Understatement of the year: The SEC and the crypto space have a turbulent history. Shaping the landscape and dictating the rules of the game, the U.S. Securities and Exchange Commission (SEC) has drawn the ire and spite of the blockchain industry. This is particularly true for SEC Chair Gary Gensler, who has become crypto’s public enemy number one.

As the watchdog of America’s TradFi markets, the SEC’s actions reverberate across the globe, impacting traditional finance and our burgeoning realm of crypto assets and digital currencies.

But last time I checked, the United States is not the center of the earth. Why does the behavior of one country’s regulatory body impact the entire industry? How has the SEC influenced the trajectory of this digital revolution?

Sponsored

Most importantly, what does this mean for the future of cryptocurrencies?

In this article, we’ll look into the complex relationship between the SEC and crypto, exploring this crucial dynamic’s history and implications.

Table of Contents

What Is The U.S. Securities and Exchange Commission?

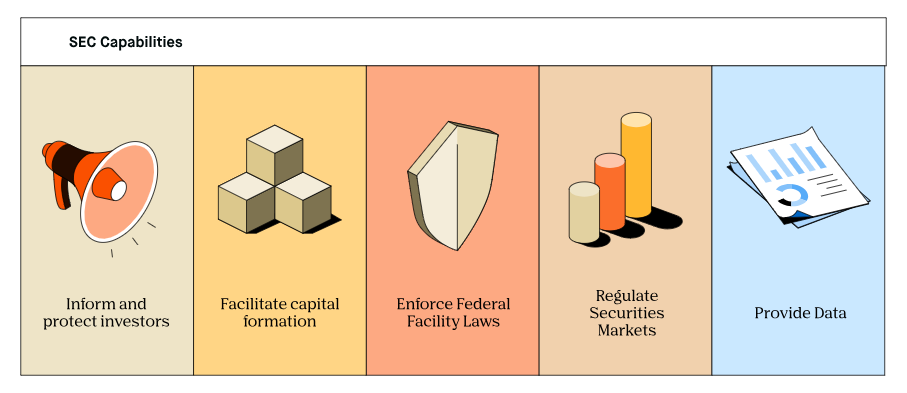

The U.S. Securities and Exchange Commission (SEC) is a federal agency that holds the reins of traditional markets in the US. Pulled together amongst the ashes of the Great Depression in 1934, the SEC aims to protect investors and maintain fair, orderly, and efficient markets.

Sponsored

The SEC enforces federal securities laws, regulates the securities industry, and the nation’s stock and options exchanges. Led by Gary Gensler, the SEC ensures that public companies adhere to transparent practices, giving investors accurate and consistent information to (hopefully) make informed investment decisions.

But that’s not all. Following the growth of the crypto market in recent years, the SEC has started poking its nose into the world of digital assets. The SEC’s role has since expanded to include the regulation of Initial Coin Offerings (ICOs) and certain types of cryptocurrencies it deems as securities.

The recent crypto crackdowns and investigations by the SEC have become a subject of intense debate and scrutiny, shaping the future of the crypto industry in significant ways.

Why Is The SEC So Important to The Future of Cryptocurrency?

Based out of Washington DC, the SEC’s role in the future of cryptocurrency cannot be overstated. As the gatekeeper of the U.S. financial markets, the SEC’s decisions and regulations have a profound impact on the trajectory of the crypto industry.

The SEC’s classification of certain coins as crypto asset securities can influence their legal status, trading practices, and overall market perception. This classification can affect everything from investor protections to the tax implications of crypto transactions.

Moreover, the SEC’s stance on Initial Coin Offerings (ICOs) and other fundraising methods used by crypto companies shapes how these startups raise capital. The SEC’s regulations are intended to deter fraudulent practices, protect investors, and ensure a level playing field in the crypto market.

On top of that, the SEC’s potential approval of cryptocurrency-based Exchange-Traded Funds (ETFs) and other investment vehicles can open the floodgates for institutional investors, bringing a new level of liquidity and stability to the crypto market.

Now that all sounds good on paper, but the SEC’s involvement in the crypto space is not without controversy. Critics argue that excessive regulation will suffocate innovation and restrict the growth potential of blockchain technology.

As I mentioned earlier, the United States is just one nation. Why do their rulings and jurisdictions have such an impact on a global market? Unfortunately, this is a tale as old as time. In much the same way that Wall Street is the center of traditional financial markets, crypto regulation in the US sets an example that other countries around the world will likely follow.

SEC and Crypto: A Timeline of Key Events

The relationship between the SEC and the crypto industry has been tense, to say the least. Marked by a series of significant events, each SEC charge or lawsuit has shaped the course of the digital asset landscape. Let’s take a walk down memory lane and revisit some of these pivotal moments.

- December 2020 – The SEC initiated an iconic lawsuit against Ripple (XRP), accusing it of conducting an unregistered $1.3 billion securities offering. This marked a turning point in the SEC’s view of cryptocurrencies, signaling a more aggressive stance.

- August 2021 – The SEC charged crypto exchange Poloniex for operating an unregistered digital exchange. The trading platform agreed to pay a $10 million settlement, setting an ongoing standard for future enforcement actions.

- February 2022 – Following SEC charges, now-defunct crypto lending platform BlockFi agreed to pay $100 million for offering an unregistered lending product.

