- The SEC has levied claims against Cardano in its case against Binance.

- The regulator’s action has put a lot of pressure on the token.

- Cardano fires back at the SEC.

The United States Securities and Exchange Commission (SEC) has stirred chaos in the cryptocurrency industry by going after two of the country’s largest cryptocurrency exchanges. In its act of ‘enforcement,’ the SEC has targeted a list of tokens, including Cardano, by labeling them as unregistered securities.

The SEC’s unwarranted interference has caused a seismic shift in the market, with many tokens like Solana, Polygon, and Cardano incurring heavy losses. The regulator’s decision has sparked a heated debate within the community, with prominent figures leading a united front against the action, including Cardano’s parent company IOHK.

Factual Inaccuracies

The SEC’s official case filing against Binance included several claims alleging Cardano was an unregistered security. The regulator specifically argued that Cardano’s three founding entities, IOHK, the Cardano Foundation, and Emurgo, owned the protocol, implying the Proof-of-Stake (POS) chain lacked decentralization.

Sponsored

On June 7, IOHK responded to the SEC’s allegations, refuting claims made by the regulator. The parent company stated the SEC’s filing contained “numerous factual inaccuracies” and emphasized that the accusations would have no impact on their operations in any way.

IOHK clarified its stance, firmly stating that “under no circumstances is ADA a security under US securities law, and it never has been.”

Sponsored

Furthermore, IOHK criticized the SEC for its apparent lack of understanding of decentralized blockchains’ operation. The blockchain company later invited regulators from different industries to help develop a framework that would not only “safeguard consumers” but also not stifle innovation within communities building decentralized protocols.

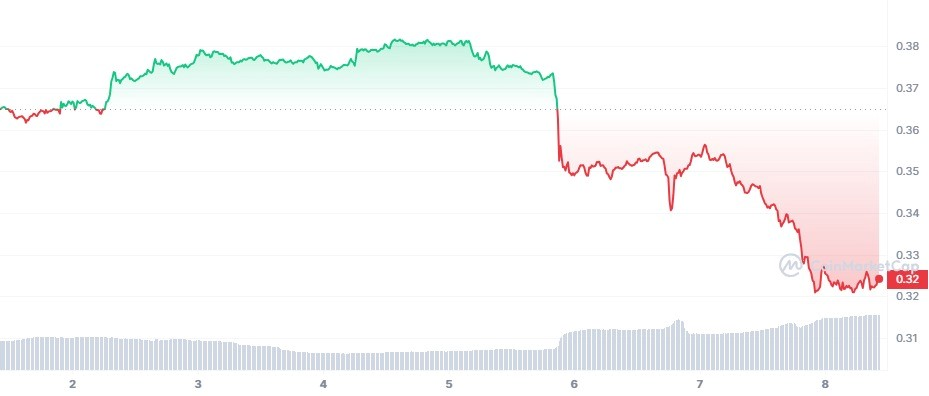

Despite IOHK’s clarification, Cardano’s ADA token experienced a sharp decline, showing no signs of recovery at press time.

Cardano Goes Down

The SEC’s allegations have cast a shadow of doubt and uncertainty over the industry, impacting several projects. Although most of the market has recovered some of its incurred losses, ADA is still struggling.

Cardano is currently the worst performer of the top ten cryptocurrency tokens at press time, experiencing a 15% loss compared to Bitcoin and Ethereum’s 3% gain. The SEC’s action led to ADA exchanging hands at $0.38 to $0.32 due to the rising pressure of selling.

On the Flipside

- Binance has also denied the SEC’s allegations. The exchange plans to defend itself in court.

- Cardano Founder Charles Hoskinson believes the SEC’s action against Binance is motivated by a hidden agenda.

- The SEC’s case against Binance and Coinbase sparked a wave of liquidations throughout the market, amounting to $104 million.

Why This Matters

Cardano is a prominent player in the industry with one of the largest communities. Despite its commitment to decentralization, the SEC has still targeted the protocol with a weak argument. The regulator’s action could hinder the project’s price performance by spreading fear and uncertainty among investors.

Read how Cardano’s CIP-1694 can provide solutions to the SEC:

Cardano and the SEC Problem: How CIP-1694 Could Provide Solutions

Read why Louis Vuitton is selling NFTs for a hefty price tag: