While Halloween is only scary for one day, the crypto market can give us nightmares all year. Whether it’s a multi-million dollar hack or another lawsuit in the SEC’s endless crusade against cryptocurrency, the blockchain industry has more than one way of giving us the cold sweats.

But where there is fear, there is also bravery. No matter the horrors the market inflicts upon us, the crypto community seems always to find a way to bounce back and return stronger than ever.

Sponsored

Let’s recap some of the scariest moments in cryptocurrency this year and give you some sage advice on overcoming your crypto market fears.

Table of Contents

Scariest Moments in Crypto This Year

Like any good Halloween horror flick, the crypto space is plagued with unexpected villains and dreadful events. We’ve seen our fair share of exploits and brutal crashes in 2023, with some sowing seeds of doubt into even the most valiant blockchain supporters.

Hacks, Hacks, and More Hacks

Crypto’s most dastardly devils have been more active than ever this year, pillaging the blockchain space and hacking protocols left, right, and center. CertiK, one of the largest security firms in the industry, estimates that over $1.3B USD has been lost to hacks and scams in 2023.

This statistic is especially chilling, considering we still have two of the most vulnerable months coming. The holiday season is a happy hunting ground for scammers looking to take advantage of bargain hunters during the gift-giving period.

Sponsored

Two specific hacks stand out among dozens of on-chain exploits: Multichain and Euler Finance.

Multichain Mayhem – In July, suspicious transactions were detected within the Multichain cross-chain bridge protocol. Over $125M worth of crypto assets and digital currencies were withdrawn from the bridge. The development team announced they were investigating the issue, only to suspend services a day later.

Most blockchain detectives consider the Multichain ‘hack’ an inside job, covering up a badly disguised rug pull. Chinese Police arrested the Multichain CEO.

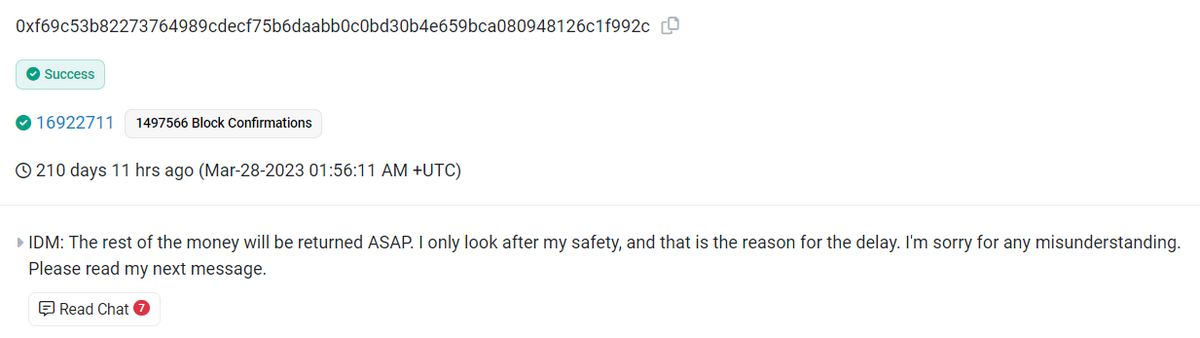

Euler Finance’s Flash Loan Fiasco – Euler Finance, a popular DeFi lending app built on the Ethereum (ETH) blockchain, fell victim to a flash loan attack in March this year. Pseudonymous hacker ‘Jacob’ could withdraw $197M from the platform by exploiting the DonateToReserve function.

Fortunately, this tale has a happy ending. Feeling remorseful and maybe wanting to avoid a life on the run, Jacob returned the stolen funds. Adding another layer of mystery, one of the wallets involved in the hack is linked to the Lazarus Group, the North Korean cybercrime group behind DeFi’s most devastating hacks.

Worldcoin’s Eyeball Hunt

Worldcoin (WLD) introduced a concept that seems straight from a dystopian sci-fi horror flick. The latest start-up from OpenAI and ChatGPT founder Sam Altman aims to create ‘Proof-of-Humaness,’ ensuring human authenticity in a world populated with bots and AI.

