The XRP Ledger is the backbone of the Ripple ecosystem. A decentralized public ledger designed to rival Bitcoin (BTC) itself, the XRPL promises to revolutionize the financial industry and reinvent cross-border payments.

Open-source, decentralized, and scalable, the XRP Ledger provides plenty of functionality to financial institutions looking to leverage blockchain technology. But despite XRP being one of the oldest cryptocurrencies in the digital asset industry, there is still some confusion about how Ripple Labs, XRP, and the XRPL interact.

In this article, we’ll explore the XRP Ledger and how this low-cost blockchain works.

What Is the XRP Ledger?

Designed to be affordable and energy-efficient, the XRP Ledger is the underlying blockchain network that supports the Ripple global payments network. Like Bitcoin, XRPL facilitates digital currency payments between anonymous accounts and provides an immutable public register of transactions.

Sponsored

The XRPL boasts a thriving developer community, claiming that the network supports a variety of dApps and products like decentralized exchanges and NFT marketplaces. Like Ethereum (ETH), the XRP Ledger is fully open-source, meaning anyone can access its codebase and create innovative applications that drive growth and adoption towards the network.

How Does XRPL Work?

The XRP Ledger is powered by a unique consensus algorithm called the Ripple Protocol Consensus Algorithm (RPCA). The RPCA algorithm is energy-efficient, fast, and capable of processing up to 1,500 TPS (transactions per second).

Sponsored

Unlike Proof-of-Work chains like Bitcoin, Ripple enjoys low transaction costs. The average cost for a simple transaction on the XRPL will set you back less than $0.0002, making it far more scalable than traditional networks.

When a transaction is initiated on the XRP Ledger, it gets sent to validator nodes which work together to confirm the transaction using the RPCA consensus mechanism. Once the transaction is verified, it is added to the XRP Ledger and the transaction is completed in a matter of seconds.

According to Ripple, there are over 150 XRPL validator nodes.

XRPL dApps

Despite being operational since 2012, the XRP Ledger doesn’t appear to have a great range of decentralized applications. This is due mainly to the fact that XRPL doesn’t support smart contracts in the same way that DeFi-rich chains like Ethereum can.

At this point, XRPL smart contracts are limited to escrow vaults, multi-signature agreements, and asynchronous payment channels. This gives developers more limited tools than if they were building on other chains like Aptos (APT) or Cardano (ADA).

That being said, there are still a couple of applications on the XRP Ledger that users can explore.

