Pepe Coin (PEPE) is the latest digital asset to flip the entire crypto market on its head, following the example set by meme coin forefathers like Shiba Inu (SHIB) and DogeCoin (DOGE). Early investors could ride PEPE hype to the moon and beyond, netting millions in profits over just a few days.

The success of Pepe Coin sparked the rapid deployment of thousands of similar meme coins on the Ethereum (ETH) blockchain. While some copycats made the 100x they promised, most were scams and rugpulls designed to extract funds from eager traders looking for the next PEPE or SHIB.

The greatest tragedy isn’t the sheer volume of scams and rugpulls launched in the wake of Pepe Coin; it’s the fact that they were easily recognizable and avoidable. In this article, we’ll explore why Pepe Coin was such a success and give you a few basic tips on how to stay safe when hunting for new meme coins.

Table of Contents

What Is PEPE Coin?

When Matt Furie first created Pepe the Frog in 2005, he never would’ve guessed that his amphibious character would become one of the biggest internet memes in history. Imagine his shock when, 18 years later, crypto traders would become overnight millionaires thanks to the popularity of a cryptocurrency meme coin created in Pepe’s image.

Sponsored

PEPE Coin is an ERC-20 token on the Ethereum blockchain. In true stealth launch fashion, PEPE was launched without any presale, and with a unique twist – zero taxes, a burnt liquidity pool, and a renounced contract. This approach was designed to make PEPE a coin “for the people, forever,” according to its official website.

Like most meme coins, Pepe Coin had no long-term vision or sustainable roadmap it set out to achieve. Pepe’s goal was simple: Have some fun and establish Pepe’s place as the King of Memes over incumbent dog-themed coins.

Why Did PEPE Price Explode?

The honest answer is no one really knows. While many skeptics believe that the Pepe Coin phenomenon was an insider play with all the biggest influencers in the space conspiring to create the ultimate pump-and-dump, there’s no hard evidence to support these claims.