It’s a noble idea, but participating in the Worldcoin ecosystem comes with a catch. Users need to get their irises scanned, taking their biometric data and turning it into hashed blockchain code that proves they’re human.

Worldcoin has promised that iris scans are immediately deleted after hashes are created, but Sam Altman’s latest venture has drawn plenty of criticism from privacy watchdogs. Security breaches and biometric data make for a malicious combo.

The fact that participants received a financial incentive in exchange for a scan of their iris made many crypto enthusiasts fearful for what might come next.

Shibarium Launch Failure

Shibarium, Shiba Inu’s much-anticipated Layer-2 blockchain, promised to be the next big thing for the SHIB community. While the dust has settled and the launch is now widely considered a success, the network’s maiden voyage was uncertain.

Technical glitches derailed the blockchain’s first moments, locking about $1.7 million in ETH within the Shibarium cross-chain bridge for several nail-biting hours. Users were met with “non-functional” RPC systems, a less-than-stellar blockchain explorer, and a network outage that lasted several days.

As it turned out, Shibarium’s architecture was solid. Shytoshi Kusama and the rest of the Shiba Inu development team underestimated the sheer volume of network traffic. Shibarium was overwhelmed by eager users, each itching to be one of the first users of the new network.

Fortunately, this story has a happy ending. But I’d be lying if there weren’t a few scary moments when the SHIB Army asked themselves if they would ever see their locked funds again.

The SEC vs. Coinbase: A New Crypto Legal Drama

Gary Gensler and the SEC spent 2023 on a quest for crypto blood. On top of their long-standing legal battle with Ripple Labs and XRP token sales, the SEC also filed a lawsuit against Brian Armstrong’s crypto exchange, Coinbase.

The SEC charged Coinbase with operating its crypto asset trading platform as an unregistered national securities exchange, broker, and clearing agency. On top of that, Gary Gensler’s troops also accused Coinbase of failing to register its crypto asset staking-as-a-service program. This service promised rewards for users willing to stake their digital assets.

Coinbase is widely considered one of the ‘good guys’ of the crypto space. The cryptocurrency exchange has always tried to stay on the right side of regulators and has avoided the fear, uncertainty, and doubt that plagues other platforms like Binance.

By launching an offense against one of the industry’s pillars of integrity, the SEC tried to bring down crypto’s image on a global scale. The SEC’s move struck fear into the hearts of Coinbase customers and crypto enthusiasts worldwide.

How to Face Your Fears in Crypto

Crypto hacks, eyeball hunts, and legal dramas are enough to freeze the blood in your veins. It’s easy to feel overwhelmed and make emotional decisions. How can you overcome these moments of fear and panic?

- Stay Educated – Knowledge is your most potent weapon against fear and uncertainty. Rely on facts from official sources you trust and the rumors and emotional commentary that run rampant on social media.

- Believe in Your Convictions – Trust your own research and stay faithful to your convictions. Solana bulls who believed in the future of the network are now up around 200% YTD, despite the network being slandered and dragged through the mud on social media.

- Uphold Good Security Practices – Keep your funds safe by avoiding suspicious dApps and smart contracts. Use a cold storage hardware wallet to lower the risk of having your private keys stolen or compromised.

On the Flipside

- Despite crypto’s fair share of scary calamities, plenty of good news and positive progress indicate that the industry is on the right track. The crypto space is finally rallying after a seemingly endless bear market, which was tarnished by catastrophic events like the LUNA death spiral and the FTX collapse.

Why This Matters

There will always be bad news and scary moments in any market. Crypto’s inherent volatility only amplifies these feelings. Overcoming these fears will help you avoid making emotional decisions driven by fear and panic.

FAQs

2024 plays host to the Bitcoin halving, an event where BTC mining rewards are reduced. Historically, Bitcoin halvings have indicated the beginning of a new bull cycle, although nothing is ever guaranteed.

2023 has been a decidedly good year for crypto. While the space suffered plenty of hacks, volatility, and legal dramas, most coins are up YTD, and sentiment has vastly improved since last year.

That’s a personal choice for you, and you alone, to make. If you do choose to invest in cryptocurrency in 2023, make sure you do your own research and never invest more than you can afford to lose.