- Cardano journeys a rocky road to recovery.

- Cardano’s first fiat-backed stablecoin becomes the best-performing native asset on the network.

- Cardano Founder Charles Hoskinson is looking for trouble with the XRP community again.

Earlier this month, Cardano excited market participants, hitting a new yearly high and sparking hopes of reaching the highly coveted $1 price level. With just a 20% gain remaining, ADA seemed poised to make another summit.

Yet, as fate would have it, the market threw a curveball, pouring cold water on everyone’s expectations and sending ADA on the hunt for liquidity. DailyCoin’s expert analyst, Insha Zia, sheds light on these exciting developments.

Table of Contents

News and Events: Understanding the Impact

ADA Rocky Recovery

Cardano set the stage on fire in March, blazing through historical resistances and catapulting to levels last seen in 2022. Riding high on its momentum in the first half of the month, ADA marked a 2-year high at $0.8, fueling excitement among market participants.

Sponsored

However, optimism quickly gave way to disappointment as Cardano experienced a sharp 30% decline, dropping to $0.57 in just one week. The main culprit? Bitcoin’s round-trip.

After tapping its new all-time high of $73,000 earlier this month, Bitcoin quickly spiraled toward $60,000, triggering chaos across the market by forcing leveraged traders out of their positions. This led to altcoins experiencing drops as high as 30%.

Sponsored

Cardano has since recovered a fair bit from its fall, bouncing back to $0.61 at press time. ADA’s recovery comes on the heels of the Federal Reserve’s dovish outlook for 2024, as it mulls over introducing interest rate cuts in the year’s second half.

Cardano’s First Fiat-Backed Stablecoin Launches and Depegs… Upwards?

On March 16, Mehen made history by launching Cardano’s first fiat-backed stablecoin, USDM. The new stablecoin is available to eligible institutional buyers in the approved 17 US states for minting. It is also scarcely available to users on Cardano’s largest decentralized exchanges, MinSwap and Genius Yield.

USDM’s debut marked a pivotal moment for the network and the community as demands for such an option intensified. The hype surrounding the new stablecoin, fueled by the prior absence of a fiat-backed stablecoin on the network, resulted in it skyrocketing by an impressive 400% to $5, a rare sight.

The sudden price surge prompted Mehen, USDM’s issuer, to caution users against buying the Cardano stablecoin at inflated prices. At the time of writing, USDM had retraced back to $1.6 after peaking at $5.

Charles Hoskinson Denies Abandoning Hydra

Hydra, Cardano’s highly anticipated layer-2 scaling solution, touted by founder Charles Hoskinson to potentially make the network the fastest payment system in the world, had recently lost its buzz after garnering much hype on social media.

The silence from IOG executives surrounding Hydra led to rumors about the project’s potential abandonment.

Charles Hoskinson swiftly addressed the FUD on X, extinguishing any potential sparks of concern. The Cardano founder debunked rumors of Hydra’s shutdown, reaffirming that the project was more productive than ever.

Hoskinson further hinted at upcoming research and enhancements to the Hydra protocol, advising the community to stay tuned to the official page for the latest information.

In a separate post later, Hoskinson also shared a link to Hydra’s monthly report, where the team behind the scaling solution detailed fixing bugs, making optimization, and exploring supporting multiple versions.

Charles Hoskinson Weighs in on ETH Foundation Investigation

Earlier this week, the SEC sought to cause mischief in the crypto industry by launching an investigation into the Ethereum Foundation, just as hopes for an Ether ETF were rising.

The SEC’s investigation marks a shift from the commission’s previous position, wherein, in 2018, former SEC official William Hinman declared Ether not a security. This stance previously sparked controversy, particularly within the XRP community, who dubbed it “ETHGate.”

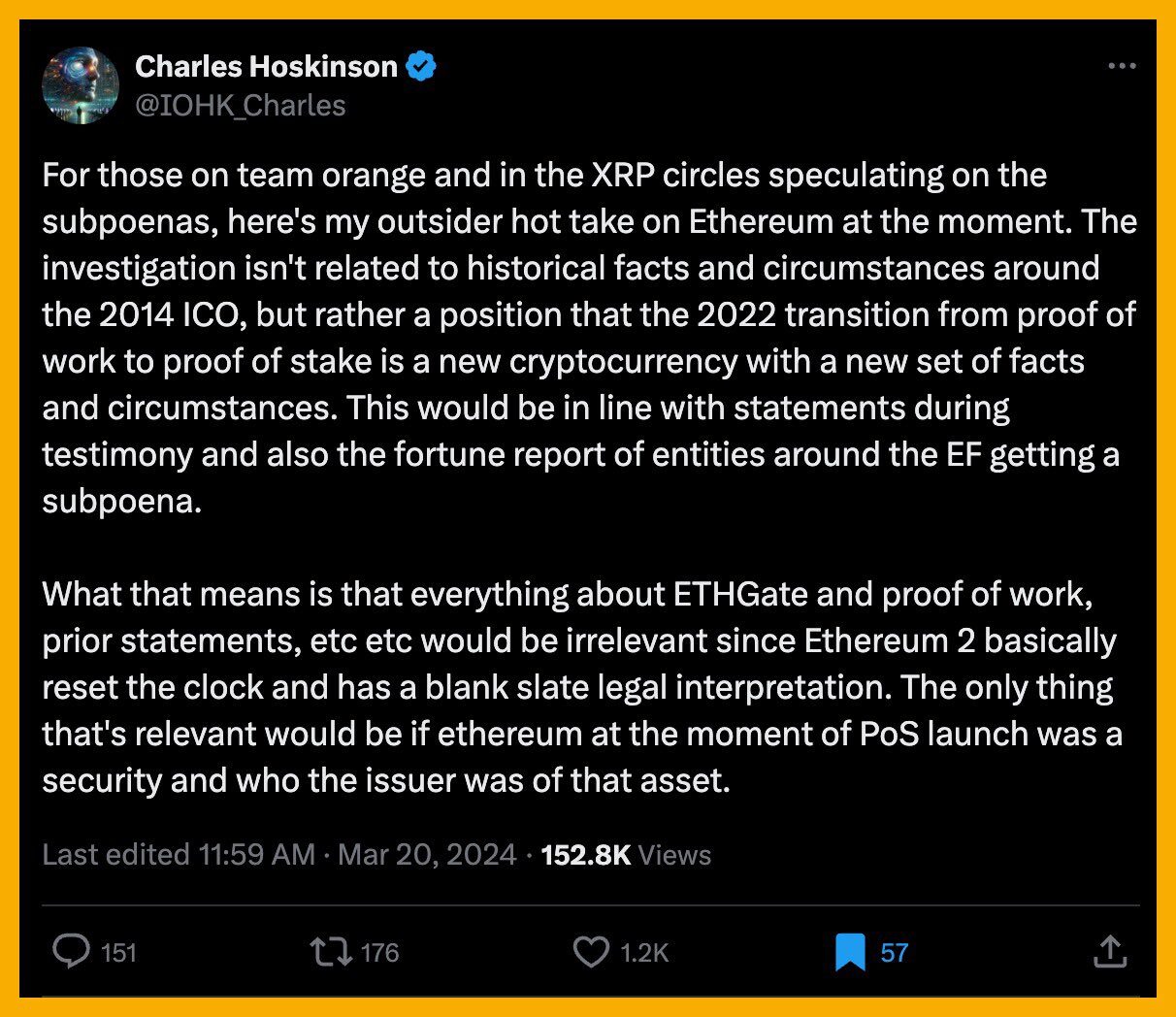

Charles Hoskinson often finds himself in heated debates with the XRP community, particularly on ETHGate. Now, with the SEC sounding a different alarm, the Cardano Founder strived to set the record straight with the XRP community.

In a now-deleted tweet, Hoskinson addressed the SEC’s investigation into the Ethereum Foundation. The Cardano founder clarified that the commission’s concerns stem from Etheruem’s transition to Proof-of-Stake in 2022, not its 2014 ICO. Hoskinson emphasized that post-’The Merge,’ Ethereum’s classification as a different cryptocurrency rendered previous ETHGate discussions irrelevant.

Cardano Dethroned as the #1 Dev Platform

Cardano has long been the top developer platform with consistent updates, solutions, and commits. According to crypto intelligence tracker Santiment, the network’s thriving development activity consistently held the number one spot in the rankings for months.

However, in a surprising turn of events, Chainlink, renowned for its decentralized Oracle network, has overtaken Cardano. Chainlink now claims the title of the number one platform by development activity, with over 451 daily developer submissions in the past 30 days. Cardano closely trailed behind with 445 daily developer submissions.

Current Outlook

Cardano’s outlook for the following weeks will be a wild ride, especially with the Bitcoin halving slated between April 12 and April 16. As we approach the halving, the market will likely experience some turbulence caused by sell pressure, which will likely ripple through ADA’s price.

However, Cardano has shown remarkable resilience, especially earlier this year, when it managed to hold onto crucial support levels despite challenging conditions. With support from larger wallets, there’s hope that Cardano is likely to weather the storm and rebound once market sentiment improves.

It’s worth noting that ADA still holds a bullish structure. Over the following months, Cardano could set its sights on tapping $1 after sweeping the liquidity at the bottom. However, the journey wouldn’t be without challenges, and achieving this milestone all hinges on fresh capital into Cardano.

On the Flipside

- Market dynamics can be unpredictable, so it is essential to consider alternative perspectives and opinions when evaluating the potential future performance of ADA.

- ADA’s yearly growth has since fallen to 30% from peaking at 63%.

Why This Matters

Cardano recently raised apprehensions by dropping a whopping 30% in a week. The following weeks are crucial for ADA to showcase strength and regain investor confidence. Should it struggle to do so, Cardano will likely drop lower and retrace a significant portion of this year’s gains.

Read more about Cardano’s first Fiat-backed stablecoin:

Cardano Stablecoin Depegs… Upward? USDM Surges 400%

Read the last DailyCoin Regular:

DailyCoin Bitcoin Regular: BTC Breaks Records, But Can the Rally Last?