As the leaves turn golden and the scent of pumpkin spice lattes fills the air, the spirit of Thanksgiving is once again upon us. Looking back on the ups and downs of Crypto in 2023, we actually have a lot to be thankful for.

January 2023 was a dark time for the crypto industry. The entire blockchain space was reeling after a devastating year. Even within the depths of the longest bear market we’ve ever seen, FTX’s catastrophic unraveling brought the cryptocurrency world to its knees and sentiment had never been lower.

Despite this, the crypto community endured, galvanized and rallied beyond anyone’s expectations. Positive new developments have been cropping up left, right, and center and the future has never looked better.

Sponsored

Before you pass the cranberry sauce and dive into that turkey, let’s take a moment and reflect on the year that was. Here’s what we’re grateful for in crypto this Thanksgiving.

Table of Contents

XRP – ‘Not a Security’

In the biggest story of the year, Brad Garlinghouse and Ripple Labs finally triumphed in their long-standing legal battle with Gary Gensler and the SEC.

The first key victory came in July when Judge Torres declared that the sale of XRP did not constitute an offer of investment contracts. In short, the SEC’s main argument and charge against Ripple Labs was thwarted.

Sponsored

But XRP wasn’t out of the woods just yet. Naturally, the SEC planned to appeal the decision and the case dawdled for several months. It wasn’t until October that Gary Gensler’s attack dogs finally capitulated and dismissed all charges against Ripple Labs.

Ripple’s victory in this case marks a key turning point for crypto regulation in the United States. The forces hampering one of the largest cryptocurrencies in the market have finally been vanquished. XRP is ready is cast off the shadows of doubt that plagued it for years and head into 2024 with clarity.

Arbitrum Airdrop: Who Doesn’t Like Free Stuff?

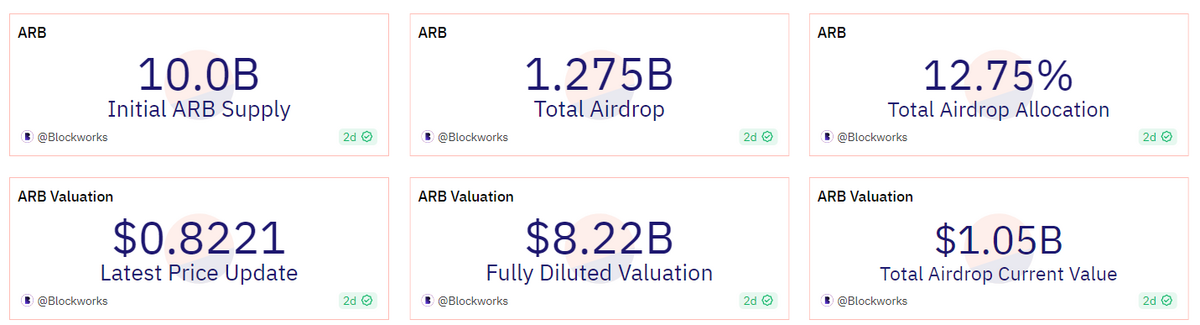

Thousands of crypto enthusiasts are feeling eternally grateful to the Arbitrum Foundation. In one of the most hotly anticipated events of the crypto calendar, the Arbitrum airdrop distributed 1.275B ARB tokens to network participants.

With the ARB token going as high as $1.75 USD in April, this altcoin airdrop was valued at over $2.1B dollars. According to on-chain data, the average allocation of each wallet was ~1,859 ARB, meaning that most users could’ve walked away with $3,000.

Who wouldn’t be thankful to receive free money?

Turn Spare Change into Millions with PEPE

Heading into more niche territory, meme coin traders have plenty to be thankful for this year. PEPE Coin flipped the cryptocurrency market on its head in 2023 and defied all expectations in the course of a few weeks.

In its quest to usurp meme coin kings like Dogecoin (DOGE) and Shiba Inu (SHIB), PEPE exploded. The internet’s favorite frog racked up billions in trading volume and kickstarted meme coin mania on the Ethereum blockchain.