Sponsored

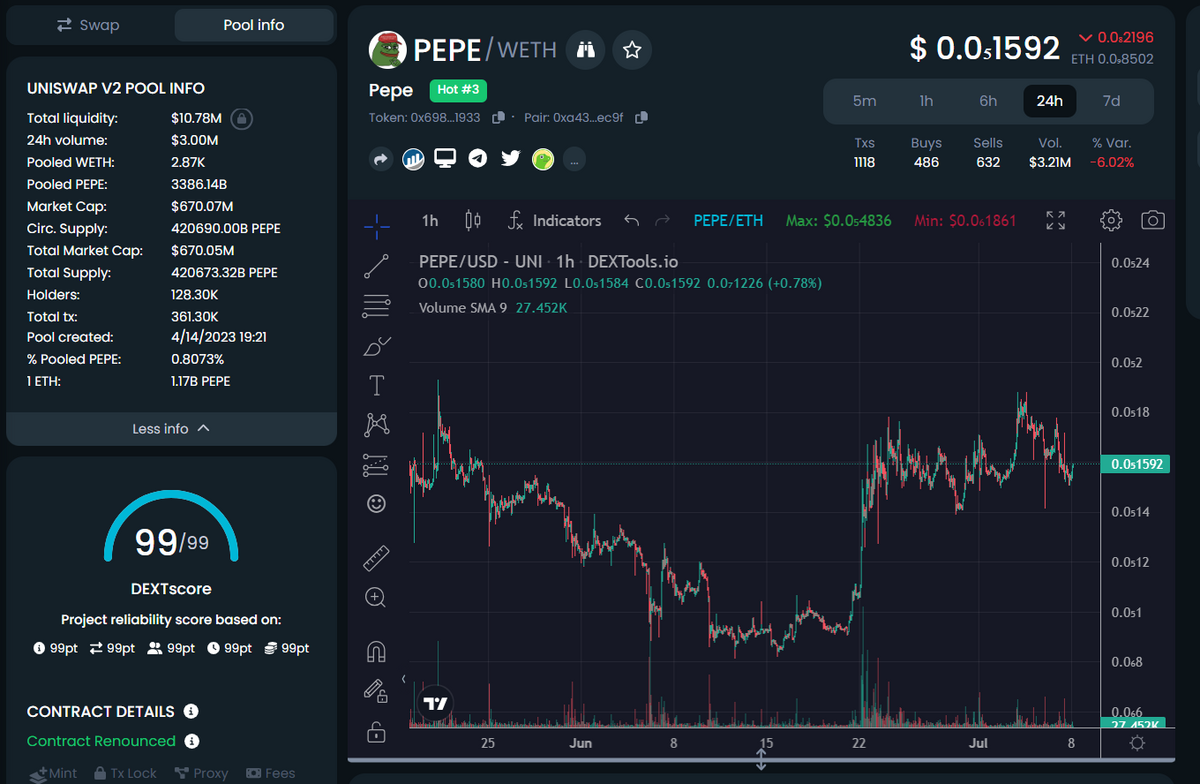

Pepe Coin exploded due to simple market psychology. The token’s low initial liquidity on Uniswap meant PEPE’s price action was volatile. Despite this, sustained buy pressure and relentless shilling from influencers and community members on Twitter meant that the PEPE chart printed green candle after green candle.

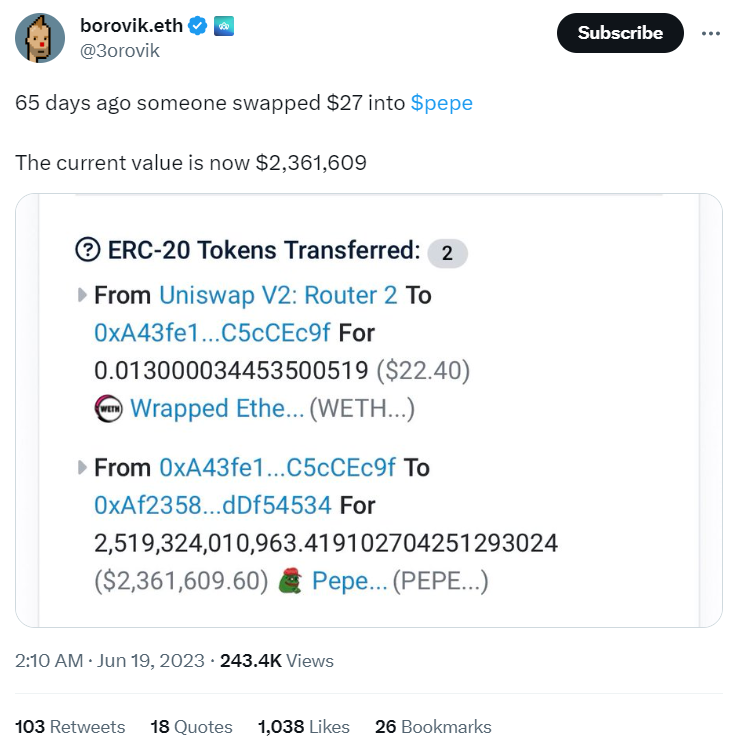

Stories of early investors turning a few hundred dollars into millions only fed the FOMO stirring across the crypto industry. Everyone and their dog wanted to buy PEPE, while crypto news outlets were quick to declare that Pepe Coin was the next Shiba Inu.

PEPE’s staggering trading volume fast-tracked the meme coin straight to top crypto exchanges, who didn’t want to miss out on trading fees. This pushed PEPE to its all-time high, registering a market capitalization of over $1.5 B USD.

Something that shouldn’t be overlooked when considering Pepe Coin’s meteoric rise is that, at a technical level, PEPE is safe. Thanks to a burnt liquidity pool and a renounced contract, traders could buy PEPE without fear of getting rugged, or having the developer run off with their funds.

What Does Pepe Coin Mean for the Crypto Market?

The rise of PEPE Coin sent shockwaves throughout the cryptocurrency market. On the one hand, PEPE brought droves of new investors into the crypto space, many of whom are attracted by the prospect of astronomic profits. In a perfect world, this influx of capital stimulates growth and innovation in the market and brings us closer to mass adoption.

On the other hand, Pepe’s fairytale success spawned thousands of scam coins and rugpulls masquerading as the next big meme coin, extracting millions of dollars from reckless traders during meme coin mania.

The Dangers of MemeCoin Season

The emergence of meme coin season has brought with it a new set of challenges and risks. While the allure of quick profits is enticing, it’s crucial to understand the potential dangers of trading these highly volatile assets.

