- Cautious sentiment has continued in the cryptocurrency market with mixed performance.

- The top 10 cryptocurrency rankings have seen no major shakeups despite price fluctuations.

- Even though some cryptocurrencies have seen major price gains, the market cap is still down for the week.

The past week continued the cautious sentiment in the cryptocurrency market. While some digital assets managed to buck the trend and notch gains, others experienced price declines.

Toncoin Continues Impressive Run, Up 31.4% This Week

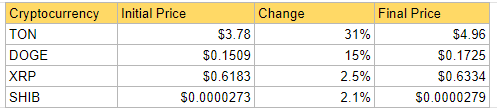

Out of the top 10 cryptocurrencies, only four avoided losses. Shiba Inu (SHIB) and XRP (XRP) saw modest gains of 2.1% and 2.4% respectively. Dogecoin (DOGE) staged a significant comeback, erasing last week’s losses and climbing 15% to return to its price point from two weeks ago.

The standout performer this week was Toncoin (TON), which continued its impressive run with a 31% increase in price, marking its second consecutive week of over 30% gains.

Sponsored

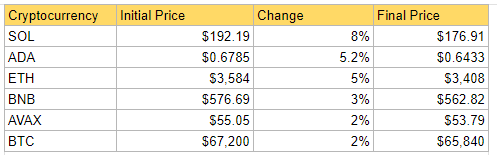

The remaining six top 10 cryptocurrencies ended the week in the red. Solana (SOL) took the biggest hit, dropping 8%. Cardano (ADA), Ethereum (ETH), and Binance Coin (BNB) experienced more moderate losses, falling between 3% and 5.2%. Rounding out the list were Bitcoin (BTC) and Avalanche (AVAX), both of which dipped by exactly 2%.

This week’s price movements did little to shake up the top 10 rankings. While Toncoin maintained its position after its surge last week, there were no surprise newcomers to the list.

Winners

Half of the top 10 cryptocurrencies experienced price increases over the past week. Here’s a look at the gainers, ranked by their percentage increase:

Losers

Half of the top 10 cryptocurrencies experienced price losses over the past week. Here’s a look at them, ranked by their percentage decrease:

This is just a snapshot of the current market conditions at the time of writing. Cryptocurrency prices are constantly fluctuating, so it’s important to do your own research before making any investment decisions.

On the Flipside

- While some altcoins surged this week, they may be susceptible to corrections if the broader market continues its decline.

- Despite a few gainers, major coins like Bitcoin and Ethereum are still down, indicating broader investor uncertainty.

Why This Matters

Overall, the past week continued the trend of cautious trading in the crypto market. While some coins managed to post gains, others experienced price declines. As the market continues to navigate a period of uncertainty, investors will be closely watching for signs of a more decisive trend in the coming weeks.

Want to learn more about the potential impact of Dogecoin being integrated into Twitter’s new payment system, X Payments? Read here:

DOGE Landing On X Payments? Twitter Secures 3 More Licenses

Curious about how Solana stacks up against Ethereum in DeFi? This article explores efficiency through the metric of DEX volume to TVL. Check it out: