- Cardano has yet to recover from the SEC’s crypto crackdown, trading 25% below its June High.

- Despite whale interest increasing and its DeFi ecosystem expanding, Cardano’s price remains unaffected.

- Cardano’s price action in the following weeks depends on who takes control: The Bears or the Bulls.

Cardano has been struggling to gain momentum since the SEC crypto crackdown. Despite the development team’s multiple attempts at addressing the concerns regarding its decentralization, the ecosystem continues to face turbulence as major US exchanges delist Cardano and dump their ADA holdings.

Currently trading 25% below its June high, Cardano struggles to break through crucial resistances, even with rising whale interest and its DeFi ecosystem thriving.

Cardano Whales Confident

Since the SEC’s crackdown, Cardano (ADA) has been consolidating between $0.26 and $0.29, struggling to break through. The token still traded under $0.29 at press time with a daily trading volume of $210 million.

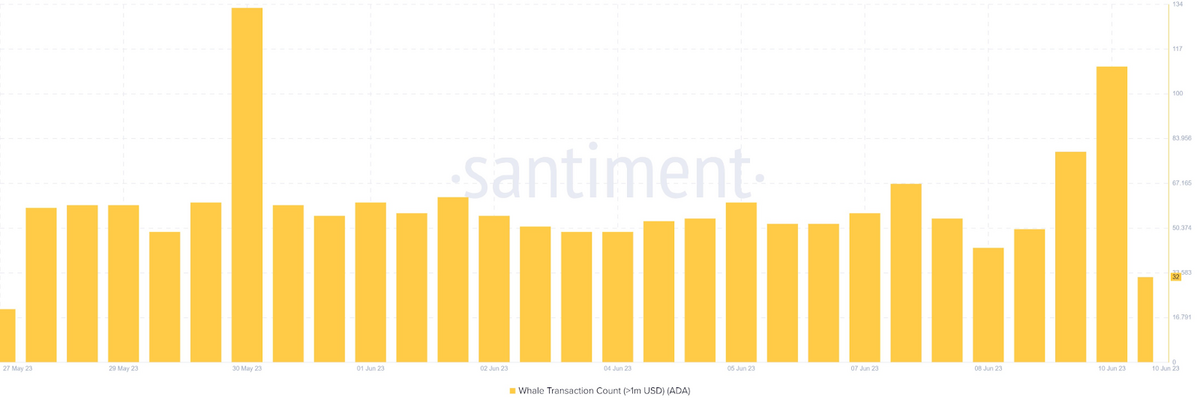

However, despite the slow movement, Whale interest in the ecosystem has been burgeoning, even when ADA plunged to its two-year low of $0.22 in June. According to Santiment data, Whales have maintained an average of 110 daily transactions exceeding $1 million on the network.

Sponsored

Additionally, according to IntotheBlock data, addresses holding 100 million to 1 billion ADA have seen a 3% increase in their holdings over the past month, indicating that smart money is confident in the long-term prospects of Cardano and accumulating ADA.

Sponsored

However, despite the growing whale interest, ADA has yet to overcome the massive obstacle at $0.3.

Cardano Retail Investors Not Confident

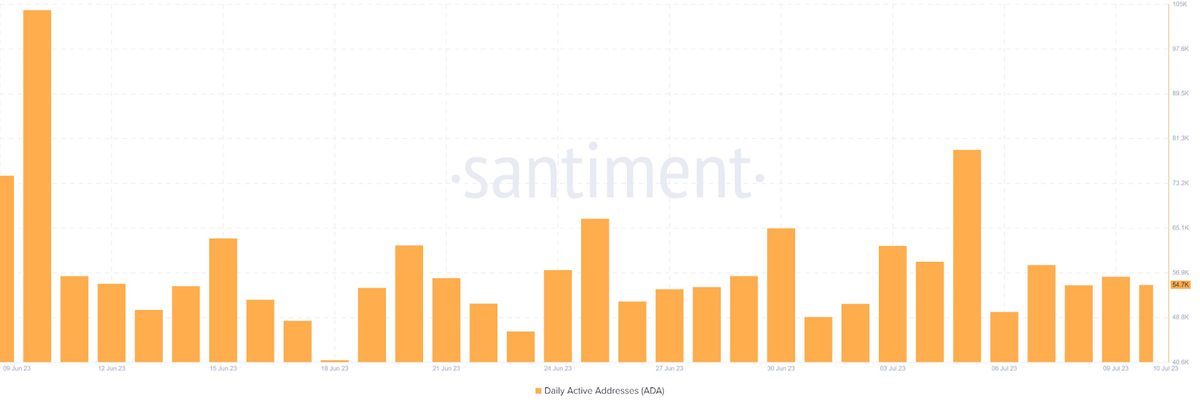

While Cardano whales continue to accumulate ADA and remain unfazed by the negative news surfacing, retail investors, on the other hand, have been significantly affected. Cardano’s daily active user count has dwindled since the SEC’s security classification, and like its price, it has yet to recover.

According to Santiment, Cardano Daily Active Addresses dropped from over 100,000 on June 10 to 50,0000 on July 10, marking a 50% decline and indicating a lack of confidence among retail investors.

If activity from retail users remains scarce, Cardano price action could struggle to move in the following weeks.

$0.30 is the Level to Beat for ADA

Overcoming the $0.30 level is crucial for Cardano bulls in the upcoming weeks, but it may be a challenge considering the mounting sell pressure from the bears. Over the past month, Cardano’s previous attempts to reclaim $0.30 have been met with resistance from massive sell walls set by the bears, hindering its recovery.

If the bulls manage to overpower the bears, there’s a high possibility that Cardano could reach $0.32 for the first time in over a month. However, if the bears take control, ADA’s price could crash toward $0.25.

At press time, investor sentiment remained primarily bearish, as reflected by on-chain, derivatives, and exchanges data by IntoTheBlock.

On the Flipside

- ADA is 90% down from its all-time high of $3.1 at press time.

- Cardano Founder Charles Hoskinson believes that by the summer of 2023, Cardano could surpass Bitcoin, Ethereum, and every other cryptocurrency in decentralization.

Why This Matters

The following weeks are crucial for Cardano and could shape its trajectory for the rest of the year. ADA has been struggling to break through $0.3, and with whale interest rising, it could likely retest its June high. However, if its support level fails to hold, the token could revisit $0.25, hindering its progress.

Follow up on Cardano developments:

DailyCoin Cardano Regular: Bears & Bulls Clash, TVL Swells, But Price Remains Steady

Read how Cardano is incentivizing governance actions:

How Cardano Looks to Incentivize Contributors on Governance Actions

FAQs

Securities are tradable financial instruments representing company ownership, such as stocks and bonds. Whether Cardano is classified as a security depends on several factors, including regulatory frameworks and token characteristics, such as decentralization. In the United States, the Securities and Exchange Commission (SEC) considers Cardano to be an unregistered security, although the founders of Cardano dispute this classification. However, it’s important to note that Cardano may not be considered a security in other jurisdictions worldwide.

The decline in Cardano’s price could be attributed to several factors, including the SEC’s classification of ADA as an unregistered security, major US exchanges delisting the token, lack of confidence among retail investors, and other contributing elements.

A Cardano Whale is an entity or person that holds a significant amount of ADA. Given the scale of their holdings, whales can influence the market and impact the token’s price movements.

Due to their significant holdings, Whales can influence the market, but it’s worth noting that they do not control the crypto market. While Whales can cause short-term price movement through their trading activities, the overall market is influenced by several factors, such as supply and demand dynamics, market sentiment, news, developers, and more.