- The recent streak of net inflows to crypto funds ended last week.

- Bitcoin funds dominated last week’s outflows.

- CoinShares argues that recent outflows do not suggest a significant shift in sentiment.

For nearly three months, positive sentiment bolstered by the anticipation of approving Bitcoin (BTC) spot ETF in the U.S. had driven weekly net inflows into crypto investment funds. However, after slowing down the week prior, crypto funds finally ended their inflow streak last week.

11-Week Crypto Fund Inflow Streak Broken

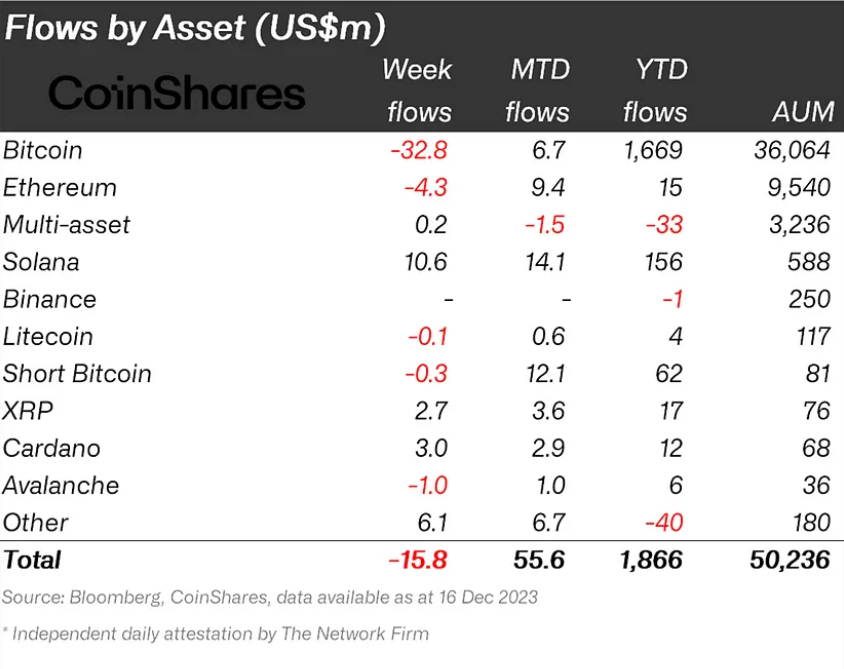

The recent 11-week run of net inflows that saw crypto investment funds rake in over $1.7 billion has ended. Last week, crypto funds recorded net outflows of $16 million, according to CoinShares’ most recent digital asset fund flows report published on Monday, December 18.

Per the report, BTC investment funds recorded the most outflows, with $33 million. However, investment funds linked to the leading digital asset were not the only focus of outflows.

Aside from BTC, Ethereum (ETH) and Avalanche (AVAX)-related funds also recorded outflows of $4.4 million and $1 million, respectively.

Sponsored

Despite these outflows, a basket of altcoins bucked the trend even as CoinShares suggested that last week’s outflows did not necessarily indicate an overall shift in sentiment.

SOL, ADA, XRP, LINK Buck Outflow Trend

Unlike BTC, ETH, and AVAX-linked funds, Solana (SOL), Cardano (ADA), XRP, and Chainlink (LINK)-related funds recorded inflows in the past week of $10.6 million, $3 million, $2.7 million, and $2 million, respectively. The divergence suggests a rotation of capital from higher cap to lower cap assets, indicating a growing risk appetite.

Sponsored

CoinShares contended that last week’s net outflows were more likely linked to profit-taking than a significant shift in market sentiment. The asset management firm based this analysis on the week’s mixed regional flows. While crypto investment funds in the U.S. and Germany recorded outflows of $18 million and $10 million, respectively, funds in Canada and Switzerland recorded inflows of $6.9 million and $9.1 million, respectively.

On the Flipside

- Inflows to crypto funds remain net positive year-to-date (YTD) above $1 billion.

- CoinShares suggests investors are only pausing to take profits and have not turned bearish.

Why This Matters

Crypto fund flows provide insight into investor sentiment. According to CoinShares, last week’s inflows hint at a prevalence of profit-taking sentiment after an extended period of price appreciation.

Read this for more on the recent crypto inflow streak:

Crypto Fund Inflows Plummet 76% as Short Sentiment Rises

ETH whales are accumulating. Find out more:

Ethereum (ETH) Whales Eye Higher Prices With $230M Spree