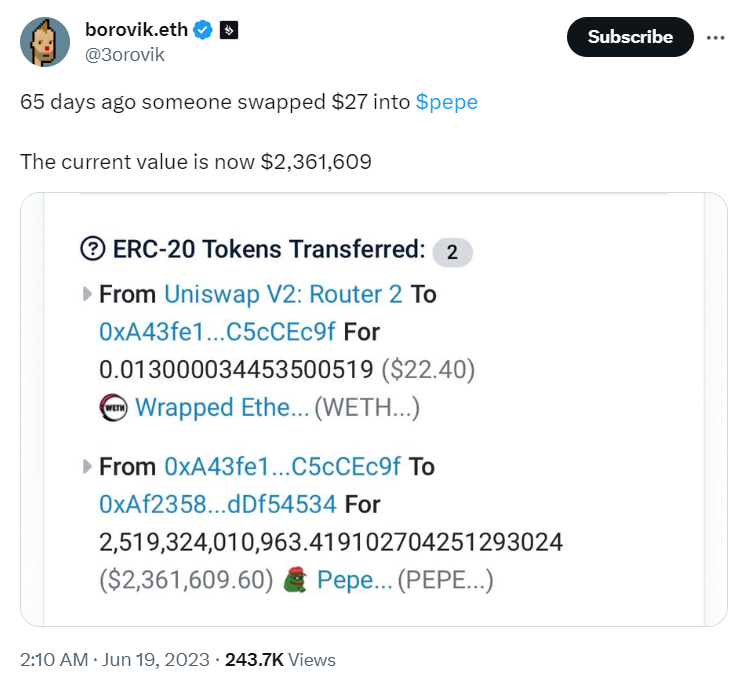

Early buyers who threw a handful of notes at the meme coin were handsomely rewarded, with some traders turning two digits into seven figures over the course of a few weeks.

No one really knows why this particular PEPE Coin skyrocketed the way it did. Hundreds, if not thousands of Pepe-inspired digital currencies have launched over the years, but most fizzle out and die after a few hours.

While PEPE is now down over 80% since its all high, those on-chain sleuths and meme coin gamblers who found it early are no doubt enjoying a very different Thanksgiving this year.

Cryptocurrency’s Post-FTX Recovery

When Sam Bankman-Fried’s cryptocurrency exchange halted withdrawals in November 2022, it really seemed like the end of crypto. SBF was widely considered the crypto’s champion and was well-liked and respected by the outside world.

When SBF’s throne of lies was revealed, the crypto market was sent into a pit of despair. Cascading liquidations pulled Bitcoin as low as $17k, and crypto assets like ETH saw triple digits on some exchanges for the first time since 2020. It really looked like the end.

But against all odds, we turned it around. Bitcoin rallied and brought up the rest of the market with it. BTC is up around 80% YTD since the collapse and faith in the crypto space has been restored.

Arguably, the FTX collapse has required crypto exchanges like Binance and Coinbase to show more transparency than they have previously. Most leading exchanges now provide Proof-of-Reserves, demonstrating that they have enough digital assets to meet customer withdrawals during periods of panic.

There’s no denying that the FTX debacle dealt a terrible blow to the crypto space, but it’s forced crypto exchanges to operate more transparently. I don’t know about you, but that’s definitely something worth feeling thankful for.

Solana X Visa Collaboration

No ecosystem felt the FTX’s collapse harder than Solana (SOL). Sam Bankman-Fried, Alameda Research, and FTX Ventures have been some of the biggest supporters of the third-generation blockchain.

Commentators across the crypto space were quick to condemn Solana, claiming that the ‘VC chain’ was dead.

Despite this, Solana has been one of the best performers in 2023, currently trading hands around 189% YTD. The network has overcome all expectations and proved itself as one of the most powerful ecosystems in the industry.

Solana’s speed and scalability haven’t gone unnoticed. In fact, Anatoly Yakovenko’s network has attracted the attention of one of the world’s largest payment systems.

