- Solana DEXs enjoy a major increase in trading volume.

- As a result, Solana TVL (Total Value Locked) jumped significantly.

- Despite the surge, Solana’s token price remains stable.

After facing an existential crisis post-FTX collapse, Solana has seen an enormous rebound. Known for its high-speed blockchain technology, the SOL token is up more than 100% in the last month, and its ecosystem is growing.

Most recently, its decentralized exchanges gained significant traction, with a substantial increase in trading volume. This volume is driving a surge in the chain’s TVL (Total Value Locked) metric.

Solana DEXs Surge in Trading Volume

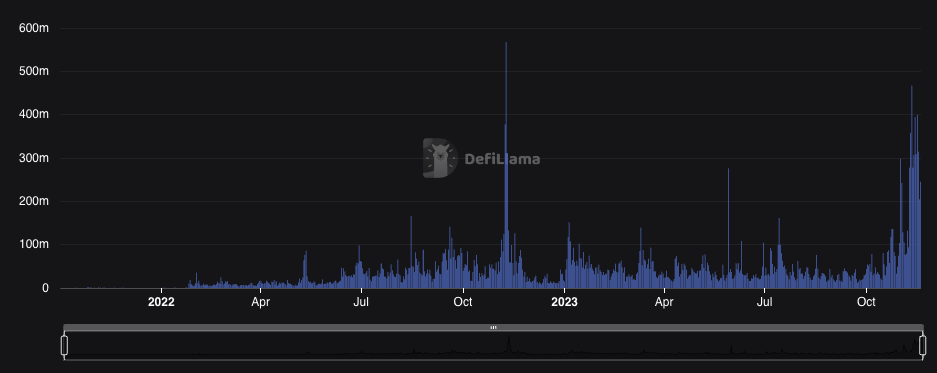

Solana’s decentralized exchanges, particularly Orca and Raydium, have experienced a significant increase in trading volume, with a 34% rise observed in the past week. This surge has propelled the overall weekly trading volume on Solana’s DEXs beyond the $3 billion mark.

In the past 24 hours, DEX volume was $337.89 million, contributing to $3.014 billion in trading volume over the last seven days. Such a substantial increase in volume hasn’t been seen since November 2022 amid the FTX collapse.

Sponsored

Accompanying the rise in trading activity is a substantial increase in Solana’s Total Value Locked. The TVL, a critical measure of the value of assets deposited in the DeFi platforms, has climbed by 43% since the beginning of November, from $409.68 million to $585.42 million.

The growth can be attributed to several factors, including increasing trust in decentralized platforms, and a growing global interest in DeFi solutions. Notably, crypto traders are increasingly distrusting centralized platforms, especially after the FTX collapse.

Sponsored

Interestingly, despite the significant uptick in DEX activity, Solana’s token price has remained relatively stable, trading above the $60 mark. This stability amidst growth is noteworthy in the often volatile cryptocurrency market.

Solana Surged More Than 600% This Year

In 2023, Solana (SOL) demonstrated an extraordinary market performance, with a remarkable 600% increase in value. On January 1, 2023, Solana traded at just below $10. Currently, it trades at $60.48.

Much of this increase came over the last month, as the altcoin more than doubled in the last 30 days. This bullish trend culminated in SOL reaching a high of $68 last week, before seeing a 10% correction.

The price rally indicates strong investor confidence in Solana’s technology, especially among institutions. Notably, 2023 marked a year of substantial institutional investment in Solana, with inflows amounting to an impressive $767 million. This figure surpasses the total institutional investments received in 2022 and is the highest since the 2021 bull market.

On the Flipside

- There are ongoing concerns regarding the large stash of SOL held by the now-defunct FTX exchange. However, these are yet to impact SOL price.

- Like many other altcoins, SOL currently trades far below its all-time high (ATH) of around $260, achieved nearly two years ago.

Why This Matters

The increase in trading volume and SOL’s price surge indicate strong market confidence in Solana’s technology and its potential as a DeFi platform.

Read more about how the FTX bankruptcy affects Solana:

FTX Moves $13.54M Solana (SOL) Amid Stalled Rally

Read more about Sam Altman’s exit from Open AI:

Sam Altman’s Exit from OpenAI Rattles Controversial Worldcoin