- Bitcoin fees soar to a six-month high.

- Ordinals activity makes a strong resurgence.

- Some predict higher fees will become the default going forward.

Ordinals exploded onto the scene earlier this year, utilizing Bitcoin’s blockchain in new ways to create digital artifacts, including NFTs. This provoked controversy among Bitcoin purists, who raised issues with the network being used for non-monetary purposes and higher fees due to increased network activity.

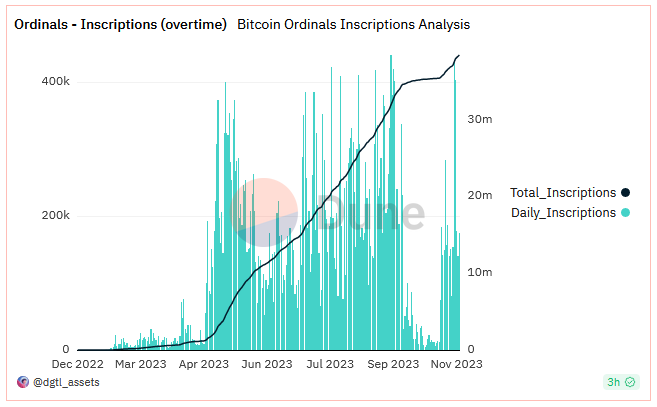

These digital artifacts, also known as Inscriptions, numbered hundreds of thousands of daily entries into the Bitcoin ledger during their peak but saw a dramatic decline in activity by late September. Although some had taken the decline as a sign of the end of the Ordinals experiment, late October saw their resurgence, triggering a jump in transaction fees at the same time.

Bitcoin Fees Soar

According to data from Dune Analytics, Ordinals activity sunk as low as 4k daily Inscriptions on October 12. However, this lull was soon followed by a strong resurgence as daily Inscriptions topped 403k on November 5.

Sponsored

Although November 5’s figure is below the all-time high of 441k daily Inscriptions, achieved on September 15, the uptick in activity indicated that Ordinals is far from finished. Moreover, the November 5 spike in Inscriptions netted miners $852.7k in daily Ordinals fees. For comparison, October 12’s local bottom in Ordinals activity yielded just $5.4k daily Ordinals fees for miners.

Commenting on the resurgence in Ordinals activity, tech entrepreneur Mike Alfred mentioned that Bitcoin miners stand to “make a literal mint.” However, users will suffer due to contending with a slower network and paying higher fees.

BTC Fees on the Rise

Bitcoin users are on the hook for network inefficiency and higher fees as Ordinals activity increases. Data from Blockchain.com showed an uptick in network fees to an average of $6.85 per transaction on November 7, marking a six-month high.

Sponsored

As Bitcoin makes further headway in establishing itself as a legitimate asset in the future, the chairman of Barefoot Mining, Bob Burnett, anticipates network fees to continue climbing. Burnett advised BTC holders to move their coins into long-term storage in preparation for an explosion in interest and activity.

Bitcoin fees are determined by the size of the transaction concerning the block’s 4MB limit, with larger transactions attracting bigger fees and network demand at the time of transacting.

Historically, fees have been between $0.50 and $2.50, but if Burnett’s prediction of an explosion in popularity and activity comes to pass, users should expect a much higher minimum cost.

On the Flipside

- Ordinals is described as a “square peg in a round hole” workaround due to the Bitcoin protocol not being designed from the ground up with large data storage in mind.

- Rising fees contradict Satoshi Nakamoto’s vision of BTC as a peer-to-peer “cash system.”

Why This Matters

The uptick in Ordinals activity has rehashed divisions about its place within the BTC ecosystem. While purists voice their concerns, it’s undeniable that miners stand to gain. Bitcoin’s long-term success depends on incentivizing miners, particularly as block rewards dwindle after each halving.

Learn more about the pushback from Bitcoin purists against Ordinals here:

Bitcoin Core Dev Insists on Ordinals Ban, Starts Civil War Instead

Find out about the allegations leveled against CoinMarketCap for exploitative practices here:

CoinMarketCap Grift Allegations Mount as Minswap Speaks Out