The SEC is suing Ripple, its CEO Brad Garlinghouse and its founder Christian Larsen for the allegedly illegal sale of 14.6 billion units of XRP, Ripple’s native currency, for a cash value of 1.3 billion USD.

Why does the SEC consider the sale of XRP illegal? The SEC argues that XRP tokens are akin to securities (i.e., similar to shares in a company), and if a company raises money by selling its shares in the US, those shares must be registered with the regulatory body. So the SEC is arguing that because Ripple raised capital by selling XRP without registering those tokens, Ripple broke the law.

The Accusation

The following is an excerpt from its complaint, in which the SEC describes Ripple’s alleged violations:

By engaging in the conduct set forth in this Complaint, Defendants engaged in and are currently engaging in the unlawful offer and sale of securities in violation of Sections 5(a) and 5(c) of the Securities Act... and Larsen and Garlinghouse also aided and abetted Ripple’s violations of those provisions. Unless Defendants are permanently restrained and enjoined, they will continue to engage in the acts, practices, and courses of business set forth in this Complaint and in acts, practices, and courses of business of similar type and object.

In plain terms, the SEC’s rules (and US securities law) require that any person or company raising money from investors by selling assets (usually stocks) has to register those assets with the SEC. Registration comes with a detailed description of the asset on offer, information the SEC argues investors need about an asset before parting with their cash to acquire it. With a company offering shares, the SEC requires detailed financial data or a description of a new venture’s business plan and revenue model so investors can better evaluate whether the $100 they pay for an asset today will grow in value in the future.

The Key to the Case

The key to the case is whether or not XRP tokens should be considered securities. In its complaint, the SEC argued that it warned Ripple in 2012 that XRP tokens very likely did constitute securities and should therefore be registered. According to the court filing, “Ripple and Larsen ignored this advice and instead elected to assume the risk of initiating a large-scale distribution of XRP without registration.”

The heart of this case will hinge on whether or not the SEC can convince US courts to back its position that XRP is a security. The outcome of this matter (and the appeals that will be filed no matter the court’s decision), will have implications for the entire crypto space.

How the SEC Defines a Security

The SEC’s position is that XRP tokens fall into a specific class of security and lays out its argument in the complaint:

The definition of a ‘security’ under the Securities Act includes a wide range of investment vehicles, including “investment contracts.” Investment contracts are instruments...through which a person invests money in a common enterprise and reasonably expects profits or returns derived from the entrepreneurial or managerial efforts of others... ... As the United States Supreme Court noted in SEC v. W.J. Howey Co., Congress defined ‘security’ broadly to embody a ‘flexible rather than a static principle, one that is capable of adaptation to meet the countless and variable schemes devised by those who seek the use of the money of others on the promise of profits.

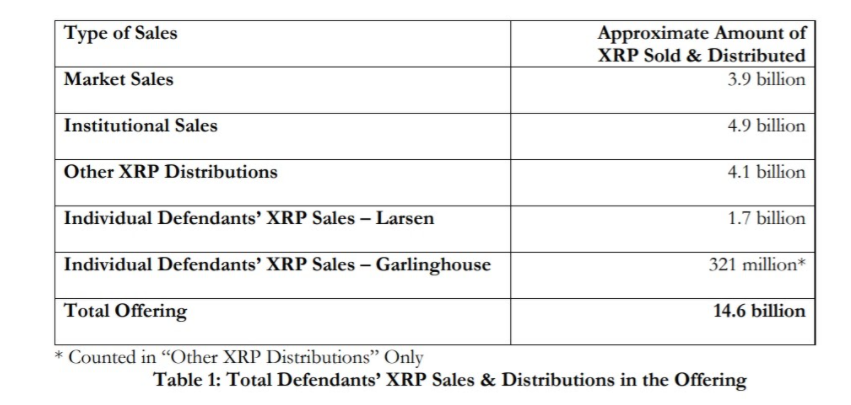

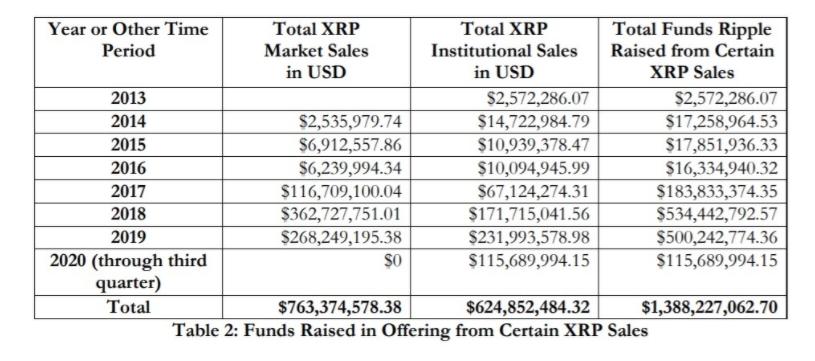

The regulator argues Ripple, Larsen and Garlinghouse have been illegally selling XRP for more than eight years and included the following table of sales totals in its complaint.

According to the complaint, the sale of XRP enabled the company to fund its operations and enriched Larsen and Garlinghouse as they attempted to find a use case for the XRP tokens.

In analyzing defendants’ conduct regarding the offer, sale and distribution of XRP, the SECconcludes that the vast majority of XRP purchasers acquired the digital asset as an investment. The SEC argues that anyone who bought XRP did so because they believed they could profit by selling at a higher price in the future (as opposed to buying XRP to use it as a currency).

What Does the SEC Want?

As for how to “fix” what the SEC sees as illegal behavior, it is asking the court to.

- permanently stop defendants (Ripple, Larsen and Garlinghouse) from selling XRP or any other non-registered assets;

- order defendants to surrender all profits they made from selling XRP;

prohibit Defendants from participating in any offering of digital asset securities; - impose additional monetary penalties on defendants.

What Is Ripple’s Defense?

One of the main arguments in Ripple’s defense is that XRP has a variety of functions that differ from the concept of a “security” as the law understands it. XRP functions as a virtual currency, a medium of exchange to facilitate transactions locally and internationally.

Moreover, the company notes that nowhere in the world has XRP been considered a “security,” citing interpretations by regulators in the UK, Singapore and Japan, where it has been defined as a virtual currency outside the scope of securities regulation.

...Securities regulators in the United Kingdom, Japan, and Singapore have likewise concluded that XRP is a virtual currency not subject to securities regulation. As the U.K. Treasury recently explained, ‘widely known cryptoassets such as Bitcoin, Ether and XRP’ are not securities, but ‘[e]xchange tokens'’ that ‘are primarily used as a means of exchange.

Who’s Right?

It is clear that when applying a restrictive interpretation of “security,” some elements of the definition are missing in XRP’s case. However, new technologies and investment methods regularly require judges to interpret rules that never foresaw these innovations.

For now, US courts are being asked to apply existing law to new technological and economic realities. It remains to be seen whether the SEC can convince the courts that the supply, sale and distribution of XRP constitute investments that require regulation.

While we cannot anticipate what US judged will decide, it is clear this case will set a precedent, the mark of a before and after period in the framework of cryptocurrency regulation in the United States.