- Solana stablecoin volumes skyrocketed in the past few months.

- Phoenix DEX recorded massive USDC volumes into the blockchain.

- The major part of the volume was not actually transferred.

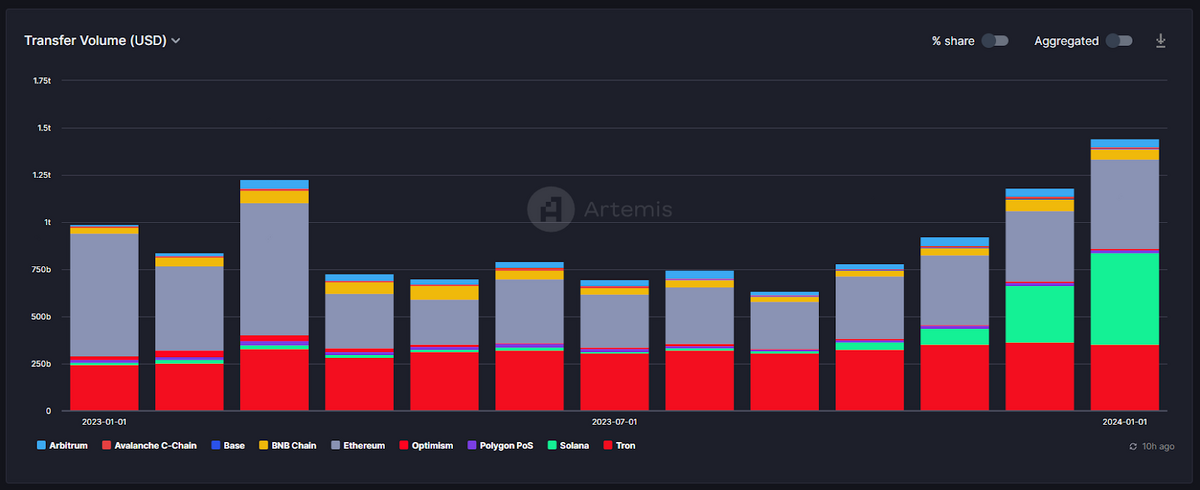

The volumes of stablecoins moved on the Solana blockchain recently have significantly increased, outperforming Ethereum. However, on-chain metrics suggest that the portion of volumes was not genuine.

As volume is a critical metric that gives valuable insights into market activity and helps us make better-informed investment decisions, DailyCoin looks into how this has happened.

Solana Stablecoin Volumes Spiked Heavily

The total value of stablecoins transferred across the Solana blockchain is experiencing an incredible surge for the second consecutive month.

Sponsored

In January alone, 33.8% of all on-chain stablecoin transfers (equivalent to a $144.3 billion volume) occurred on Solana, making it a leading blockchain and surpassing the traditionally dominant Ethereum.

Quite a significant amount for Solana, whose monthly stablecoin trading volumes were 778% lower just three months ago.

The explanation of why this happened is simple. The growth in Solana stablecoins was first kickstarted by the Jito (JTO) token airdrop, which caused a significant wealth effect amongst users as nearly $200 million were given away, say Jon Ma and Nirmal Krishnan, the top executives of Artemis blockchain data provider.

Sponsored

“This created more liquidity for existing users and an influx of new users searching for airdrops. Additionally, the growth of meme coins like BONK and WIF, which have historically never played out on Solana, has created room for more retail activity.”

But that is not all. As Artemis execs highlighted, the increasing on-chain activity on Solana has generated interest in orderbook DEXes, particularly one called Phoenix.

Phoenix Contributed to High USDC Volumes

Phoenix, an on-chain orderbook decentralized exchange, has played a significant role in Solana’s recent stablecoin volume increase. It stood out as a highly active DeFi protocol, especially since the beginning of 2024.

