- After facing regulatory hurdles, Cardano’s ADA experienced a sharp decline.

- Despite dismissing accusations and releasing new protocols, the token has struggled to recover.

- Weeks after the allegations, ADA finally had a green day and surged 8%.

Cardano’s ADA token has faced unwarranted regulatory pressure from the SEC. Despite its parent companies and founder refuting allegations against the token, ADA struggled to find footing due to the rising sell pressure, shedding more than one-third of its price in two weeks.

However, with leading TradFi institutions like Blackrock and Fidelity showing interest in the crypto industry, the market is on track for a seismic shift, countering the chaos from the SEC’s attack.

TradFi’s newfound interest has ignited a wave of optimism within the market, hoping for a summer bull run. As a result, top projects, including Bitcoin, Ethereum, and Cardano, have registered significant gains.

Overnight Success

Investment giant BlackRock’s US Bitcoin ETF filing has flipped market sentiment and fueled a market rally. With crypto experts suggesting the filing could lead to large inflows for Bitcoin and other tokens, the market saw an overnight rally, rising by 5% over the past 24 hours.

Sponsored

Leading tokens like Bitcoin, Cardano’s ADA, and Ether (ETH) surged as much as 7% to post some of the largest single-day gains this month, according to CoinMarketCap data.

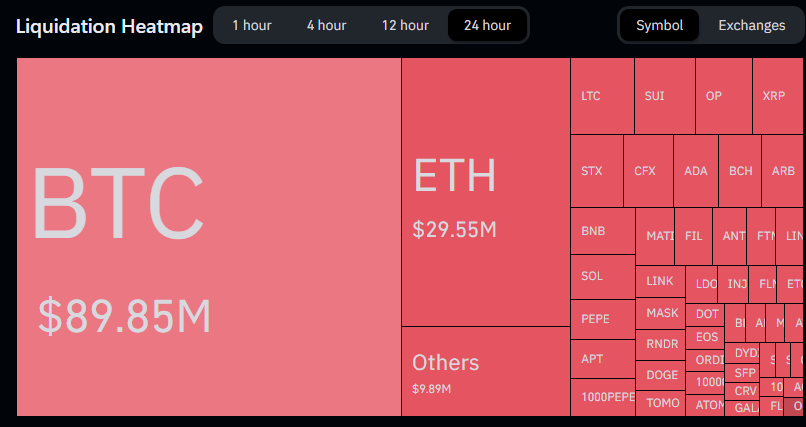

Cardano’s ADA registered an 8% price gain, rallying from $0.24 to $0.28. At press time, ADA stood at $0.2785. What’s more is that according to Coinglass, the overnight surge caused $147 million in short liquidations across crypto-tracked futures, of which over $1.47 million were attributed to ADA shorts.

Over $1 million in ADA short liquidations took place on Binance.

Sponsored

Despite the positive price action, ADA is still 26% down from its June peak of $0.381 and has yet to recover from the SEC’s attack. However, despite its regulatory challenges, with a bull run looming on the horizon and its DeFI TVL making a new all-time high in ADA, Cardano whales are waking up from their slumber.

Whales Ready For a Swim

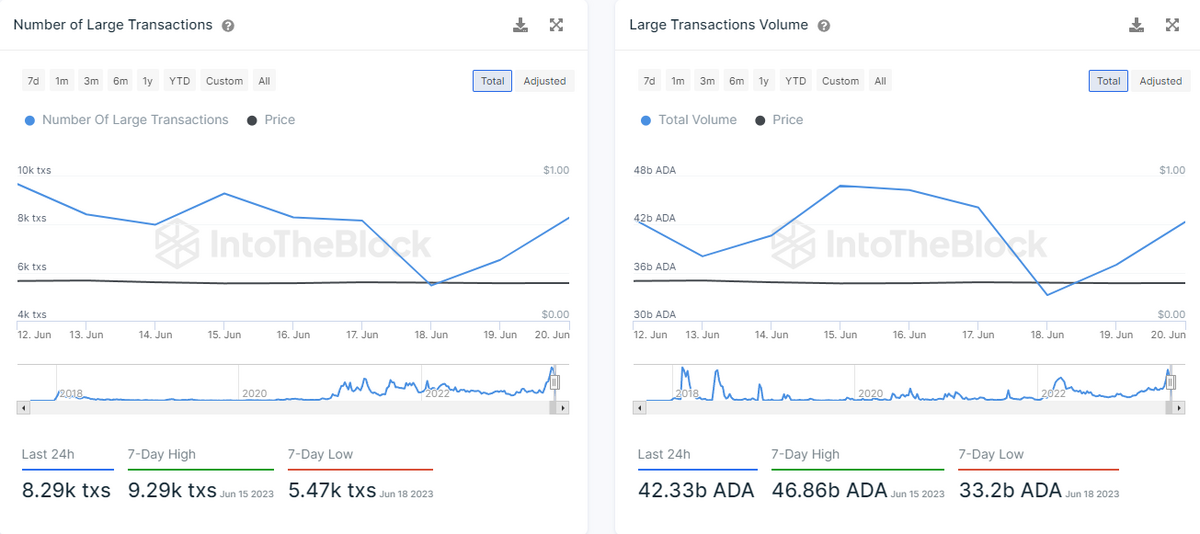

According to IntoTheBlock data, Whale interest in Cardano has been burgeoning lately. While large transactions worth over $100,000 have declined since the SEC’s accusations, it seems trends are about to change.

On June 19, over 6,500 large transactions took place on Cardano. The number has since increased to over 8299 on June 20, registering a large transaction volume spike from 36.98 billion ADA to 42 billion ADA or approximately $11.6 billion.

Nevertheless, it’s important to note that this pressure doesn’t have much impact now; however, it could entice other whales to follow suit. With more whales making large transactions, significant price movements could follow.

At press time, Cardano showcased mostly neutral signals. On-chain signals suggested a bearish trend, whereas exchanges and derivatives exhibited bullish trends.

On the Flipside

- According to IntotheBlock data, Whales moved as high as $35 billion on May 30, the highest in 2023.

- Cardano recently made a new DeFI TVL all-time high of 507 million ADA, a 250% increase since the start of the year.

- Cardano Founder Charles Hoskinson shared that Cardano will operate as he envisioned in Summer 2023.

Why This Matters

Cardano’s ADA token suffered at the hands of unprecedented market manipulation by the SEC. Positive news and trend reversals fueled by institutional giants’ interest in the crypto market could help the token recover its losses.

Follow up on what Charles Hoskinson is doing:

Cardano’s Charles Hoskinson Hunts Aliens, Draws Bemusement

Read more about Cardano’s new update: