Forks in Crypto are a perfect example of decentralization in action. The beauty of open-source, decentralized blockchain protocols is that anyone can suggest new rules and functionalities that improve the network.

Despite blockchain forks having existed for years, there’s still plenty of confusion around what they are and how they work. Key milestones like Cardano’s (ADA) Vasil upgrade or Ethereum’s (ETH) Merge are much more than catchy names, they’re hard forks that improve the chain with new features.

Why do cryptocurrency forks happen and what do they mean for a blockchain network? What are the different kinds of blockchain forks and are they always for the best of the ecosystem?

What is a Fork in Cryptocurrency?

As we all know, a blockchain network is a chain of data interconnected by units called blocks. When new blocks are created, they reference the data and events of previous blocks, which is why we can trace every transaction on the Bitcoin network right back to its genesis.

Sponsored

When a blockchain fork occurs, it creates a permanent divergence from the network’s latest version. Like branches on a tree, a blockchain split causes a new version of the network to run, often with new features and new rules, like a change in block size.

This process is called forking and essentially creates a new blockchain without changing the old version of the blockchain. In most cases, the new chain benefits from software upgrades voted in by community members.

Why Do Forks Happen?

Forks in crypto help blockchain networks improve. For example, the Alonzo hard fork introduced smart contracts to the Cardano blockchain. Ethereum’s iconic hard fork, ‘The Merge,’ transitioned the network to a Proof-of-Stake algorithm, making it more scalable and energy efficient.

Sponsored

Of course, not all forks stand the test of time and fulfill their vision of becoming new and improved versions of old chains. Bitcoin forks, despite being cheaper and more efficient networks, were never able to usurp Satoshi Nakamoto’s original and become the world’s largest cryptocurrency.

Just like in your kitchen drawer, not all blockchain forks are created equal. Let’s take a look at what types of forks exist and how they’re different.

The Different Types of Blockchain Forks

There are two primary kinds of forks in the crypto world. In most cases, blockchain forks are recognized as either hard forks or soft forks. Both varieties serve the same purpose but have slight differences.

An easy way to understand the difference between hard forks and soft forks is to imagine upgrading your computer. In this example, a soft fork is like installing new software like an updated operating system. On the other hand, a hard fork is like replacing your computer entirely.

Hard Forks

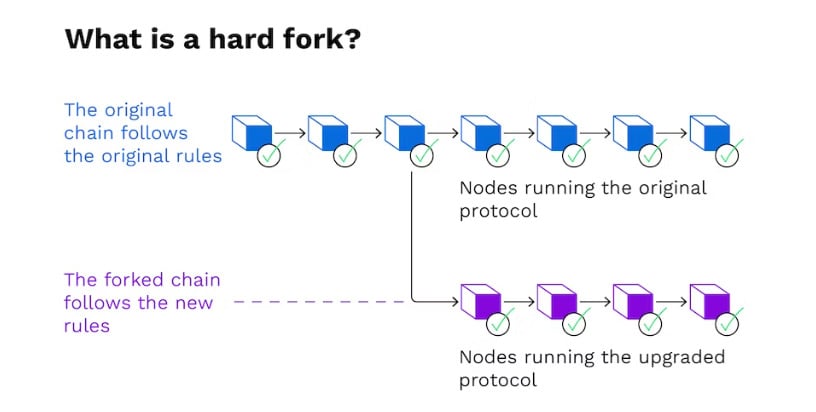

In a hard fork, a significant upgrade means that the network effectively splits into two separate chains. Changes to the blockchain protocol are not backward-compatible, meaning that the new chain will not recognize the old chain. Node operators need to upgrade their software, or else the network won’t recognize their new blocks.

When this happens, node operators and community members need to make an important decision. Will they continue to use the updated software protocols of the new chain? Or would they rather stick to the old rules and the previous version of the software?

