- The Bitcoin halving triggers high fees and long confirmation times.

- Peter Schiff revels in the post-halving woes.

- Schiff argues that tokenizing gold would be superior to Bitcoin.

Bitcoin’s hotly anticipated fourth halving took place on April 20, slashing the block reward for miners to 3.125 BTC. The event kicked off a new era of heightened competition among miners trying to secure increasingly scarce rewards. Many expect it to catalyze further innovation and adoption of experimental token standards like the BRC-20 and UTXO models on the base layer.

However, the halving also triggered a surge in transaction fees and network congestion, prompting Peter Schiff to slam Bitcoin as “a failure.” In a continuation of his ongoing attacks against BTC, the gold bug argued that tokenized gold would represent a “much better” version of Bitcoin than Bitcoin.

Tokenized Gold Better Claims Schiff

Attacking Bitcoin post-halving, Schiff declared that tokenized gold would work “much better on a blockchain than Bitcoin,” offering users near-instantaneous confirmations and minimal transaction fees.

This take came in response to criticisms over gold’s poor transportability, as X influencer Magoo PhD re-engaged debate over the superiority of Bitcoin over the shiny metal by asking Schiff, “How much does it cost to ship even 1lb of gold around the world in a secure manner?”

Sponsored

Schiff brushed off Magoo PhD’s comment as “irrelevant,” stating that gold is not currently used as a currency but tokenizing it on a blockchain would bestow the precious metal with the same digital transportability as BTC. Yet it would remain a superior monetary asset to the leading cryptocurrency, in Schiff’s view.

However, Magoo PhD countered by resurfacing a past exchange from 2022 where he had already explained to Schiff the pitfalls of tokenized gold. Namely, tokenizing physical gold still requires trusting a third party to store and custody the gold, introducing counterparty risk that Bitcoin’s trustless model avoids.

Sponsored

While the merits of Bitcoin over gold, and vice versa, continue to be debated, the post-halving reality was one of skyrocketing network fees.

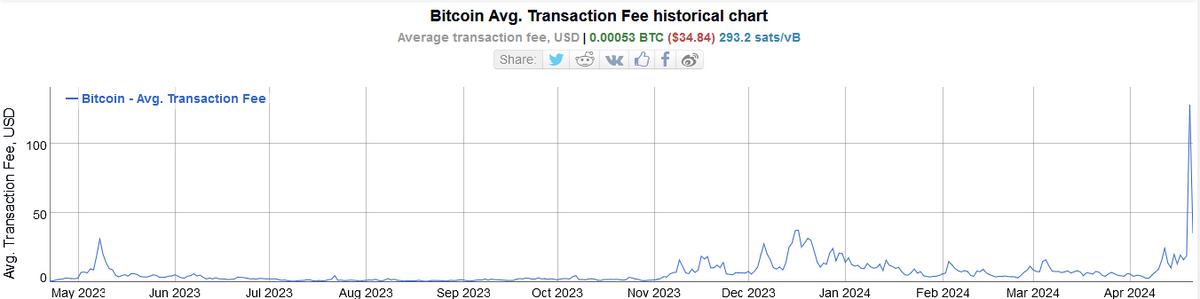

Bitcoin Fees Spike to New ATH

According to Bitinfocharts, the average Bitcoin transaction fees skyrocketed to an all-time high of $127.97 on April 20, the day of the halving, blowing past the previous record of $62.78 set back on April 21, 2021. While the average fee has since dropped 73% to $34.84, this remains significantly higher than the pre-halving range of $2.87 to $24.39 during April.

The sudden fee spike after the halving event may be attributable to several factors, including the launch of Runes, a new token standard based on Bitcoin’s UTXO model, differing from the Ordinals protocol underlying BRC-20 tokens. As explained by Bill Barhydt, Abra CEO, Runes aims to streamline the creation of fungible tokens on the base layer using “edicts” that transfer ownership without bloating the chain.

The situation has elicited a mixed response. Vinny Lingham, Rumi CEO, viewed it as bullish for “locking up supply” and potentially catalyzing the next bull run to $100,000 by dampening selling pressure. However, Dan Held highlighted how high fees present an existential problem for small balance holders if Bitcoin doesn’t resolve scaling to accommodate all use cases.

On the Flipside

- Redeemable tokenized gold already exists with offerings such as PAXG and XAUT.

- There is an ongoing debate around whether Ordinals and now Runes, are network spam, and should be banned.

Why This Matters

At its core, this clash between Schiff and Bitcoin proponents represents the fundamental ideological divide over what constitutes superior money, with neither side willing to back down. However, of greater concern for BTC is the potential for high fees to bring out a divide between the haves and have-nots.

Institutional investors appear unfazed by halving ramifications.

Bitcoin Halving Fuels FOMO as Institutional Investors Dive In

Cardano holders raise concerns over Kraken snub.

Kraken Wallet Excludes Cardano: ADA Advocates Alarmed