- Crypto investment funds continued their run of net positive inflows last week.

- Bitcoin funds continued to dominate amid spot ETF anticipation.

- Recent inflows follow a spike in ETP trading volumes.

Crypto investment funds are enjoying a sustained period of growth and investor enthusiasm. Last week, these funds extended their streak of net inflows for an eighth week as investor sentiment remained firmly positive.

Crypto Funds Add $176M to Hit 2-Month Streak

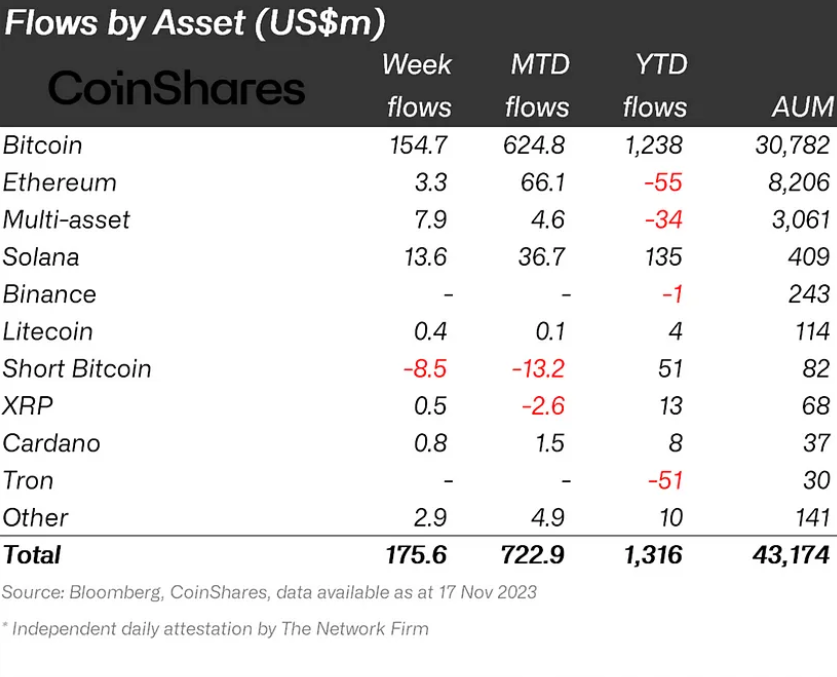

Last week, crypto exchange-traded products (ETPs) saw net inflows totaling $176 million, according to CoinShares’ most recent digital asset fund flows report published on Monday, November 20. As highlighted by CoinShares, last week’s inflows extended the current streak of inflows for an eighth consecutive week, bringing year-to-date (YTD) inflows to a net positive of $1.32 billion.

As is typically the case, Bitcoin funds saw the largest inflows during the week in review with $155 million. CoinShares attributed Bitcoin’s continued dominance to sustained optimism that the U.S. SEC will soon approve a spot Bitcoin ETF product. The asset manager suggested investors were trying to position themselves ahead of the price rally that could follow. Nonetheless, altcoins also witnessed significant inflows last week.

Funds related to Solana, Ethereum, and Avalanche recorded net inflows of $13.6 million, $3.3 million, and $1.8 million, respectively. Uniswap and Polygon funds also recorded minor inflows of $550k and $860k, respectively.

Sponsored

Recent inflows come as trading volumes on crypto ETPs surge, signaling a mounting expectation of more gains among traditional and institutional investors.

ETP Trading Volumes Double

CoinShares noted that ETP trading volumes now average $3 billion weekly, twice the average of $1.5 billion this year. At the same time, the ETP share of crypto trading volumes continues to beat historical averages.

Sponsored

CoinShares asserted that the ETP share of crypto trading volumes is averaging 11%, well ahead of the long-term historical average of 3.4%. The firm also noted that this metric surpasses levels seen in the 2020/2021 bull run.

On the Flipside

- YTD yearly inflows in 2023 remain far behind the $10.7 billion recorded in 2021 and the $6.7 billion recorded in 2020, according to CoinShares.

Why This Matters

Crypto fund flows provide insight into investor sentiment. Last week’s report suggests that investors remain optimistic about the nascent market and are actively increasing their exposure.

Read this to learn more about the recent streak of crypto inflows:

Crypto Inflows Top $1B in 2023 as Investors Anticipate Boom

See what experts are saying about a potential settlement between the DOJ and Binance:

$4B Binance DOJ Settlement Questioned by Legal Experts