- Bitcoin price action continues to stoke negative sentiment.

- The dynamic between small and large holders has flipped.

- Signs indicate a change in retail interest.

Bitcoin has been trending lower while showing little signs of fight after hitting a new $74,000 all-time high in March, stoking concerns of a return to the bear market. With negative sentiment mounting, an intriguing dynamic among entity holdings is playing out as small accounts load up on coins and whales reduce their holdings.

Small Investors Pile into Bitcoin

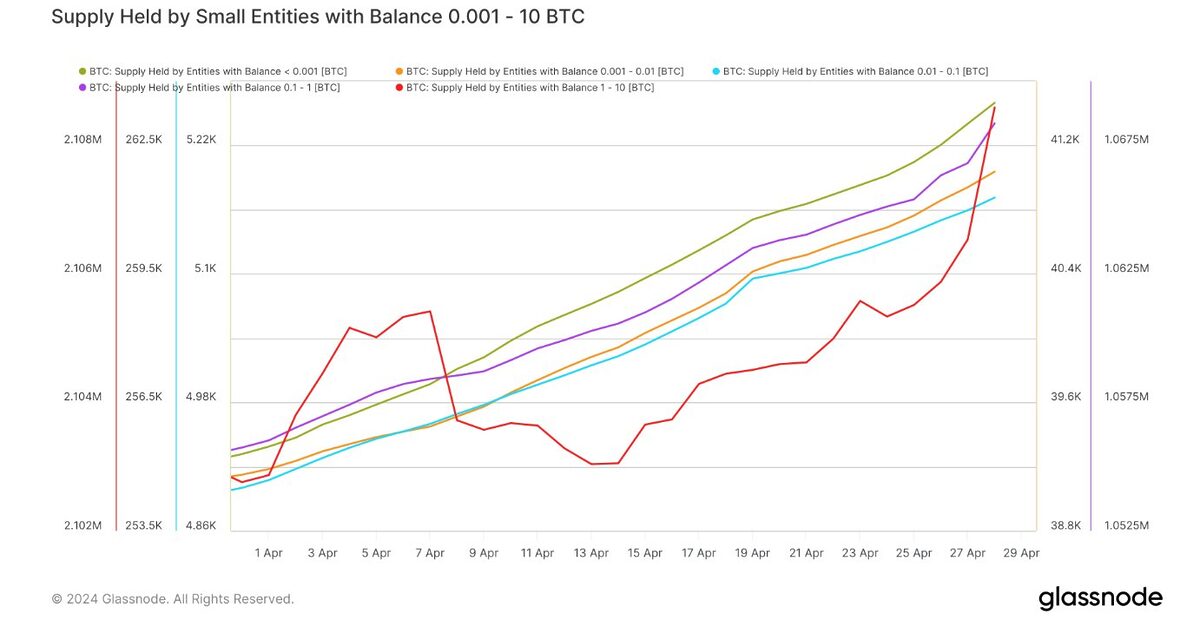

As Bitcoin continues trending down, Glassnode data revealed that small account holders are increasing their holdings as whales exit their positions. Small accounts holding between 0.001 and 10 BTC increased their holdings since April, with the 1-10 BTC cohort adding around 7,000 BTC in April and seeing the sharpest rise in holdings from April 24 onwards.