- November 2022 – Sam Bankman-Fried’s crypto exchange, FTX, collapses after losing $8B worth of customer funds. Ironically, for an entity meant to protect people, the SEC was nowhere to be seen.

- February 2023 – Keen to keep making friends in the crypto space, the SEC ordered Kraken to discontinue its US-based staking service, alleging that it offered unregistered securities to retail investors.

- June 2023 – The SEC sues Coinbase, a leading cryptocurrency exchange, for operating as an unregistered national securities exchange, broker, and clearing agency. Given that Coinbase has a reputation as being the compliant ‘good guys’ of the space, this suit is a major escalation in the SEC’s enforcement actions against crypto platforms.

- June 2023 – SEC summer continues. In a landmark case, Gary Gensler’s SEC launched a lawsuit against Changpeng Zhao and Binance, the world’s largest crypto exchange. The SEC lawsuit charged Binance with operating as an unregistered national securities exchange and broker. The lawsuit also extended to Binance’s staking-as-a-service program, which the SEC alleged was an unregistered securities offering.

As you can see, the last year has marked a significant change in sentiment between the SEC and the crypto industry. Many of these events are still unfolding and reshaping the future direction of the crypto market.

SEC and Bitcoin

Bitcoin, the pioneer of the cryptocurrency world, has had its own unique journey with the SEC. As the first and most prominent digital asset, Bitcoin has often been the center of the SEC’s attention.

Fortunately for MicroStrategy and all the other Bitcoin Maxis, the SEC does not classify Bitcoin (BTC) as a security, primarily because it was not issued in an Initial Coin Offering (ICO) or any other type of fundraising event.

Instead, Bitcoin was mined, and its value is not tied to the efforts of a particular entity or group, which gives it a pass under the Howey Test ruling. This classification, or lack thereof, has allowed Bitcoin to operate in a different regulatory space than other cryptocurrencies.

Before getting too excited, remember that this does not mean Bitcoin is entirely free from the SEC’s oversight. The SEC has been actively regulating Bitcoin-related investment products, such as Bitcoin Exchange-Traded Funds (ETFs).

SEC and Crypto: Which Coins Are Unregistered Securities?

In its ongoing mission to regulate and crush the cryptocurrency market, the SEC has identified several coins that it considers to be unregistered securities. This classification is based on the Howey Test, a legal standard used to determine whether a transaction qualifies as an “investment contract” or security.

In June 2023, the SEC identified 19 tokens as unregistered securities in lawsuits against crypto exchanges Binance and Coinbase. These altcoins have suffered since the press release, which caused a sharp selloff and led to a significant slump in their combined market value.

In case you missed it, these are the coins classified as securities by the SEC:

Solana (SOL), Cardano (ADA), Polygon (MATIC), Cosmos (ATOM), Binance Coin (BNB), Binance USD (BUSD), The Sandbox (SAND), Decentraland (MANA), Algorand (ALGO), Chiliz (CHZ), Near (NEAR), Flow (FLOW), Internet Computer (ICP), Voyager Token (VGX), Dash (DASH), Nexo (NEXO), COTI (COTI), Filecoin (FIL) and Axie Infinity (AXS).

The big question that remains to be answered is whether or not Ethereum (ETH) will eventually be labeled as a security.

While it might cause some alarm bells for crypto investors, it’s important to remember that the SEC’s classification of a crypto asset as a security does not necessarily mean the coin is illegal or fraudulent. It just means that the coin must comply with securities laws, including registration requirements and disclosure obligations.

Pros and Cons of the SEC’s Crypto Involvement

The SEC’s involvement in the crypto industry has been a polarizing debate, with experts weighing in both support and criticism. What are the pros and cons of the SEC’s crypto involvement?

Pros

- Investor Protection – In a perfect world, the SEC helps prevent fraudulent practices, protect investors from scams, and ensure that crypto market participants can access accurate and reliable information.

- Crypto Market Stability – By enforcing compliance with securities laws, the SEC can deter manipulative trading practices and maintain fair and orderly markets.

- Confidence and Institutional Adoption – The SEC’s approval of crypto-related investment products, such as ETFs, can pave the way for increased institutional adoption of cryptocurrencies.

Cons

- Innovation Stifling – The crypto industry is rapidly evolving, and the SEC has been criticized for forcing emerging crypto startups off US shores.

- Regulatory Uncertainty – Applying traditional securities laws to cryptocurrencies is a complex issue, and the SEC’s behavior breeds uncertainty in the market.

- Global Discrepancies – Crypto is a global market. The SEC’s regulations only apply in the U.S., creating discrepancies and challenges in how crypto is regulated worldwide.

On the Flipside

- Never forget the SEC’s rulings only apply in the United States. Other countries all over the planet are leading the way with far more flexible and clear regulations that support growth and innovation within the industry.

Why This Matters

In the same way traditional markets in the U.S. influence global financial conditions and the USD is the world’s dominant trading currency, the actions of the SEC may influence how cryptocurrency is viewed and regulated around the world.

FAQs

The crypto market has overcome countless catastrophes in its lifespan, from complete bans in China to the insolvency of FTX. It is unlikely that an SEC lawsuit spells the end of the crypto industry.

The SEC is going after Binance because they claim that Changpeng Zhao’s company operates as an unlicensed and unregistered securities exchange.

The SEC sees the cryptocurrency market as a threat to investor safety due to the litany, scams, and insolvent exchanges operating in the space.