- Market Volatility – Meme coins are notorious for their extreme price swings. A coin’s value can skyrocket in a matter of hours, only to plummet just as quickly. Buying meme coins at peak hype is a good way to see the value of your bags evaporate in mere minutes.

- No Fundamental Value – Unlike traditional cryptocurrencies like Bitcoin (BTC), Cardano (ADA), or Ripple (XRP), meme coins often lack a solid foundation of technology or utility. Their value is entirely driven by social media hype and investor sentiment, which is fickle and unpredictable.

- Pump and Dump Schemes – The meme coin market is ripe for manipulation. Malicious actors can artificially inflate a coin’s price through coordinated buying and shilling, only to immediately dump on their followers.

- Rug Pull – It’s a hard pill to swallow, but most meme coins are outright scams. Developers can “pull the rug” by suddenly withdrawing all the liquidity from the market, making it impossible to sell tokens.

How can one navigate the meme coin market safely in the face of these risks?

How to Stay Safe in DeFi

Navigating the DeFi landscape, especially during a memecoin season, requires caution, knowledge, and strategic decision-making.

The most common way scammers will exploit DeFi markets is by removing liquidity from the decentralized exchange hosting the trading pool or changing the contract. In some cases, scammers will also separate their holdings among various wallets to make it look as though holder distribution is far more decentralized than it appears.

Let’s quickly go over how to recognize these scam techniques and how you can avoid them.

Locked Liquidity

When a token’s liquidity is locked, a certain amount of capital, usually in the token and a base currency like Ethereum, is reserved in the liquidity pool and cannot be removed. This helps to ensure that there is always enough capital in the pool for traders to buy and sell the token.

In some cases, liquidity pool tokens are also ‘burnt,’ meaning they’re sent to a dead address that no one can control. This essentially means that the liquidity can never be changed.

A locked or burnt liquidity pool is a strong positive signal as it reduces the risk of a ‘rug pull,’ where developers drain the liquidity pool and leave investors with worthless tokens.

Renounced Contract

Another security you might often hear about in the meme coin market is a ‘renounced contract.’ When a contract is renounced, it means that the original creators of the contract no longer can interact with it in any way.

For example, developers who don’t renounce ownership of their contracts might be able to mint millions of new tokens, inflate the asset’s market cap and immediately dump all their new tokens to drain the value of the liquidity pool.

Imagine a meme coin with a circulating supply of 100 tokens valued at $1 USD each. You’ve bought ten, meaning you own 10% of the supply. Without your knowledge, the project owner mints 900 new tokens into his own wallet through an unrenounced contract.

Now, the supply has multiplied tenfold, devaluing the price of an individual coin down to $0.10 while you still only hold ten tokens. By minting new tokens, the developer has scammed you and devalued your investment from $10 to $1.