OnXRP

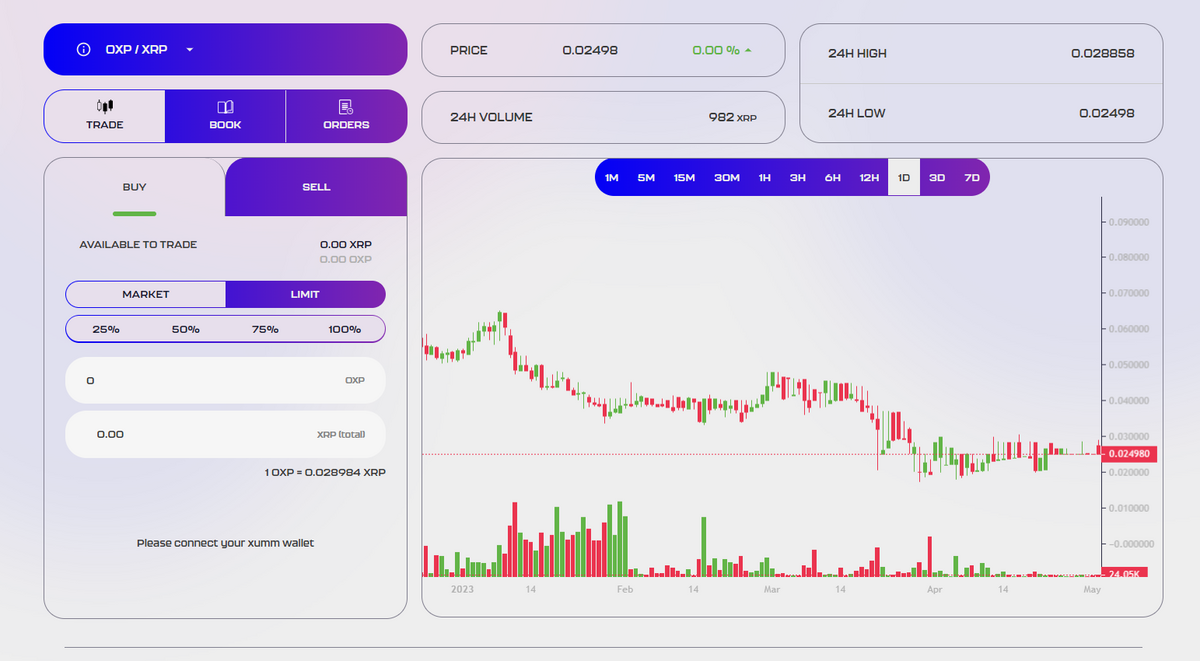

OnXRP is a one-stop shop for a permissionless and trustless experience on the XRP Ledger. The platform features a decentralized exchange and NFT marketplace. With OnXRP, users can trade cryptocurrency tokens, like stablecoins, directly on-chain in real time.

What’s interesting about OnXRP is that the team has control over which tokens get listed on the exchange. While this limits the chances of scams, one could argue that it means the platform isn’t truly decentralized.

What’s more, the OnXRP DEX has low trading volume, registering as little as 982 XRP tokens in a 24-hour period. This figure pales in comparison to the statistics we see on other networks with far smaller market caps.

XRP.cafe

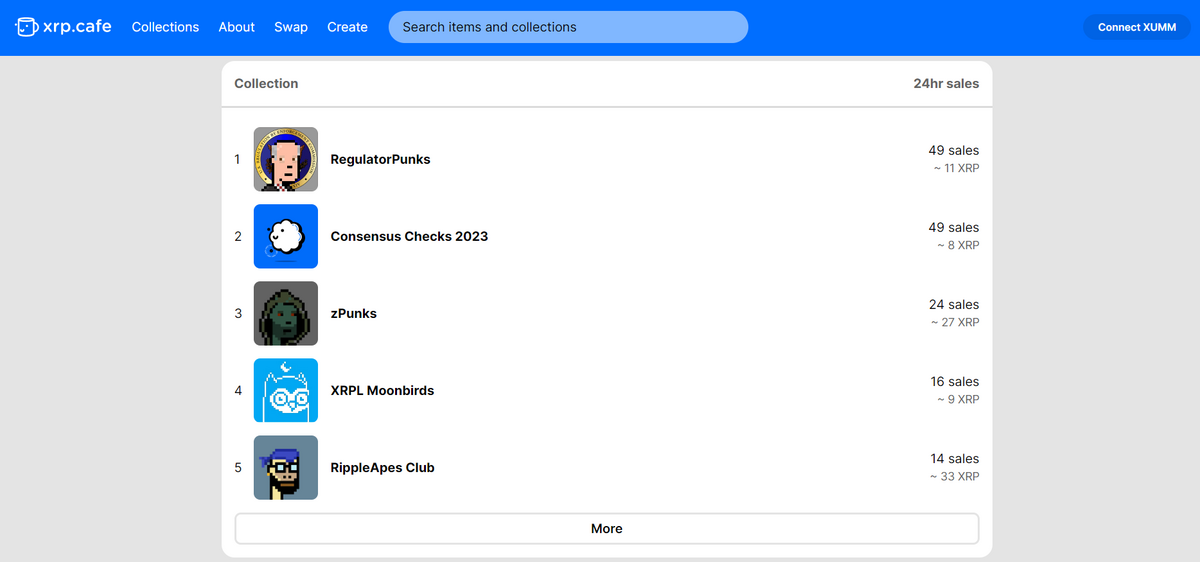

XRP.cafe is a simple marketplace where collectors buy and sell trending non-fungible tokens on the XRP ledger.

