The Avalanche crypto network is a powerful Layer-1(L1) blockchain platform with a diverse and colorful ecosystem. The Avalanche network aims to disrupt the competitive L1 race and provide a low-cost alternative to leading smart contract platforms like Ethereum and Solana.

Powered by its unique infrastructure and its native token, AVAX, the Avalanche network is scalable and secure. Avalanche takes advantage of multiple different blockchains and subnets to limit network congestion. If you’ve used the Avalanche blockchain before, chances are you were impressed by its minimal transaction fees, speed, and diversity of dApps.

Avalanche has already established itself as a home for decentralized finance, NFTs, and crypto gaming. In fact, due to its performance and popularity as a smart contract platform, many crypto enthusiasts consider Avalanche to be an ‘Ethereum Killer.’

Sponsored

After partnering with Amazon, the Avalanche crypto community claims that AVAX is more bullish than ever. In this guide, we’ll strap on our snowboots and ask the big questions:

What is Avalanche, and why is AVAX a cryptocurrency worth watching?

History of Avalanche

The Avalanche Network’s story begins back in 2018 with the founding of Ava Labs. Ava Labs aimed to engineer an innovative and scalable blockchain, capable of high transaction throughput and low transaction fees.

Sponsored

Ava Labs is led by Emin Gün Sirer, an associate professor at Cornell University. Gün Sirer is best known for his work in computer networking and engineering peer-to-peer systems. He was also an early contributor to developing Bitcoin scaling solutions.

With the vision of revolutionizing the DeFi landscape and providing a powerful smart contract platform, the Avalanche network was born. The Ava Labs team showed promise to institutional investors, successfully raising over $50M USD before launching the Avalanche Mainnet on September 21, 2020.

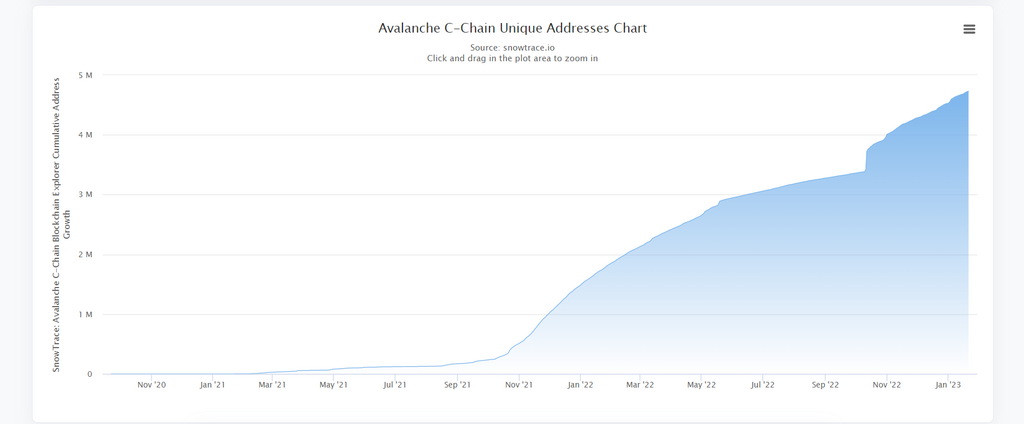

Source: Snowtrace

The Avalanche Network remained relatively quiet for the first few months of its lifespan before enjoying a strong influx of DeFi and cryptocurrency users in the fourth quarter of 2021. This was mainly due to high trading volume and AVAX price reaching its all-time high ($146) in November 2021. At its peak, AVAX had a market cap of over $40B.

Despite a decline in AVAX’s price, the Avalanche network remains a popular choice for both users and developers, hosting hundreds of dApps and deep on-chain liquidity and usage metrics.

How Does Avalanche Work?

The Avalanche network is powered by a Proof-of-Stake (PoS) consensus mechanism, similar to the Cardano blockchain. Without going into too much detail, network validators are randomly selected to process transactions and produce new blocks based on their staked AVAX tokens.

Other consensus mechanisms, like Bitcoin’s Proof-of-Work (PoW) model, use considerably more energy to power and secure the network. This makes Avalanche a far more energy-efficient blockchain than its PoW competitors.