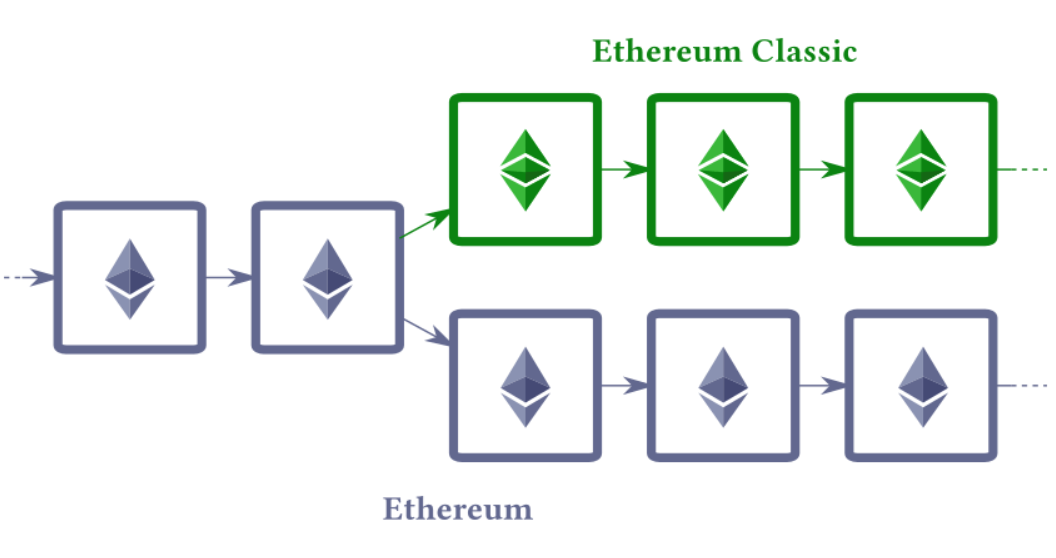

If there is enough community support for the old chain and the old rules, the pre-fork chain may continue to exist. This is why we still have networks like Ethereum Classic.

If a hard fork creates a new chain that means it also creates a new coin. Because a fork is a split of an existing chain, you can usually expect to have new cryptocurrency tokens. For example, if you held 1 Ether during The Merge, you would also have 1 Ether on the Ethereum PoW chain that still exists alongside the new Ethereum PoS chain.

Soft Forks

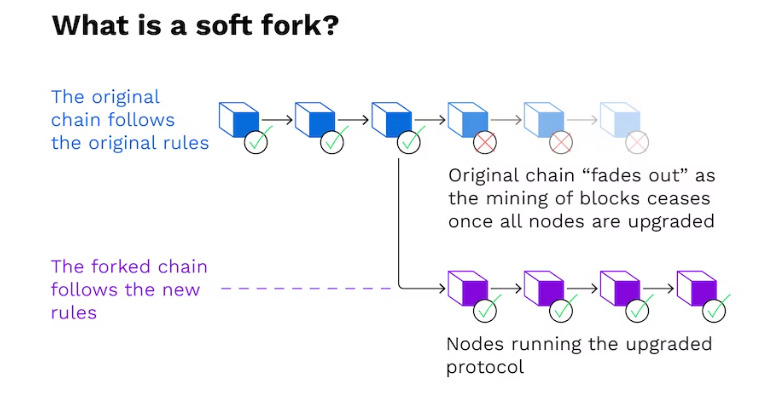

A soft fork occurs when changes occur to the network, but nodes and miners aren’t required to upgrade themselves to continue participating in the blockchain. These nodes can still create new blocks under the new rules.

In blockchain technology, a soft fork is like a light software update. Any new blocks still recognize the existing network and node operators, so it doesn’t force a blockchain split and result in a new blockchain.

DeFi Application Forks

If you have any experience in the wild world of decentralized finance, you’ve probably heard the word ‘fork’ mentioned in a slightly different way. DeFi application forks are essentially copies of existing platforms and smart contracts that might feature slight alterations.

To give you an example, think of the UniSwap decentralized exchange. The project is completely open source, so anyone can dive into the application’s source code to see how it works. As more blockchain networks, like BNB Chain and Polygon, emerged, these networks needed their own DEXes for users to trade tokens on.

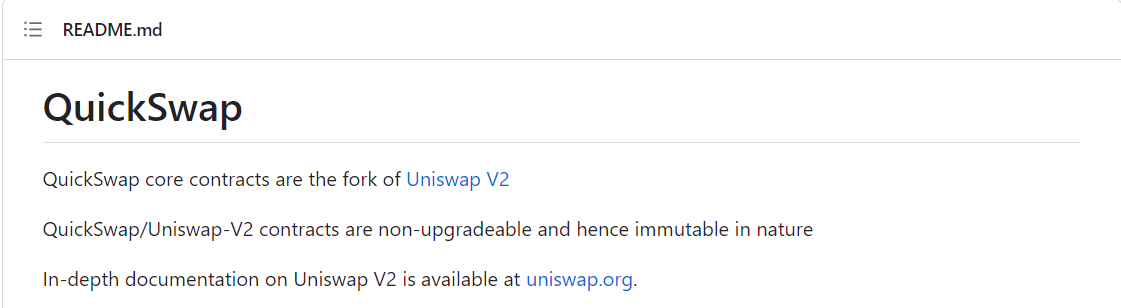

Instead of building new apps and code from scratch, it’s much easier to simply copy, or ‘fork’ an existing platform that works well. If you check the source code for QuickSwap, the leading DEX on Polygon, you’ll see that all its basic code and functionality are directly copied from UniSwap’s code.

Forking dApps is a common practice in the DeFi world. A comprehensive list of crypto projects created from forks is available on DefiLlama.

Historic Blockchain Forks

Crypto history is full of crucial forks that have helped blockchain protocols address dangerous security issues and improve the most popular networks. Some of these hard forks have resulted in new coins that have held their position in the Top 100 cryptos by market cap for years on end.

