Bitcoin Runes are one of the most hyped and anticipated narratives of 2024. Ordinals and BRC-20 tokens have already brought previously unimaginable functionality to the Bitcoin network, sending transaction fees sky-high and attracting the ire of Bitcoin maxis.

While Ordinal fever appears to have calmed down, the Bitcoin ecosystem continues to expand at a delirious pace.

Sponsored

With advocates of Bitcoin’s thriving on-chain ecosystem claiming that the Runes protocol will reimagine BTC token standards, the question needs to be asked: What are Bitcoin Runes, and are they as important as everyone claims?

Table of Contents

What are Bitcoin Runes?

Bitcoin Runes are a new token standard for issuing fungible tokens on the Bitcoin blockchain. Founded by Casey Rodarmor, the original creator of the Bitcoin Ordinal protocol, in September 2023, Runes officially launched in April 2024 at Block 840,000 in a deliberate nod to the iconic Bitcoin halving event.

The fungible token protocol promises to expand Bitcoin’s growing DeFi ecosystem and resolve some of the issues that plague BRC-20 cryptocurrencies, namely those concerning blockchain efficiency.

Why Does Bitcoin Need Runes?

Suppose you’ve ever used an alternative Layer One blockchain like Ethereum or Solana. In that case, you’ll know that each network boasts a wide variety of digital assets, including utility and governance tokens, meme coins, and NFTs.

Sponsored

Providing a new fungible token standard helps make the Bitcoin ecosystem more diverse, allowing teams and developers to issue native tokens on the Bitcoin blockchain.

While the BRC-20 token standard pioneered this movement in 2023 using Ordinal theory, the protocol wasn’t without its flaws. Despite their revolutionary design, BRC-20 tokens are remarkably inefficient.

Issue and trading of BRC-20 tokens produce a large number of wasteful UTXOs, which add unnecessary bloat and congestion to the network, making Bitcoin transactions sluggish and expensive.

The new Runes protocol, on the other hand, is far more efficient. Rodarmor’s intelligent design effectively reuses these junk UTXOs, making for a cleaner and more seamless user experience.

But how exactly does all that work?

How Do Bitcoin Runes Work?

If we take a look underneath the hood, we find two fundamental features driving the new protocol: UTXOs and OP_Return.

What Does UTXO Mean?

UTXOs, or Unspent Transaction Output, are a complicated name for a rather simple idea. By definition, a UTXO is a specific amount of a digital asset that is the output of a previous transaction and is still waiting to be spent.

If you’ve ever tried minting a BRC-20 token or an Ordinal NFT, but another collector beat you to it, you’ve very likely received a UTXO instead of the asset you actually wanted. The received UTXO can still be reused, even if you didn’t mint that rare collectible.

Still scratching your head? Think of a UTXO as the receipt you get from a credit card machine when your payment declines. The receipt proves that some kind of activity took place, but the value in your account hasn’t changed, and you can still spend that money on something else.

Bitcoin Runes are assigned to UTXO assets through the Runes protocol using the OP_Return function, which characterizes each asset with important data.

What is OP_Return?

OP_Return is a unique function used for Bitcoin data storage that gives Bitcoin Runes their enigmatic quality. Essentially, OP_Return allows users to mint runes and encode specific data onto UTXO assets, including a name, symbol, or supply cap, without affecting the asset’s spendability.

Most importantly, the Rune protocols OP_Return code only allows users to etch up to 80 bytes of data to an asset. This is dramatically lighter and more efficient than BRC-20’s gargantuan memory capacity, which is capped at 4MB. Ultimately, this makes the Runes project more efficient at managing network resources.

Fancy technological terms aside, what does this actually mean?

What Does It All Mean?

In its simplest terms, the Runes protocol is a vastly more efficient platform for issuing and creating fungible tokens on the Bitcoin blockchain. It is far less resource-intensive than existing protocols like BRC-20, and uses unspent junk assets to store data and token information.

Using Runes instead of BRC-20 tokens will ease network congestion on Bitcoin and reuse and repurpose UTXOs that would otherwise sit dormant and add unnecessary bloating to the network.

As an added bonus, Bitcoin Runes and the UTXO model are also compatible with the Bitcoin Lightning network, meaning that they can theoretically be issued and traded in seconds while taking advantage of Bitcoin L2’s dramatically reduced fees.

However, for all the technological advancements, use cases for Bitcoin runes are still relatively underwhelming. For the time being, Runes tokens are almost exclusively limited to meme coins and airdrops.

