- BRC-20 has proven to be a game-changer for Bitcoin.

- Thanks to the hype surrounding BRC-20, Bitcoin transaction fees have surpassed that of Ethereum.

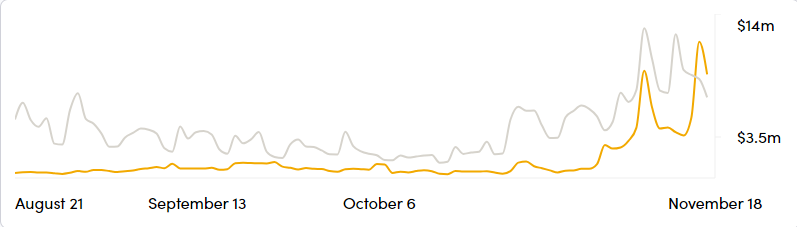

- While Bitcoin sits below Ethereum, considering its trajectory, it could soon outperform the reigning king.

Ethereum has long reigned as the leading DeFi platform, playing host to countless projects and drawing in millions of users. However, with Bitcoin’s recent foray into smart contracts, native assets, and NFTs, it’s steadily gaining ground.

In an interesting twist, the reigning crypto king, Bitcoin, has surpassed Ethereum in daily transaction fees, hinting at an intriguing shift in the industry’s landscape.

Bitcoin Closes In On Ethereum

BRC 20, Bitcoin’s new token standard, has ushered in a transformative era for the network, introducing newfound utility layers. By allowing users to inscribe JSON code onto individual satoshis, the new token standard provides Bitcoin with capabilities akin to Ethereum, such as token contracts and native assets.

Sponsored

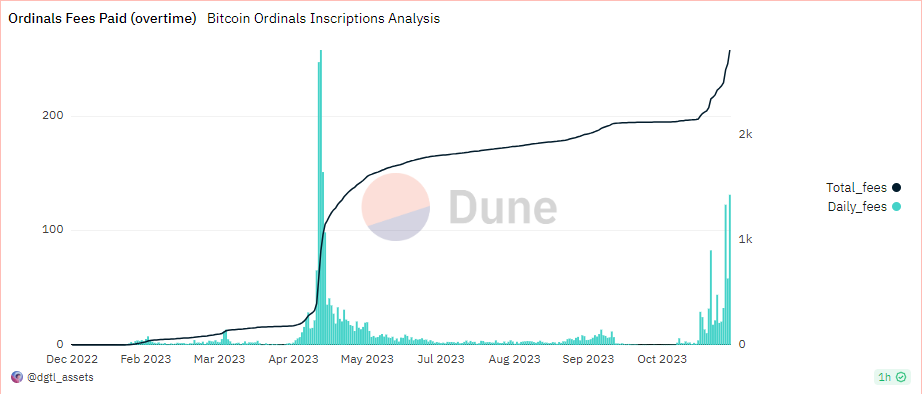

Since the introduction of the BRC-20 token standard, Bitcoin has experienced a massive surge in activity. Transaction fees on the network have skyrocketed, leading to occasional delays as the mempool contends with over 200,000 unconfirmed transactions.

At press time, the network boasts a remarkable 41 million inscriptions, accumulating a total transaction fee surpassing 2800 BTC, equivalent to $102 million. The recent surge in Bitcoin’s price, fueled in part by the news of a Spot ETF Approval, has contributed to the remarkable spike in total transaction fees.

This was particularly evident on November 16, when Bitcoin’s transaction fees surpassed Etheruem’s, totaling $11.6 million compared to Ethereum’s $8 million. The trend continued the following day, with Bitcoin once again outperforming Ethereum, collecting over $8 million in transaction fees compared to Ethereum’s $6 million.

Sponsored

While Bitcoin’s Total Value Locked (TVL) currently stands at $270 million, ranking 11th, in contrast to Ethereum’s substantial $25 billion TVL and 1st place, it’s worth noting that the BRC-20 and ordinals were introduced this year. With Bitcoin’s impressive growth trajectory, it could soon bridge the gap and potentially surpass Ethereum.

On the Flipside

- Bitcoin maximalists harbor strong reservations toward BRC-20 tokens, with core developers contemplating the complete removal of the protocol.

- Bitcoin only has nine DeFi protocols in comparison to Etheruem’s 952.

Why This Matters

Bitcoin’s success in the DeFi sector demonstrates its utility and competitive edge against leading projects despite not natively supporting these frameworks.

Read more about the latest addition to Upland:

Upland Expands Arsenal with New War-Infused Game, Polemo

Follow up on why the latest Charles Hoksinson and Ethereum Drama:

Cardano’s Charles Hoskinson Weighs in on ETH Insider Drama