- Binance suspended withdrawals on the Solana network due to intermittent issues.

- The surge in trading volume on Solana potentially strains the network.

- Binance is identifying optimization areas to address the issue.

Solana’s recent trading volume surge, particularly driven by memecoins, signifies a growing interest and participation in its ecosystem. However, this increased activity may have contributed to issues with exchange withdrawals.

The cryptocurrency exchange Binance recently announced the intermittent suspension of withdrawals on the Solana network, citing increased transaction volumes.

Binance’s Halts Solana Withdrawals

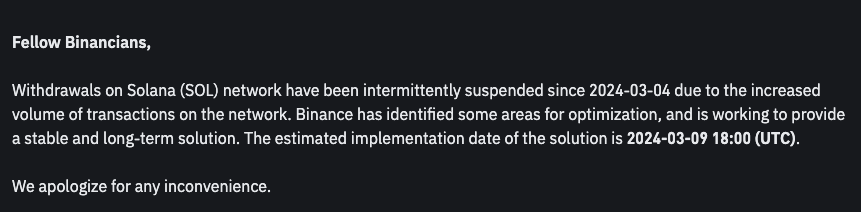

On Wednesday, March 6, Binance informed its users of the intermittent suspension of withdrawals on the Solana (SOL) network. The exchange revealed that withdrawals have been intermittently suspended since Monday, March 4.

To address this issue, Binance claims it identified areas for improvement that would lead to a “stable and long-term solution.” While Binance did not reveal these solutions, they set the implementation solution for Saturday, May 9.

Solana Network Experiences Significant Spike in Transactions

The issues on Binance coincided with a remarkable spike in transactions on Solana. On Monday, May 4, Solana’s decentralized exchange (DEX) trading volume astonishingly surpassed Ethereum’s, registering a record $2 billion in transactions within a 24-hour. This was the same day that Binance started suspending Solana transactions.

The surge is predominantly attributed to the increased activity surrounding memecoins within Solana’s ecosystem. In particular, established memecoins such as WIF, POPCAT, BONK, TRUMP, and WEN saw a significant surge in activity.

The spike in Solana’s transaction volume could be a plausible factor behind Binance’s decision to suspend withdrawals on the Solana network intermittently. High transaction volumes necessitate operational adjustments by exchanges to ensure stable network performance.

On the Flipside

- Binance has experienced issues leading to the suspension of Solana (SOL) withdrawals on several occasions, including in April 2022. At the time, the exchange cited a high volume of withdrawal requests that included blank transaction IDs, which led to transaction failures on the Solana network.

- Solana dropped 7% on the day of the announcement. However, the drop coincided with a larger market correction, hitting other major altcoins.

Why This Matters

The suspension of SOL withdrawals by Binance underscores the ongoing scalability challenges faced by blockchain networks. As the DeFi sector continues to expand, the ability of these networks to handle surges in transaction volumes is crucial for their long-term viability and success.

Sponsored

Read more about Solana’s recent surge in transactions:

Can Solana Ecosystem Overtake Ethereum as Memecoins Surge?

Read more about Radix’s plan to boost DeFi liquidity: