The Bitcoin halving is one of the biggest events in the crypto calendar. Rolling around only once every four years, the BTC halving event is eagerly anticipated by blockchain and cryptocurrency enthusiasts. It is historically considered the leading catalyst for an upcoming bull run.

Why is the Bitcoin halving such a crucial milestone in the cryptocurrency world and what does it mean for the digital asset market? Is it truly the herald of new all-time highs for BTC, or is the halving just another clever ploy promising outsized returns?

Table of Contents

What Is the Bitcoin Halving?

One of the main reasons Bitcoin is considered valuable is its inherent scarcity and anti-inflationary mechanisms. No matter what happens in global financial markets or international politics, there can never be more than 21 million BTC.

Sponsored

While the circulation of fiat currencies like the USD or the Euro can be endlessly created, BTC is hard-coded to have a fixed supply. This is why many Bitcoin bulls claim that the crypto asset is the modern world’s ultimate store of value.

While most of the BTC supply is now freely roaming through markets and blockchain wallets, around 6% of all Bitcoin is still in the process of of being distributed. These new bitcoins enter the circulating supply through block rewards paid to bitcoin miners who help to secure the network and produce new blocks.

Every 210,000 blocks, or roughly every four years, the amount of bitcoins distributed to miners in each block gets cut in half. This reduction in emissions is called the Bitcoin halving, originally coined by BTC’s mysterious founder, Satoshi Nakamoto.

Sponsored

Seems simple enough, but why would a reduction in bitcoin mining rewards be bullish for the crypto market?

Why is the Bitcoin Halving Event Such a Big Deal?

The Bitcoin halving is widely considered a positive catalyst for BTC price. There are plenty of theories as to why the halving is so influential, but the two most commonly accepted beliefs are as follows:

Reduction in Miner Sell Pressure

Bitcoin mining has come a long way from its early days. In the early years, almost anyone interested in a new digital asset could mine BTC from home using a semi-powerful computer.

These days, however, BTC mining is a competitive commercial endeavor. Bitcoin mining rigs demand enormous resources to operate effectively, requiring gargantuan amounts of energy and hyper-specialized hardware to be profitable.

These materials aren’t cheap, and some Bitcoin mining operations are constantly selling a portion of their block rewards to remain afloat and stay in business.

Every time a Bitcoin halving event rolls around, the number of bitcoins being sold by miners is effectively cut in half, greatly reducing the consequent sell pressure that hits the markets.

Against reduced selling, Bitcoin bulls have historically prevailed in post-halving months and years, leading many investors to believe that the Bitcoin halving is a key driving force behind the surging price of Bitcoin.

Bitcoin Becomes More Scarce

With the rate of new bitcoin issuance decreasing and the number of long-term investors increasing, the amount of bitcoin changing hands on the market declines. This time around, it looks as though Bitcoin scarcity will hit new levels.

Thanks to the success of Bitcoin ETFs and the growing number of long-term whale holders like Michael Saylor and Microstrategy, significant amounts of Bitcoin’s total supply are getting locked up into the hands of some of the world’s largest financial institutions and central banks.

Entities like Blackrock, Vaneck, and Valkyrie have needed to secure large positions of Spot BTC to offer Bitcoin ETFs to their clients, meaning that their holdings likely won’t be back on the market for a long time.

On top of that, the number of lost bitcoins only continues to rise. Chainalysis, a reputable blockchain research firm, estimates that over 20% of all BTC is stored in inaccessible wallets that have remained untouched for years.

What Does the BTC Halving Mean for Other Cryptos?

Bitcoin is undoubtedly the trendsetter within the digital asset market. The world’s original cryptocurrency is the first port of call and deepest source of liquidity in the market, making it the center of gravity in the wider ecosystem.

Historically, most crypto assets follow Bitcoin’s price movements. When BTC pumps, other coins like Ethereum (ETH), Cardano (ADA), and Solana (SOL) are never far behind. Likewise, when Bitcoin dumps, its younger siblings quickly collapse in its wake.

Given that Bitcoin’s halving has historically signaled bullish market dynamics, many market participants argue that it is good news for Bitcoin and the entire blockchain industry.

