- The DOJ is reportedly open to settling criminal charges with Binance.

- Legal experts have questioned the options being considered for a potential settlement.

- Despite reservations from experts, the crypto community has shown significant excitement.

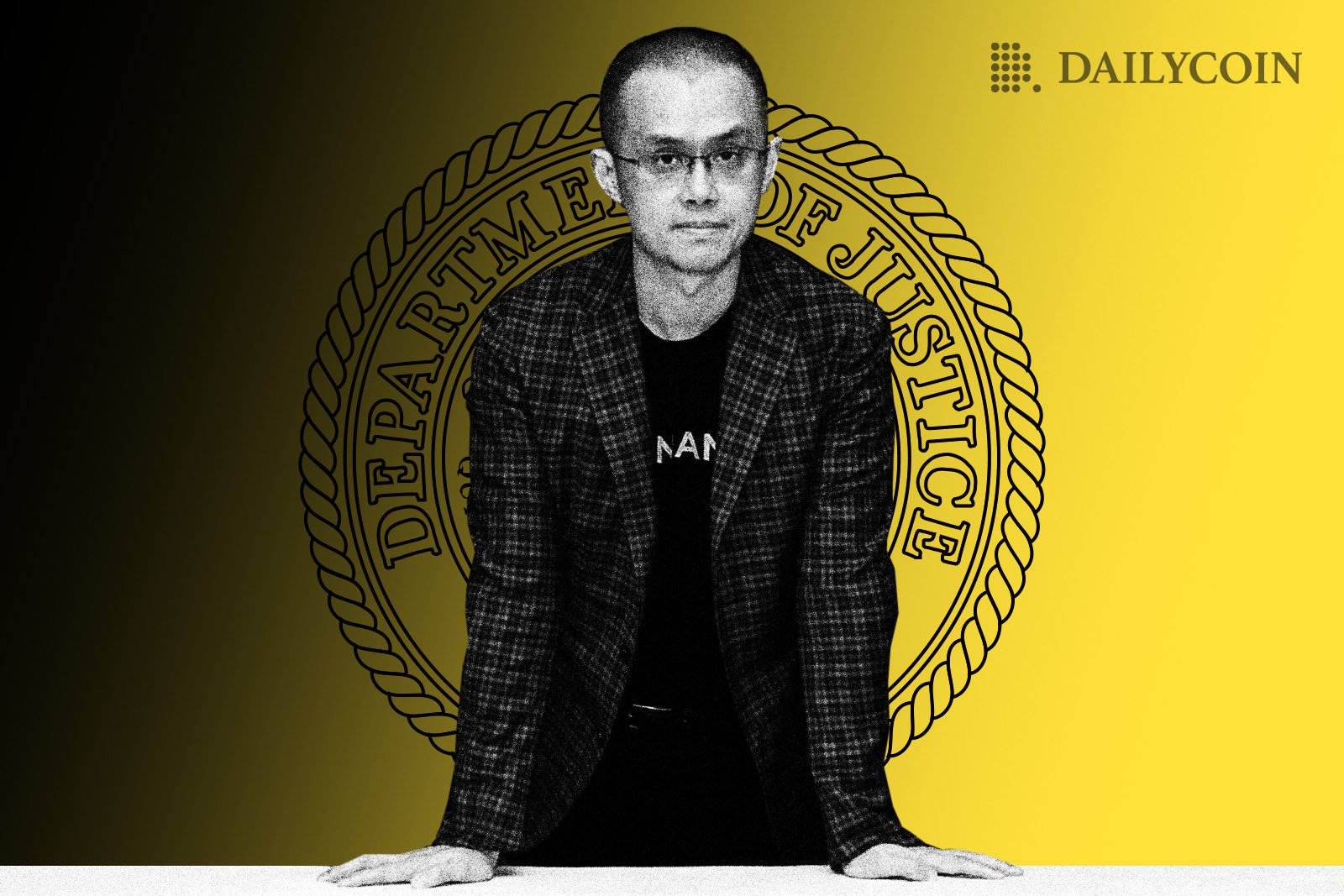

A lingering fear for many members of the crypto community has been what will happen if the U.S. Department of Justice (DOJ) followed up its multi-year investigation of Binance, the world’s largest crypto exchange, with criminal charges.

While a recent Bloomberg report suggests that this fear may never materialize, legal experts have raised eyebrows at the potential options of the settlement deal.

Experts Question Practicality of $4B Deal

On Monday, November 20, Bloomberg reported that the U.S. DOJ was considering a $4 billion deal to settle criminal charges against Binance, citing persons familiar with the matter. According to the report, prosecutors intend to reach an agreement by the end of November 2023 that will allow the exchange to continue operations and prevent collateral damage to customers and the crypto market.

Sponsored

The discussed options include a full settlement with the condition that Binance founder Changpeng “CZ” Zhao face criminal charges. Alternatively, Binance and the DOJ may also reach a deferred prosecution agreement (DPA). The DPA would see the DOJ file charges but not prosecute them on the condition that Binance pays the $4 billion fee, admits wrongdoing, and meets certain requirements.

The proposed options have triggered questions among legal experts. Prominent crypto community member and lawyer, Carlos D’Angelo suggested that it would be “odd” for Zhao to want to pay the enormous sum of money and still face criminal charges.

Former SEC enforcement official and Duke University School of Law senior lecturer John Reed Stark contended that Binance was unlikely to abide by a DPA. Stark highlighted that as part of a DPA, the firm would face round-the-clock monitoring and admit to crimes that could complicate legal troubles in other jurisdictions.

Sponsored

Despite the doubts over the practicality of the proposed settlement options, the crypto community has taken the news of a potential settlement between Binance and the DOJ in stride.

Potential Binance DOJ Deal Sparks Bullish Excitement

Galaxy CEO Mike Novogratz asserted that the proposed settlement between the crypto exchange and the DOJ would be “super bullish!!”

Novogratz was not alone in this opinion as others like prominent crypto trader Johnny contended Binance could finally put fears over its operations in the rearview.

The crypto community’s excitement has been mirrored in the price chart. At the time of writing, Binance’s BNB is the only crypto asset posting over 1% gains in the past 24 hours among crypto assets ranked within the top 20 by market capitalization. CoinMarketCap data shows BNB is trading at $253.17, representing a 2.82% gain in the past 24 hours.

On the Flipside

- The timing and structure of the proposed settlement deal remain vague.

- A $4 billion settlement deal will represent one of the largest ever in a cryptocurrency case.

- Binance still faces lawsuits from the U.S. SEC and CFTC.

Why This Matters

Members of the crypto community and prosecutors have long feared that criminal charges against Binance could trigger a run on the exchange that could hurt customers and the broader crypto market. A settlement with the DOJ could help prevent this outcome and allow the business to move on.

Read this to learn more about why prosecutors are skeptical about pursuing criminal charges against Binance:

Is Binance Too Big to Fail? DOJ Worries of Run on Exchange

Learn more about Tether’s move to Freeze 225 million USDT:

How Tether’s $225M Freeze Rebuts Crypto’s “Hidden Money” Tag