Cardano vs. Solana is arguably the fiercest battle between alternative layer one blockchains in the cryptocurrency industry. Each network brings plenty to the table and has the potential to dethrone kingpin Ethereum at the top of the smart contract hierarchy.

While Cardano sticks to a purist, systematic approach and envisions a utopian blockchain ecosystem, Solana sacrifices these ideologies in exchange for a bit more razzle-dazzle.

What are the key differences between Solana and Cardano? What makes these blockchain platforms so powerful, and which will come out on top?

Table of Contents

Cardano vs. Solana: Quick Facts

Before diving underneath the hood and dissecting the finer points of the Cardano vs. Solana debate, let’s recap some of the basics:

| Cardano | Solana | |

| Founder | Charles Hoskinson | Anatoly Yakovenko |

| Launched | 2017 | 2020 |

| Market Cap | $20B | $80B |

| Circulating Supply | 35B | 444M |

| All-time High | $3.1 | $262 |

| Consensus Mechanism | PoS | PoH & PoS |

Unlike Proof-of-Work networks, Solana and Cardano rely on validator nodes to verify transactions and create new blocks. This makes them vastly more sustainable than yesteryear’s blockchains while ensuring minimal transaction fees.

What Is Cardano (ADA)?

Founded by Charles Hoskinson, Cardano is a Proof-of-Stake (PoS) blockchain network designed from the ground up from peer-reviewed academic theory. Thanks to the Ouroboros consensus mechanism, Cardano is energy efficient, decentralized, and highly secure.

The Cardano network is considered the purist blockchain and ticks all the boxes of a perfect protocol. Since its genesis block, Cardano has maintained perfect network uptime and boasts some of the best decentralization scores in the industry.

Sponsored

Hosting various dApps, products, and services, the Cardano ecosystem is slowly but surely growing. The network has proven stable and reliable, making it a popular choice for businesses leveraging blockchain technology to create inventive new use cases.

What Is Solana (SOL)?

Anatoly Yakovenko envisioned the Solana blockchain with scalability and functionality in mind. Blending both Proof-of-History (PoH) and Proof-of-Stake (PoS), Solana is perhaps the most performant blockchain in the cryptocurrency industry.

Transaction speeds on Solana are some of the best in the space. The network is capable of handling a transaction throughput that legacy networks like Bitcoin (BTC) and Ethereum (ETH) can only dream of.

Solana’s ecosystem is burgeoning, with on-chain activity surging to staggering levels. The network boasts a thriving decentralized finance scene, with on-chain trade volumes threatening Ethereum’s reign.

Solana vs. Cardano: Key Differences

At first glance, Solana and Cardano are quite similar. They are both layer-one blockchains that support smart contract development and employ consensus algorithms dedicated to sustainability and energy efficiency.

Both networks offer various apps and services, like defi and NFT protocols, but that’s where the similarities end. What are the defining characteristics that separate the two networks?

Scalability

One of the biggest differences between the two networks is their respective scalability and speeds.

In theory, the Cardano blockchain is capable of handling 250-1000 transactions per second, with transactions processed in seconds. In reality, the limits of Cardano’s scalability have never truly been tested due to an insufficient amount of on-chain activity.

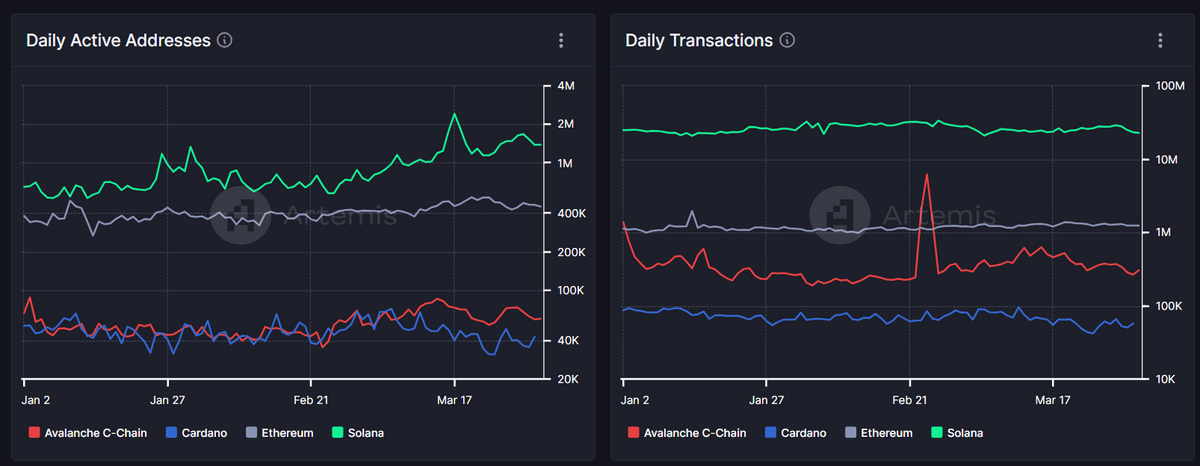

Data provided by Cexplorer, the leading Cardano blockchain explorer, suggests that the network regularly handles under ten transactions per second.

