- Tether has strategically maintained a liquidity cushion of nearly $3.3 billion.

- Tether has unveiled the augmented surplus of shareholder capital across 15 blockchains.

- Other stablecoins issued by Tether have faced liquidity divergence, posing a looming challenge to their peg.

Amidst the burgeoning landscape of blockchain ecosystems, a notable entity emerges as a guardian of financial equilibrium: Tether, a prominent stablecoin issuer. Behind the scenes of its operations lies a meticulously crafted strategy involving the maintenance of a formidable liquidity cushion, a silent guardian of the Tether ecosystem.

Tether’s Reserves Report Reveals Capital Across 15 Blockchains

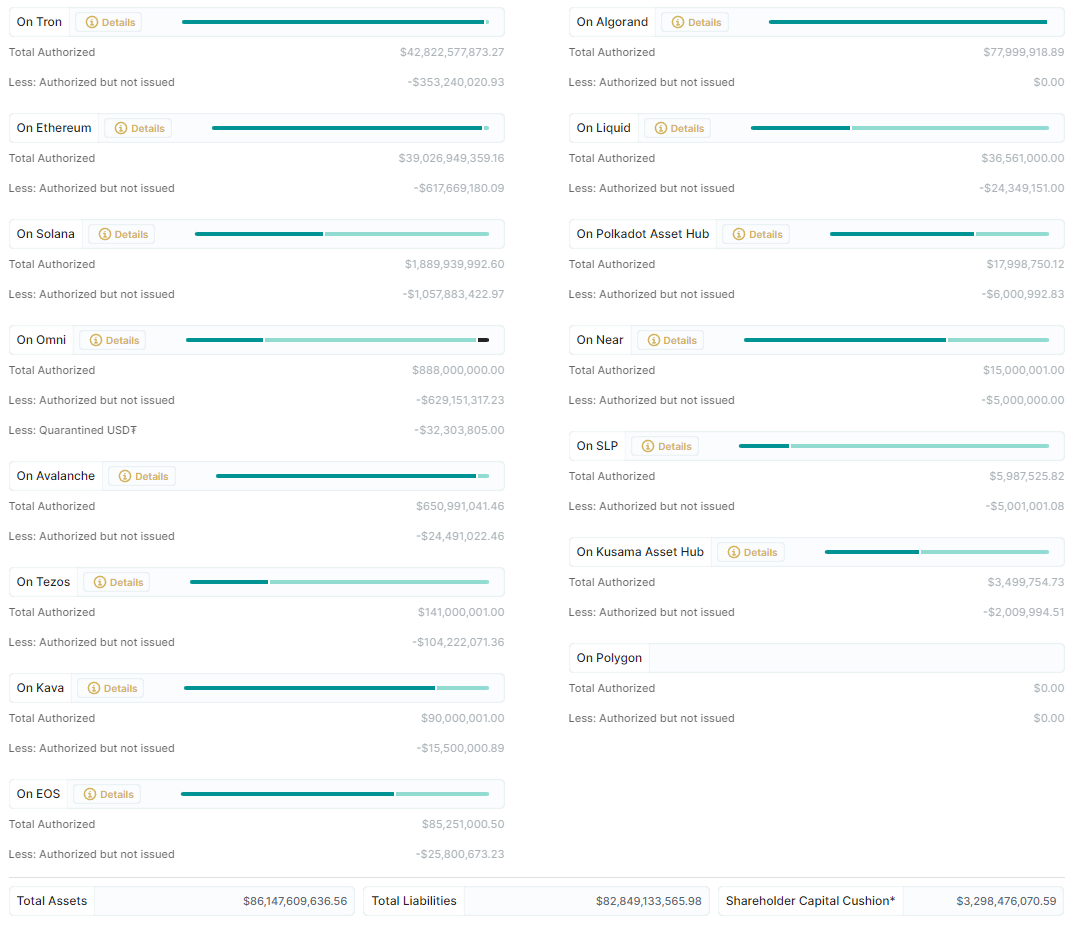

According to the latest reserves report dated August 24th, Tether’s combined surplus in shareholder capital cushion is $3.29 billion. This sum is meticulously distributed across 15 diverse blockchain ecosystems. Except for Algorand and Polygon, Tether retains the authority to release USDT tokens, potentially numbering in the millions.

Amid this collection, the Solana ecosystem stands as the front-runner, boasting a pre-authorized issuance value of $1.57 billion. Following closely are Ethereum and Tron, securing the second and third positions with pre-authorization amounts of $617 million and $353 million, respectively.

Transparency Concerns Loom Over Tether’s $86.1B Asset Pool

Despite these developments, Tether has yet to address the pivotal role of issuance preauthorization in upholding transparency and fostering trust among the wider population.

Sponsored

The aggregated assets under Tether’s domain currently reach $86.1 billion. Counterbalancing this figure, total liabilities account for $82.8 billion, thus definitively confirming a robust reserve coverage exceeding 100%.

However, it’s crucial to discern that other stablecoins within the company’s ambit, such as XAUT, EURT, MXNT, and CNHT, are not privileged with the same liquidity cushion as USDT. The report clearly outlines that these stablecoins, issued by Tether, lack the necessary balances to serve as a buffer and sustain a steadfast 1-1 peg during financial turmoil.

On the Flipside

- The absence of a full independent audit still raises questions about the authenticity of the reported reserve backing, echoing past regulatory fines for misleading statements.

- The Commodity Futures Trading Commission has fined Tether $41 million for spreading “untrue” statements about reserve holdings before.

Why This Matters

Tether’s position as the leading provider of stablecoins underscores its pivotal role in the cryptocurrency landscape. The substantial liquidity cushion and reserve backing signal a commitment to stability and trust, influencing the broader market sentiment.

Sponsored

To delve deeper into the current state of stablecoins’ market value, click here:

Stablecoin Market Value Hits Lowest Point since August 2021

To stay updated on the recent developments in the SEC vs. Ripple trial and the notable withdrawal of attorneys from the case, read more here:

Major Shake-up in SEC vs. Ripple Trial as Attorneys Withdraw from Case