Bitcoin Halving Price History

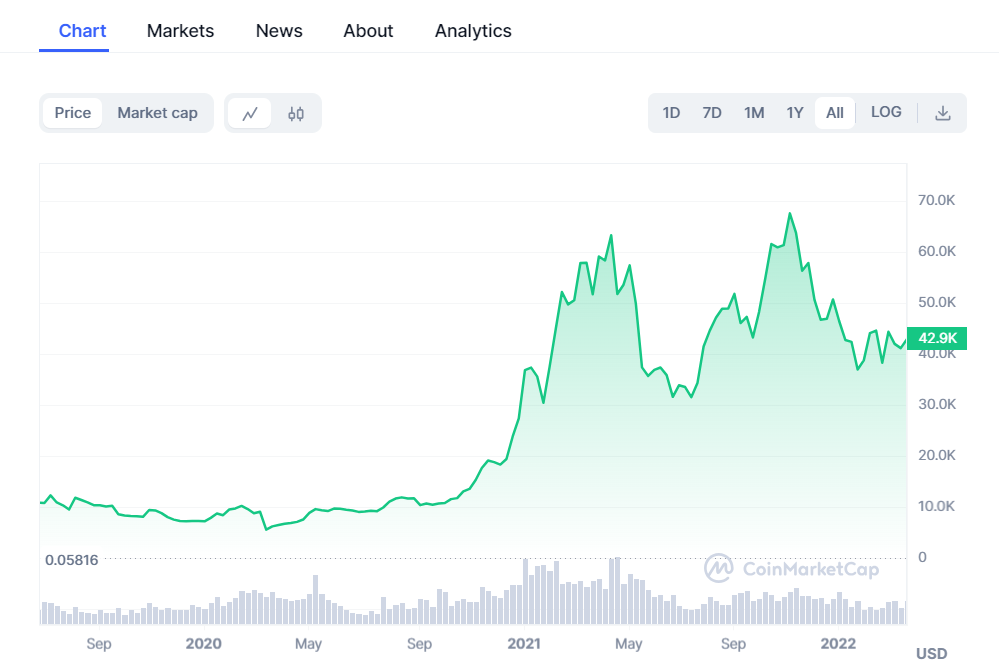

Speaking of historical data, what exactly can we learn from previous halvings? What impact did past halvings have on Bitcoin price appreciation and how dramatically did they change the circulating supply of Bitcoin.

More importantly, can we expect past performances to repeat in the future? How likely is it that we’ll see the same levels of profitability witnessed after the last halving?

The First BTC Halving

Unsurprisingly, the first halving was met with caution and skepticism. The Bitcoin network was still in its infancy and was largely misunderstood and mistrusted by most people. While Bitcoin’s code declared that the crypto’s inflation rate would diminish and fewer new coins would enter the blockchain, would it happen as expected?

Or would the naysayers and detractors finally get to say ‘I told you so’ and prove the whole cryptocurrency movement to be a flagrant scam?

As we neared the first Bitcoin halving, BTC traded hands at a mere $12 per coin. Each new block saw the release of 50BTC into the network, and the computational power required to produce a Bitcoin block was significantly smaller than it is today.

The first halving was successfully passed on November 28, 2012. Bitcoin block rewards dropped from 50 BTC per block to 25 BTC. Over the next 12 months, Bitcoin went on one of its most iconic bullruns, surging from around $12 to eventually top out at $1,152 USD in December 2013.

Bitcoin had proven its point. The halving mechanism was real, and BTC scarcity was only beginning.

The Second Halving

Four years later, the crypto market was better prepared. This time, everyone knew the Bitcoin halving was no hoax, and they were desperate to get in on a slice of the action. The bear market that followed the previous cycle had purged plenty of investors from the market, but the Bitcoin faithful were eager to witness a second halving.

In the lead-up to the second halving, 1 BTC was valued at roughly $650 USD. While down dramatically from its previous all-time highs, BTC had come a long way from its humble beginnings and was ready to make its mark on the financial markets again.

The exact date was July 9, 2016, when Bitcoin’s emission rate was yet again cut in half. Block rewards dropped from 25 BTC to 12.5 BTC per block, with the reduction breathing new life into the Bitcoin charts.

What followed was staggering. Bitcoin went from strength to strength over the next year and a half, proving all its doubters wrong on its conquest to $17,000, a milestone reached in December 2017.

The Third Halving

The second halving sent a clear message: Bitcoin was here to stay. But what did the third halving have in store? By this stage, traders had recognized the pattern and bought large amounts of BTC before the halving, hoping to front-run the upcoming bull cycle.

However, the third Bitcoin halving went somewhat under the radar in May 2020. The world was deep in the grip of the international COVID-19 pandemic, meaning investors worldwide were steering well clear of high-risk asset classes like cryptocurrency.

The months following the halving were relatively calm, especially compared to previous cycles. However, Bitcoin’s next market rampage could be delayed, not canceled altogether.

Throughout 2021, Bitcoin became a household name as crypto mania swept the globe. The world’s first cryptocurrency skyrocketed to almost $69,000 USD as miner rewards dropped to just 6.25 BTC per block, and Bitcoin cemented itself as one of the best-performing assets in history.

What Can We Expect from the Next Bitcoin Halving?

With the next Bitcoin halving just within reach, the entire crypto market is eagerly waiting with bated breath for an upcoming bull run. Halving countdowns are cropping up across the internet, with cryptocurrency exchanges like Binance scratching off the days individually.

As always, it’s important not to get swept up in the euphoria of the occasion. Just because every previous halving has signaled an incoming bull market does not guarantee new all-time highs.

We’ve witnessed higher amounts of volatility ahead of the 2024 halving than in previous years, with thousands of traders investing millions in the crypto market in anticipation of the upcoming halving.

Already, BTC is approaching new all-time highs well before the scheduled date, an unfamiliar occurrence in Bitcoin history. This may not be the only ‘first’ we witness in this cycle.

On the Flipside

- Always do your own research and keep a level head when navigating the crypto market. While the Bitcoin halving has historically led to price appreciation, there is no guarantee that this will repeat after future halvings.

Why This Matters

Bitcoin’s halving is a key event in the crypto calendar not only because of its impact on Bitcoin price but also because of what it means for Bitcoin scarcity and its anti-inflation mechanics.

FAQs

The next Bitcoin halving is expected to occur on the 19th of April, 2024. Following this, Bitcoin halving happens every 210,000 blocks or roughly every four years.

Historically, Bitcoin halvings precede bullish market dynamics driven by Bitcoin price appreciation. However, this is never guaranteed.

The Bitcoin halving is a mechanism coded into the Bitcoin protocol. Every 210,000 blocks, the number of bitcoins distributed through block rewards gets cut in half.