- Cardano has yet to recover from its regulatory troubles.

- In the following weeks, ADA could retest a crucial level.

- The outcome of the retest could determine Cardano’s trajectory for the rest of the year.

Since the SEC classified ADA as a security, Cardano has struggled to break through crucial resistances, trading 25% below its June high.

Still, despite these challenges, Cardano has exhibited remarkable strength by successfully navigating market turbulence, fueling a heated competition for dominance between the bulls and bears. With Cardano looking for a retest of a critical level, the question looms:

Sponsored

Will the bulls charge ahead and propel ADA to new heights? Or will the bears interrupt the parade and push the price further into the wilderness?

Retesting $0.3

Cardano (ADA) has been consolidating between $0.26 and $0.29 for five weeks, struggling to break through this tight range. Even with Whale activity and its DeFi TVL spiking, the token’s price has remained relatively unaffected, adding to Cardano’s struggles.

However, ADA has recently started gaining momentum and is again eyeing a retest of the major resistance at $0.3 as it trades at $0.29 at press time.

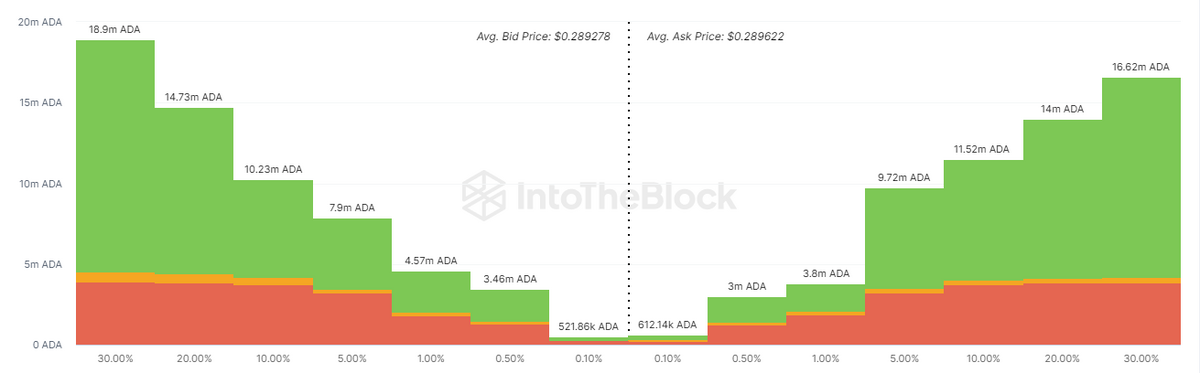

If Cardano overcomes the sell wall at $0.3, it could reach $0.32 for the first time in over a month, marking a full recovery from the SEC’s attack. However, should the Bears take control, ADA’s price could plummet toward $0.25, introducing further turmoil.

It’s worth noting that over the past month, Cardano’s previous attempts to reclaim $0.3 have been met with resistance from massive sell walls set by the Bears. So, breaking the $0.3 resistance is crucial for Cardano Bulls in the following weeks, as it could shape the trajectory for the rest of the year.

Cardano’s (ADA) Current Outlook

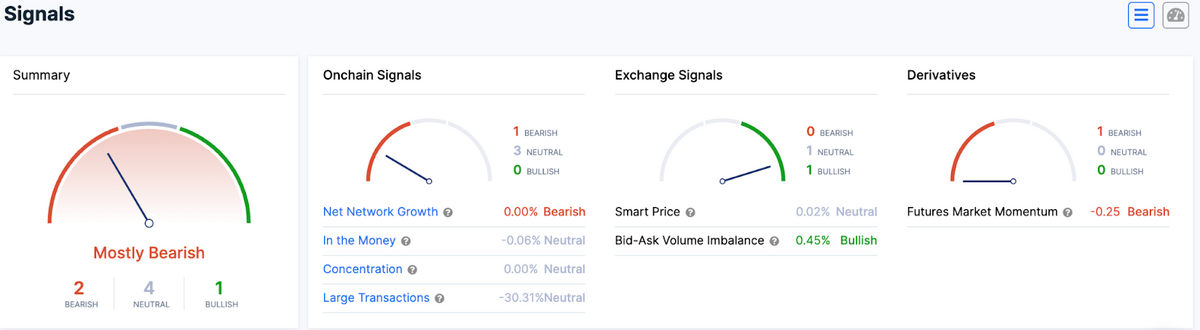

Cardano’s investor sentiment has remained primarily bearish in July, likely influenced by Robinhood and Celsius selling their ADA holdings.

However, ADA’s recent performance has given rise to interesting bullish patterns, such as the Ascending Triangle, Power of Three, and a MACD Bullish Crossover, suggesting an imminent breakout above $0.3.

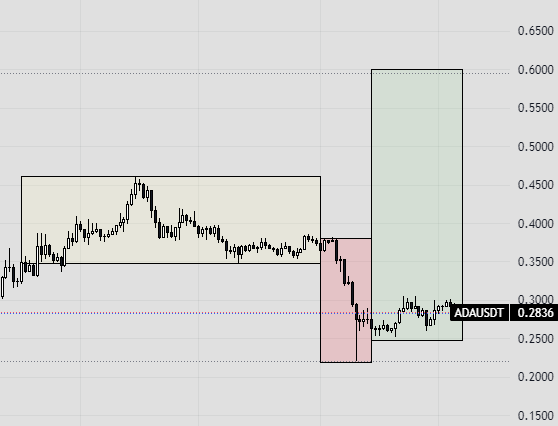

On a higher time frame chart, Cardano has made four unsuccessful attempts to breach the $0.3 level over the past month, forming a distinct Ascending Triangle. According to the indicator, with the support level rising after every rejection, the next test is crucial and could finally be when the resistance breaks.

Adding to the bullish bias, considering Cardano’s long-term price action, it could also be on the verge of entering the expansion phase, as indicated by the Power of Three technical analysis tool, gaining the much-needed momentum to break through $0.3. However, Cardano’s journey may not be as smooth as many hope, depending on how the bulls react in the next few weeks.

On the Flipside

- Market dynamics can be unpredictable, so it is important to consider alternative perspectives and opinions when evaluating the potential future performance of Cardano.

- Speaking of recoveries, Solana has fully recovered from the SEC’s attack, rallying 65% over the past month.

- ADA is 90% down from its all-time high of $3.1 at press time.

- The SEC’s case against Binance and Coinbase sparked a wave of liquidations throughout the market, amounting to $104 million.

Why This Matters

The following weeks are make-or-break for the Bulls, as they must execute a Hail Mary play to propel Cardano above $0.3. Should they fail, the Bears will take over, pushing ADA to $0.25, where it will continue to consolidate for several weeks.

Cardano’s solution to its regulatory problems:

Cardano and its Regulatory Problems: How EDI Can Be A Solution

Read more on Cardano:

DailyCoin Cardano Regular: Bears & Bulls Clash, TVL Swells, But Price Remains Steady