- Crypto funds have recorded net outflows for the past two weeks.

- CoinShares has attributed recent outflows to U.S. macroeconomic concerns.

- Some crypto assets managed to buck the broader trend.

Interest in crypto investment funds is waning.

Over the past two weeks, global crypto funds have recorded net outflows, with analysts attributing last week’s flows to U.S. macroeconomic headwinds.

Hawkish Fed Outlook Triggers $206M Exodus From Crypto Funds

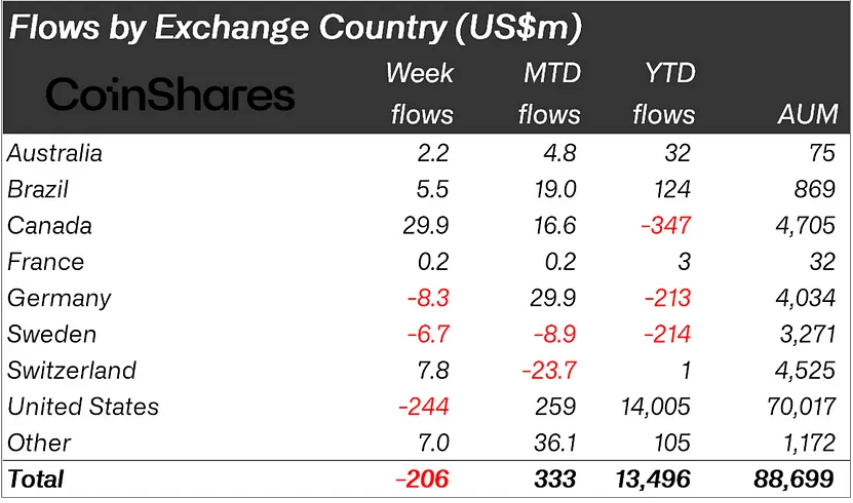

Last week, global crypto funds, including Grayscale’s spot Bitcoin ETF, Ark 21 Shares’ spot Bitcoin ETF, and ProShares futures Bitcoin ETF, recorded net outflows of $206 million, according to CoinShares’ most recent crypto fund flows report released on Monday, April 22.

Sponsored

Per the report, the majority of outflows came from U.S.-based funds, which saw outflows totaling $244 million, while regions like Canada and Switzerland-based funds saw inflows of $30 million and $8 million, respectively.

As explained by CoinShares Head of Research James Butterfill, the recent outflows are likely linked to “expectations that the FED is likely to keep interest rates at these high levels for longer than expected.”

Last week, Federal Reserve Chair Jerome Powell championed the idea of keeping interest rates higher for longer. The Fed regulates interest rates to regulate spending, which in turn helps regulate inflation, which is the result of excess money chasing few goods.

Sponsored

The higher the interest rate, the less likely borrowing for investments and excessive spending are to take place. While this is good for bringing down inflation, it does not bode well for risk assets like crypto, which tend to fare better when people have excess money to gamble with.

Powell’s recent stance comes as the U.S. Consumer Price Index (CPI), a key inflation metric based on the periodic change in the prices of consumer goods, grew higher than expected both in February 2024 and March 2024.

Despite the Fed’s decided hawkishness and the overall net outflows from crypto funds, some assets fared better than others.

A Mixed Bag

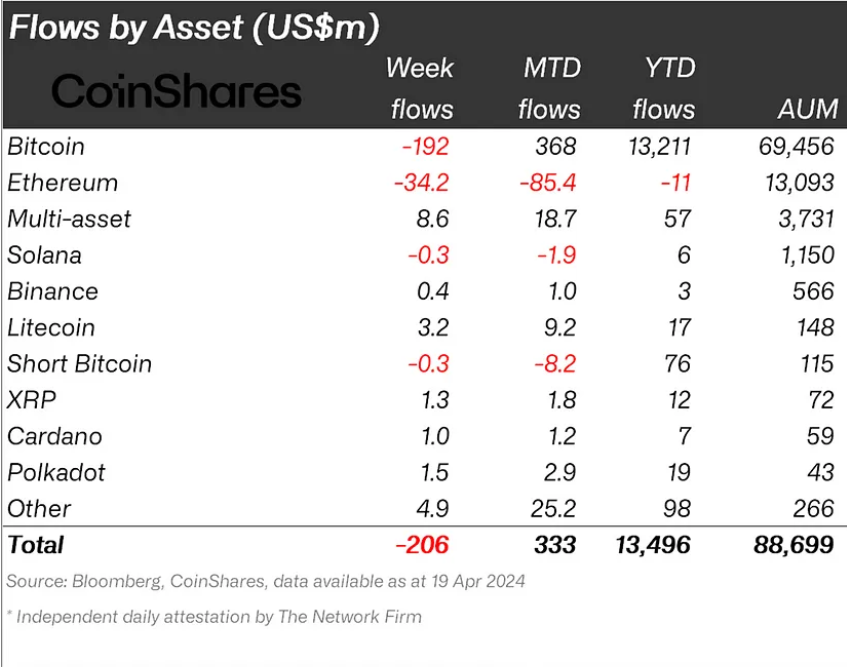

Per CoinShares’ most recent report, funds tied to Bitcoin were the primary focus of outflows with $192 million. Like Bitcoin, Ethereum funds also saw significant outflows of $34 million, marking a six-week streak. Meanwhile, Solana only saw minor outflows of $300,000.

Beyond Bitcoin, Ethereum, and Solana, most other altcoins recorded inflows with notable mentions including Litecoin and Chainlink with $3.2 million and $1.2 million, respectively.

On the Flipside

- Last week, short Bitcoin funds also recorded outflows of $300,000, suggesting that investor sentiment has also not fully turned bearish.

- Year-to-date (YTD) net flows to crypto funds remain at record levels at around $13 billion.

Why This Matters

Crypto fund flows can serve as an indicator of the crypto market sentiment. Last week’s outflows suggest that investors may prefer to stay on the sidelines while they weigh up the impact of delayed interest rate cuts.

Read this for more on recent crypto fund flows:

Crypto Funds Net Inflows Resume on Bitcoin’s $70,000 Rebound

Robert F. Kennedy Jr. plans to incorporate blockchain technology in U.S. governance if elected president. Find out more:

RFK Jr.: “I’m Gonna Put the Entire U.S. Budget on Blockchain”