Bitcoin Runes vs BRC-20

The arrival of Bitcoin runes prompts the burning question: How do they compare to Bitcoin’s incumbent fungible token protocol?

| Runes | BRC-20 | |

| Founder | Casey Rodarmor | Domo |

| Launch Date | April 2024 | March 2023 |

| Model | UTXO-Based | Ordinal Inscriptions |

| Efficiency | High – Due to low data requirements and the reuse of UTXOs | Low – Due to proliferation of junk UTXOs and high data requirements |

| Storage | Data is stored using OP-Return | Data is inscribed onto individual Satoshis |

| Compatibility | Compatible with the Lightning Network and selected wallets | Requires Ordinal-compatible wallet software |

Where can I Trade Bitcoin Runes?

Given the raging hype the crypto space witnessed for Ordinals and BRC-20 tokens, it’s unsurprising that traders are clamoring to join in the action. Ordinal NFT projects, like Runestones and RSIC, became wildly popular, with many enthusiasts anticipating that holding these collections would make them eligible for Rune airdrops.

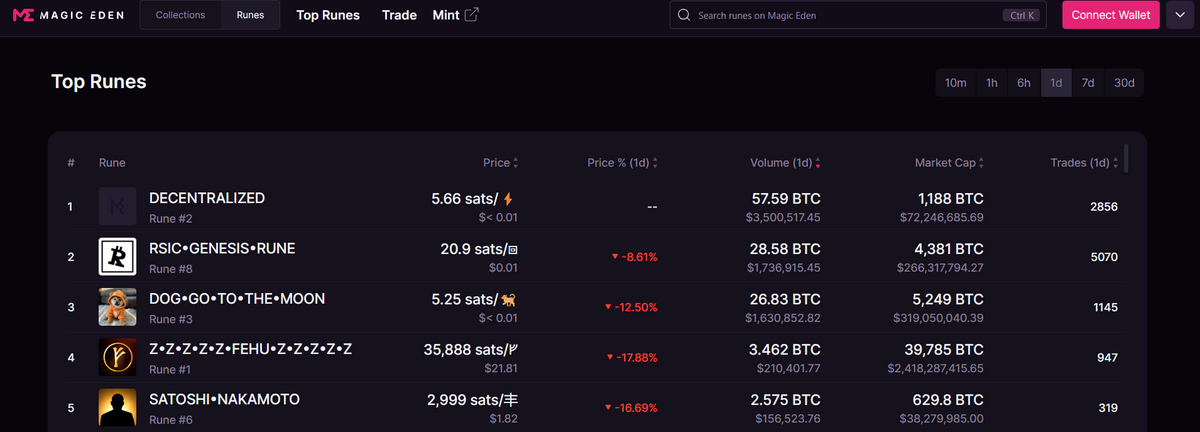

For now, Magic Eden and the OKX exchange have emerged as some of the leading marketplaces for buying and selling Bitcoin Runes. If you want to get started trading Runes, you’ll also need a compatible web3 wallet, like xverse or Unisat.

Bitcoin Runes Pros and Cons

Like every shiny new advancement in the crypto space, Bitcoin runes offer their fair share of benefits and drawbacks.

Pros

- They’re simple – Runes provides a much easier way to store, trade, and manage fungible tokens on Bitcoin. Gone are the days of accidentally mishandling your BRC-20s and losing them or needing to execute separate inscription transactions anytime you want to transfer them.

- Efficient – Thanks to the UTXO model, Runes are far more efficient than any other fungible token protocol on Bitcoin, using fewer resources and easing network congestion.

- Boosted miner revenue – Bitcoin miners rejoice. While block rewards have dropped since the halving, Runes are likely to bolster network activity and provide miners with an increased revenue stream thanks to high transactions.

- Lightning compatible – In theory, Runes are compatible with the Lightning network, meaning that they can be transferred quickly and affordably.

Cons

- Gas spikes – Despite Runes technically reducing network congestion, the launch of the protocol drove Bitcoin gas fees to all-time highs.

- Overhyped – Bitcoin Runes were touted as the next big thing, yet most early adopters report losses and high gas fees.

On the Flipside

- It’s still early days, but we’re yet to see the UTXO-based model yield something truly unique. For the time being, the Runes protocol has only produced a variety of meme coins.

Why This Matters

The Runes protocol is yet another technological advancement in the Bitcoin ecosystem. Given that Bitcoin is the largest digital asset in the crypto market, it’s important to stay informed on new developments within the network.

FAQs

The Runes protocol is an experimental platform that supports the issuance of fungible tokens on the Bitcoin network.

The Runes project aims to resolve some of the congestion and efficiency issues of former token standards on Bitcoin, including BRC-20.

You can buy Bitcoin Runes on marketplaces like Magic Eden and the OKX exchange.