Its unique infrastructure distinguishes the Avalanche network from other Layer-1 smart contract platforms. What many cryptocurrency investors don’t know about AVAX is that the Avalanche network is composed of three separate blockchains. These independent blockchains each serve different purposes while maintaining interoperability.

Avalanche Contract Chain (AVAX C-Chain)

Most Avalanche DeFi users are familiar with the Avalanche C-chain. The AVAX Contract Chain supports smart contract deployment and hosts the blockchain network’s dApps and NFTs. This chain is also called the execution layer.

The Avalanche C-Chain uses an EVM, or Ethereum Virtual Machine. This convenient technology allows developers to port over existing Ethereum dApps and deploy them on the Avalanche Network. It also provides a familiar environment and user interface for crypto enthusiasts with Ethereum experience.

Avalanche Exchange Chain (AVAX X-Chain)

As the name would suggest, the Avalanche X-Chain handles simple blockchain transactions, like sending and receiving AVAX tokens. This is the sole responsibility of the X-Chain.

Keeping basic exchange transactions to a dedicated blockchain helps to reduce network congestion significantly and facilitates faster throughput and low-cost transactions for users on a larger scale.

Avalanche Platform Chain (AVAX P-Chain)

I don’t blame you if you’ve never heard of the Avalanche Platform Chain, or P-Chain. The AVAX P-Chain is reserved for validators and node operators in the Avalanche ecosystem.

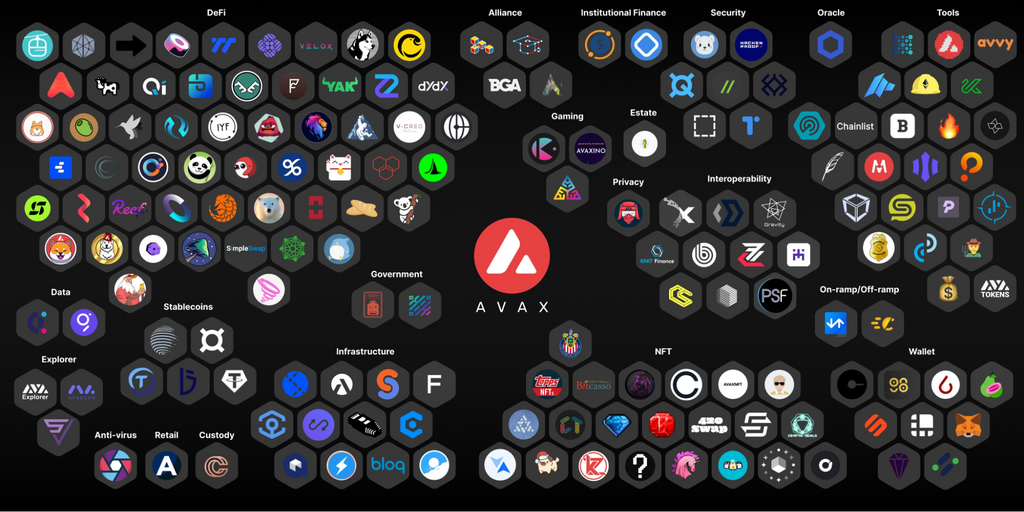

The Avalanche Ecosystem

The Avalanche ecosystem is home to many decentralized apps, NFT collections, and blockchain-based gaming platforms and subnets. Not to be confused with validator nodes or one of the primary network blockchains mentioned above, Avalanche subnets are a bit like private blockchains on the Avalanche network.

To avoid potential congestion issues on the AVAX C-Chain, some Avalanche validators can operate their own subnets. This is particularly helpful for Avalanche crypto game developers like Crabada or CrystalVale.

Decentralized finance is widespread on the Avalanche network, with plenty of AVAX-native dApps like Pangolin, TraderJoe, and Platypus Finance providing services and use cases for AVAX tokens. Several larger, multichain protocols, such as AAVE and GMX, have also made their platforms compatible with the Avalanche blockchain.

What is AVAX Used for?

AVAX is the native token of the broader Avalanche ecosystem and serves a variety of use cases. It’s used to pay transaction fees on the network and is the currency of exchange for trading AVAX NFTs.