As seems to be the trend on the XRP ledger, trading volumes are low compared to competing networks. This is potentially due to the fact that Ripple Labs and the XRP community are more focused on building scalable global payments networks than thriving DeFi and NFT ecosystems.

Who Created the XRP Ledger?

The XRP Ledger was created by Ripple, a San Francisco-based company dedicated to building scalable decentralized networks. Ripple was founded in 2012 by Chris Larsen, Jed McCaleb, and Arthur Britto with the goal of providing a faster and more cost-effective way to transfer money across borders.

The company has gone through a few branding changes in its lifespan. Originally called RipplePay, the blockchain startup rebranded to OpenCoin in 2012 and held an ICO, selling the XRP token to early investors. Under the guidance of David Schwartz, the Ripple CTO, the XRPL was launched shortly after.

Ripple’s primary focus is on providing blockchain-based payment solutions to RippleNet, a network of financial institutions such as central banks and payment processors.

What’s the Difference Between Ripple, XRP and the XRPL?

For crypto enthusiasts learning about Ripple, it can be hard to wrap your head around all the moving parts underneath the Ripple umbrella. Let’s recap the roles and responsibilities of each element.

- Ripple – Led by CEO Brad Garlinghouse, Ripple is the technology company behind the wider Ripple ecosystem.

- XRP – XRP is a cryptocurrency used to pay transaction fees and secure the XRP Ledger.

- XRP Ledger – The XRPL is a public, decentralized blockchain network where users can transfer and store cryptocurrency and interact with dApps.

XRP Ledger Pros & Cons

Offering a fast and affordable network, the XRP Ledger certainly has plenty going for it and has great potential as a global payments network. However, it has some glaring drawbacks when compared with its competitors.

Pros

- Fast – The XRPL is a performant network able to achieve a transaction throughput of up to 1,500 TPS.

- Affordable – The XRP Ledger is cheap and scalable, with every transaction fee only costing the user a fraction of a cent.

- Energy-efficient – According to Ripple, the XRPL uses 61,000 times less energy than the Bitcoin blockchain. This makes it a far more sustainable option for blockchain mass adoption.

Cons

- Outperformed by newer competitors – While XRP is faster and more affordable than networks like Bitcoin and Ethereum, it’s completely outclassed by modern blockchains like Aptos or Solana.

- Underdeveloped ecosystem – Despite being operational for over a decade, there are hardly any functional dApps built on the XRPL.

- Low usage – XRP is one of the largest cryptocurrencies in the industry. However, usage statistics like DEX trading volume show that not many holders are actually using the XRPL regularly.

On the Flipside

- In 2020, the U.S. Securities and Exchanges Commission (SEC) filed a lawsuit against Ripple. This lawsuit has had a resounding effect on the growth of XRP and might be a reason why the XRPL doesn’t receive as much usage as it should.

Why You Should Care

The XRPL is the cornerstone of the Ripple ecosystem and the XRP cryptocurrency. XRP is one of the largest digital assets in the industry, so it’s important to understand how its main product works and the use cases it provides.

FAQs

XRP and the XRP Ledger are not the same thing. XRP is a cryptocurrency, while the XRPL is a decentralized blockchain network.

While some people would argue that XRP could replace Bitcoin due to its increased scalability, the reality is that Bitcoin is far more decentralized and is also considered a store of value.

XRP Ledger fees are estimated at around USD 0.0002 per transaction.

You can buy XRP tokens on top crypto exchanges like Binance or Coinbase.

Yes, anytime you want to send a transaction you will need XRP to pay the network fees. This requirement extends to banks and other financial institutions.