- Cardano and Polygon have failed to recover as much as their competitors following the SEC’s crypto crackdown.

- Cardano and Polygon continue to fall despite bullish news.

- The following weeks are crucial in shaping Cardano and Polygon’s trajectories for the remainder of the year.

The SEC’s recent crypto crackdown sent tremors throughout the industry, leading to tokens plunging as much as 50%. As a result, major US exchanges were compelled to delist tokens the SEC deemed securities, adding copious amounts of sell pressure on the market.

While some tokens have since recovered from their losses, Cardano and Polygon continue to face challenges. Despite their thriving ecosystem, MATIC and ADA are still reeling from the SEC’s accusation as they struggle to regain their footing.

Bumpy Recovery

In a high-profile lawsuit against leading crypto exchanges in the US, the SEC classified Solana (SOL), Polygon (MATIC), and Cardano (ADA), among other tokens, as unregistered securities. The regulator’s decision cast a shadow of fear and doubt over the market, leading to Cardano, Polygon, and Solana crashing by over 40%.

Sponsored

Tokens the regulator listed as securities, such as Solana, have since made remarkable progress, recovering a significant portion of their losses. At press time, Solana has fully recovered to pre-SEC levels, exchanging hands at $21.55, marking a 65% increase over the past month.

Cardano and Polygon, on the other hand, have been on an extended decline since the SEC targeted the tokens. According to CoinMarketCap data, Polygon traded at $0.74, down 22%, and Cardano at $0.29, down 25%, respectively, from their June Highs.

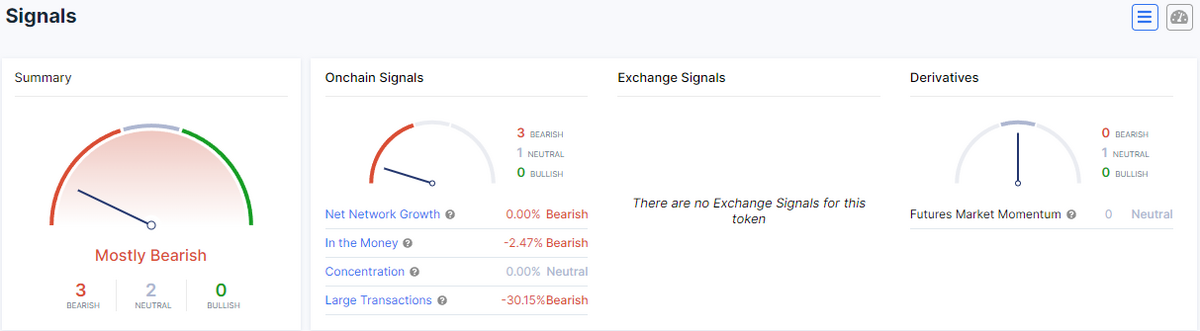

Despite ranking seventh by market capitalization, Cardano remained one of the worst-performing major tokens over the past month, with bearish sentiment prevailing among investors compared to Polygon’s bullish sentiment.

Sponsored

According to Coinglass, the open interest for Polygon stood at $150 million, with a long-to-short ratio of 1.04, suggesting that more investors were buying MATIC rather than selling. In contrast, Cardano’s open interest stood at $110 million, with a long-to-short ratio of $0.9, suggesting that investors were selling ADA instead of buying.

The SEC’s crackdown continues to impact Cardano and Polygon, as both tokens grapple with the repercussions of the SEC’s crackdown hindering their recoveries. However, both ecosystems have promising developments in the pipeline, which could help them regain lost ground in the following weeks.

What’s Next for Cardano and Polygon?

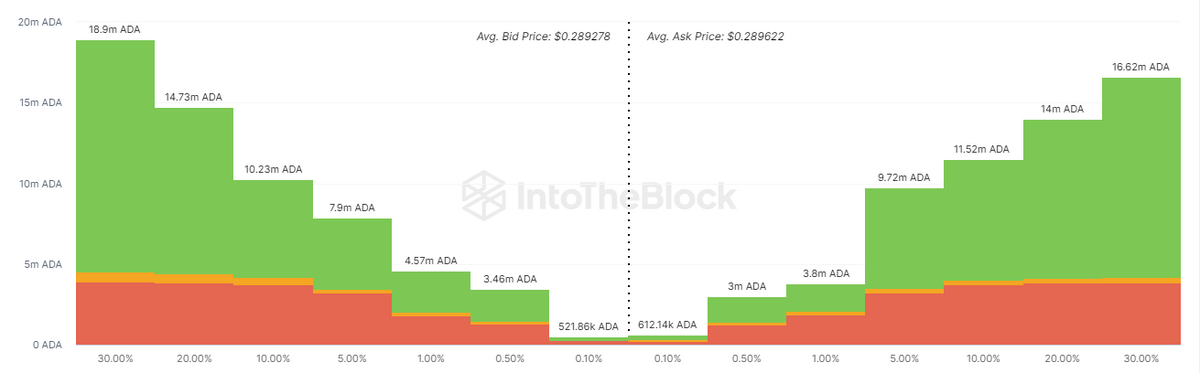

Cardano’s DeFi ecosystem has thrived lately, with its TVL consistently breaking records. Whale interest in Cardano has also risen over the past months. However, despite the ecosystem’s success, the fate of ADA ultimately hinges on its ability to overcome the sell wall at $0.3.

Overcoming the resistance at $0.3 is crucial for Cardano bulls in the upcoming weeks. Should the bulls prevail, ADA could reach $0.32 for the first time in over a month. However, if the bears take control, ADA’s price could plummet toward $0.25.

Polygon, conversely, is gearing up for a major upgrade, Polygon 2.0. The success of this upgrade could shape MATIC’s trajectory for the remainder of the year, potentially helping its recovery. Given the recent appointment of the new CEO, Whale interest in Polygon has also risen, leading to over 10 million MATIC tokens accumulated in under two days and a 3% surge.

All signs on Polygon are bullish, and there’s a high chance the asset could recover fully. However, for Cardano, it depends on how the following weeks go.

On the Flipside

- ADA is 90% down from its all-time high of $3.1 at press time.

- At press time, MATIC was 75% down from its all-time high of $2.92.

- Cardano Founder Charles Hoskinson believes that by the summer of 2023, Cardano could surpass Bitcoin, Ethereum, and every other cryptocurrency in decentralization.

- The SEC’s case against Binance and Coinbase sparked a wave of liquidations throughout the market, amounting to $104 million.

Why This Matters

While the SEC crackdown has had a lasting impact on Cardano and Polygon, the potential for recovery remains. The following weeks are crucial in determining where these tokens are headed as they navigate challenges and leverage their respective strengths.

Read more on Cardano:

Cardano (ADA) Whale Interest Burgeons, But Price Unaffected

Read more on the SEC:

SEC Case Continues to Weigh on Binance.US as BTC, USDT Trade at Discount

FAQs

Polygon is a Layer-2 scaling solution for Ethereum. It was designed to address the issues faced by Ethereum. MATIC is the native token of the Polygon network and is used for various purposes within the ecosystem, such as paying gas fees, participating in governance, and more.

The SEC is not against cryptocurrencies as a whole. However, it is responsible for enforcing laws and regulations to protect its investors. Some of the SEC’s recent actions could be perceived as being against crypto; however, factors such as the unregulated nature of cryptocurrencies and the prevalence of fraud and market manipulation are valid concerns for the regulator.

The SEC protects investors by enforcing securities laws, ensuring compliance, and taking legal action against fraudulent activities.

According to CoinGecko, Cardano’s all-time high is $3.09, achieved on September 2, 2021.