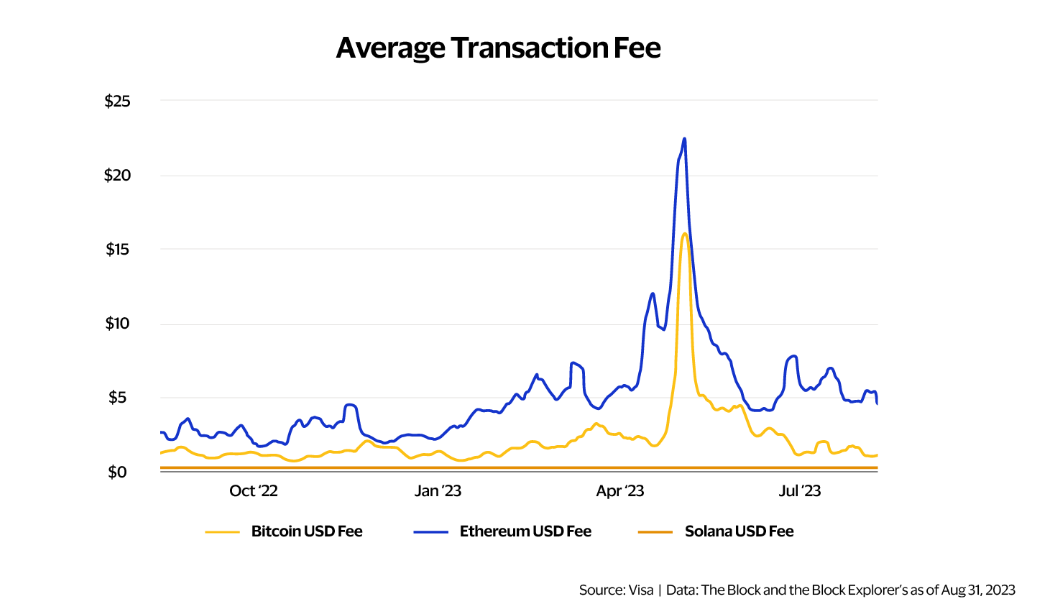

In September, Visa published a comprehensive deep dive on the Solana blockchain, citing its high transaction throughput, low gas fees, and blistering speed as the ideal environment to develop its stablecoin settlement platform.

As the bridge between Web2 and Web3 begins to blur, SOL bulls are thankful that a global powerhouse like Visa has chosen Solana as the future of their blockchain endeavors.

Shibarium Launch

The SHIB Army has plenty to feel grateful for this year. After years of rumors, Shibarium finally became a reality and provided a home for thousands of SHIB holders across the world.

Led by Shytoshi Kusama, the Shiba Inu team put their blood, sweat, and tears into the layer 2 scaling solution. In August, Shibarium launched to overwhelming fanfare and excitement. In fact, the development team underestimated just how fanatical the SHIB Army proved to be, with the influx of users causing a network outage as soon as it went live for the first time.

Over the course of the following two weeks, the team tinkered away behind the scenes. Polygon co-founder Sandeep Nailwal pitched in to help get the network back on its feet and Shibarium was officially relaunched to the public on the 28th of August.

Since then, over 1M wallets have bridged over to Shiba Inu’s network. Shibarium has sprouted a handful of DeFi (Decentralized Finance) apps and smart contracts to support early adopters and the SHIB Army finally has its own network to expand its growing ecosystem.

With Shibarium now ticked off Shytoshi’s to-do list, the top dog in the Shiba Inu pack can turn their attention to Shiba Inu’s next great milestone: the Shiba Inu metaverse.

Spot Bitcoin ETFs Get Closer Everyday

While traditional finance still casts a cautious eye over the crypto market, some of the industry’s biggest names are lobbying to get Spot Bitcoin ETFs up and running in the United States.

Designed to simplify Bitcoin investing for the masses, these spot Bitcoin ETFs will give financial institutions the regulatory clarity needed to manage BTC funds on behalf of investors. This will provide the much-needed confidence that traditional investors need to properly dive into the crypto market.

Spot Bitcoin ETFs are expected to bring a massive influx of capital into the crypto space and provide greater stability and liquidity to the cryptocurrency market. Investors who previously sat on the sidelines will be able to join the crypto space, guided by familiar names like Blackrock and Fidelity.

As it stands, these are the institutional funds that have filed for Spot Bitcoin ETFs in 2013:

- BlackRock

- WisdomTree

- Invesco/Galaxy

- Valkyrie

- Wise Origin

- VanEck

- BitWise

- Fidelity

Long story short, Bitcoin adoption is growing and the biggest names in finance want a piece of this pumpkin pie. BTC holders, take a second to thank the Wall St. fat cats for bringing Bitcoin to the world this year.

On The Flipside

- Crypto investors are no stranger to volatility. While 2023 has been packed with positive developments in the world of blockchain technology, the crypto winter endures. We’re still far away from the euphoric highs of 2021.

Why This Matters

We have so much to be thankful for in the crypto space this holiday season, especially compared to this time last year. If you told your family to go all in on Bitcoin at $69,000 at Thanksgiving in 2021, this is your chance to put things right.

FAQs

With the next Bitcoin halving just around the corner, the crypto market is expected to perform well in 2024. To find specific coins that will ‘boom’, you should always do your own research and formulate your own thesis instead of investing in random altcoins mentioned in F.A.Q. sections.

Historically, Bitcoin halving years generally indicate the beginning of a new bull cycle. Naturally, nothing is guaranteed and anything can happen, so do your own research and never invest more than you can afford to lose.