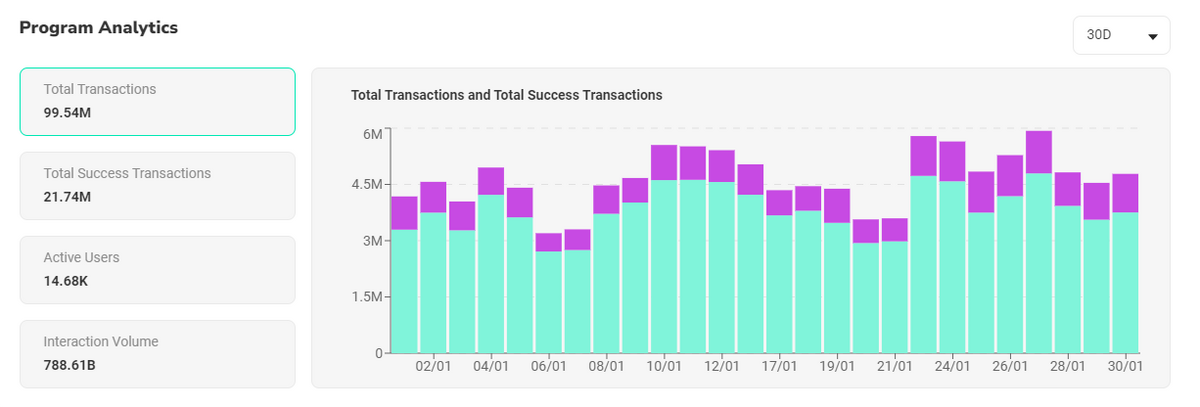

The protocol’s orderbook carried out 99.5 million transactions within the past month, reaching the impressive 788.61 billion volume of interactions this January, as per Solscan blockchain explorer.

Much of this volume came from the stablecoin transfers, particularly USDC. As the Artemis team says, Phoenix’s share reached about $13 billion in December alone.

But as on-chain analytics discovered, Solana recorded at least $219.7 billion worth of USDC transfers related to Phoenix’s official wallet. It’s nearly 54% of the whole network’s stablecoin volume.

USDC is the main stablecoin, contributing to most transactions on the Phoenix exchange. At least one-third (33%) of the total value locked on the protocol comes in the world’s second-largest stablecoin at the time of writing.

The Numbers Don’t Match

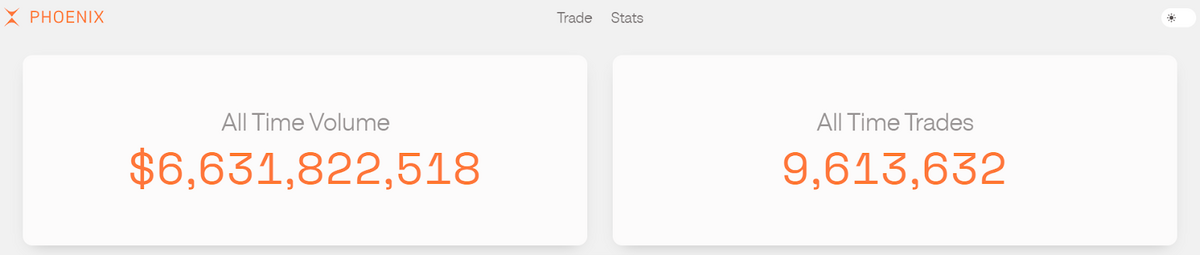

However, if we look at the all-time volume that has ever passed through Phoenix, we will see that it is not much higher than $6.63 billion at the time of publishing.

Moreover, a platform launched in August 2023 only processed the cumulative USDC volume of $2 billion over the past 30 days. And this is the total number generated from at least eight different USDC trading pairs available in its orderbooks.

DeFiLlamma’s data matches the latter figures. According to the on-chain aggregator, Phoenix’s total trading volumes (stablecoins included) climbed upward since the first week of December, steadily increasing by $2.3 and 2.5 billion each month until February 2024.