Solana, on the other hand, was built with speed and scalability in mind. On-chain data shows the network continuously processes over 800 real TPS, with non-vote transactions hovering between 2000 and 4000. The upcoming Solana Firedance Client is expected to push these figures to even greater heights.

But it hasn’t all been smooth sailing for Solana. While the network’s blistering speed is impressive, it’s caused plenty of issues for Solana.

Network Stability

One of Solana’s biggest criticisms is its instability. While it’s great news that the chain has so many eager users, the burden of success is often hard to bear.

On numerous occasions, Solana has suffered unexpected network outages that caused the blockchain to freeze. While the network has always been restored relatively quickly, instability is a massive concern for the crypto faithful.

Meanwhile, Cardano’s meticulous, research-driven approach to blockchain architecture has meant that the network has maintained perfect, unbroken uptime since its launch.

This has become a source of great pride amongst Cardano fans, who consider the network’s stability and security one of its strongest features.

Decentralization

Decentralization is one of the founding principles of the blockchain world. A blockchain network’s whole point is that its governance and infrastructure are well-distributed and free from singular points of failure.

In this respect, Cardano is one of the market leaders. With over 3000 separate validators and one of the highest Nakamoto coefficient scores in the industry, the Cardano network is as decentralized as it comes.

When Solana originally launched, blockchain purists were scathing of the low number of validators on the network and the questionable distribution of SOL tokens to angel investors. Solana was considered a centralized VC chain designed purely for early investors to dump their tokens on a ravenous crypto market.

However, Solana has been able to turn things around in recent years. The collapse of FTX and Alameda Research, some of its biggest supporters, has leveled the playing field and meant that SOL tokens are well distributed between market participants.

Moreover, over 1700 validators work day and night to ensure that the Solana network is properly distributed. Solana now boasts an impressive Nakamoto Coefficient score. While it still hasn’t achieved Cardano ADA levels of decentralization, it still beats out other layer one rivals like Ethereum or NEAR.

Programming Language

Solana and Cardano are built using vastly different programming languages. While the average user won’t notice the difference, it remains an important difference that significantly impacts the network itself.

Cardano and all the dApps and projects built upon it are written in Plutus, a smart contract programming language written in Haskell. This language is only used within the Cardano ecosystem, making it difficult for developers to onboard and limit interoperability with other networks.

All EVM networks rely mainly on the Solidity programming language, meaning that developers can easily hop between chains to deploy new protocols.

Solana contracts are written in Rust, a far more common programming language. This makes it much easier to bring new developers into the ecosystem and encourage the creation of new applications and services that grow the chain.

Why Is Solana Better Than Cardano?

Solana fans would argue that the network is far better suited to supporting millions of users. The network has proven itself as the most performant blockchain in the industry and handles more transactions and active wallets than most of its competitors.

The network features low fees and fast transactions, making it perfectly placed for mass adoption. Beyond that, the network appears to have resolved the uptime issues it previously suffered and is becoming more decentralized by the day.

Why Is Cardano Better Than Solana?

Cardano fans will tell you that the Cardano network is doing things correctly and taking its time.

On paper, Cardano is the perfect open-source network. Its unique Proof-of-Stake consensus mechanism is efficient and keeps transaction costs low, while the network’s huge variety of stake pools ensures maximum decentralization.

Beyond that, Cardano’s native token, ADA, didn’t witness the huge angel investor funding SOL benefitted from, meaning that ADA has a far more organic token distribution.

Final Verdict

Comparisons are fun, but let’s get down to business. Which network is objectively superior, and which altcoin is a better investment?

Ultimately, it depends on your personal preference and investment thesis.

Solana might be faster, flashier, and more popular, but it still needs to work on plenty of things before it can truly win the layer one race.

Likewise, Cardano might be perfect on paper, but theory will only get you so far. Until the network is battle-tested and the ecosystem starts seeing a significant influx of users, Cardano fans won’t know if their blockchain is ready to take over the crypto market.

On the Flipside

- Both Solana and Cardano face stiff competition from a growing number of rival layer-one blockchains. As more modern networks emerge, Solana and Cardano might be outclassed and left behind in favor of newer, more impressive technology.

Why This Matters

Cardano vs Solana is a raging debate in crypto circles. Knowing more about these networks’ strengths and their differences will help you better understand the blockchain industry and the SOL and ADA tokens.

FAQs

That’s a matter of personal preference and depends on your investment goals.

According to CoinMarketCap data, Solana’s market capitalization is around 80B at the time of writing.

ADA fans consider Cardano the best crypto, mostly due to its research-driven approach to development and industry-leading decentralization.