments’ ability to efficiently fight against money laundering and terrorist financing.

Another important feature is the enterprise and government-grade blockchain, on which CBDC would only be issued. Blockchains of such levels combine the best aspects of public and private blockchains. They still operate on decentralized infrastructure but require permission to access certain data. Such hybrid blockchains are regulatory-compliant and can meet the complex needs of integrity, transparency, and privacy at the same time.

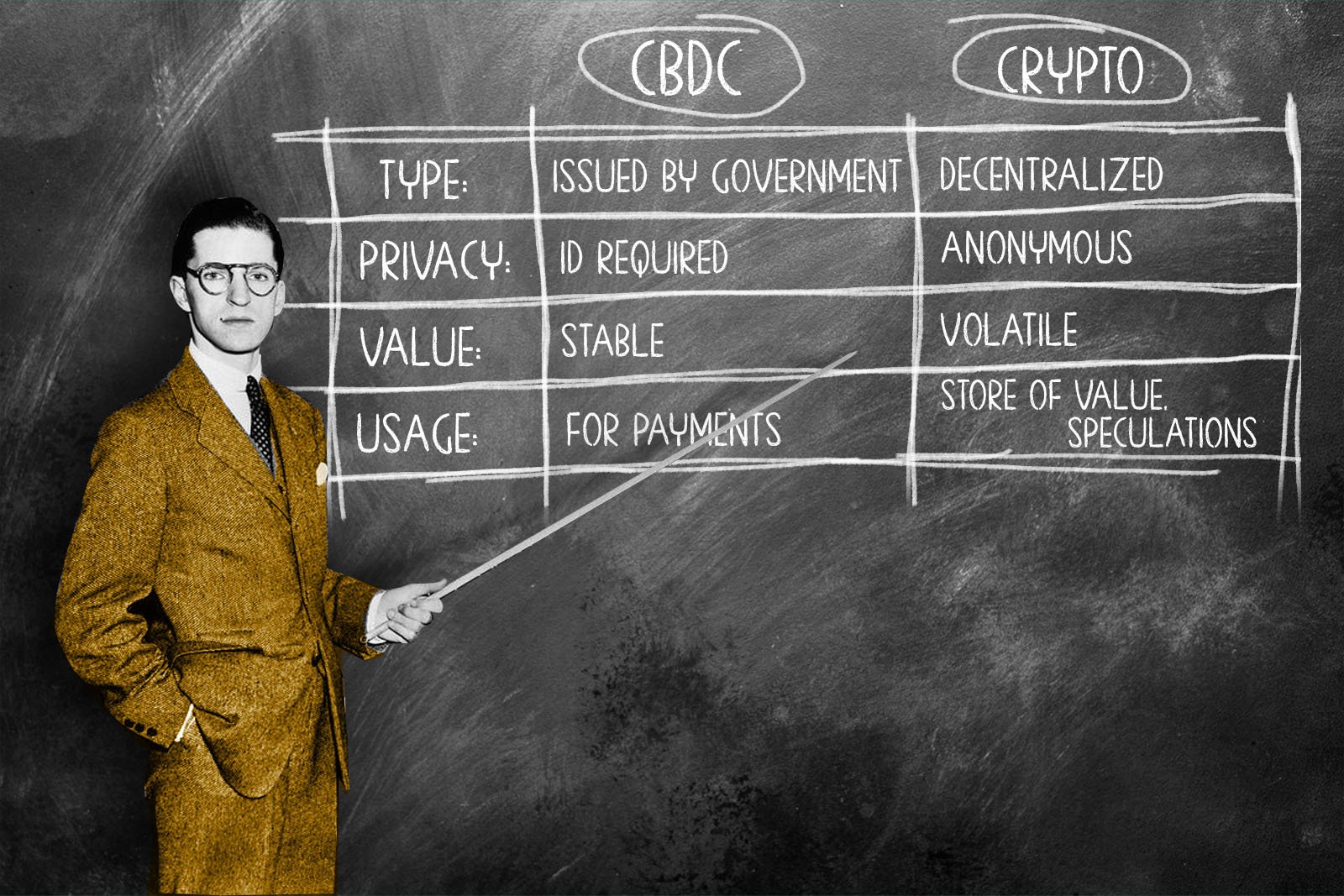

How CBDCs Are Different from Cryptocurrencies

Centralization

Central Bank Digital Currencies are centralized currencies issued by centralized governmental institutions. They are fully regulated and under the control of monetary authorities. In the meantime, cryptocurrencies are decentralized and have no authorities behind them.

Consensus

CBDCs most possibly would be built on permissioned blockchains as they must be regulatory compliant. However, they are not protected from the risk of an increase in supply. In times of economic uncertainties and critical situations, governments could print extra money, and the same could happen to CBDCs. This is an inflationary action and typically, the increase in supply eventually reduces the value of the money.

In contrast, cryptocurrencies operate on an open-source public network and usually have a fixed supply. The limited supply means they are scarce, and scarcity typically leads to a price increase over time. In addition to that, cryptocurrency supply cannot be changed without the consensus of the community, which adds an extra layer of protection against an increase in supply.

Anonymity

Cryptocurrencies come with the full package of anonymity. Typically they are issued on the decentralized open-source public blockchain with an anonymous nature. There are no regulations on public blockchains, and it is easy for users to keep their identities private. Especially, when not all crypto exchanges require ID verification to make transactions.

CBDCs could only be possible on permissioned blockchains that are regulatory compliant and come with additional security features. This automatically means lower privacy standards. Although some parts of transaction data might be kept private, the identities of the users are not anonymous.

Why Banks Are Slow in CBDC Adoption

The Bank for International Settlements (BIS) has analyzed the potential impact of CBDCs on global financial stability and addressed several factors regarding their further adoption in its report.

According to their study, the fast pace of CBDC adoption could unbalance the financial systems. Currently, central banks hold large reserves of the country’s money in the accounts of commercial banks.

The switch to digital money would require the withdrawal of reserves from banks. Without these deposits, commercial banks become unable to issue loans and credit. In the end, this severely impacts financial chains, capital allocations, investments, and economic growth.

BIS also named the central banks’ responsibility and infrastructure discussions as another factor that could slow the adoption. Theoretically, central banks could be the creators and operators of the CBDC ecosystem.

The problem is they lack expertise in direct financial services with end-users, contrary to the commercial banks. To fully manage the CBDC ecosystem, central banks would have to create it from scratch or collaborate with private financial institutions and share functions with them.

On The Flipside

- The biggest concerns regarding CBDCs are related to the increased governmental control, greater surveillance capabilities, and potential privacy infringements.

- Government-backed CBDCs might slow the adoption of privately issued stablecoins and cryptocurrencies. Contrary to cryptos like Bitcoin, CBDCs cannot be used as a store of value or hedge against inflation.

- From a security perspective, CBDCs are more vulnerable to cyber attacks than cash.

- Digital transactions highly depend on internet speed. However, in many jurisdictions, internet connections are not fast enough yet.

Why You Should Care?

Central banks are the banks for governments and create the course of how money is used in a particular country. Despite the fact that the Central Bank Digital Currency (CBDC) concept is still in early development, it could become a reality one day that will affect us directly.