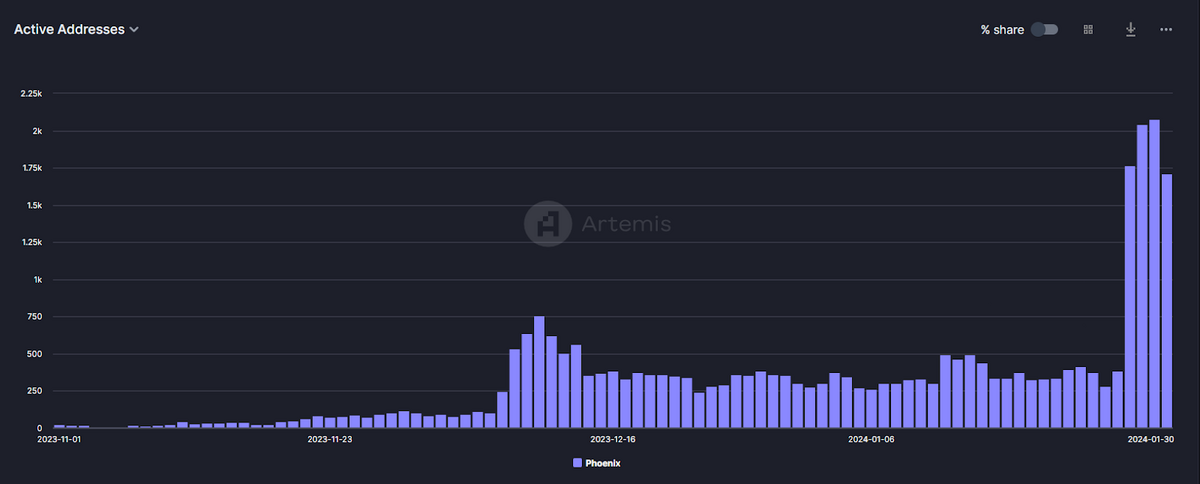

The confusion arises, however, when looking at Phoenix’s active addresses, which have lingered below 500 since mid-December and only skyrocketed in the very last days of January, reaching close to 2000 active users per day.

This means that in January alone, the platform had around 16,800 active users, collectively generating $2.5 billion worth of transactions, or on average $148.8K each.

So, how could a protocol with a $6.46 billion all-time trading volume possibly push Solana’s stablecoin volumes up by at least twice the higher number?

The answer lies in the unique characteristics of the Phoenix exchange, which allows us to raise doubts about the veracity of this stablecoin trading volume.

Phoenix Records Any Order on Blockchain

Contrary to an Automated Market Maker (AMM), the popular type of decentralized exchange, Phoenix is an instant settlement on-chain orderbook DEX with active liquidity.

This means such an exchange manages its orderbooks on-chain, and any order placed on its orderbook is instantly recorded on the blockchain. And any order means any order. Whether the order is executed or canceled, it is already recorded onto the digital ledger.

Such an operating model enables faster, real-time price discovery and reduces the risk of high slippage compared to the off-chain orderbook DEXes, where only executed transactions are recorded on the blockchain.

At the same time, on-chain orderbook DEXes are much more vulnerable to data manipulations, as orders can be canceled the next second after they have been recorded on the blockchain.

Public data suggests that the on-chain orderbook nature of Phoenix could have contributed to inflating Solana’s volumes as it recorded all orders, including those that were immediately canceled.

As on-chain analytic @jhackworth discovered, at least 88% of Solana’s USDC trading volume mainly came from two major accounts that can be identified as the market maker regularly sending stablecoins between different accounts:

Solana is a high-speed and low-cost blockchain for decentralized applications, often called the Ethereum killer. It can handle 65,000 transactions per second and is a scalable choice for fast, cheap, high-volume stablecoin transfers.

Solana Stablecoins Volume Metric Becomes Questionable

So, what about the trading volume metric, you may ask? Is it still reliable? After all, volume is still one of the key metrics that can influence market cap by reflecting the network’s activity and liquidity and investors’ sentiment.

However it may be, the Solana network alone boasts 26 decentralized exchanges, with at least four of them being on-chain order book DEXes that instantly record any order on the blockchain.

Considering that all of these platforms are relatively young and have the potential to grow, we should be cautious not to take Solana stablecoin volume metrics too seriously—or at least bring a much bigger grain of salt when we evaluate them.

Find out more about the EU’s crypto regulation:

MiCA Tames Crypto Asset Service Providers. How Does It Affect Retail Investors?

Check out what to do when the exchange has frozen your assets:

Crypto Withdrawals Frozen? Here’s What You Must Know