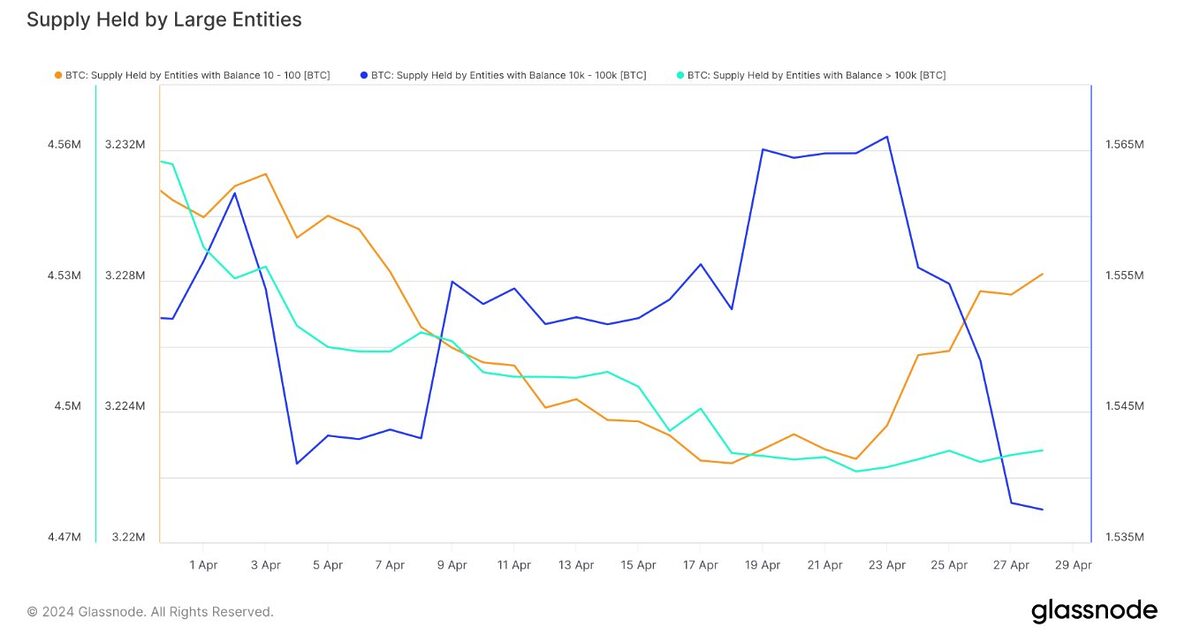

The 10-100 BTC category of accounts increased their holdings from about 3.223 million BTC on April 22 to just over 3.228 million BTC on April 28. However, the 10,000 to 100,000 BTC cohort collectively dropped their holdings from just over 1.565 million BTC on April 23 to around 1.540 million on April 28.

Commenting on this changing dynamic between entities, X influencer Bitinning concluded that “regular people” are regaining interest in Bitcoin, even as price action continues to stall and disappoint.

Are Retail Investors Back?

Analyst “_Checkmate” corroborated Bitinning’s conclusion that “regular people” are regaining their interest in Bitcoin lately. The analyst noted that shrimps (holders of less than 1 BTC) had recently upped their accumulation and “appear to be stacking sats once again.”

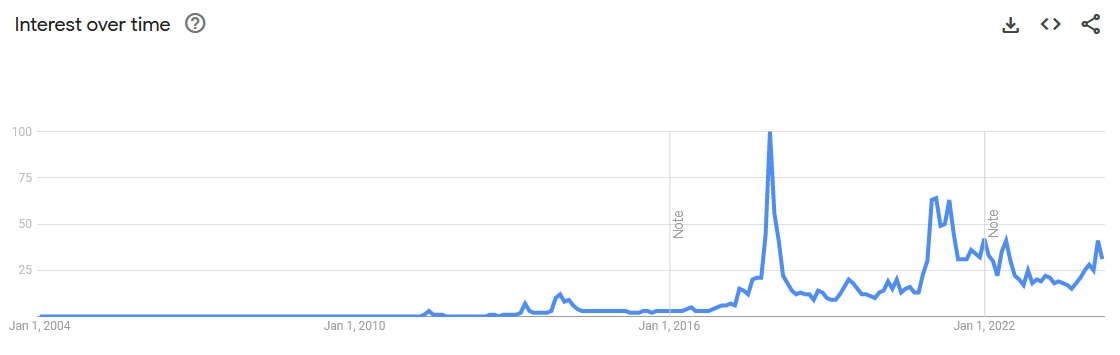

Google Trends data mirrors this narrative of reviving retail interest. The search term “Bitcoin” bottomed out with a reading of 15 in September 2023 before trending higher, peaking at a local top of 41 in March 2024 as Bitcoin recorded a new ATH.

However, the subsequent month has seen search interest dip slightly lower, potentially reflecting sentiment resulting from the stagnant price action witnessed in recent weeks.

On the Flipside

- BTC whales are defined as holding 1,000 or more BTC, while a super whale holds 10,000+ BTC.

- The Glassnode data excluded the category 100 – 10,000 BTC.

- Despite the recent price dip, long-term Bitcoin adoption and usage metrics remain strong.

Why This Matters

Bitcoin’s changing ownership landscape signals a fairer distribution among holders. However, whales reducing their BTC exposure during a period of price uncertainty may signal a predicted short-term price decline by large account holders.

Sponsored

Prolonged price uncertainty triggers concerns the bull run is over.

Crypto Bull Run Over? BTC Weekly Close Stirs Concern

Bitcoin ETF mania takes hold as HK debuts and Australia considers applications.

Bitcoin ETFs’ Global March: HK Debuts & Australia Sets Target