- Binance’s market share drops to 48.7% amidst regulatory challenges.

- OKX gains 4.3% market share, leveraging Binance’s downturn.

- DEX landscape saw mixed results.

Binance has long stood as a giant in crypto, dominating the industry. However, 2023 witnessed a subtle yet significant shift, cutting into the market share of the dominant exchange.

Over the past year, Binance’s market share dipped below the 50% mark for the first time. As Binance faced regulatory issues, other exchanges, notably OKX and Bybit, expanded their influence.

Binance’s Market Share Wanes Amidst Regulatory Tides

On Wednesday, January 17, Tonkeninsight released a report on the state of crypto exchanges in 2023. The report details several major trends in the industry, including the relative decline of Binance.

Sponsored

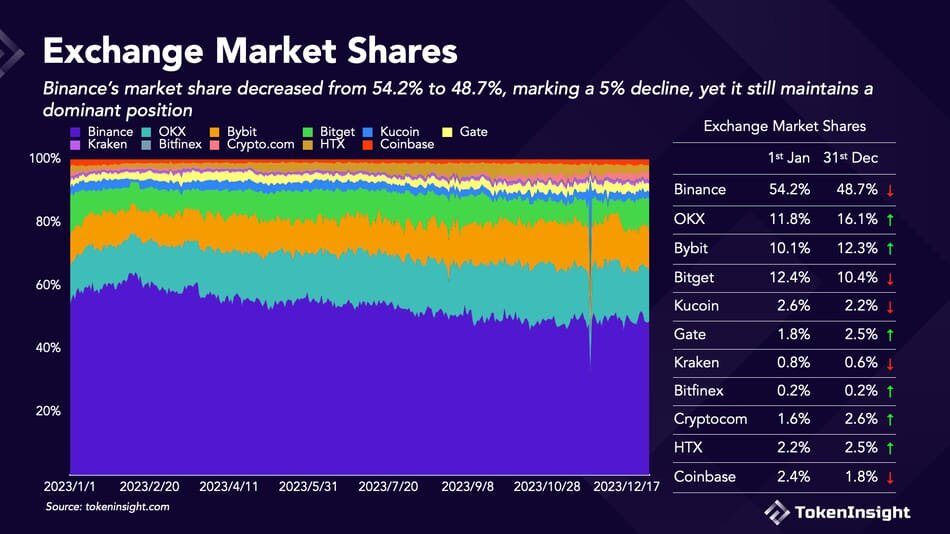

Binance’s market share declined from 54.2% at the beginning of 2023 to just 48.7% by year’s end. The main driver of this change was the Securities and Exchange’s lawsuit against the exchange.

This trend reached a critical point when Binance CEO Changpeng Zhao issued a public resignation letter, leading to a significant dip. At that point, Binance’s market share dropped to a low of 32% before rebounding.

Concurrently, other exchanges seized the opportunity to expand their market footprint. TokenInsight revealed that OKX, in particular, showcased a notable increase in its market share, marking an increment of 4.3%. Bybit, another significant player, also capitalized on the shifting market conditions, enhancing its market share by 2.2%.

DEX See Mixed Results in 2023

TonkenInsight’s report also revealed that, in 2023, decentralized exchanges (DEX) maintained a stable presence in the market. While not seeing dramatic growth, DEXs remained stable, accounting for approximately 2.83% of the total trading volume throughout the year.

Sponsored

The first quarter marked the zenith for DEXs, with a peak market share of 2.98%, coinciding with the highest transaction volume. However, this early surge was followed by a contraction in trading volume and market share over the next two quarters.

One of the standout performers in the DEX space was Orca, which, riding on the resurgence of the Solana ecosystem, significantly increased its market share, ending the year at 9.22%.

Another notable mention is PancakeSwap V3, whose launch in April 2023 brought substantial enhancements to its platform, pushing its average daily trading volume in the fourth quarter to over four times that of V2.

On the Flipside

- DEXs have a small yet loyal user base of tech-savvy traders. Increasing their market share requires educating new users about their platforms and features.

- Despite their advantages in terms of custody, DEXs still account for a relatively small portion of the total market share.

Why This Matters

Binance’s fluctuating market share and the rise of contenders like OKX and Bybit reflect the industry’s sensitivity to regulatory movements. Meanwhile, the stability of the DEX sector amidst these changes highlights traders’ diverse preferences and strategies within the crypto ecosystem.

Read more about decentralized exchanges and why they are important:

Decentralized Exchanges: Crypto’s Wild West or Blockchain Essential?

Read more about a Solana-based gaming project going multi-chain:

Solana-Based Taki Games Launches Polygon Pools on Quickswap