In the spirit of decentralization, the AVAX token is also used to vote on crucial governance proposals that help shape the ongoing development of the Avalanche ecosystem. This gives investors greater influence on the future of the Avalanche network and helps the community settle upgrade decisions democratically.

On the Flipside

While AVAX and the Avalanche network have been proven a high-performing and desirable blockchain for users and institutions alike, there are some lingering concerns about its tokenomics.

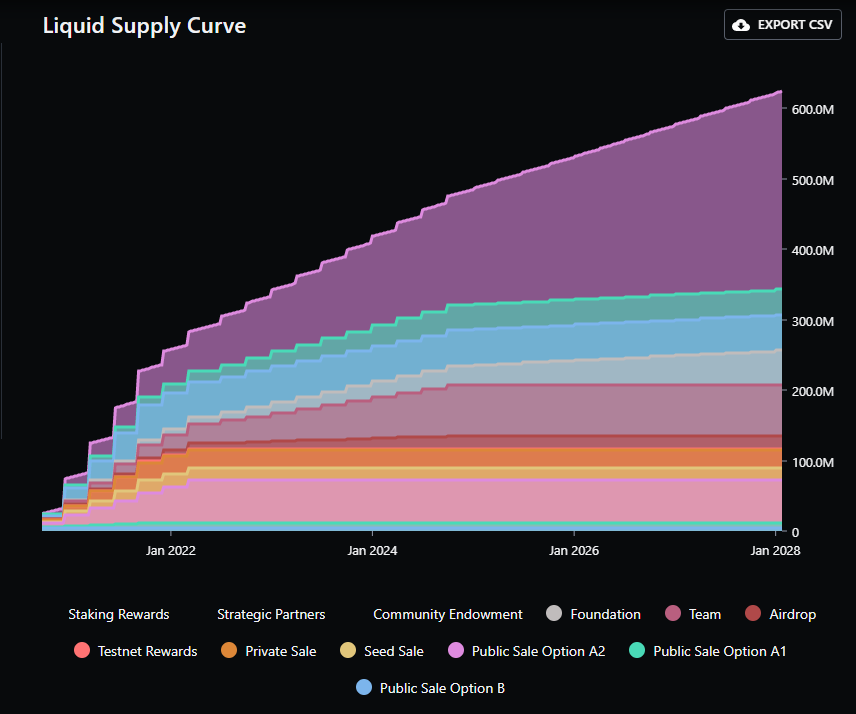

Source: Messari

There is a large discrepancy between the AVAX token’s circulation and total supply. The vesting schedule indicates that there are still plenty of tokens being distributed to early buyers, who bought into the Avalanche Ecosystem at much lower prices than most retail investors.

Why You Should Care

With institutional Web2 brands like Amazon choosing Avalanche as their base of operations, the blockchain is expected to receive an influx of users and adoption in the future.

The Avalanche crypto network is one of the top L1 ecosystems in the industry. Understanding how the Avalanche blockchain works are essential, whether you’re exploring decentralized finance and NFTs on AVAX or building powerful solutions for modern businesses.

FAQs

You can buy Avalanche (AVAX) on most leading centralized exchanges. These include popular sites like Binance and Coinbase.

According to the Official Avalanche site, the Avalanche Network can achieve a transaction throughput of over 4,500 per second (TPS). This is significantly faster than legacy blockchains like Bitcoin and Ethereum, which manage seven and 14 TPS, respectively.

AVAX is the native token of the Avalanche blockchain. This cryptocurrency can pay transaction fees on the Avalanche network, interact with Dapps, and vote in Avalanche governance proposals.

Like most cryptocurrencies and digital assets, AVAX’s price is unpredictable and subject to unexpected movements. We recommend you always conduct thorough research before making any investment decisions and never invest more than you can afford to lose.

Other smart contract-capable L1 blockchain networks like Ethereum (ETH), Polkadot (DOT), and the BNB Chain are similar to the Avalanche Network.

As is typical among cryptocurrencies, AVAX price often moves closely with Bitcoin (BTC). It’s also important to remember that no one knows what could happen in the crypto market, so AVAX price predictions and forecasts you see online may be unreliable.