- Crypto funds saw record outflows last week.

- CoinShares has attributed the apparent shift in market sentiment to jitters following Bitcoin’s price correction.

- Despite the broader trend of outflows, a basket of altcoins managed to fare well.

Following the approval of spot Bitcoin ETFs in the U.S., significantly high investor demand has largely led to record inflows for crypto funds. Last week, however, this demand appeared to dwindle amid concerns about Bitcoin price action, ending a record-breaking run of inflows.

$1B Outflow Breaks 7-Week Streak

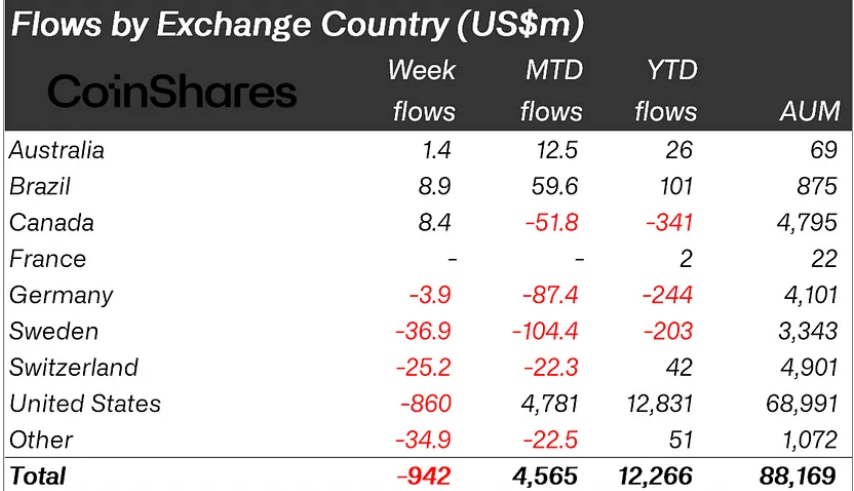

Last week, crypto funds saw record outflows totaling $942 million, according to CoinShares’ most recent fund flows report. The net weekly outflows ended a seven-week streak of inflows that had seen crypto funds record a whopping $12.3 billion, far more than the $10.6 billion recorded for 2021 at the peak of the last bull market cycle.

CoinShares suggested that last week’s record net weekly outflows came amid jitters over Bitcoin’s price action. The asset had quickly retreated below $61,000 after clinching new all-time highs above $74,000.

Sponsored

"We believe the recent price correction led to hesitancy from investors, leading to much lower inflows into new ETF issuers in the US," CoinShares Head of Research James Butterfill wrote.

Last week, the newly launched Bitcoin ETFs saw a record five days of net outflows, only able to rake in $1.1 billion in inflows. All the while, Grayscale’s GBTC continued to bleed heavily, with outflows totaling $2 billion. For context, these funds had recorded over $3 billion in inflows the week before, far outpacing about $1.2 billion in outflows from GBTC.

Beyond the U.S., crypto funds in Sweden, Switzerland, Hong Kong, and Germany also saw net outflows of $37 million, $25 million, $35 million, and $4 million, respectively. Brazil and Canada were the only regions to buck the trend, with net inflows totaling $9 million and $8.4 million, respectively.

Looking specifically at how funds tied to different assets fared, Bitcoin funds unsurprisingly saw the largest net outflows totaling $904 million. Funds tied to Ethereum, Solana, and Cardano also suffered net outflows totaling $34 million, $5.6 million, and $3.7 million, respectively.

Sponsored

In a twist suggesting capital rotation to smaller cap assets, other altcoins fared better, with net inflows totaling $16 million. Notable mentions in this category include Polkadot, Avalanche, and Litecoin, with $5 million, $2.9 million, and $2 million, respectively.

Read this for more on recent Bitcoin ETF flows:

Bitcoin ETFs End Week in Net Outflows Amid BTC Pullback

Nigeria’s crackdown on Binance has taken a new turn. Find out more: