What is a Crypto Whale? If you’re new to the blockchain space, understanding this term is one of the first things you should learn in your crypto education.

Whether intentional or not, crypto whale movements cause huge swings in the market. Staying up to date with whale activity, both bullish and bearish, is an easy way to gain a competitive edge in the crypto market.

Whales are known to deliberately manipulate digital currency prices for their own benefit. However, inefficient handling of cryptocurrency liquidity can also lead whales to ruin, as we saw so spectacularly during Sam Bankman-Fried’s fall from grace.

Sponsored

But how do these whales control digital asset price movements, and how do you avoid getting washed away in their splashes?

What Is A Crypto Whale?

Fundamentally, a crypto whale is a wallet address that holds a significantly large amount of a particular cryptocurrency. In most cases, the number of coins needed to qualify as a whale is subjective, although most of the crypto community would agree that holding 1,000 BTC bestows the ‘Bitcoin Whale’ status.

Holding large amounts of crypto gives these whales enormous control and influence over the markets. To give you an idea, let’s take a look at Dogecoin (DOGE). The largest DOGE holder on the Dogecoin mainnet owns 24% of the total DOGE supply. With a snap of their fingers, this wallet could sell off their coins and print a catastrophic red candle on the DOGE chart.

Sponsored

While this isn’t a good idea due to limited liquidity, this whale has a massive influence over the price movements of DOGE. For this reason, many whales prefer to trade cryptocurrency in OTC (over-the-counter) deals, where they won’t directly impact crypto prices.

There are certain market manipulation techniques available to whales that we small fish should be aware of.

How Whales Move the Crypto Market

Just like in the real ocean, the movements and behaviors of whales churn and disrupt the lives of simple shrimps that get caught up in their wake. Here are some of the common ways that crypto whales manipulate prices.

Buy/Sell Walls

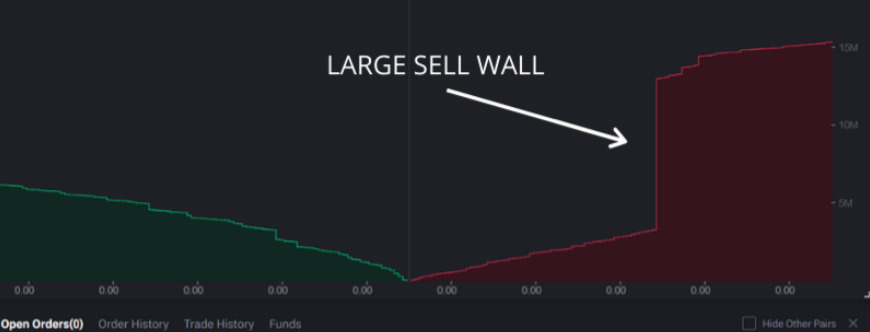

Whales mentally exhaust bullish buyers by setting large sell orders and creating what’s called a sell wall. What does this mean? Imagine you’re a trader, and you’re expecting a crypto asset like Ethereum (ETH) to go up in price.

You head to a crypto exchange like Binance to buy ETH, but when you look at the order book, you see a brick wall of sell orders worth $10 million. That means the bulls need to buy $10M worth of ETH, and the price will hardly move.

A thick sell wall is often enough to discourage buyers who remove their buy orders, letting standard market sell pressure overwhelm the bulls and drive prices down. This technique can also be applied to NFT collections.

“But why would a whale deliberately drive down prices if they hold a large amount of cryptocurrency?!” I hear you asking. The answer is simple, it means they can buy more at even lower prices.

As you can probably guess, buy walls work the same way as sell walls, just in the opposite direction. Bearish sellers with short positions might see a wall of large buy orders and close their short sell positions, losing faith in their bearish bias. In doing so, bears need to buy back the specific cryptocurrency being traded to close their shorts, pushing prices up.

Liquidation Hunting

Volatility in the crypto market is a given, yet when traders use a lot of leverage, things get even crazier. When leverage traders get liquidated, they automatically need to close their positions to pay back whatever they borrowed when opening the position.

To put it simply, when a long position gets liquidated, the trader automatically has to sell the currency being traded and vice versa for a short position. An overleveraged market causes a cascade of forced liquidations that result in dramatic price movements.

When crypto whales unexpectedly make large buys or sells, they can trigger these liquidation points that force traders to close their positions.

Multi Walleting

For some, being a Bitcoin whale and having a Bitcoin wallet filled with thousands of BTC is a status symbol. However, other whales are more discrete and don’t want their movements tracked on the blockchain.

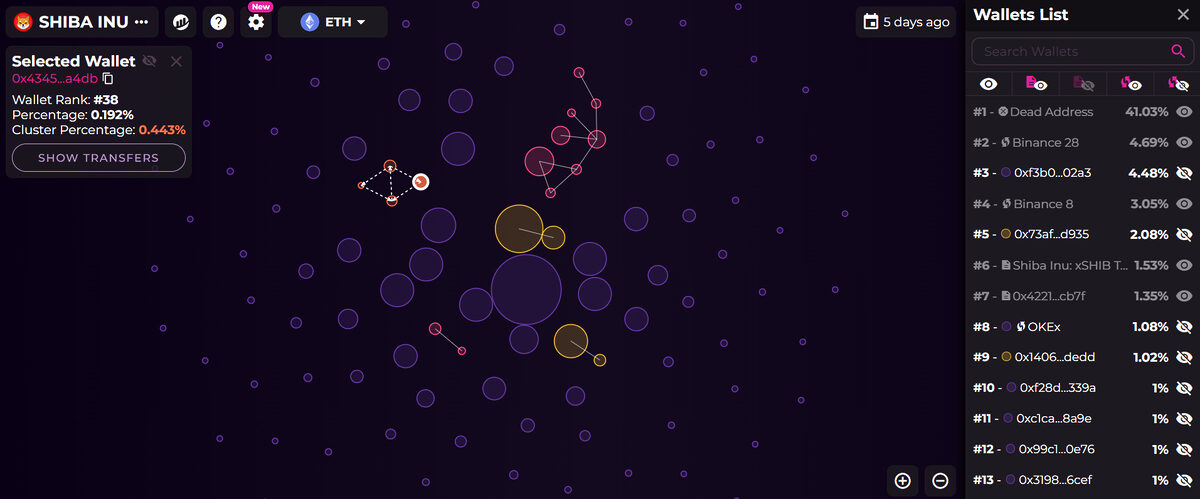

Such whales separate their holdings into smaller wallets to keep prying eyes away from their wallets. By avoiding detection, these whales are able to manipulate the market without their movements being recognized as whale transactions.

This example shows that these four wallets have a history of sending SHIB between themselves. While the largest wallet has 0.192% of the SHIB supply, it forms a cluster with other wallets that collectively hold 0.443%.

Known Crypto Whales

Not all crypto whales are anonymous. In fact, some of the largest holders of some currencies are public figures who are well-recognized within the crypto industry. Generally, these public figures don’t partake in the market manipulation practices common amongst anonymous whales.

- MicroStrategy – Michael Saylor’s software company is one of the world’s most extensive publicly recognized Bitcoin whales.

- Brian Armstrong – The founder of Coinbase was an early investor in digital assets like Bitcoin.

- Tesla – Elon Musk’s electric vehicle famously bought $1.5 billion worth of BTC back in 2021.

- Winklevoss Twins – Entrepreneurial twins Tyler and Cameron Winklevoss own an estimated 70,000 bitcoins and founded the Gemini crypto exchange.

- Vitalik Buterin – Ethereum’s whimsical founder is understandably an ETH whale. He was also the largest Shiba Inu (SHIB) whale, before burning the SHIB coins he never wanted.

There was once a time when Sam Bankman-Fried was considered a crypto whale, however, his infamously mismanaged funds led to his own demise. The FTX balance sheet was packed with cryptocurrency tokens like FTX token (FTT) and Serum (SRM) with high market capitalization and low liquidity.

When rumors started circulating that FTX was insolvent, there wasn’t enough liquidity in the market to sustain the selling pressure on these tokens. FTX’s balance sheet was propped up on nothing but artificially inflated assets, which ultimately meant they didn’t have enough liquid funds to pay their depositors.

What Is Crypto Whale Watching?

One of the double-edged swords of blockchain functionality is that everything is transparent and verifiable on-chain, meaning that anyone can track the movements of crypto whales. Whales can avoid this to some extent by splitting their holdings among several wallets, but savvy blockchain sleuths can still find linked wallets relatively easily.

Whale watching is a useful skill. Whales are generally skilled traders with excellent knowledge and understanding of the market. Tracking whale wallets is a good way to identify cryptocurrencies that might have positive catalysts on their horizon.

On the other hand, if a whale starts selling a particular cryptocurrency, that could be considered an indicator that the big players in the market predict that bad news is on the way. If popular Twitter accounts like Whale Alert share that a whale is sending a large amount of crypto to an exchange, they might be preparing for a large sell-off.

It’s important to be aware that whales know that everyone can see this information, so you need to bear in mind that any whale transactions could also be yet another layer of manipulation to lead you astray.

Pros and Cons of Crypto Whales and Whale Watching

For all their tactics and techniques, crypto whales are also a force of good in the crypto industry. Let’s take a look at the benefits and drawbacks of crypto whales and whale watching in the crypto market.

Pros

- Support crypto projects – Whales who buy and hold certain cryptocurrencies take a large number of coins out of circulation, increasing token scarcity and reducing potential sell pressure.

- Provide deep liquidity – Crypto whales sometimes provide liquidity to decentralized exchanges to earn trading fees. This reduces price volatility by greater deeper market liquidity within token pairs.

- Identify new trades – Tracking whale wallets is a good way of knowing what smart money is expecting will happen next in the crypto market.

Cons

- Market manipulation – Crypto whales exercise powerful control over the market, and can manipulate prices to try and influence your trades and investment decisions.

- Centralization issues – Looking back to the Dogecoin example, if one wallet holds such a high concentration of coins they might be able to blackmail developers into acting within their interests. Their ability to destroy a digital asset’s value is a threat to decentralization.

On the Flipside

- Never forget that the crypto market is a PvP environment. It’s a zero-sum game in which whales are actively looking to extract value from the market at the expense of others.

Why You Should Care

Learning about crypto whales and the techniques they might use to manipulate the market can help you make informed decisions in the crypto space.

FAQs

There are no official thresholds for the amount of cryptocurrency you need to hold to qualify as a whale for most altcoins. However, the general rule of thumb suggests that holding 1,000 BTC gives a holder whale status.

The biggest crypto whale is undoubtedly Satoshi Nakamoto, the founder of Bitcoin. Satoshi is believed to hold over 1 million bitcoins, which he has never sold.

Most whales generally choose to store their cryptocurrency using hardware wallets. These cold storage solutions provide the best possible security and keep your coins safe from hacks.

Crypto whales are both a blessing and a curse for the industry. They can be a source of both stability and volatility within the market. Whether they are good or bad for the industry arguably depends on how they behave more than whether they exist.