Even Dogecoin (DOGE), the most famous meme coin in the crypto market, was born from a fork of other networks. The Dogecoin blockchain was forked from LuckyCoin, which was in turn a Litecoin fork.

Bitcoin (BTC) Forks

The Bitcoin blockchain is the oldest and best-known cryptocurrency network in the world. Naturally, many developers have tried to fork Bitcoin and create new and improved networks.

Bitcoin Cash

In August 2017, Bitcoin Cash (BCH) made history by becoming the first-ever fork of the Bitcoin blockchain. Like the original Bitcoin, BCH has a maximum supply of 21,000,000 coins.

Bitcoin Cash features a larger block size, meaning that the network can process more transactions per second than the original Bitcoin network. It’s also cheaper to use, with lower transaction fees.

This Bitcoin fork is also called the SegWit upgrade, named after the initial proposal that eventually resulted in the Bitcoin Cash hard fork.

Bitcoin Gold

Another fork of the world’s first cryptocurrency, Bitcoin Gold aims to provide a more scalable alternative to Bitcoin as a payment network. Bitcoin Gold’s vision was to make Bitcoin mining accessible to everyone. The forked network used common GPUs to mine new coins, instead of Bitcoin’s competitive and intensive ASIC mining rigs.

Ultimately, Bitcoin Gold was more of a passion project than a genuine competitor. Its community appears to have abandoned the network. There have been no updates to the Bitcoin Gold site since 2021.

Ethereum Forks

The Ethereum blockchain has certainly witnessed a messy history, but you don’t become the future of finance without overcoming some challenges along the way. Fortunately, the Ethereum community is resilient, as proven through several significant hard forks throughout the network’s lifespan.

Ethereum Classic

The story of Ethereum Classic is an essential part of crypto history. It involves a historic hack worth hundreds of millions and a ‘gross misuse’ of blockchain technology from Vitalik Buterin and the Ethereum community.

The DAO was an investment group created in the early days of the Ethereum blockchain. In 2016, the DAO successfully raised over 150 million dollars worth of ETH, with the intention of becoming a venture capitalist firm in the emerging DeFi space.

When hackers found a smart contract exploit in the DAO’s wallet, they were able to siphon over $60 million in Ether, giving the hackers an enormous stake in the network and raising concern over whether the network was truly usable. At the time, the DAO held over 14% of all circulating ETH.

After much negotiating between Vitalik Buterin, the Ethereum community, and the hackers themselves, it was eventually decided that a network hard fork could kickstart a new network from before the hack occurred, returning funds to investors and rewriting Ethereum’s history.

This was an extremely controversial decision. It went against all the principles of blockchain technology, such as decentralization and immutable transactions. The Ethereum community was split in two; those who agreed with the hard fork proposal and those who did not.

The Ethereum blockchain we know and love today is the new chain created from this historic hard fork. The old chain, whose community did not accept the display of power and control, is now called Ethereum Classic.

Ethereum POW (Proof-of-Work)

In late 2022, the Ethereum blockchain finally completed its long-awaited migration to a Proof-of-Stake consensus mechanism. This new chain was the result of years of work and reduces Ethereum’s annual energy consumption by as much as 99%.

Ethereum miners who were against The Merge hard-forked the old chain and created Proof-of-Work Ethereum. The Ethereum PoW functions just like the normal Ethereum blockchain did pre-merge. However, the new coin, ETHPOW has little demand and the network doesn’t see much user traffic.

On the Flipside

- Forks in crypto are essential processes that improve blockchain networks and help drive progress in the industry. However, they do pose security risks if poorly executed.

Why You Should Care

Hard fork events like The Merge, the Alonzo upgrade and the Shanghai update are crucial moments in blockchain evolution. Being informed about the processes involved can help you prepare for potential outcomes and help you better understand blockchain technology.

FAQs

There are plenty of Bitcoin forks in the cryptocurrency industry. Some of the most well-known forks of Bitcoin include Bitcoin Cash, Bitcoin SV, and Bitcoin Gold.

Nothing happens to your Ethereum during a hard fork, it will stay in the crypto wallet or exchange that you use to store your ETH. You’ll also receive a new cryptocurrency on the new chain created by the hard fork like we saw when the Ethereum Proof-of-Work chain was created.

Whether a hard fork is good or bad depends on your point of view. For example, most people consider The Merge to be a good hard fork because it reduces Ethereum’s energy consumption. However, Ethereum miners might consider it bad, because they will lose a source of revenue.

The effect of forks on crypto prices is unpredictable. In theory, a hard fork generally means a blockchain is being upgraded, which could be considered a bullish catalyst. However, hard forks are often treated as ‘sell-the-news’ events. It’s up to each individual to decide how they think the crypto price will react to a fork event.

Forks in crypto are a way of implementing new rules or features into an existing blockchain network.