- Crypto funds have recorded another week of net outflows.

- Recent outflows suggest a significant disinterest in these crypto funds.

- Bitcoin funds, as in previous weeks, suffered the most.

The recent decline in interest in crypto investment funds shows no signs of abating.

Sponsored

Before last week, these funds had recorded consecutive net outflows for two weeks. Last week, this trend continued for a third week.

Crypto Funds Bleed $435M

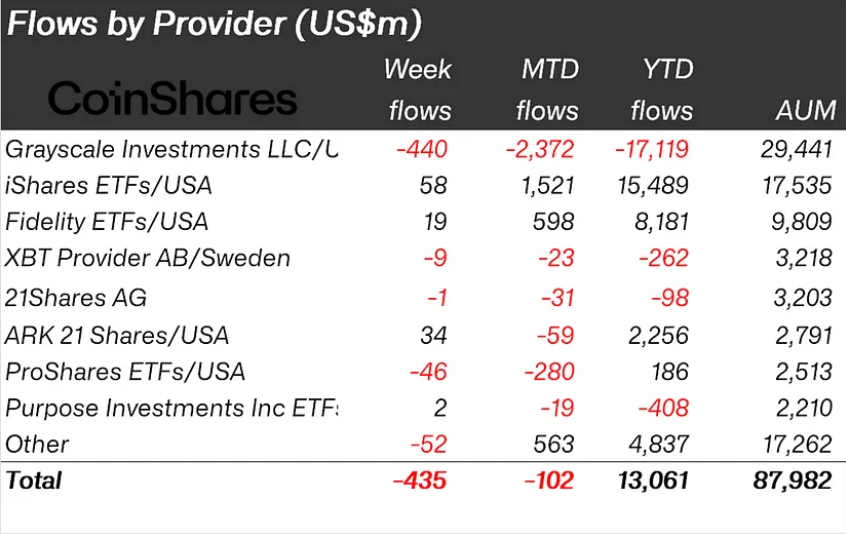

Last week, investors withdrew $435 million from crypto investment funds, according to CoinShares’ most recent crypto fund flows report published on Monday, April 29. The net outflow continues the current trend for a third week and marks the second largest outflow since the record $1 billion in a week in March 2024.

Last week’s net outflows came as spot Bitcoin ETFs, particularly in the U.S., failed to keep up with outflows from Grayscale’s converted ETF despite the latter hitting a nine-week low. The newly issued ETFs had only recorded inflows of about $126 million during the week, dwarfed by Grayscale’s $440 million outflows.

Beyond the U.S., Germany and Canada also recorded outflows of $16 million and $32 million, respectively.

With Grayscale leading outflows, Bitcoin-backed funds suffered the most, with investors withdrawing $423 million. Meanwhile, Ethereum-linked funds also saw $38 million in net outflows.

On the Flipside

- Beyond Bitcoin and Ethereum, several altcoins managed to buck the outflow trend. These altcoins include Solana, Litecoin, and Chainlink, each seeing inflows of $4 million, $3 million, and $2.8 million, respectively.

- Despite the recent outflow streak, year-to-date (YTD) flows to crypto funds remain at record levels at around $13.6 billion.

Why This Matters

Crypto fund flows in recent weeks suggest that investors are remaining broadly risk-off, likely due to U.S. macroeconomic concerns.

Sponsored

Read this for more on recent crypto fund flows:

Crypto Funds Hit 2-Week Outflow Streak on Hawkish Fed Fears

See how Vitalik Buterin takes crypto Twitter through a head-scratching puzzle-solving journey that leads to greater cryptographic proof efficiency:

Did Ethereum’s Vitalik Buterin Just Create a New Form of Math?