- Cardano (ADA) continues to navigate regulatory tensions.

- ADA has yet to recover from the SEC’s crypto crackdown.

- The Edinburgh Decentralization Index (EDI) could address Cardano’s regulatory uncertainties.

Cardano continues to face regulatory pressure as major US exchanges initiate a delisting spree and dump their ADA holdings, citing regulatory uncertainty.

While Cardano has exhibited strength by holding firm above crucial support levels despite news of impending chaos surfacing, its fate in the US hangs by a thread. Interestingly, the upcoming Edinburgh Decentralization Index (EDI) could address its regulatory uncertainties by laying the foundation for a solid regulatory framework.

What is the Edinburgh Decentralization Index (EDI)?

The Edinburgh Decentralization Index is a collaborative effort between the University of Edinburgh and the Cardano Foundation that aims to measure the level of decentralization of cryptocurrencies such as Bitcoin, Ethereum, and Cardano.

Sponsored

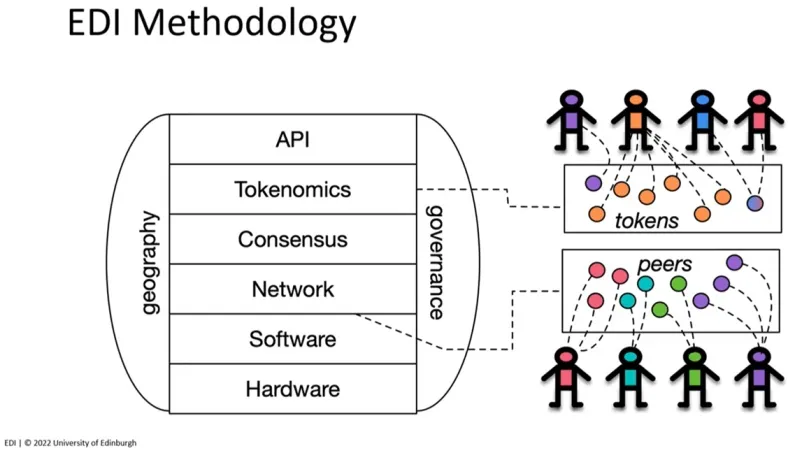

The index aims to analyze different layers, such as governance, consensus, and more, as shown in the diagram below, to identify the different aspects of the centralization of a cryptocurrency project.

According to the developers of the EDI, each layer holds significance in determining the decentralization of a project. For example, centralization at the consensus layer exposes vulnerabilities in the transaction validation process, while centralization at the tokenomics level introduces the risk of price manipulation. Additionally, centralization at the network level threatens censorship and so on.

The EDI index aims to accelerate adoption by laying a solid framework for regulators to adhere to beyond abstract definitions, which could significantly impact the future of Cardano and other cryptocurrency projects.

How does the Edinburgh Decentralization Index (EDI) Impact Cardano?

The Edinburgh Decentralization Index is one of Cardano’s many meticulously researched projects. The index incorporates important metrics such as the Herfindahl-Hirschman, Gini, and Nakamoto coefficients. These metrics would provide valuable insights into Cardano’s level of decentralization, further cementing its position in the crypto industry.

Sponsored

Cardano founder Charles Hoskison has previously highlighted the potential impact of EDI on governments and regulatory bodies worldwide. The founder shared that by using the index to assess decentralization, policy-makers could formulate informed regulations and differentiate between cryptocurrencies as either commodities or protocols based on their decentralization.

Hoskinson emphasized that major regulatory bodies, such as MiCA and those in the United States, could adopt these metrics once they are complete, fostering a more nuanced and optimized regulatory framework.

On the Flipside

- Cardano Founder Charles Hoskinson believes that by the summer of 2023, Cardano could surpass Bitcoin, Ethereum, and every other cryptocurrency in decentralization.

- The SEC’s recent case against Binance and Coinbase sparked a wave of liquidations throughout the market, amounting to $104 million.

Why This Matters

Cardano is the seventh-largest token by market cap and the third-largest blockchain ecosystem. The SEC’s actions had a damning effect on a token as impactful and large as Cardano. The Edinburgh Decentralization Index could potentially address the SEC’s concerns with the network and the cryptocurrency sector as a whole.

Read about other solutions:

Cardano and the SEC Problem: How CIP-1694 Could Provide Solutions

More on Cardano:

What Is Cardano’s Hydra Pay, and How Does It Revolutionize Micro Payments?