Mehen’s USDM promises to bring new depth and stability to Cardano’s thriving DeFi ecosystem. While the Cardano network already has an impressive selection of algorithmic stablecoins, the chain has often been criticized for not offering a digital asset as ‘reliable’ as USDT or USDC.

What is a fiat-backed stablecoin, and why have they widely considered a safer alternative to their algorithmic cousins? Is Mehen’s USDM digital currency truly secure, and will it usurp DJED’s place as the Cardano blockchain’s safe haven?

Table of Contents

What Is USDM?

Named after a mythological Egyptian serpent tasked with protecting the Sun God, Ra, and the body of Osiris, Mehen Finance envisions a transparent, stable, and economically secure on-chain ecosystem within the Cardano network.

Like their cross-chain peers, Tether (USDT) and USD Coin (USDC) are fiat-backed stablecoins pegged to the value of the United States dollar. That means that, no matter what happens in the crypto market, 1 USDM can always be redeemed for cold, hard fiat currency through the Mehen App.

Sponsored

Beyond that, USDM is fully integrated into Cardano’s DeFi ecosystem. That means USDM can be used freely in Cardano’s financial applications, including decentralized exchanges and lending platforms.

How Does USDM Work?

In what can only be described as a great step forward for the cryptocurrency industry and a milestone achievement for Cardano, creating USDM is a relatively straightforward process.

Sponsored

Eligible financial institutions and individuals can connect both a Cardano wallet and their real-world bank account to the Mehen app. Once connected, fiat USD can be deposited into Mehen reserves.

For every $1 stored in Mehen reserves, the user can mint 1 USDM on the Cardano Blockchain through Mehen’s secure and verified smart contracts. A 1.5% burn fee is charged on all withdrawals to cover operational fees.

All mint and burn transactions are verified through Charli3, Cardano’s leading decentralized oracle protocol, adding a layer of trust and security to the platform.

While the financial institutions responsible for minting and burning USDM must complete KYC procedures and strictly adhere to AML (anti-money laundering) standards, the average user can still use USDM anonymously and interact with Cardano defi discretely.

What Problem Does Cardano’s USDM Solve?

Despite the impressive strides and innovative technology, the crypto market is best known for one thing: volatile price movements. While these meteoric price surges and devastating market dumps have made crypto assets popular, they’ve also made cryptocurrencies a poor means of exchanging value.

Stablecoins like USDM help to provide a haven from the cryptocurrency market’s inherent volatility. For example, while ADA, the native token of the Cardano network, might swing up or down as much as 20% in a day, USDM is pegged to the value of the USD and should maintain a consistent value.

While algorithmic stablecoins like DJED have existed on Cardano for years, there are still lingering doubts about their safety. Though DJED has no history of dramatic depegs, crypto market participants are forever fearful of another LUNA-esque disaster.

Being a fiat-backed stablecoin, USDM’s depeg risk is significantly lower than an algorithmic coin because USDM can always be redeemed for USD at a 1:1 ratio.

USDM Concerns

While it all sounds good on paper, there are still a few lingering doubts about Mehen and the USDM stablecoin.

First, the rollout of the Mehen platform has been plagued with delays and stories of dropped partners. USDM and the Mehen protocol were originally expected to launch in 2023, but they were set back by the brutal collapse of Silicon Valley Bank, Silvergate, and Signature Bank in March.

A prospective banking partner, Cross River, who was expected to work alongside Mehen, also backed away from associating with the platform. Instead, the banking firm opted to side with Circle, the industry powerhouse behind USDC.

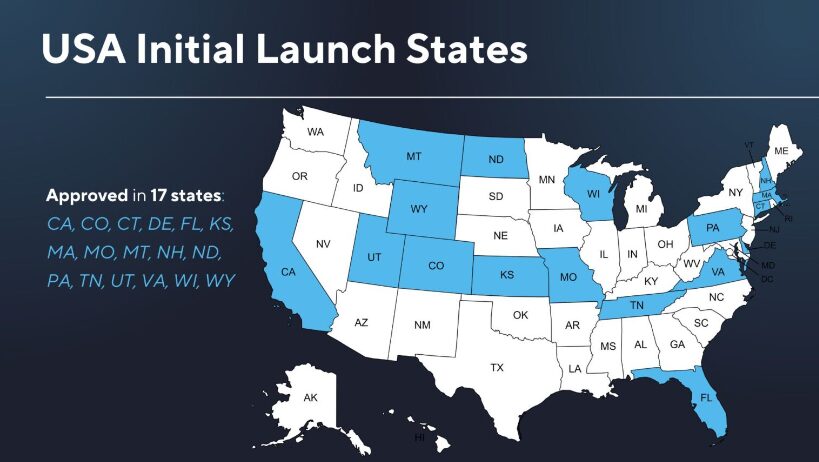

Additionally, USDM minting and burning is only currently available in 17 U.S. states. This presents a sizable obstacle to adoption and might inhibit Mehen’s growth potential. That said, plans have been implemented to expand the protocol’s exposure to European jurisdictions.

Finally, questions have been raised regarding whether or not the Mehen team is truly all in on the project itself. The protocol Chief Technology Officer, Steven Fisher, has disclosed that he already has a separate daytime job and considers USDM a passion project.

While that’s not a particularly serious issue, USDM holders might prefer that the CTO of a protocol that will likely handle millions of dollars worth of funds considers the platform his top priority.

Mehen’s USDM Pros and Cons

Mehen and USDM provide a much-needed service to the Cardano blockchain, but what drawbacks should we look out for?

Pros

- Fiat-Backed – Unlike its stablecoin rivals on Cardano, USDM is fully backed by fiat reserves, giving holders greater confidence and protecting the crypto asset from a catastrophic depeg.

- Interoperable with Cardano DeFi – As you’d expect, USDM integrates directly with the leading DeFi apps on Cardano, like Minswap.

Cons

- Limited Exposure – Given that USDM token minting and redemption is only available to certain financial institutions in 17 U.S. states, the protocol might struggle to grow effectively.

- Competitive Market – Cardano’s stablecoin market is already dominated by DJED and IUSD, which might make it hard for USDM to gain traction.

On the Flipside

- The fact that the protocol’s Chief Technology Officer considers the project a passion project might give some holders pause.

Why This Matters

A fiat-backed stablecoin will add confidence and security to Cardano’s burgeoning DeFi ecosystem.

FAQs

USDM is a cryptocurrency created by the Mehen protocol that lives on the Cardano network.

A fiat-backed stablecoin is a digital asset pegged to the value of a certain fiat currency and redeemable for that currency at a 1:1 ratio.