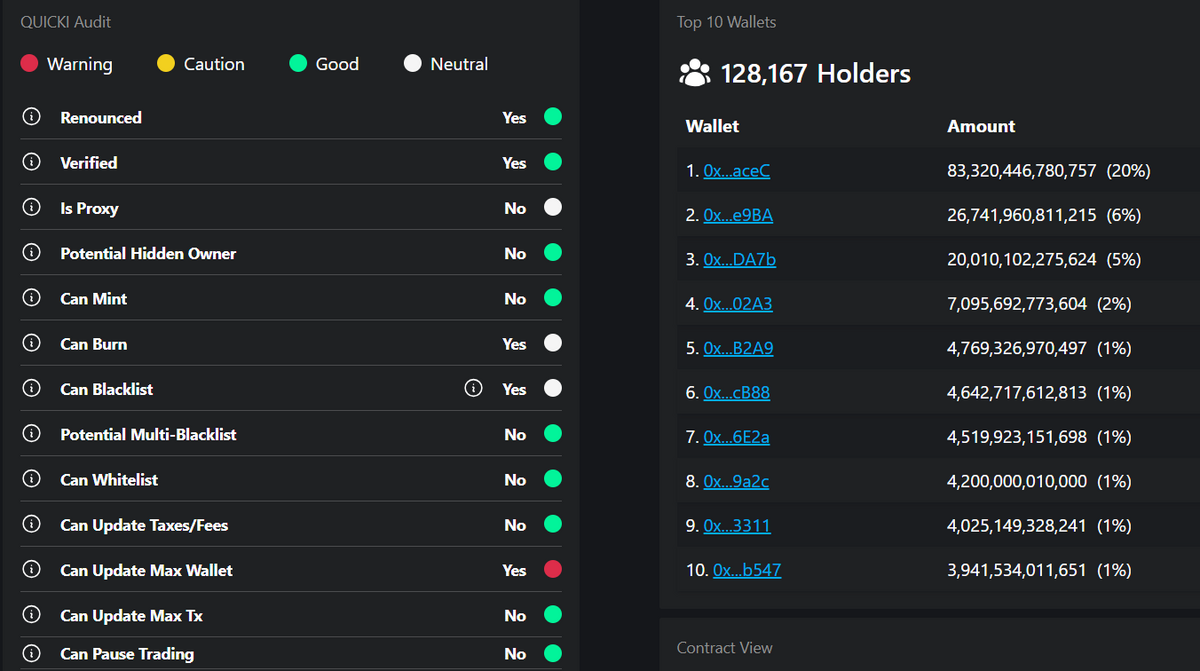

Always ensure a token contract is verified and renounced before buying any meme coin. If you don’t know how to do that, don’t worry. I’ll provide you with a few essential tools later in this guide.

Top Holders

A healthy token distribution is one where no single address holds a disproportionately large amount of the total supply. If top holders dominate the token supply, they can manipulate the market by buying or selling large amounts of tokens.

Even worse, top holders that own the lion’s share of a token supply can dump their tokens whenever they feel like it, potentially destroying the price of an asset in seconds. You don’t need to be a rocket scientist to see why that isn’t healthy for a growing cryptocurrency.

What Basic Tools Help Me Check If New Tokens Are Safe?

I appreciate this all sounds complicated, but fear not. Plenty of helpful online tools are simple to use that will give you all this information in a digestible format.

- DexTools – More than just a charting platform, DexTools provides real-time data about tokens on EVM networks. Simply search for the coin you want to investigate and Dextools will quickly give you a basic security audit checking the status of the token’s liquidity and contract.

- Tokensniffer and Quick Intel – Essential tools in the meme coin space; Tokensniffer and Quick Inteal scan Ethereum-based tokens. They provide information about a token’s contract, its holders, and transfers. It can also help you identify duplicate and similar contracts, which can be useful in spotting potential scams.

- BubbleMaps – Some scammers will try to split their tokens across multiple wallets to hide the fact that they hold a disproportionate supply of tokens. Fortunately, Bubblemaps shows linked wallets, meaning you can easily identify when one person controls several wallets.

It essentially comes down to this: Before buying any meme coin on a decentralized exchange, always ensure the contract is renounced and double-check that token liquidity is locked or burnt.

Pros and Cons of Memecoin Season

Meme coin season is the ultimate rocks-or-diamonds guessing game in the crypto industry, capable of multiplying your wallet or emptying it in a matter of hours. Let’s review the pros and cons:

Pros

- Big, fast profits (sometimes) – Memecoins can offer huge returns in a short period. For example, early Pepe Coin buyers become overnight millionaires after throwing a few hundred dollars at the meme coin.

- Increased Interest in Crypto – Meme coin hype attracts new investors to the crypto space, potentially leading to blockchain mass adoption.

Cons

- High Volatility – Memecoins are known for their extreme price volatility. Investors can see their investments plummet in value just as quickly as they rise.

- Lack of Intrinsic Value – Unlike traditional cryptocurrencies, meme coins often lack a solid technological foundation or use case, making their long-term value uncertain.

- Risk of Scams – The meme coin market is a breeding ground for scams, including pump and dump schemes and rug pulls.

On the Flipside

- Blockchain contract security is a deeply complicated field. This guide touches on common DeFi scams and how to avoid them, but barely scratches the surface of DeFi security.

Why This Matters

In the wake of Pepe token’s success, meme coin scams are more common than ever. Following these basic rules will help you to protect your capital and avoid rugpulls in the DeFi space.

FAQs

You can buy PEPE on crypto exchanges like Kucoin, OKX, and Kraken.

You can check the current price, circulating supply, and 24-hour trading volume of Pepe on crypto tracking sites like CoinMarketCap.

If PEPE were to reach $1 USD per PEPE token, the project’s market cap would be over $420 T. That’s 400 times larger than the value of the entire crypto market.

Yes, PEPE is available to trade on Binance.